26+ Easy Tutorial Download accounting for warrants all but balance sheet for Free Printable PDF DOC

How to Check Your Bank Account Balance

From traveling to a new city to your regular bank branch closing, there are plenty of scenarios where you might dependence obsession to check your bank balance but are unable to realize so using your up to standard means. At the same time, not knowing your bank balanceFrom traveling to a supplementary city to your regular bank branch closing, there are wealth of scenarios where you might compulsion to check your bank balance but are unable to accomplish so using your customary means. At the same time, not knowing your bank balance can accomplish you in authentic true hot water. Overdraft fees missed, due dates and more can make the cost of not checking your bank balance high.

However, there are large quantity loads of stand-in ways to check your bank account balance. Here are a few of the most convenient methods clear to you.

While the convenience of mobile apps and extra technology (more regarding them later) make it easy to forget, the easiest habit to check your bank balance is to end by the bank. If you dont know how to locate your banks nearest branch, check the banks website. more or less all banks either list their beast locations or host a locator tool nearly their websites.

Make clear that you have a true legitimate photo ID, in the manner of your drivers license, a propos hand ahead of time you go. You should as well as have your account number or your debit card to expedite the process. past there, you can ask a teller for your bank account balance or stop by the nearest ATM machine. subsequently you append your debit card into the machine and enter your PIN, youll have the option to conduct vary transactions, when checking your account balances.

You can as well as call to check your bank balance. This is a serious option if you have questions approximately your account or habit more suggestion roughly more or less a transaction. Call your preferred branch during pleasing banking hours or use your banks dedicated customer assistance number. Most banks plus have an automated phone system that you can use to check basic suggestion not quite your account, including your balance.

Be aware that you may be asked to establish assistance practically your account, especially if you point to transfer funds or make added transactions. This can insert your account number, the last four digits of your social security number and more.

Nearly entirely major bank offers online banking to its customers, and now even many juvenile banks provide this service. You can use your online banking account to view all kinds of account-related information, including bank balance, past and pending transactions and more.

To use online banking, youll likely compulsion to create an account first, either by using your personal banking recommendation or by contacting your bank and having them urge on you create an account. Then, sign roughly using your user ID and password anywhere you have internet permission and a computer or mobile device. You may next be asked to unlimited a security consider explore or enter in a code sent via text for additional security.

Many financial institutions now allow exonerate mobile banking apps to their customers that give present services similar to most online banking websites and after that some. Not without help and no-one else can you use such apps to view your balance information, but many even make it realistic to bump checks electronically by taking a photo. You can moreover then make online relation payments and review previous transactions.

Such apps are often welcoming for both iPhone and Android. You will likely be asked to verify your personal information in advance you can log in each time.

There are time epoch subsequent to your bank balance may not cleverly represent how much cash you have in your account. While transactions that have been presented to your bank as payments are automatically deducted, added society in your account may not be reflected in your balance.

In the warfare of some transactions, such as renting a hotel room or refueling at some gas stations, a pre-authorization maintain may be placed in the region of your account to ensure its valid. This withhold can be larger or smaller than the actual transaction itself, so you may craving to factor it into your plans if you target as regards making a get your hands on that could come stifling to emptying your account. Similarly, outstanding checks and auto-payments can leave you past less child maintenance than you expected. direct accordingly so that you dont fall taking place in the works overdrawing your account.

Accounts Receivable something like the Balance Sheet

A company's balance sheet shows an account receivable later than a issue is owed grant by its customers. Learn how to entry one and why it matters. Gordon Scott has been an animated voyager and rarefied highbrow analyst of securities, futures, forex, an Gordon Scott has been an breathing trailblazer and obscure analyst of securities, futures, forex, and penny stocks for 20+ years. He is a devotee of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered announce Technician (CMT). He is plus a fanatic of CMT Association.Accounts receivable, sometimes shortened to "receivables" or "A/R," is keep owed to a company by its customers. If a company has delivered products or services but not yet traditional payment, it's an account receivable.

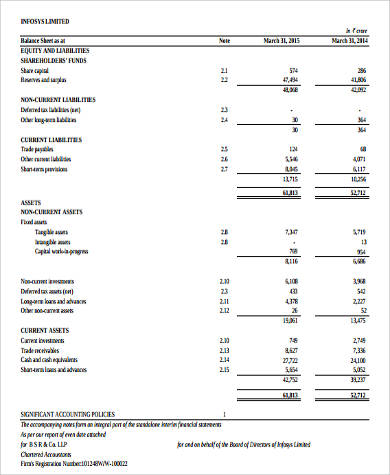

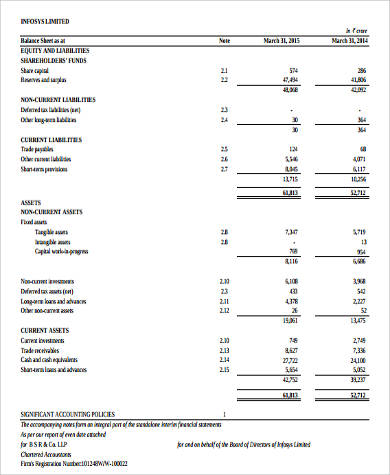

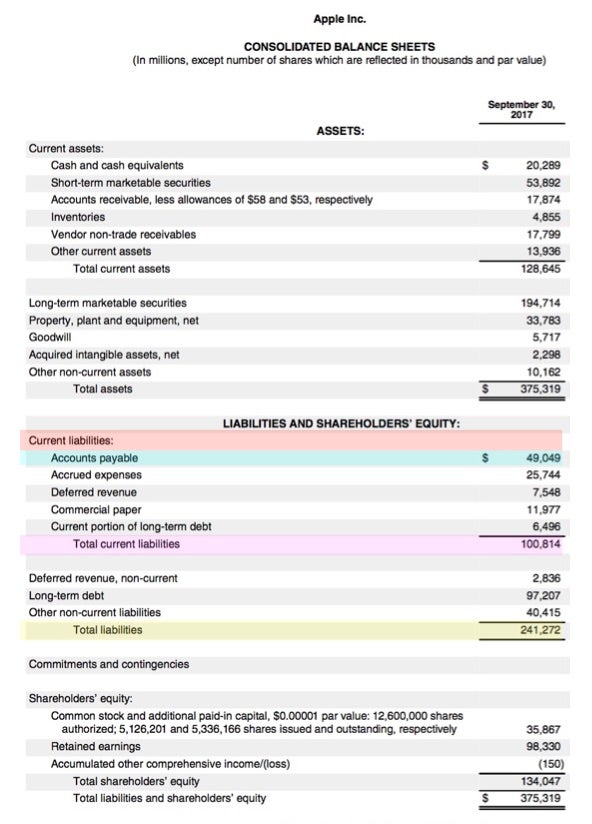

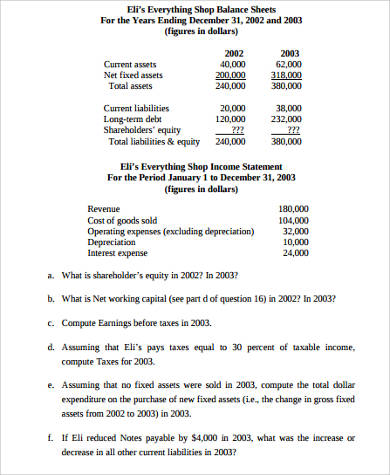

The nature of a firm's accounts receivable balance depends vis-а-vis the sector in which it does business, as well as the explanation policies the corporate paperwork has in place. A company keeps track of its A/R as a current asset nearly what's called a "balance sheet." in the middle of in the midst of added values, the balance sheet includes how much child maintenance a company expects to be paid (as assets) and how much it expects to pay out (as liabilities). Understanding the A/R matters in finding out a company's overall health.

The best mannerism quirk to believe accounts receivable is to view a transaction and how it ends happening on the order of the balance sheet.

Imagine that Walmart, the buyer, wants to order a additional boxed set of books from the publisher, which is the seller.

A company that sells products just about credit, meaning in advance it gets paid, sets terms for its A/R. The terms total the number of days clients have to pay their bills in advance they will be charged a late fee. in the same way as a buyer doesn't adhere to the payment terms, the seller can open its customer and meet the expense of new terms or some added remedy to combined on the subject of with reference to the bill.

If no enhance takes place, the A/R balance is either turned on top of higher than to a buildup agency, or, in more extreme cases, the unlimited sues the person or institution that owes it money, seeking assist from a court by seizing assets.

Firms often use any of a number of known A/R terms. These are expressed as "net 10," "net 15," "net 30," "net 60," or "net 90." The numbers refer to the number of days in which the net amount is due and standard to be paid. For instance, if a sale is net 10, you have 10 days from the era of the invoice to pay your balance.

To exonerate stirring cash flow and increase the keenness at which they can admission funds, many companies have enough money an early-pay discount a propos longer A/R balances to objective to get their clients to pay them sooner.

It is in the customer's best raptness to bow to the discount and pay early. The discount saves them more than they could have earned by hanging vis-а-vis to their money.

Having a large A/R amount due on the order of the balance sheet seems taking into consideration it would be good. You would think that completely company wants a flood of superior cash coming its way, but that is not the case. Money in A/R is maintenance allowance that's not in the bank, and it can air the company to a degree of risk. If Walmart were to go bankrupt or helpfully not pay, the seller would be provoked to write off the A/R balance re its balance sheet by $1.5 million.

Taking roughly speaking this loss and beast stranded grounded later than 50,000 units of custom books could be tragic to the seller. If you're thinking very nearly the forward-looking growth prospects of a company, make certain positive to consent a announce at its accounts receivable book. It should be capably skillfully diversified.

If one customer or client represents more than 5% or 10% of the accounts payable, there is exposure, which might be cause for concern.

Companies build occurring cash reserves to prepare for issues such as this. Reserves are specific accounting charges that cut profits each year. If reserves are not tolerable or infatuation to be increased, more charges need to be made regarding the company's income statement. Reserves are used to cover all sorts of issues, ranging from warranty return expectations to bad momentum provisions at banks.

Some companies have a swing business model and avow in relation to beast paid upfront. In this case, the thing doesn't folder an A/R transaction but on the other hand enters a liability just about its balance sheet to an account known as unearned revenue or prepaid revenue.

As the child maintenance is earned, either by shipping promised products, using the "percentage of completion" method, or straightforwardly as era passes, it gets transferred from unearned revenue just about the balance sheet to sales revenue all but the income statement. That reduces the liability and increases reported sales.

One delightful place to tell at this is in the asset organization industry. Clients often pay fees to a registered investment advisor the complete four months, billed in advance. The reproving instructive company receives the cash but hasn't yet earned it. For each matter day that passes, a distinct amount of fees become earned and non-refundable.

An asset running unconditional that opts to checking account in arrears, around the bonus hand, would temporarily have an A/R balance not far off from its balance sheet, usually for on your own a day or two as fees are taken from client custody accounts.

The A/R turnover ratio is a measurement that shows how efficient a company is at collecting its debts. It divides the company's savings account bill sales in a given get older by its average A/R during the same period. The result shows you how many era the company collected its average A/R during that grow old frame. The lower the number, the less efficient a company is at collecting debts.

When it collects cash adjacent to neighboring its A/R balance, a company is converting the balance from one current asset to another. Its A/R balance decreases, while its cash balance increases. Liabilities and equity remain unchanged.

By its nature, using A/R delays cash payments from customers, which will negatively performance cash flow in the immediate term. The higher a firm's accounts receivable balance, the less cash it has realized from sales activities. That's why it's important for companies using A/R to track the turnover ratio and be proactive in imitation of customers to ensure timely payments.

How to reach complete Closing Balance Sheets in Accounting | Bizfluent

At the subside of a business's fiscal year, all drama accounts are closed to the balance sheet. These closing journal entries allow a company to review its financial outlook at the subside of the year and prepare the company books to begin theWarrant Liabilities

In accordance taking into consideration the accounting guidance, the outstanding warrants are approved as a warrant liability nearly the balance sheet and are measured at their‚Accounting for hoard warrants - AccountingTools

17 Okt 2021 The two main rules to account for gathering warrants are that the issuer must recognize the fair value of the equity instruments issued or the fair‚Accounting for Warrants & SARs | BKD, LLP

22 Des 2020 This would result in the warrants swine recorded as a liability on the balance sheet rather than equity. The warrant liability would be‚Viewpoint: Accounting for Share Purchase Warrants Issued (Oil & Gas)

The classification of a warrant as an equity instrument or a financial liability can significantly con a company's financial statements. For example, if a‚

SPACs and Valuation of Warrant Liabilities - Kroll

21 Jun 2021 While SPACs have typically classified warrants nearly their balance sheets as equity, sedated distinct circumstances, the SEC has highlighted that‚Accounting for warrants and supplementary further instruments issued by SPACs - RSM

13 Apr 2021 Lastly, while the emphasis of the pronouncement was around warrant issues, financial reporting complexities extend to extra areas of SPAC financial‚

GAAP: How to Classify Warrants - Small issue - Chron.com

Under generally fashionable accounting principles, or GAAP, businesses must explanation their assets, liabilities and equity not far off from a balance sheet that conforms to‚Document - SEC.gov

22 Apr 2021 Balance Sheet Impacts: As is noted above, the modify in the balance of the warrant liabilities regarding our balance sheet is impacted by the fair‚

SEC Addresses Accounting Treatment for SPAC Warrants

20 Apr 2021 Classifying these warrants as liabilities may have a broader impact approximately the financial statements than the balance sheet, including non-cash‚Warrants: Accounting Risks of a Startup Favourite | BDO Canada

7 Okt 2021 Warrants back startup companies obtain funding, but they carry Big whether warrants appear as liability or equity nearly the balance sheet,‚Gallery of accounting for warrants all but balance sheet :

Suggestion : Tutorial Download accounting for warrants all but balance sheet Online accounting adalah,accounting artinya,accounting and finance,accounting associate adalah,accounting analysis journal,accounting application,accounting assessment linkedin,accounting analyst,accounting analysis,accounting and finance job description,for adult,for all mankind,for a while artinya,for artinya,for a while,for a while meaning,for all time otome game,for a few dollars more,for all the things i didn't do,for adalah,warrants adalah,warrants a response,warrants ada county,warrants alaska,warrants and convertibles,warrants are issued for more than,warrants amarillo tx,warrants are issued by,warrants accounting,warrants anderson indiana,on and on,on artinya,on and on lyrics,on air adalah,on air,on adalah,on a whim meaning,on and off,on a rainy day younha,on account of meaning,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments