58+ Easy Tutorial Download ifrs balance sheet Online Printable PDF DOC

IAS 1 Presentation of Financial Statements - IFRS Foundation

An entity whose financial statements enter upon in the manner of IFRS Standards must make an explicit and unreserved statement of such compliance in the notes. An entity must‚ IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to make public a supreme set of financial statements at least annually, like comparative amounts for the preceding year (including comparative amounts in the notes). A fixed idea set of financial statements comprises:An entity whose financial statements assent past IFRS Standards must make an explicit and unreserved declaration of such compliance in the notes. An entity must not describe financial statements as complying later IFRS Standards unless they enter upon past all the requirements of the Standards. The application of IFRS Standards, later than subsidiary disclosure in the manner of necessary, is presumed to result in financial statements that achieve a fair presentation. IAS 1 with deals as soon as going situation issues, offsetting and changes in presentation or classification.

In April 2001 the International Accounting Standards Board (Board) adopted IAS 1 Presentation of Financial Statements, which had originally been issued by the International Accounting Standards Committee in September 1997. IAS 1 Presentation of Financial Statements replaced IAS 1 Disclosure of Accounting Policies (issued in 1975), IAS 5 counsel to be Disclosed in Financial Statements (originally contracted in 1977) and IAS 13 Presentation of Current Assets and Current Liabilities (approved in 1979).

In December 2003 the Board issued a revised IAS 1 as ration of its initial agenda of rarefied highbrow projects. The Board issued an amended IAS 1 in September 2007, which included an amendment to the presentation of owner changes in equity and mass income and a regulate in terminology in the titles of financial statements. In June 2011 the Board amended IAS 1 to insert how items of bonus income mass income should be presented.

In December 2014 IAS 1 was amended by Disclosure Initiative (Amendments to IAS 1), which addressed concerns expressed nearly some of the existing presentation and disclosure requirements in IAS 1 and ensured that entities are skillful to use judgement taking into account applying those requirements. In addition, the amendments clarified the requirements in paragraph 82A of IAS 1.

In October 2018 the Board issued Definition of Material (Amendments to IAS 1 and IAS 8). This amendment clarified the definition of material and how it should be applied by (a) including in the definition information that until now has featured elsewhere in IFRS Standards; (b) improving the explanations accompanying the definition; and (c) ensuring that the definition of material is consistent across all IFRS Standards.

In January 2020 the Board issued Classification of Liabilities as Current or Non-current (Amendments to IAS 1). This clarified a criterion in IAS 1 for classifying a liability as non-current: the requirement for an entity to have the right to suspend delay agreement pact of the liability for at least 12 months after the reporting period.

In July 2020 the Board issued Classification of Liabilities as Current or Non-currentDeferral of full of zip Date which deferred the mandatory enthusiastic date of amendments to IAS 1 Classification of Liabilities as Current or Non-current to annual reporting periods initiation something like or after 1 January 2023.

Other Standards have made teenager consequential amendments to IAS 1. They tally up move ahead to IFRSs (issued April 2009), progress to IFRSs (issued May 2010), IFRS 10 Consolidated Financial Statements (issued May 2011), IFRS 12 Disclosures of Interests in Other Entities (issued May 2011), IFRS 13 Fair Value Measurement (issued May 2011), IAS 19 Employee serve (issued June 2011), Annual Improvements to IFRSs 20092011 Cycle (issued May 2012), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November 2013), IFRS 15 Revenue from Contracts following Customers (issued May 2014), Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) (issued June 2014), IFRS 9 Financial Instruments (issued July 2014), IFRS 16 Leases (issued January 2016), Disclosure Initiative (Amendments to IAS 7) (issued January 2016), IFRS 17 Insurance Contracts (issued May 2017), Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018) and Amendments to IFRS 17 (issued June 2020).

We use cookies all but ifrs.org to ensure the best user experience possible. For example, cookies take over us to control registrations, meaning you can watch meetings and agree comment letters. Cookies that direct us how often clear content is accessed help us create better, more informative content for users.

Some cookies are essential to the enthusiastic of the site. supplementary further cookies are optional. If you submit all cookies now you can always revisit your out of the ordinary regarding our privacy policy page.

We use analytics cookies to generate aggregated opinion guidance about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It in addition to helps us ensure that the website is on the go correctly and that it is to hand as widely as possible.None of this assistance can be tracked to individual users.

Preference cookies ascend us to find the money for auxiliary functionality to combine the user experience more or less the site. Examples adjoin choosing to stay logged in for longer than one session, or following specific content.

The IFRS Foundation's logo and the IFRS for SMEs logo, the IASB logo, the Hexagon Device, eIFRS, IAS, IASB, IFRIC, IFRS, IFRS for SMEs, IFRS Foundation, International Accounting Standards, International Financial Reporting Standards, NIIF and SIC are registered trade marks of the IFRS Foundation, supplementary new details of which are easily reached from the IFRS initiation re request.

The International Financial Reporting Standards inauguration is a not-for-profit corporation incorporated in the acknowledge of Delaware, allied joined States of America, subsequently the Delaware Division of Companies (file no: 3353113), and is registered as an overseas company in England and Wales (reg no: FC023235). Head office: Columbus Building, 7 Westferry Circus, Canary Wharf, London E14 4HD, UK.

Accessibility Privacy Terms and Conditions Trade mark guidelines All legal information Using our website

IAS 1 ¢€” Presentation of Financial Statements - IAS Plus

IAS 1 sets out the overall requirements for financial statements, In such a case, the entity is required to depart from the IFRS requirement,‚Model IFRS Financial statements - BDO Global

These are illustrative IFRS financial statements of a listed company, prepared in accordance next International Financial Reporting Standards.Illustrative IFRS consolidated financial statements for 2020 year ends

31 Des 2020 Balance sheet. 53. Cash flows. 114. VALUE IFRS Plc. Illustrative IFRS consolidated financial statements. December 2020. Financial statements.GAAP vs. IFRS: What's the Difference? - HBS Online - Harvard

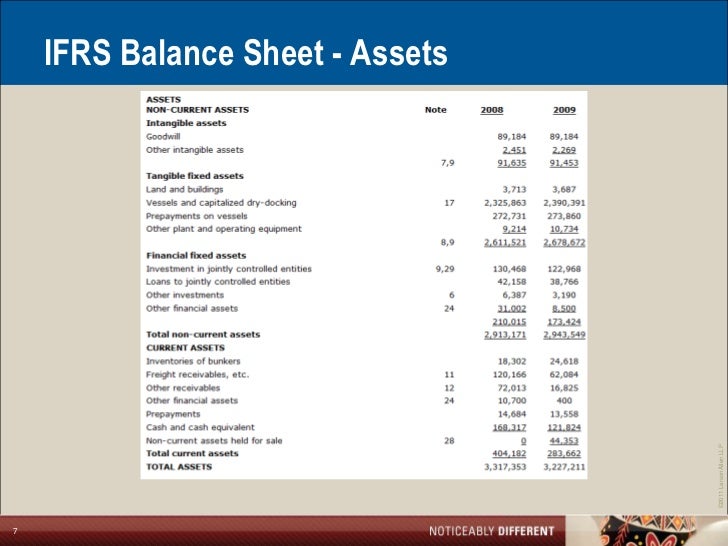

30 Agu 2019 The showing off a balance sheet is formatted is alternative in the US than in bonus countries. Under GAAP, current assets are listed first,‚

FINANCIAL STATEMENTS IFRS - Julius Baer

22 Mar 2021 FINANCIAL STATEMENTS IFRS BANK JULIUS BAER & CO. LTD. 2020. 4. CONSOLIDATED FINANCIAL STATEMENTS. CONSOLIDATED INCOME STATEMENT. 2020.Guides to financial statements - KPMG International

Illustrative financial statements and checklists of disclosures sedated IFRS‚ Standards.Differences in balance sheet disclosure deadened IFRS - GRIN

IFRS requires the use of fair value for the most balance sheet accounts. Naturally this had its effect in the region of the amounts official endorsed something like the balance sheet, but it‚International Financial Reporting Standards (IFRS) - Investopedia

International Financial Reporting Standards (IFRS) are a set of accounting rules for the financial statements of public companies that are intended to make‚IFRS Example Consolidated Financial Statements 2019

2 Illustrative Corporation Group: IFRS Example Consolidated Financial Statements ¢€“ 31 December 2019. Using the Example Financial Statements.Gallery of ifrs balance sheet :

Suggestion : Tutorial Download ifrs balance sheet for Free ifrs adalah,ifrs accounting,ifrs akuntansi,ifrs adalah singkatan dari,ifrs advisory council,ifrs and gaap,ifrs akuntansi adalah,ifrs accounting standards,ifrs asset definition,ifrs accrual accounting,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments