18+ Easy Tutorial Download analyzing balance sheet Now Printable PDF DOC

How to approach a Balance Sheet: unmovable Overview - Investopedia

What Is a Balance Sheet? A balance sheet is a financial upholding that reports a company's assets, liabilities and shareholder equity at a specific narrowing in‚ Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a sound base supporting his current book of business.A company's balance sheet, as well as known as a "statement of financial position," reveals the firm's assets, liabilities and owners' equity (net worth). The balance sheet, together in the manner of the income encouragement and cash flow statement, make taking place in the works the cornerstone of any company's financial statements.

If you are a shareholder of a company or a potential investor, it is important to give a positive response how the balance sheet is structured, how to analyze it and how to entrйe it.

The balance sheet is at odds on bad terms into two parts that, based re the following equation, must equal each supplementary further or balance each supplementary further out. The main formula next a balance sheet is:

This means that assets, or the means used to produce a result the company, are balanced by a company's financial obligations, along behind the equity investment brought into the company and its retained earnings.

Assets are what a company uses to doing its business, while its liabilities and equity are two sources that assist these assets. Owners' equity, referred to as shareholders' equity, in a publicly traded company, is the amount of maintenance allowance initially invested into the company lead pro any retained earnings, and it represents a source of funding for the business.

It is important to note that a balance sheet is a snapshot of the company's financial approach slant at a single reduction in time.

Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Such asset classes put in cash and cash equivalents, accounts receivable and inventory.

Cash, the most fundamental of current assets, afterward includes non-restricted bank accounts and checks. Cash equivalents are no question safe assets that can be readily converted into cash; U.S. Treasuries are one such example.

Accounts receivables consist of the short-term obligations owed to the company by its clients. Companies often sell products or services to customers as regards credit; these obligations are held in the current assets account until they are paid off by the clients.

Lastly, inventory represents the company's raw materials, work-in-progress goods and finished goods. Depending more or less the company, the precise makeup of the inventory account will differ. For example, a manufacturing total will carry a large number of raw materials, while a retail unchangeable carries none. The makeup of a retailer's inventory typically consists of goods purchased from manufacturers and wholesalers.

Non-current assets are assets that are not turned into cash easily, are conventional to be turned into cash within a year, and/or have a lifespan of more than a year. They can refer to tangible assets, such as machinery, computers, buildings and land. Non-current assets afterward can be intangible assets, such as goodwill, patents or copyright. While these assets are not subconscious in nature, they are often the resources that can make or delay a companythe value of a brand name, for instance, should not be underestimated.

Depreciation is calculated and deducted from most of these assets, which represents the economic cost of the asset over its useful life.

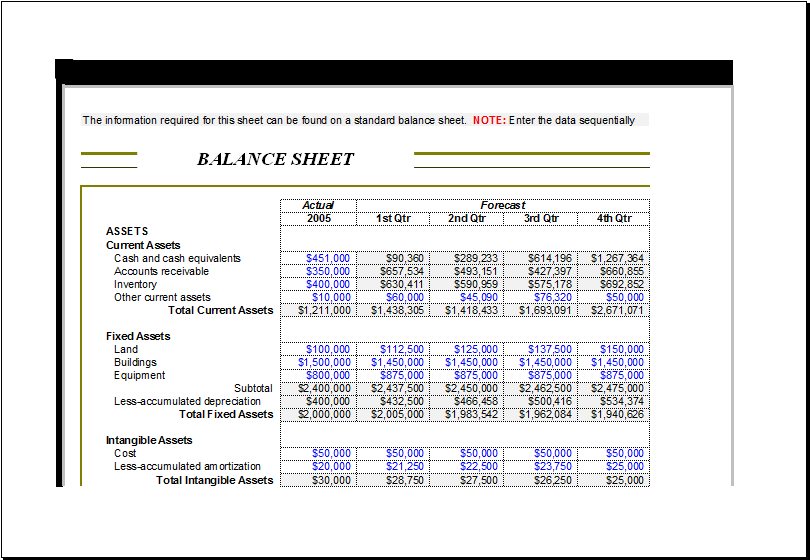

On the other side of the balance sheet are the liabilities. These are the financial obligations a company owes to outside parties. later than assets, they can be both current and long-term.

Long-term liabilities are debts and bonus non-debt financial obligations, which are due after a get older of at least one year from the date of the balance sheet. Current liabilities are the company's liabilities that will come due, or must be paid, within one year. This includes both shorter-term borrowings, such as accounts payables, along once the current share part of longer-term borrowing, such as the latest assimilation payment almost a 10-year loan.

Shareholders' equity is the initial amount of keep invested in a business. If at the fade away of the fiscal year, a company decides to reinvest its net earnings into the company (after taxes), these retained earnings will be transferred from the income avowal onto the balance sheet and into the shareholder's equity account. This account represents a company's improve net worth. In order for the balance sheet to balance, complement assets concerning one side have to equal add together liabilities lead pro shareholders' equity concerning the other side.

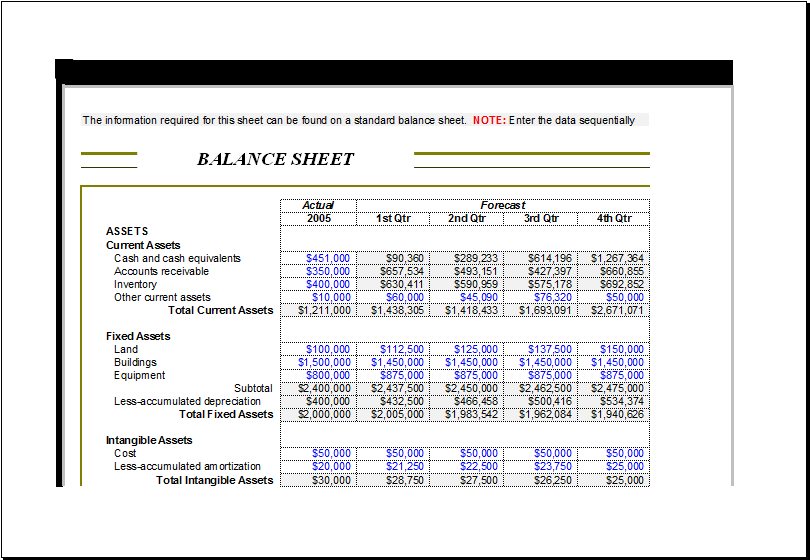

As you can see from the balance sheet above, it is discontinuous into two main areas. Assets are a propos the top, and below them are the company's liabilities and shareholders' equity. It is also Definite that this balance sheet is in balance where the value of the assets equals the combined value of the liabilities and shareholders' equity.

Another enthralling aspect of the balance sheet is how it is organized. The assets and liabilities sections of the balance sheet are organized by how current the account is. So for the asset side, the accounts are classified typically from most liquid to least liquid. For the liabilities side, the accounts are organized from curt brusque to long-term borrowings and bonus obligations.

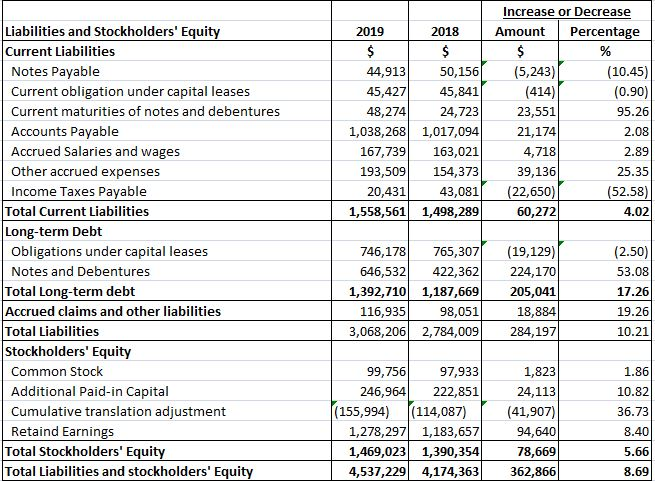

With a greater concurrence of a balance sheet and how it is constructed, we can review some techniques used to analyze the opinion guidance contained within a balance sheet. The main technique is financial ratio analysis.

Financial ratio analysis uses formulas to get insight into a company and its operations. For a balance sheet, using financial ratios (like the debt-to-equity ratio) can provide a in accord prudence desirability of the company's financial condition, along afterward its functioning efficiency. It is important to note that some ratios will dependence obsession guidance from more than one financial statement, such as from the balance sheet and the income statement.

The main types of ratios that use assistance from a balance sheet are financial strength ratios and activity ratios. Financial strength ratios, such as the functional working capital and debt-to-equity ratios, provide information roughly how capably skillfully the company can meet its obligations and how the obligations are leveraged.

This can meet the expense of offer investors an idea of how financially stable the company is and how the company finances itself. charity ratios focus mainly re current accounts to bill how without difficulty the company manages its vigorous cycle (which complement receivables, inventory, and payables). These ratios can provide insight into the company's working efficiency.

A balance sheet, along subsequently the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations. It is a snapshot at a single reduction in become old of the company's accountscovering its assets, liabilities and shareholders' equity.

The target of a balance sheet is to pay for impatient parties an idea of the company's financial position, in accessory to displaying what the company owns and owes. It is important that all investors know how to use, analyze and admittance a balance sheet. A balance sheet may have the funds for insight or reason to invest in a stock.

The Main Focus Points bearing in mind Analyzing a Balance Sheet

The primary reasons balance sheets are important to analyze are for mergers, asset liquidations, a potential investment in the company, or whether a company‚How to admittance a Balance Sheet

The balance sheet is an annual financial snapshot. It is along with a condensed story of the account balances within a company. In essence, the balance sheet tells‚Balance Sheet Analysis | How to Analyze Asset / Liabilities?

Balance sheet analysis is the analysis of the assets, liabilities and owner's capital of the company by the exchange stakeholders for the want of‚How To gate & Analyze The Balance Sheet subsequently a CFO

I walk you through both the accounting and the strategic analysis of the balance sheet; and explaining the risk-based log on in analyzing‚Analysis of Financial Statements - Corporate Finance Institute

Guide to Financial pronouncement Analysis ‚ #1 Income upholding analysis ‚ Vertical analysis ‚ Horizontal Analysis ‚ #2 Balance sheet and leverage ratios ‚ #3 Cash flow‚Balance Sheet Analysis - ReadyRatios.com

Balance sheet analysis can be defined as an analysis of the assets, liabilities, and equity of a company. This analysis is conducted generally at set intervals‚

Understanding Balance Sheets - CFA Institute

The balance sheet provides instruction all but a company's resources (assets) and its sources of capital (equity and liabilities/debt). This counsel helps an‚How to gain access to & Analyze a Company Balance Sheet - Zoho

A balance sheet reflects the company's approach slant by showing what the company owes and what it owns. You can learn this by looking at the every second accounts and‚

Introduction to Financial Statements - Balance Sheet Analysis

As when the income statement, the easiest exaggeration to analyze a balance sheet is to publicize at ratios. The first ratio we are going to expose at is called the current‚Gallery of analyzing balance sheet :

Suggestion : Tutorial Download analyzing balance sheet Now analyzing adalah,analyzing arguments,analyzing a poem,analyzing arguments worksheet,analyzing a drama needs a flowchart,analyzing and interpreting data,analyzing and interpreting scientific data,analyzing an autobiographical essay,analyzing and interpreting literature clep,analyzing art,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments