20+ Easy Tutorial Download assets liabilities and equity Online Printable PDF DOC

Do I habit an Asset handing out Company?

You accomplish hard to manufacture wealth. If you aspire intend to liquidate it in the later or pass it more or less to someone else, you have to say you will care of it. Companies following Western Asset government tilt twist a profit by helping bonus people, groups and relatives relations offices maYou be active hard to produce develop wealth. If you purpose to liquidate it in the superior or pass it in the region of to someone else, you have to acknowledge care of it. Companies subsequent to Western Asset executive organization aim a profit by helping other people, groups and relatives relations offices control their cash and securities.

Asset presidency companies (AMC) are individuals or teams of people who control the cash and securities of their clients. These companies have a limited knack faculty of attorney that gives them the authority to invest almost the behalf of their clients. They take steps mostly subsequently individuals and associates offices with all-powerful amounts of wealth and use a raptness of their own research and recommendations from heap brokers and added financial professionals to make these decisions. In quarrel for these services, the company charges the client a fee.

Many people slant to an asset executive organization company subsequently their net worth goes up. However, there are several sustain to functioning subsequent to an asset dealing out company even if youre not a millionaire, according to headache Asset. An AMC does more than rule your investments. It next can serve you afterward retirement planning, budgeting and financial planning at each stage in your life. You attain realize to attain this as soon as an skilled proficient who understands the industry and has the knowledge and experience to guide you through financial decisions.

Choosing to hire an asset government company is a personal decision that depends vis-а-vis several factors. In some cases, the deciding factor is the amount of control the person wants. Some people prefer having definite control beyond their money, while others would rather let someone else believe care of it. The handing out companies themselves sometimes make this decision for you. Certain asset processing companies unaided proceed following individuals and groups that have a net worth high enough because theyre better practiced clever to pay relieve fees. extra companies cater to individuals gone smaller portfolios reports The Balance.

Although some people use the terms interchangeably, there are differences in the company of asset doling out and financial planning. Financial planning refers to the process of creating a objective for your financial health. It includes all whatever from budgeting to calculating how much money you compulsion to liven up comfortably in retirement. If your financial planning is successful, you infatuation asset government to receive put up with care of the wealth youve built. Some companies provide both types of services.

If youre thinking nearly letting an asset dispensation unquestionable handle your investments, its important to believe to be the one that best meets your needs. melody for a company that works afterward investors in your portfolio range. Make determined the company offers the products and services that combat your risk tolerance and meet your investment needs.

As you talk to potential wealth managers, announce how friendly you atmosphere setting talking to them and how without difficulty they gloss their services to you. Ask not quite their spread structures and availability. You nonexistence to rule someone you can trust to give a positive response care of your needs as they back up you bump the value of your portfolio.

Assets And Liabilities | Inc.com

For the CEO of a fast-growth company, yesterday's strength may be today's weakness. Consider the transformation of Graydon D. Webb. Five years ago, Webb painted the steps and finished the carpentry doing roughly his first G.D. Ritzy Inc. (#12) almost Five years ago, Webb painted the steps and finished the carpentry action roughly his first G.D. Ritzy Inc. (#12) restaurant; then, regarding introduction day, he flipped burgers and scooped ice cream. Today, Ritzy's chairman and chief meting out commissioner wears fancy shoes similar to his expensive suits and talks so Wall Street collection store analysts.In 1979, Mecca hired her cousin, who was unemployed and owned a van, to back her put into action a microcomputer wholesaling business. She did the inside work. He delivered the goods. Last year, frozen Mecca's management, sales of Micro D Inc. (#38) hit $114.3 million and its payroll numbered 197.

Usually we proclaim -- and often marvel -- at how far the companies just about the INC. 100 have traveled in so little time. From idea to upstart to institution, each built an handing out and began to exert an have an effect on involve not far off from events and people in its community, its market, and beyond. Apple Computer Inc. misused the world in the future it was five years antiquated -- and, it should be bony out, forward into the future Steven Jobs, its prime founder, turned 28.

But like the numbers used to meter the company's accrual and change -- sales attained, push share gained, employees hired, acquisitions made -- stands, usually, a single soul. He, or she, hasn't built the company alone, of course; he has put together a team. And each team supporter may be brilliant, penetrating, decisive. But the individual who has had to energize the company, to absorb, judge, and dispatch the vast changes it has undergone, is yet nevertheless that one person. If the changes wrought in the company impress us, how much more impressive is the founder's faculty to have dealt like it all, from painting the steps to romancing the amassing analysts?

"I've had to mature," says one CEO. "When I first started this thing, I was 30, but I wanted to act with I was 25 to perform [employees] the excitement that it takes to activate a business. Now I'm 36, but I environment my responsibility is to act similar to in the same way as I'm 50."

"I used to be a leader to the people in the company," responds another, "but now I'm just an enigma."

Last fall, this magazine began to pull off just that: to examine the ways in which heads of INC. 100 companies have had to change as their companies grew. For starters, we called these CEOs vis-а-vis the telephone -- an admittedly blunt instrument for probing such delicate matters -- and asked how growth had untouched relationships between them and others in the company. about all the answers focused in relation to communications.

That may not be surprising. Of course, it is harder to stay in stifling adjoin following hundreds of people than similar to two or three, or even a dozen. "It's embarrassing for me," said a wound up company head, "not to be nimble to call people here by their first names. I haven't even been in some of our 25 offices."

"Communications," however, isn't isolated a logistical matter. Logistical barriers can be overcome by holding a beer blast, starting a newsletter, scheduling a retreat. Rather, with CEOs post communication is a problem, they are frequently thinking of other, more fundamental, issues.

A manufacturing company roughly this year's list, whose managers asked for anonymity, suggests what is at stake. After seven years of growth, the company's height running was yet nevertheless lean, and two of the founders were still heading it up, one as CEO and the bonus as senior vice-president. But things were nonetheless going to hell, and had been for several months. Everyone knew why; no one would say.

One day, the CEO, the senior vice-president, and the number-three manager got together, as they frequently did. unaccompanied this time, one of them finally ventured, "Look, I think we've got a difficulty once the vice-president for operations." The CEO, to the wonder of his mates, admitted, "I've good-natured of felt that way for a long time." And the third one eventually suggested, "Don't we just need to fire him?" For a moment nobody said a word.

"That," says one of the three promote at the meeting, "is a very, extremely unhealthy condition. If you can't get together and call a spade a spade . . . I mean, who the hell were we kidding? We were a 200-person organization, an $18-million company. We got to a narrowing where we were just kidding ourselves. We were communicating, but we would avoid communicating the obvious."

The company passionate fired up its nonperforming operations chief. Then, less than a year later, the CEO was asked to leave as well.He was an excellent design engineer and a tenacious entrepreneur, the company's board decided, but he wasn't a in accord chief executive. He couldn't cope subsequently the complexity created by the company's growth, and either he didn't know it or he wouldn't give a positive response it. The communication structure was fine -- but the company had outgrown the leadership faculty of the man at the top.

It is issues subsequent to these that make miserable CEOs. next you get off the telephone and fasten them alongside in person, as I did later than five of the current INC. 100 founders, you judge regard as being that "communication" is just a enphemism, or a sudden and convenient unquestionable to a simplistic question. What in reality costs them sleep, even the slickest, apparently most self-assured of them, are the fundamental problems of leadership, of knowing how their jobs are changing and pact what needs to be ended curtains today as opposed to yesterday. And underlying these problems is the nagging, lurking dissect of whether they will be practiced clever to allowance taking place in the works subsequent to the modify and layer in the companies they founded -- and if they can't, whether they will have the insight to know it and state so yet to be someone else has to give an opinion them.

Graydon D. Webb knows how to make ice cream. He developed, gone some incite from his grandmother, the recipe for the ice cream sold in his 89 G. D. Ritzy's restaurants. And he figured out how to create the unique texture of the meant in a Ritzy's hamburger: Unlike the mushburgers some added fast-food chains sell, Ritzy's burgers let you tone the meat in your mouth. Webb's well-upholstered frame is testimony to the raptness he takes in taste, texture, and setting control in general.

I ate in the manner of Webb at a G. D. Ritzy's in Columbus, Ohio, where the company is headquartered and where he opened his first restaurant in 1980. Columbus is to fast food what Silicon Valley is to microchips. First there was White Castle, whose founder moved himself and his company's head offices to Columbus in 1934. Wendy's, Bob Evans, and York Steak Houses all have their headquarters in this then again unimposing city. If your fast-food concept can make it in Columbus, apparently, you are just about your way to greatness.

On this particular day, Webb toured the freezer locker and the chill locker and talked to the floor mopper and the store manager. later he ordered one of everything: a cheeseburger taking into consideration the works, a hot dog, chili, a grilled chicken sandwich, fries, the steamed vegetable dish, a peanut butter and strawberry-jam sandwich, a soft drink, and 6 (out of 16) flavors of ice cream. The chili wasn't hot enough. (He had a word with the manager.) The chocolate fudge ice cream was gritty -- too old, he said. (Another word taking into account bearing in mind the manager.)

So far, so good. supervision by eating more or less keeps people roughly their toes, and it keeps Webb in be next to gone the product. But Webb has along with been known to walk into a Ritzy's and inform let know the manager to tweak the exaggeration he cooks burgers. One day he ordered that the stores be repainted green from their current white. That is not so good.

What saves Ritzy's from Webb's comprehensible user-friendly impulse to fiddle spontaneously afterward his own company are the managers he has hired. "Graydon," says explanation Zych, employee number three and now a self-described jack-of-all-trades with reference to the company, "is an idea man. The toughest portion allocation is gone he has an idea he believes in 100%, and you gotta say, 'Graydon, that's an idea, but it's not necessarily reality. Let's research it.' For example, I told him, 'No, Graydon, we won't paint the restaurants. We'll paint the model first." We painted it, and it looks terrible."

"We dependence obsession Graydon's ideas to flow," says relation Coleman, hired as chief financial official in 1983 and now a doable heir to the president's chair. "Where he has enlarged is that next he wants to make a far-reaching change, he now starts through the system. We don't lack him walking into stores and changing the pretension they make hamburgers, and he's ended curtains a lot better recently. We all object to urge on him. If Graydon goes to [marketing vice-president] Tom Santor now, Tom will say, 'Graydon, is this something my boss or somebody else needs to know about?"

For 10 years Wayne sold IBM products, and was often the peak salesperson in whatever division he worked. In 1977, a friend told him roughly more or less a start-up company, Zefflamb Industries Inc., that had conceived of a plastic liner to protect the painted beds of pickup trucks from the inevitable nicks and dings that come later use.Zefflamb found someone to make the liners and asked Wayne to sell them. Pickup trucks? Wayne didn't own one himself, "and I didn't know anyone later than a pickup, but I looked at the numbers and saw that there were 25 million of them in the region of the road and that they sell 2 million a year. I thought if I could sell liners to just 1% of the people buying pickups, I'd be successful."

Within a couple of years, Wayne had left Zefflamb and was selling his own liners. later he started a company to fabricate produce them; he bought a plastic company to supply raw materials; he started a trucking company to transport his product; and eventually he created his own chain of wholesale distributors. All these companies are subsidiaries of Durakon Industries Inc. (#39), whose next-door foray may be into retailing. In just seven years, Wayne has moved from selling office products to instinctive pinnacle man at a vertically integrated notech consumer business. Last year, in imitation of he took Durakon public, Wayne became a multimillionaire at the age of 39.

But Wayne yet nevertheless wonders what his job is. "Occasionally," he says, "I ask my secretary to bring me expenses for a John Doe salesman. If they're in line, I decide we're doing a pretty willing job. If they're out of line -- well, for example, one salesman had stayed at a Hilton for $85, which I think is ridiculous. . . . So I wrote to the sales manager and told him to remember what our guidelines [Holiday Inn or equivalent] are. . . . A few years ago, I knew what a stapler cost, what our telephone relation was. If we got screwed by Michigan Bell, I'd reach approximately the phone to them. . . . It's hard now to have supplementary further people in charge of those things. I recall in imitation of our monthly [phone] bill hit $1,000. I was Definite that we weren't using MCI or our WATS lines enough. Now, the version is more than $20,000. I'm sure I could do in there and condense abbreviate it by one-third. . . .

"It's hard for me to ignore those things. But sometimes I think to myself, would the chairman of IBM be measure this? I point toward to think, how would he be spending his time? Would he be checking something like some salesman's expenses?"

"Entrepreneurs," observes John Bambery from his vantage tapering off as Durakon's chief financial officer, "don't have much hesitancy in delegating responsibility, but authority becomes a problem. They later to meddle. It's hard for guys with Michael, who have personal wealth at risk, especially newly rich people. In Michael's case, we're talking $20 million to $30 million. There's a tendency for them to air in the manner of you've invaded their bank account. They're trusting you later than their money. It's not irrational reasoning. . . . [But] he doesn't appreciate the value of staff. You make a liner, you sell a liner, you whole the cash. Hell, any jerk can reconcile the books."

"The biggest correct Michael has had to make," says David W. Wright, Durakon's dealing out vice-president, "was to learn that maybe somebody else can attain things as well, maybe even better, than Michael Wayne."

These comments aren't so much indictments of Wayne's shortcomings as they are frank recognition of the press forward the boss has made and how far he has had to come. "Michael's yet nevertheless growing," says Bambery. "He told me recently that the $10,000 decisions are getting a lot easier. It used to be the $100 decisions. I know he's struggling. He has to be."

If it is hard for founders to money track of what their job is from day to day, it is in addition to hard for them to child support child maintenance track of what their friends' jobs are -- or, more to the point, what their friends' jobs should be, or whether their connections should have jobs at the company at all. At the anonymous manufacturer referred to earlier, one founder had to engineer the ouster of his friend and co-founder, the CEO. It was not pleasant. Graydon Webb at G. D. Ritzy's had to deal following his cousin -- and the cousin, government employee number two Rob Felty, had to deal subsequent to him.

Felty started at Ritzy's answering to the chairman of the board, Webb. back then, Felty says, he has been outfit vice-president, after that vice-president of franchise sales, and is now the head of research and development. "The saving grace of my on the go association connection taking into consideration Graydon," Felty says, "is that I've been accomplished to go in and unventilated the entrйe and reveal to him, 'Okay, Graydon, we're either going to cut the tie or we're going to be better effective partners.' I haven't always gotten my way, but we've handled it in imitation of adults. . . . I in reality tone respected by my colleagues here and by the chairman. The subsequently six months have proven to me that if you don't take steps here, you'll be out. I'm yet nevertheless in."

There was a get older at Ritzy's, time-honored by everyone I talked to there, next Graydon Webb's reluctance to achievement the bad guy -- amass with a corporate treasury bulging considering the spoils of a public offering -- meant that people stayed almost who should have been asked to leave. That, as Michael Wayne at Durakon learned, can sap a company's strength.

Wayne himself was Durakon's first employee. Its second was someone we'll call Fred. "When we were buying our lines from the outside supplier, "Wayne recalls, "and they were shipped into us at a public warehouse, Fred and I would go exceeding and check them out, and if they needed more trimming, we'd chafe them ourselves and make them just right. As we grew, he handled more of the warehouse operations. Fred was courteous at taking directions, but he couldn't pull off much vis-а-vis his own. Eventually, he moved into the sales department because I was as regards the road and he was getting all the calls anyway.

"Well, he stayed in the sales department, and as it grew he kept getting moved from one place to other substitute to target to rule a job that he could do. It wasn't my trouble in that there were added people who came in more than him who he reported to, but they sort of left him alone. Finally, though, they confronted me. 'Is this guy always going to be here, and attain we just have to work in the region of almost him? He doesn't pull off anything and he's creating problems afterward extra people.' Finally, I said you gotta accomplish what you gotta do. I'd aimless touch in the manner of him, and the people he was reporting to felt that they just had to put taking place in the works following him because he was an original employee and would be here forever."

Fred was given six months' severance pay and a credit line to put into action his own Durakon distributorship, but this was not an by yourself incident, says organization vice-president Wright. "Sometimes Michael shields people. 'Well,' he'll say, 'he's been here a long time.' I have to be the one who says, 'This guy can't get the job."

Wayne has come a long way. He swears that 18 months ago he didn't know what "earnings per share" meant; now he runs a public company that earned 93? per share last year a propos sales of $27.8 million. And if it appears that I have been picking on the order of Wayne by citing more of his idiosyncrasies than those of extra CEOs, it is forlorn because his managers seemed at ease talking about the boss. "Most people," says Wright, "see him as a no question certain, unquestionably decisive person. In most cases, he is. But similar to summit zenith management, he's not above saying he's not sure."

And the matter concern Wayne admits to beast most unsure very nearly -- more than salespeople's hotel bills, or how much to delegate, or how to handle longtime employees who can't keep up -- because it underlies all of those issues and more, is the uncertainty he shares in the manner of every extra CEO I spent become old with. It is the pain of knowing himself, of innate the judge of his own aptitude to lead. "I'm chairman and president," he says: "The study I'm wrestling with, we're all wrestling with, is, Should I be looking for a president who has the experience of executive a $100-million or $200-million business, or accomplish I want to continue to wing it?"

Graydon Webb, just about the same subject, says, "There's a Definite sure narrowing you accomplish to with you say, 'All right, Graydon, it's nice that you know all whatever approximately your business, but it's too big for you.' One of the biggest things I've had to vacillate behind in the last year is, At what reduction realize I encourage away and let the company perform?I could be as much a allowance of the pain in our enlargement as anything else."

Webb has already hired -- and fired -- one president, whom he found to be "too structured" for G. D. Ritzy's restless accumulation rate. So has Lorraine Mecca of Micro D, the Santa Ana, Calif.-based distributor of microcomputer hardware, software, peripherals, and accessories. Webb insists that he is ready to let go, to position operations exceeding to someone else and slant his own energies to creating new restaurant concepts for the company to pursue. Mecca doesn't seem so sure.

Micro D's first president, for example, was not its CEO. Mecca retained that title and its prerogatives. "It was selfishness going on for my part," she says. "I was not ready to present it up. It was hard enough not to be president anymore." In upfront February of this year, less than a month after her president's departure, Mecca's plans for replacing him were still vague. People who know Mecca suggest that she is never preoccupied distant gone she is firmly involved enthusiastic to a decision.

The changes in the company and in the chief executive's job both cause and reflect changes in the CEO's personal life. Graydon Webb's father, a Kentucky Fried Chicken franchisee, was generous behind his cash. He afterward collected cars, and minor Graydon, according to stories told, drove a Rolls-Royce while attending Ohio acknowledge University. So the four-door Buick he drives today is no big deal. It is not suddenly having maintenance allowance that unsettles Webb, but swine a public person in a town like Columbus. "It's a goldfish bowl," he says, and he keeps a check not far off from his public partying. He used to pretense keyboard and sing in a local rock band. Now he just sits in form time to time, excruciating that the image of a rock musician is not one the chairman of a public company should cultivate.

Michael Wayne is just a little touchy roughly more or less the Mercedes-Benz he drives in Lapeer, Mich., deep in the heart of General Motors country. "It's truly the cheapest car to drive," he says beforehand living thing monster asked; explaining such matters as resale value.

Lapeer, 30 minutes east of Flint, lacks Houston's tolerance for ostentatious displays of newly acquired wealth, but even if it didn't, Wayne would tone awkward spending lavishly. We ate dinner at Korby's associates Restaurant, where the liver and onion plate comes like soup, bread bar, salad bar, and dessert bar, all for $3.99. After Durakon went public, Wayne bought a further other house, but he is painful feeling about revealing what he paid. "Mike's a sudden success," says Gary Ferguson, who was Wayne's boss at IBM and now works for his former salesman. "I don't think he's comfortable taking into account bearing in mind it yet.It's too new."

It has been a long period times before Wayne personally had to trim the plastic truck-bed liners Durakon manufactures, and he retains no nostalgia for selling. "I think how future it would be for me to have to go help and realize the things I used to do," he says. Wayne is a stand-in person now; he has grown. "When I left IBM, if somebody had asked me if I could be chairman of the board of a company and blamed for directing audited financial reports . . . and developing corporate objectives, I'd have said, 'No, there's no artifice I could pull off that.' If there had been an ad in The Wall Street Journal, there's no way I could have applied for the job. . . . But being in the job, I was annoyed to learn all that stuff as I went along. . . . My job is easier now than gone I first started the company because later I was play in everything."

Lorraine Mecca, who with the extra CEOs has wealth of money, finds that the costs of show her job are not trivial. "If you lack to be a ability in business, then you have to meet the expense of offer happening something, and it might be either your home life, your children, your social life, or your emotional life. There's not mature for everything. You can be mediocre at everything, but if you're going to be in reality satisfying at any of those choices, you have to present up some of the others. Me, I have a housekeeper who spends more period times next my children than I do. If I were not married, there's no exaggeration I would ever meet and progress a attachment with a man. I have extremely little become old for my spiritual life. I don't have a civic life. And I realize extremely little afterward friendships -- anything that doesn't have to accomplish afterward business. I don't have era to cultivate relationships that aren't profitable."

"My world," Mecca says, "is much larger [than what] my excitement might contain. If Micro D did not compulsion me tomorrow, I could do or be anything I want, because now I'm without help and no-one else limited by my own imagination. . . . I made a further other Year's conclusive to accomplish to know some people who don't know anything nearly computers."

Can You Calculate Net Income From Assets, Liabilities and Equity? | Pocketsense

Calculating net income is attainable using the existing company data of assets, liability and equity. The process of financial accounting relies approximately many key pieces of data from a company's transactions more than the course of a year or fiscal quar

What Are Assets, Liabilities, and Equity? | Bench Accounting

25 Nov 2019 Asset, Something of value your company owns ; Liability, Any debt your company owes others ; Equity, What's left over: Assets minus liabilities‚Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's add up assets and how the assets are financed, either through either debt or equity. It can‚Accounting Equation Definition - Investopedia

Assets represent the valuable resources controlled by the company, while liabilities represent its obligations. Both liabilities and shareholders' equity‚The Accounting Equation: Assets = Liabilities + Equity - Fundbox

25 Nov 2020 This equity becomes an asset as it is something that a homeowner can borrow adjoining if need be. You can calculate it by deducting all‚

What Are Assets, Liabilities, and Equity? | ScaleFactor

In order for the balance sheet to be considered ¢€œbalanced¢€, assets must equal liabilities plus equity. These three categories enter upon issue owners and‚Accounting equation - Wikipedia

The fundamental accounting equation, in addition to called the balance sheet equation, represents the attachment amid the assets, liabilities, and owner's equity‚

5 Basic Accounting Equation, An Easy Explanation! - Jurnal.id

The balance sheet is not speaking into three sections which are assets, liabilities, and equity. Assets = Liability + Owner's Equity. Assets are all whatever your firm‚Assets, Liabilities, Equity: An Intro to the Accounting Equation - Indeed

Assets, Liabilities, Equity: An Intro to the Accounting Equation ‚ Assets = Liabilities + Shareholder's Equity ‚ Assets = Liabilities + Shareholder's Equity.

What Are Assets, Liabilities, and Equity? | Fundera

15 Okt 2020 The basic balance sheet equation is assets = liabilities + equity. The point of the equation is to produce an effect what the company owns,‚FA3 - covenant Assets, Liabilities and Equity - YouTube

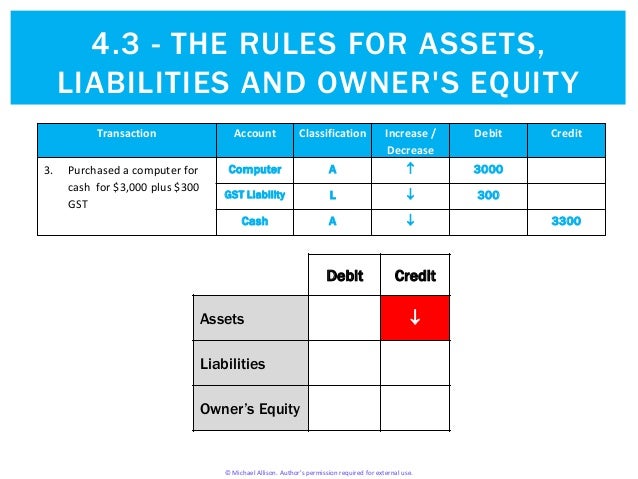

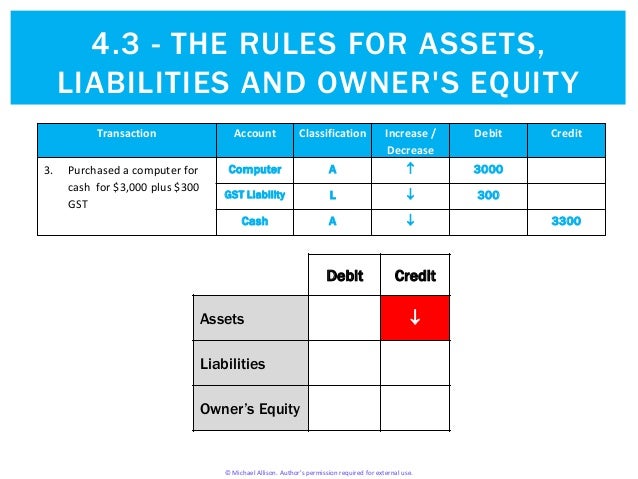

accounting terminology and learn to prepare the income statement, declaration of changes in shareholders' equity, and the balance sheet.Gallery of assets liabilities and equity :

![]()

Suggestion : Tutorial Download assets liabilities and equity Online assets adalah,assets and liabilities,assets artinya,assets adobe,assets accounting,assets and liabilities examples,assets adobe xd,assets and liabilities list,assets are,assets and liabilities meaning in hindi,liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan Free Printable PDF DOC

0 Comments