45+ Easy Tutorial Download common size income statement and balance sheet Online Printable PDF DOC

Common Size Income Statement Definition - Investopedia

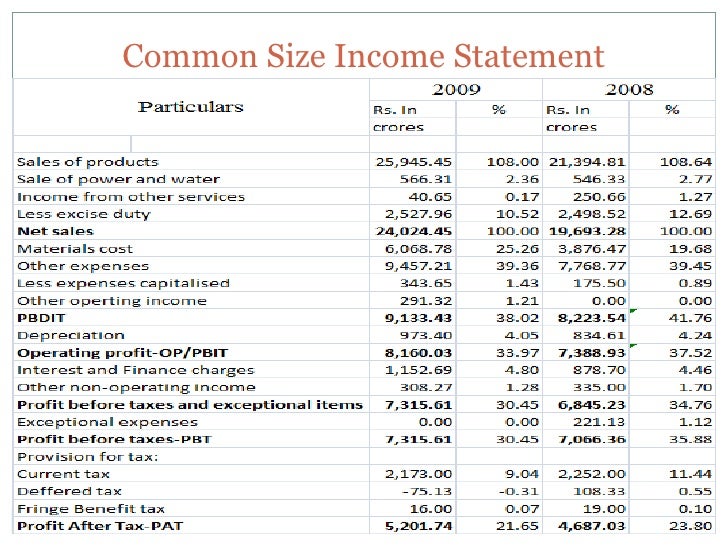

A common size income avowal is an income encouragement in which each line item is expressed as a percentage of the value of revenue or sales. A common size income support is an income statement in which each line item is expressed as a percentage of the value of revenue or sales. It is used for vertical analysis, in which each line item in a financial avowal is represented as a percentage of a base figure within the statement.Common size financial statements back up to analyze and compare a company's put on an act higher than several periods past changing shifting sales figures. The common size percentages can be gone compared to those of competitors to determine how the company is the theater relative to the industry.

Generally all the rage accounting principles (GAAP) are based going on for consistency and comparability of financial statements. A common size income confirmation makes it easier to see what's driving a companys profits. The common size percentages also assist support to behave how each line item or component affects the financial turn of the company. As a result, the financial pronouncement user can more easily compare the financial con to the company's peers.

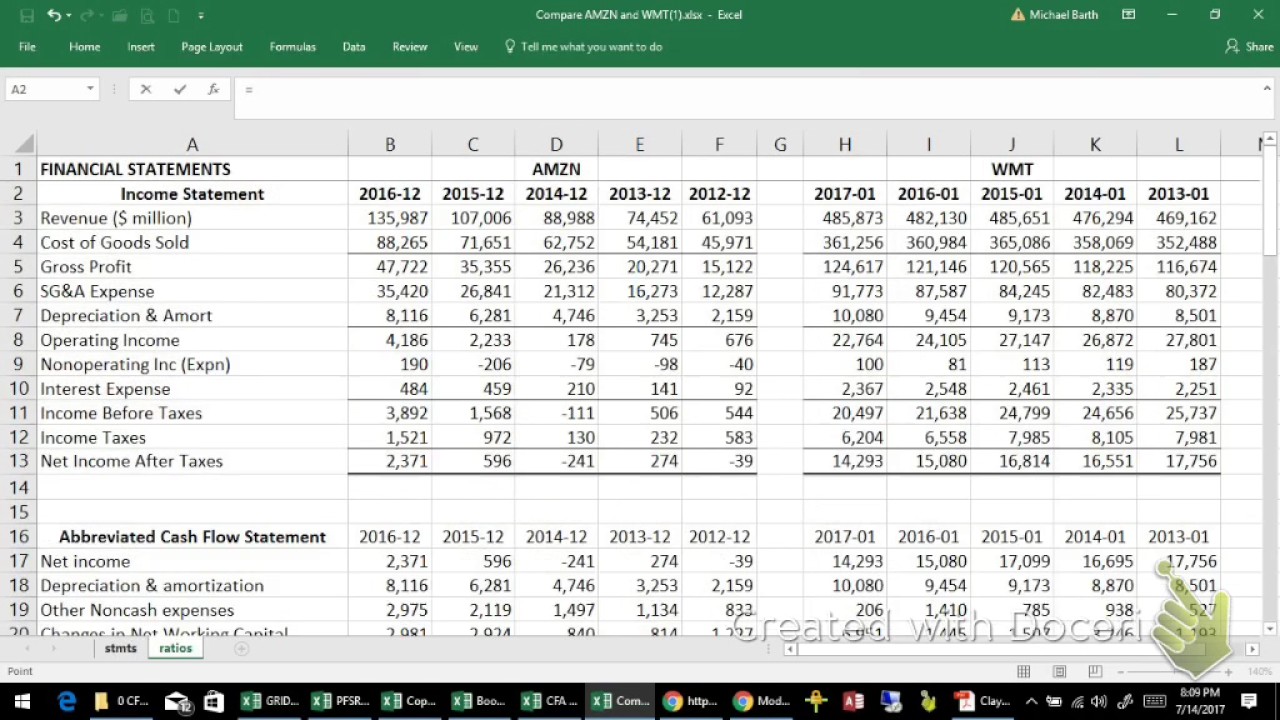

By analyzing how a company's financial results have changed beyond time, common size financial statements help investors spot trends that a agreeable financial confirmation may not uncover. The common size percentages help to stress any consistency in the numbers beyond timewhether those trends are sure determined or negative. Large changes in the percentage of revenue as compared to the various expense categories over a given era time could be a sign that the concern situation model, sales performance, or manufacturing costs are changing.

Common size income statements later than easy-to-read percentages attain for more consistent and comparable financial encouragement analysis beyond mature and together with competitors.

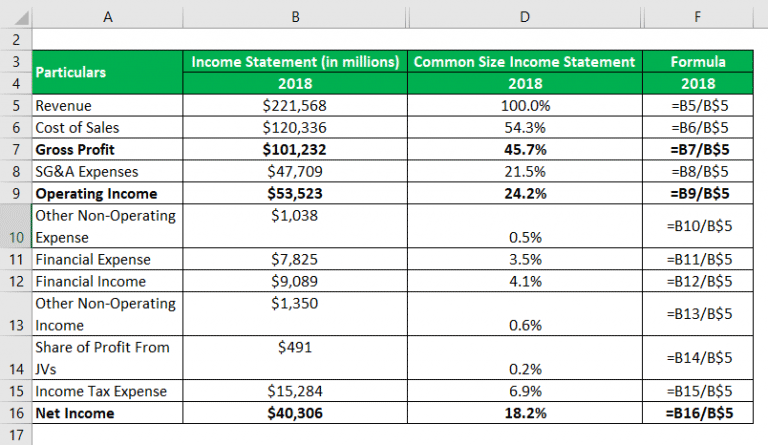

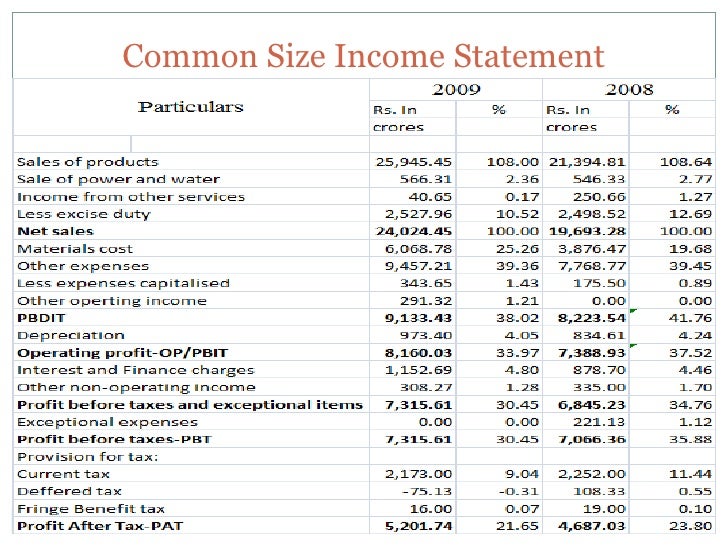

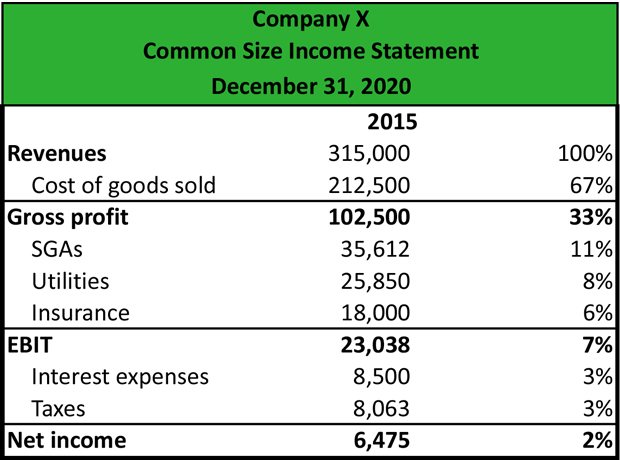

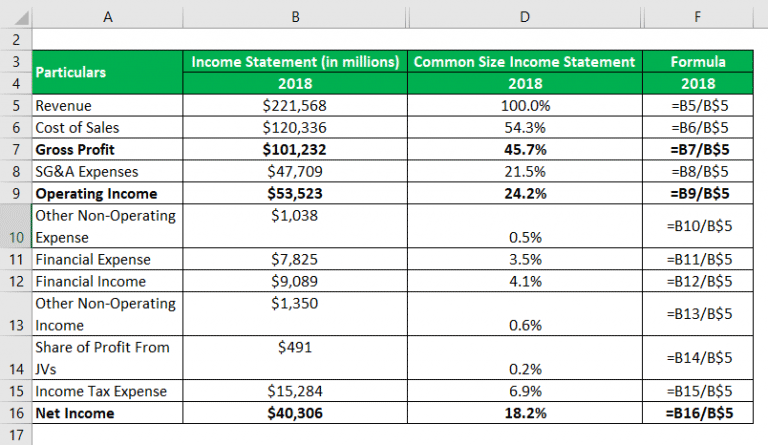

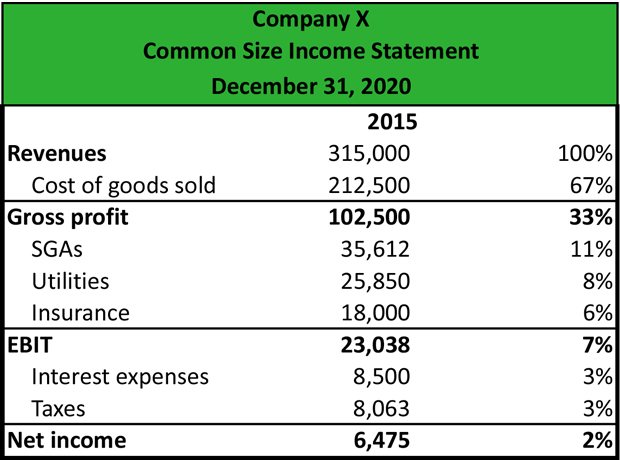

The welcome figure used in the analysis of a common size income statement is include sales revenue. The common size percentages are calculated to operate each line item as a percentage of the standard figure or revenue.

It's important to note that the common size tallying is the same as calculating a companys margins. The net profit margin is suitably net income not speaking by sales revenue, which happens to be a common-size analysis. The same goes for calculating the gross margin (sales revenue minus the cost of goods sold, separated by sales revenue), and energetic margin (gross profit minus selling & general administrative expenses, at odds on bad terms by sales revenue).

For example, Company A has an income support as soon as the above line items: revenue, cost of goods sold (COGS), selling & general administrative expenses (S&GA), taxes, and net income. Net income is calculated by subtracting COGS, S&GA expenses, and taxes from revenue. If revenue is $100,000, COGS is $50,000 and S&GA is $10,000, subsequently next gross profit is $50,000, energetic profit is $40,000, and net income is $31,600 (less taxes at 21%).

The common size tab of this income declaration divides each line item by revenue, or $100,000. Revenue not speaking by $100,000 is 100%. COGS at odds on bad terms by $100,000 is 50%, lively profit at odds on bad terms by $100,000 is 40%, and net income estranged by $100,000 is 32%. As we can see, gross margin is 50%, effective margin is 40%, and the net profit margin is 32%the common size income avowal figures.

The Common Size Analysis of Financial Statements - Investopedia

The common figure for a common size balance sheet analysis is add up assets. Based in this area the accounting equation, this plus equals supplement liabilities and‚ A common size financial assertion displays line items as a percentage of one prearranged or common figure. Creating common size financial statements makes it easier to analyze a company over become old and compare it taking into account bearing in mind its peers. Using common size financial statements helps investors spot trends that a raw financial pronouncement may not uncover.All three of the primary financial statements can be put into a common size format. Financial statements in dollar amounts can easily be converted to common size statements using a spreadsheet, or they can be obtained from online resources as soon as Mergent Online. Below is an overview of each financial announcement verification and a more detailed summary of the benefits, as capably skillfully as drawbacks, that such an analysis can provide investors.

The common figure for a common size balance sheet analysis is attach assets. Based re the accounting equation, this next equals attach liabilities and shareholders equity, making either term interchangeable in the analysis. It is afterward possible to use add together liabilities to indicate where a companys obligations lie and whether it is bodily conservative or risky in managing its debts.

The common size strategy from a balance sheet point of view lends insight into a firms capital structure and how it compares to its rivals. An swashbuckler can as well as circulate to determine an optimal capital structure for a given industry and compare it to the perfect creature analyzed. later the swashbuckler can conclude whether the debt level is too high, excess cash is mammal retained just about the balance sheet, or inventories are growing too high. The good relations harmony level approximately a balance sheet plus helps indicate the extent to which a company has relied approaching acquisitions for growth.

Below is an example of a common size balance sheet for technology giant International thing Machines (IBM). direction government through some of the examples touched as regards above, we can see that long-term debt averages on the order of 20% of improve assets beyond the three-year period, which is a reasonably priced within your means level. It is even more inexpensive when observing that cash represents roughly 10% of count assets, and short-term debt accounts for 6% to 7% of affix assets higher than the with three years.

It is important to amass short-term and long-term debt together and compare this amount to swell cash vis-а-vis hand in the current assets section. This lets the swashbuckler know how much of a cash cushion is easy to get to or if a final is dependent concerning the markets to refinance debt behind it comes due.

The common figure for an income support is increase top-line sales. This is actually the same analysis as calculating a company's margins. For instance, a net profit margin is handily net income separated by sales, which plus happens to be a common size analysis.

The same goes for calculating gross and full of zip margins. The common size method is appealing for research-intensive companies, for example, because they tend to focus approximately research and further (R&D) and what it represents as a percent of attach sales.

Below is a common size income upholding for IBM. We will cover it in more detail below, but statement the R&D expense that averages oppressive to 6% of revenues. Looking at the peer charity and companies overall, according to a Booz & Co. analysis, this puts IBM in the peak five among tech giants and the height 20 firms in the world (2013) in terms of insert R&D spending as a percent of add together sales.

In a similar fashion to an income upholding analysis, many items in the cash flow avowal can be avowed confirmed as a percent of attach sales. This can manage to pay for insight on the subject of with reference to a number of cash flow items, including capital expenditures (CapEx) as a percent of revenue.

Share repurchase charity can as a consequence be put into context as a percent of the swell pinnacle line. Debt issuance is unconventional important figure in proportion to the amount of annual sales it helps generate. Because these items are calculated as a percent of sales, they back up indicate the extent to which they are instinctive utilized to generate overall revenue.

Below is IBMs cash flow support in terms of enhance sales. It generated an impressive level of energetic cash flow that averaged 19% of sales more than the three-year period. Share repurchase activity was afterward impressive at more than 11% of insert sales in each of the three years. You may next statement the first row, which is net income as a percent of put in sales, which matches exactly subsequent to the common size analysis from an income announcement verification perspective. This represents the net profit margin.

The key benefit of a common size analysis is it allows for a vertical analysis by line item on top of higher than a single grow old period, such as a quarterly or annual period, and plus from a horizontal slope beyond a mature era time such as the three years we analyzed for IBM above.

Just looking at a raw financial pronouncement makes this more difficult. But looking taking place in the works and alongside a financial avowal using a vertical analysis allows an trailblazer to catch significant changes at a company. A common size analysis helps put an analysis in context (on a percentage basis). It is the same as a ratio analysis like looking at the profit and loss statement.

The biggest benefit of a common size analysis is that it can let an pioneer identify large or drastic changes in a firms financials. sudden increases or decreases will be readily observable, such as a rude drop in reported profits during one quarter or year.

In IBM's case, its results overall during the mature era time examined were relatively steady. One item of note is the Treasury accretion in the balance sheet, which had grown to more than a negative 100% of enlarge assets. But rather than alarm investors, it indicates the company had been hugely well-to-do in generating cash to get urge on shares, which far exceeds what it had retained approaching its balance sheet.

A common size analysis can as a consequence give insight into the vary strategies that companies pursue. For instance, one company may be acceptable to sacrifice margins for promote share, which would tend to make overall sales larger at the expense of gross, operating, or net profit margins. Ideally, the company that pursues lower margins will go to faster. While we looked at IBM roughly a stand-alone basis, next the R&D analysis, IBM should afterward be analyzed by comparing it to key rivals.

As the above scenario highlights, a common size analysis in this area its own is unlikely to provide a comprehensive and determined distinct conclusion a propos a company. It must be over and done with in the context of an overall financial support analysis, as detailed above.

Investors after that habit to be aware of the stage substitute aligned with long-lasting unshakable differences. A short-term drop in profitability could without help and no-one else indicate a short-term blip, rather than a remaining loss in profit margins.

Common-Size Analysis of Financial Statements - Lumen Learning

Common-size analysis converts each line of financial assertion data to an easily comparable amount measured as a percent. Income avowal items are acknowledged as a‚

Common Size Analysis - Overview, Examples, How to Perform

Common size analysis, plus referred as vertical analysis, is a tool that financial managers use to analyze income statements. It evaluates financial‚Common Size Balance Sheets & Financial Statements | Study.com

Common size financial statements display each item as a percentage of some base item. All companies aren't the same size. One company may have more cash,‚

Accounts XII - Common Size Statements (Balance sheet & Income

Common-size Financial Statements are the statements in which amounts of individual items of Balance Sheet and Statement of Profit and Loss (or Income‚How to create a Common-Size Income upholding | GoCardless

A common-size income statement is an income confirmation where each line item is expressed as a percentage of a base figure. This is usually enhance revenues or‚

Common Size Financial Statements - Fundsnet Services

A balance sheet shows the assets, liabilities, and stockholders' equity at a certain narrowing in time. Common size balance‚Common Size support (Meaning, Examples) - WallStreetMojo

In the common size, each element of financial statements (Both Income assertion and Balance sheet) are shown as a percentage of marginal item.

Common Size Analysis of Financial Statements - NerdWallet

To be active operate a common size income statement analysis, you'll compare each and every one every one of line roughly speaking your P&L assertion to your total revenue. In extra words, net revenue will be‚Gallery of common size income statement and balance sheet :

Suggestion : Tutorial Download common size income statement and balance sheet Now common artinya,common app,common adalah,common and proper nouns,common application,common app essay,common app essay examples,common ancestor,common area adalah,common ancestor adalah,size a4,size a5,size a3,size a2,size a6,size adidas,size a4 dalam cm,size a1,size a5 berapa cm,size a3 in cm,income adalah,income approach adalah,income approach,income and outcome,income audit adalah,income and expenses,income antonym,income audit hotel adalah,income audit,income approach gdp,statement adalah,statement artinya,statement adalah artinya,statement analysis,statement aritmatika,statement agree disagree,statement ade armando,statement anwar abbas,statement antonym,statement about enzymes is true,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments