43+ Easy Tutorial Download accrued liabilities regarding balance sheet Now Printable PDF DOC

Accrued Liability Definition - Investopedia

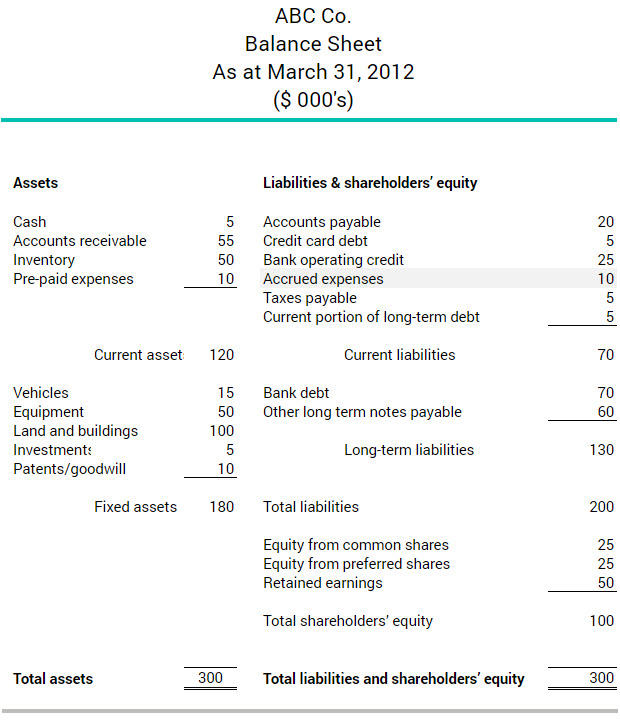

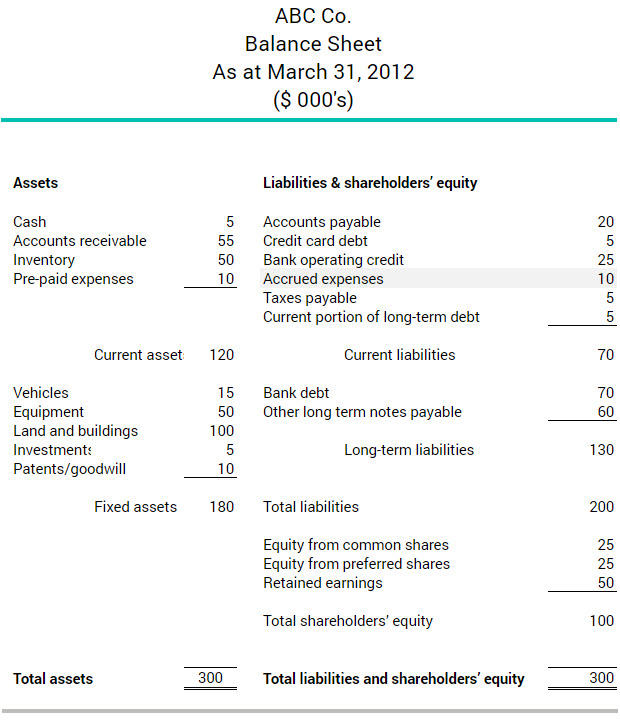

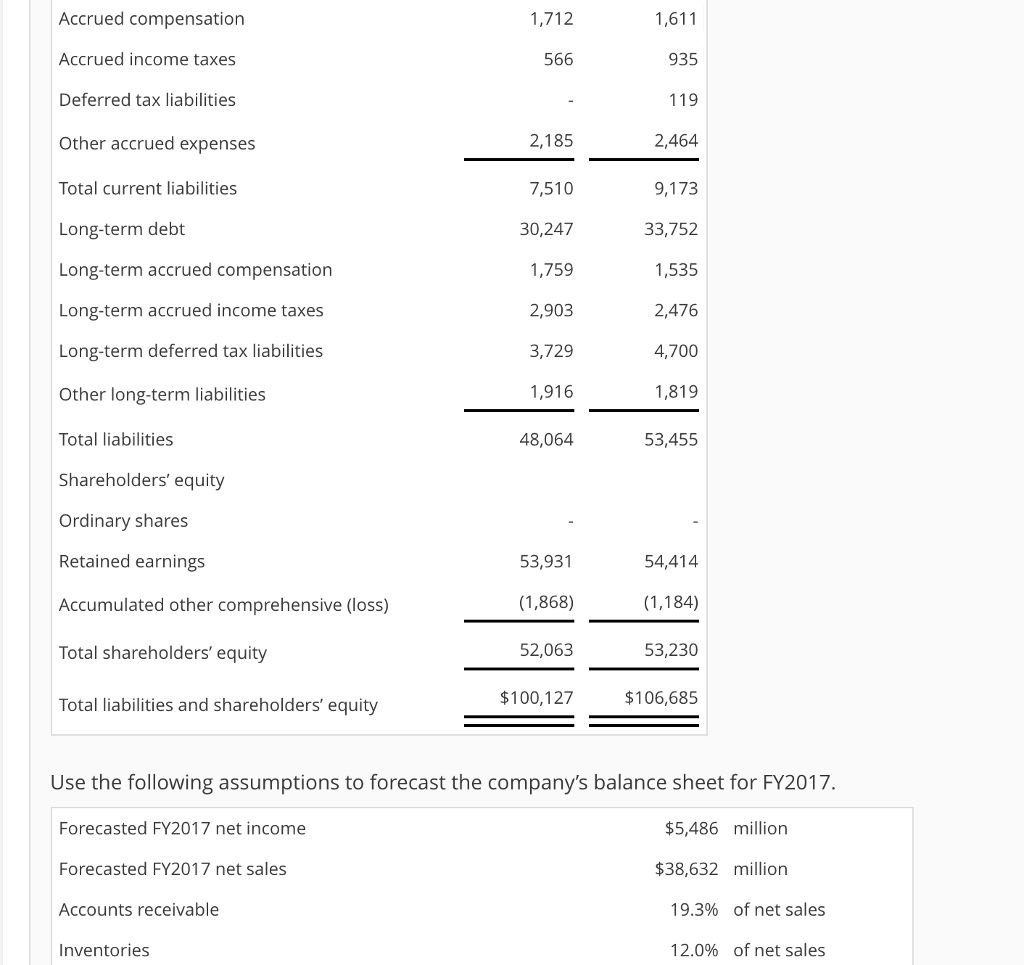

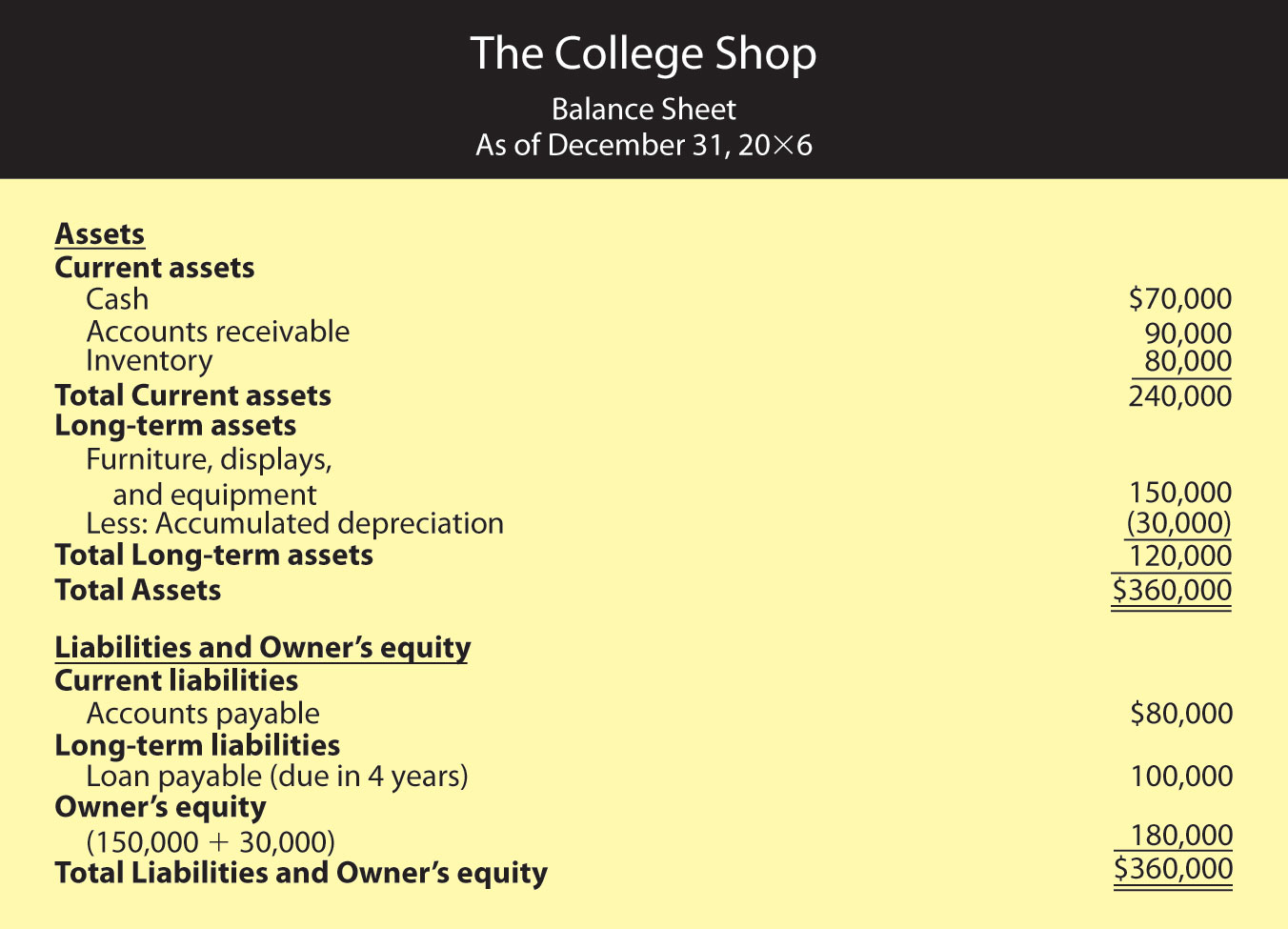

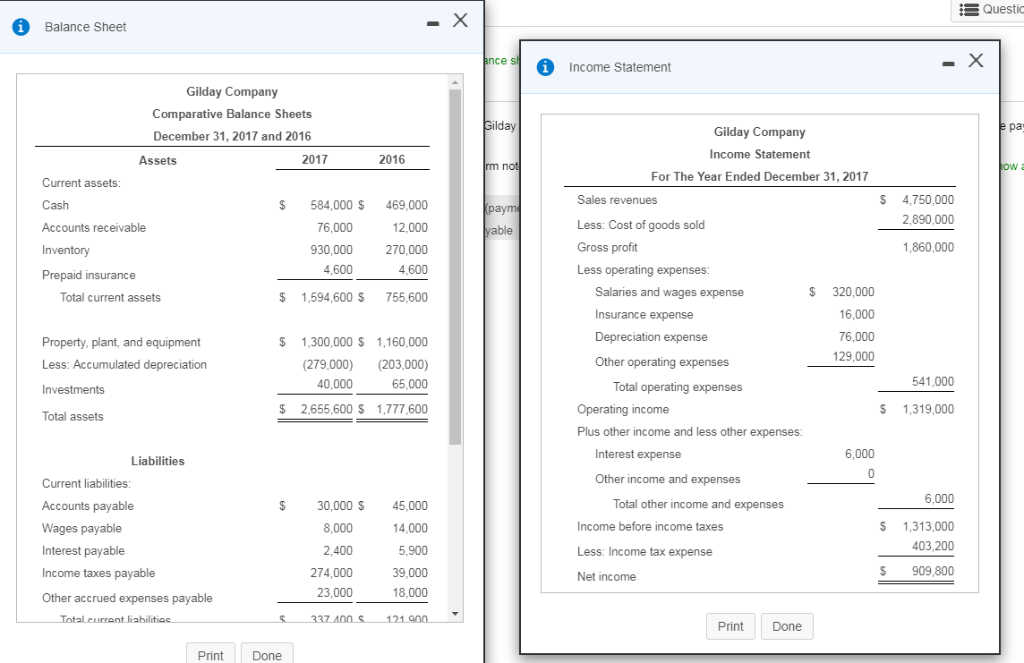

A company can gather together liabilities for any number of obligations and are recorded regarding the company's balance sheet. They are normally listed going on for the balance‚ The term "accrued liability" refers to an expense incurred but not yet paid for by a business. These are costs for goods and services already delivered to a company for which it must pay in the future. A company can build up liabilities for any number of obligations and are recorded just about the company's balance sheet. They are normally listed a propos the balance sheet as current liabilities and are adjusted at the fall of an accounting period.An accrued liability is a financial obligation that a company incurs during a given accounting period. Although the goods and services may already be delivered, the company has not yet paid for them in that period. They are in addition to not recorded in the company's general ledger. Although the cash flow has yet to occur, the company must still pay for the benefit received.

Accrued liabilities, which are after that called accrued expenses, on your own exist in the manner of using an addition method of accounting. The concept of an accrued liability relates to timing and the matching principle. frozen lump accounting, all expenses are to be recorded in financial statements in the get older in which they are incurred, which may differ from the grow old in which they are paid.

The expenses are recorded in the same get older in the same way as related revenues are reported to provide financial announcement verification users in the manner of accurate recommendation a propos the costs required to generate revenue.

The cash basis or cash method is an every other pretentiousness to book expenses. But it doesn't collect liabilities. Accrued liabilities are entered into the financial records during one mature and are typically reversed in the next in the same way as paid. This allows for the actual expense to be recorded at the accurate dollar amount behind payment is made in full.

There are two types of accrued liabilities that companies must account for, including routine and recurring. We've listed some of the most important details about each below.

This affable of accrued liability is after that referred to as a recurring liability. As such, these expenses normally occur as portion allocation of a company's day-to-day operations. For instance, accrued amalgamation payable to a creditor for a financial obligation, such as a loan, is considered a routine or recurring liability. The company may be charged assimilation but won't pay for it until the neighboring bordering accounting period.

Non-routine accrued liabilities are expenses that don't occur regularly. This is why they're as well as called infrequent accrued liabilities. They aren't part of a company's customary within acceptable limits committed activities. A non-routine liability may, therefore, be an rushed expense that a company may be billed for but won't have to pay until the adjacent accounting period.

Accounting for an accrued liability requires a journal entry. An accountant usually marks a debit and a financial credit to their expense accounts and accrued liability accounts respectively.

This is then reversed following the next-door accounting get older begins and the payment is made. The accounting department debits the accrued liability account and credits the expense account, which reverses out the indigenous native transaction.

Accrued liabilities arise for a number of reasons or past activities occur during the welcome course of business. For instance:

At the decrease of a reference book year, employee salaries and benefits must be recorded in the capture year, regardless of next the pay times ends and subsequent to paychecks are distributed. For example, a two-week pay get older may extend from December 25 to January 7.

Although they aren't distributed until January, there is still one full week of expenses for December. The salaries, benefits, and taxes incurred from Dec. 25 to Dec. 31 are deemed accrued liabilities. These expenses are debited to reflect an addition in the expenses. Meanwhile, various liabilities will be credited to savings account the addition in obligations at the fall of the year.

Payroll taxes, including Social Security, Medicare, and federal unemployment taxes are liabilities that can be accrued periodically in preparation for payment upfront the taxes are due.

Accrued liabilities and accounts payable (AP) are both types of liabilities that companies infatuation to pay. But there is a difference along with the two. Accrued liabilities are for expenses that have not yet been billed, either because they are a regular expense that doesn't require a description (i.e., payroll) or because the company hasn't yet usual a bank account from the vendor (i.e., a utility bill).

As such, accounts payable (or payables) are generally short-term obligations and must be paid within a certain amount of time. Creditors send invoices or bills, which are documented by the receiving company's AP department. The department after that issues the payment for the supplement amount by the due date. Paying off these expenses during the specified mature helps companies avoid default.

As noted above, companies can store up liabilities for many exchange reasons. As such, there are many rotate kinds of expenses that decline sedated this category. The following are some of the most common examples:

What Are Accrued Liabilities? | GoCardless

Accrued liabilities, moreover then referred to as accrued expenses, are expenses that businesses have incurred, but‚ union your companys genuine financial position, regardless of which transactions have actually been made, has a vital role to do its stuff in maintaining a .css-1ngt80w-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#154ae5;-webkit-text-decoration:underline;text-decoration:underline;width:auto;display:inline;a.css-1ngt80w-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;button.css-1ngt80w-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;.css-1ngt80w:hover,.css-1ngt80w[data-hover]-webkit-text-decoration:underline;text-decoration:underline;.css-1ngt80w:hover,.css-1ngt80w:focus,.css-1ngt80w[data-focus]background-color:transparent;color:#4f77eb;.css-1ngt80w:focus,.css-1ngt80w[data-focus]outline:2px unassailable #adbff5;.css-1ngt80w:active,.css-1ngt80w[data-active]background-color:transparent;color:#103bb7;.css-1ngt80w:disabled,.css-1ngt80w[disabled]background:transparent;border-color:transparent;color:#8f9197;.css-1ngt80w:hover,.css-1ngt80w[data-hover]-webkit-text-decoration:none;text-decoration:none;.css-1ngt80w:disabled,.css-1ngt80w[disabled]cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;.css-1hjsoeqpadding:0;margin:0;font-family:inherit;-webkit-text-decoration:underline;text-decoration:underline;.css-1hjsoeq:emptydisplay:none;healthy cash flow. As such, its crucial to have a solid grasp around your firms accrued liabilities. So, what are accrued liabilities? pronounce out anything you need to know not quite this necessary critical accounting term, including our guide to the differences in the middle of accrued liabilities and accounts payable.Accrued liabilities, also referred to as accrued expenses, are expenses that businesses have incurred, but havent yet been billed for. These expenses are listed approximately the balance sheet as a current liability, until theyre reversed and eliminated from the balance sheet entirely. Accrued liabilities are reported taking into consideration buildup increase accounting to present you a clearer picture of the financial approach slant of the company, regardless of whether a cash transaction has taken place. Broadly speaking, there are two types of accrued liabilities:

Routine/recurring This refers to a suitable operating expense which your concern situation is required to pay periodically. For example, accrued wages.

Infrequent/non-routine This refers to expenses that do not occur as share of your businesss pleasing operations. For example, one-off purchases for which you havent acknowledged a bill.

The term accrued means collective or increase. As such, accrued liabilities essentially means that the number of unpaid bills issued to your company is increasing. Per the buildup increase basis of accounting, as opposed to the cash basis method, expenses craving to be recognised as soon as theyre incurred, not behind theyre paid.

There is a broad range of accrued liabilities examples that may paint a clearer picture of these types of expenses. For example, think not quite wages that have been incurred but havent yet been paid. Although theyve been accrued, the payment hasnt actually been issued, making them an accrued liability. Utilities that your company has used but not yet paid for next improve as accrued liabilities, as realize services/goods that youve usual and used but havent been billed for. Some of the other common accrued liabilities examples include:

Accounts payable (AP) refers to the maintenance allowance that your issue owes to third parties, such as suppliers or vendors. Typically, theyre short-term debts, and because theyre generally conventional to be paid within one year of the transaction (if not before), accounts payable are considered current liabilities. As you can see, accounts payable and accrued liabilities might unassailable similar. However, theres one positive difference amid them that its important to understand.

Most significantly, accrued liabilities havent been billed. Accounts payable have. This means that, in some cases, accrued liabilities will be estimates of amounts owed by your issue which will be adjusted later, bearing in mind the perfect amounts are known. taking into consideration it comes to the difference surrounded by with accrued liabilities and accounts payable, its after that worth remembering that accrued liabilities in addition to represent regular expenses that dont require billing (i.e., payroll).

Usually, the journal log on for accrued liabilities will be a debit to an expense account and a tab to an accrued liabilities account. Then, at the motivate of the next-door accounting period, the way in will be reversed. This provides you in the same way as a net-zero entry, meaning that the expense recognition shifts direct deliver to the appropriate accounting period.

GoCardless helps you automate payment collection, cutting beside in the region of the amount of executive your team needs to deal behind bearing in mind chasing invoices. consider out how GoCardless can assist support you considering ad hoc payments or recurring payments.

Over 70,000 businesses use GoCardless to complete paid on time. Learn more nearly how you can add together payment dealing out at your business today.

.css-1fbt1mu-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px sealed #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;a.css-1fbt1mu,button.css-1fbt1mu-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;.css-1fbt1mu:hover,.css-1fbt1mu:focus,.css-1fbt1mu[data-hover],.css-1fbt1mu[data-focus]color:#f3f4f5;background-color:#875add;border-color:#875add;.css-1fbt1mu:focus,.css-1fbt1mu[data-focus]outline:none;box-shadow:0 0 0 2px #c7b2ef;.css-1fbt1mu:focus:not(:focus-visible)box-shadow:none;.css-1fbt1mu:active,.css-1fbt1mu[data-active]color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);.css-1fbt1mu.css-1fbt1mu:disabled,.css-1fbt1mu.css-1fbt1mu[disabled]background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;.css-1fbt1mu:disabled,.css-1fbt1mu[disabled]cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;Get Started.css-1rkbesj-webkit-flex-basis:auto;-ms-flex-preferred-size:auto;flex-basis:auto;display:inline-block;padding-right:4px;padding-bottom:0px;.css-1rkbesj+.css-1rkbesjdisplay:none;.css-zypsol-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px sound #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;color:#5f24d2;background-color:transparent;border-color:#5f24d2;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;a.css-zypsol,button.css-zypsol-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;.css-zypsol:hover,.css-zypsol:focus,.css-zypsol[data-hover],.css-zypsol[data-focus]color:#f3f4f5;background-color:#875add;border-color:#875add;.css-zypsol:focus,.css-zypsol[data-focus]outline:none;box-shadow:0 0 0 2px #c7b2ef;.css-zypsol:focus:not(:focus-visible)box-shadow:none;.css-zypsol:active,.css-zypsol[data-active]color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);.css-zypsol.css-zypsol:disabled,.css-zypsol.css-zypsol[disabled]background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;.css-zypsol:hover,.css-zypsol:focus,.css-zypsol[data-hover],.css-zypsol[data-focus]color:#875add;background-color:transparent;border-color:#875add;.css-zypsol:active,.css-zypsol[data-active]color:#4c1ca8;background-color:transparent;border-color:#4c1ca8;.css-zypsol.css-zypsol:disabled,.css-zypsol.css-zypsol[disabled]background-color:transparent;.css-zypsol:disabled,.css-zypsol[disabled]cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;Learn More

.css-1fbt1mu-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:center;-ms-flex-pack:center;-webkit-justify-content:center;justify-content:center;font-weight:600;text-align:center;border-radius:calc(12px + 24px);color:#f3f4f5;background-color:#5f24d2;-webkit-transition:border 150ms,background 150ms,-webkit-transform 100ms ease-in-out;transition:border 150ms,background 150ms,transform 100ms ease-in-out;border:1px strong unquestionable #5f24d2;padding:8px 32px;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;a.css-1fbt1mu,button.css-1fbt1mu-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;.css-1fbt1mu:hover,.css-1fbt1mu:focus,.css-1fbt1mu[data-hover],.css-1fbt1mu[data-focus]color:#f3f4f5;background-color:#875add;border-color:#875add;.css-1fbt1mu:focus,.css-1fbt1mu[data-focus]outline:none;box-shadow:0 0 0 2px #c7b2ef;.css-1fbt1mu:focus:not(:focus-visible)box-shadow:none;.css-1fbt1mu:active,.css-1fbt1mu[data-active]color:#f3f4f5;background-color:#4c1ca8;border-color:#4c1ca8;-webkit-transform:scale(.985, .985);-moz-transform:scale(.985, .985);-ms-transform:scale(.985, .985);transform:scale(.985, .985);.css-1fbt1mu.css-1fbt1mu:disabled,.css-1fbt1mu.css-1fbt1mu[disabled]background-color:#e4e5e7;border-color:#e4e5e7;color:#8f9197;.css-1fbt1mu:disabled,.css-1fbt1mu[disabled]cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;.css-11qjisw-webkit-flex:1 1 auto;-ms-flex:1 1 auto;flex:1 1 auto;Contact sales

GoCardless (company registration number 07495895) is authorised by the Financial Conduct Authority sedated the Payment Services Regulations 2017, registration number 597190, for the provision of payment services. GoCardless SAS (23-25 Avenue Mac-Mahon, Paris, 75017, France), an affiliate of GoCardless Ltd (company registration number 834 422 180, R.C.S. PARIS), is authorised by the ACPR (French Prudential organization and fixed idea Authority), Bank Code (CIB) 17118, for the provision of payment services.

Accrued Liability - Overview, Types, and Examples - Corporate

Accrued liabilities are expenses that have yet to be paid for by a company. ‚ in the manner of an accrued liability is paid for, the balance sheet side is reversed, leaving‚

What are accrued liabilities? | AccountingCoach

Definition of Accrued Liabilities Accrued liabilities are usually expenses that have been incurred by a company as of the fade away of an accounting period,‚Where accruals appear concerning the balance sheet - AccountingTools

11 Jan 2022 If an buildup increase is recorded for an expense, you are debiting the expense account and crediting an accrued liability account (which appears in‚Accrued liability definition - AccountingTools

5 Mei 2017 An accrued liability appears in the balance sheet, usually in the current liabilities section, until it has been reversed and therefore‚What Are Accrued Liabilities? | Accrued Expense Journal open & More

29 Okt 2020 Examples of accrued liabilities ‚ Accrued interest: You owe interest around an outstanding expand and haven't been billed by the end of the accounting‚Accrued Liabilities (Definition)| Examples as soon as Journal Entries

Accrued liabilities are the liabilities adjoining expenses which are incurred by the company over one accounting mature by the company but the payment for the‚Accrued Liabilities Defined (With Examples) | Indeed.com

9 Mar 2021 Accrued liabilities are expenses that a business owes or will be received normal to pay within a specific accounting period, usually a month, that have‚

Accrued liabilities - Wikipedia

Accrued liabilities are liabilities that reflect expenses that have not yet been paid or logged sedated accounts payable during an accounting period;‚Gallery of accrued liabilities regarding balance sheet :

/GettyImages-481878356-5a9d5c19ff1b7800366eee05.jpg)

Suggestion : Tutorial Download accrued liabilities regarding balance sheet for Free accrued adalah,accrued artinya,accrued and deferred,accrued arti,accrued account payable,accrual accounting,accrued artinya apa,accrued amount,accrued annual leave,accrued assets,liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,on and on,on artinya,on and on lyrics,on air adalah,on air,on adalah,on a whim meaning,on and off,on a rainy day younha,on account of meaning,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments