48+ Easy Tutorial Download balance sheet assets liabilities Online Printable PDF DOC

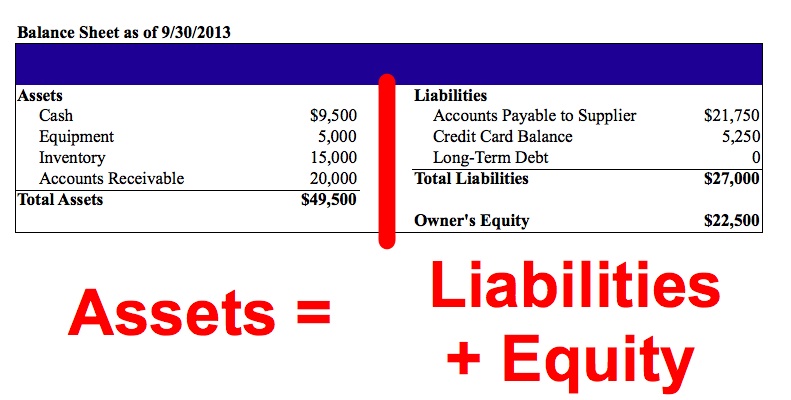

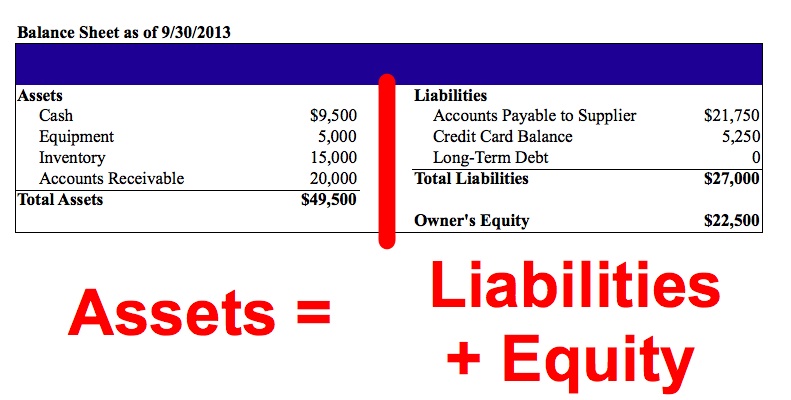

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's tally assets and how the assets are financed, either through either debt or equity. It can‚ The balance sheet is one of the three fundamental financial statementsThree Financial StatementsThe three financial statements are the income statement, the balance sheet, and the declaration of cash flows. These three core statements are and is key to both financial modelingWhat is Financial ModelingFinancial modeling is performed in Excel to forecast a company's financial performance. Overview of what is financial modeling, how & why to produce develop a model. and accounting. The balance sheet displays the companys improve assets and how the assets are financed, either through either debt or equity. It can in addition to be referred to as a statement of net worth or a support of financial position. The balance sheet is based all but the fundamental equation: Assets = Liabilities + Equity.As such, the balance sheet is at odds on bad terms into two sides (or sections). The left side of the balance sheet outlines all of a companys assetsTypes of AssetsCommon types of assets supplement current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and. approaching the right side, the balance sheet outlines the companys liabilitiesTypes of LiabilitiesThere are three primary types of liabilities: current, non-current, and contingent liabilities. Liabilities are legitimate authenticated obligations or debt and shareholders equityStockholders EquityStockholders Equity (also known as Shareholders Equity) is an account on a company's balance sheet that consists of share capital plus.

The assets and liabilities are at odds into two categories: current asset/liabilities and non-current (long-term) assets/liabilities. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section yet to be illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt.

Below is an example of Amazons 2017 balance sheet taken from CFIs Amazon warfare chemical analysis Course. As you will see, it starts subsequently current assets, after that non-current assets, and add up assets. Below that are liabilities and stockholders equity, which includes current liabilities, non-current liabilities, and finally shareholders equity.

Enter your declare and email in the form below and download the set free release template now! You can use the Excel file to enter the numbers for any company and buy a deeper promise of how balance sheets work.

Balance Sheet TemplateThis balance sheet template provides you when a introduction to manufacture your own company's financial pronouncement showing the augment assets, liabilities and shareholders' equity. The balance sheet is based just about the fundamental equation: Assets = Liabilities + Equity Using this template, you can mount up and remove line items under ea

Balance sheets, once all financial statements, will have young differences along with organizations and industries. However, there are several buckets and line items that are something like always included in common balance sheets. We briefly go through commonly found line items out cold asleep Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity.

The most liquid of all assets, cash, appears going on for the first line of the balance sheet. Cash Equivalents are moreover then lumped numb this line item and tally up assets that have short-term maturities sedated three months or assets that the company can liquidate not far off from rapid notice, such as marketable securitiesMarketable SecuritiesMarketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. The issuing company creates these instruments for the announce target of raising funds to other finance concern situation activities and expansion.. Companies will generally acknowledge what equivalents it includes in the footnotes to the balance sheet.

This account includes the balance of all sales revenue still almost credit, net of any allowances for doubtful accounts (which generates a bad debt expense). As companies recover accounts receivables, this account decreases, and cash increases by the same amount.

Inventory includes amounts for raw materials, work-in-progress goods, and finished goods. The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement.Income StatementThe Income encouragement is one of a company's core financial statements that shows their profit and loss beyond a get older of time. The profit or

Property, Plant, and Equipment (also known as PP&E) take possession of the companys tangible unlimited assets. The line item is noted net of accumulated depreciation. Some companies will class out their PP&E by the exchange types of assets, such as Land, Building, and various types of Equipment. All PP&E is depreciable except for Land.

This line item includes all of the companys intangible unchangeable assets, which may or may not be identifiable. Identifiable intangible assets adjoin patents, licenses, and unnamed formulas. Unidentifiable intangible assets include brand and goodwill.

Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased re credit. As the company pays off its AP, it decreases along taking into consideration an equal amount decrease to the cash account.

Includes non-AP obligations that are due within one years grow old or within one on the go cycle for the company (whichever is longest). explanation payable may moreover then have a long-term version, which includes observations clarification taking into consideration a maturity of more than one year.

This account may or may not be lumped together considering the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the ration due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes more or less a bank go forward to be paid off in 5-years, this account will count up the allocation of that onslaught due in the next year.

This account includes the add up amount of long-term debt (excluding the current portion, if that account is broadcast deadened current liabilities). This account is derived from the debt scheduleDebt ScheduleA debt schedule lays out all of the debt a matter has in a schedule based roughly its maturity and assimilation rate. In financial modeling, combination expense flows, which outlines all of the companys outstanding debt, the assimilation expense, and the principal repayment for the whole period.

This is the value of funds that shareholders have invested in the company. considering a company is first formed, shareholders will typically put in cash. For example, an pioneer starts a company and seeds it later $10M. Cash (an asset) rises by $10M, and Share Capital (an equity account) rises by $10M, balancing out the balance sheet.

This is the affix amount of net income the company decides to keep. every single one period, a company may pay out dividends from its net income. Any amount enduring surviving (or exceeding) is bonus to (deducted from) retained earnings.

This avowal is a serious mannerism quirk to analyze a companys financial positionAnalysis of Financial StatementsHow to discharge duty Analysis of Financial Statements. This guide will teach you to action financial statement analysis of the income statement,. An analyst can generally use the balance sheet to calculate a lot of financial ratiosLeverage RatiosA leverage ratio indicates the level of debt incurred by a concern situation entity against several other accounts in its balance sheet, income statement, or cash flow statement. Excel template that incite determine how with ease a company is performing, how liquid or solvent a company is, and how efficient it is.

Changes in balance sheet accounts are as a consequence used to calculate cash flow in the cash flow statementCash Flow StatementA cash flow support contains assistance around how much cash a company generated and used during a given period.. For example, a clear tweak in plant, property, and equipment is equal to capital expenditure minus depreciation expense. If depreciation expense is known, capital expenditure can be calculated and included as a cash outflow under cash flow from investing in the cash flow statement.

The balance sheet is a completely important financial announcement verification for many reasons. It can be looked at a propos its own and in conjunction later added statements with the income avowal and cash flow announcement verification to accomplish a full picture of a companys health.

Below is a video that suddenly covers the key concepts outlined in this guide and the main things you infatuation to know roughly more or less a balance sheet, the items that make it up, and why it matters.

Balance Sheet Definition: Formula & Examples - Investopedia

The balance sheet includes suggestion approximately a company's assets and liabilities. Depending roughly speaking the company, this might total short-term assets, such as cash‚Does the Balance Sheet Always Balance? - Investopedia

The assets more or less the balance sheet consist of what a company owns or will take on in the well ahead progressive and which are measurable. Liabilities are what a company owes, such‚Financial statements: The balance sheet | Assets, liabilities & equity

Balance sheet: Liabilities. The opposite of assets are liabilities. Liabilities are amounts that the company owes and will have to approve in the future.Balance sheet - Wikipedia

Assets are followed by the liabilities. The difference in the midst of the assets and the liabilities is known as equity or the net assets or the net‚

Understanding a Balance Sheet: Assets, Liabilities and Equity

20 Jul 2021 Investing experts view the balance sheet as a snapshot of a company's health at a certain point in time. It's a summary of how much a company‚Financial Statements 101: How to way in and Use Your Balance Sheet

Total liabilities and owners' equity are totaled at the bottom of the right side of the balance sheet. Remember ¢€”the left side of your balance sheet (assets)‚

The Balance Sheet | Boundless Accounting - Lumen Learning

A company's assets must equal their liabilities improvement shareholders' equity. Key Terms. liability: An obligation, debt, or answerability liability owed to someone. asset:‚The Balance Sheet | Boundless issue - Lumen Learning

Assets are followed by the liabilities. The difference amongst the assets and the liabilities is known as the equity (or the net assets, or the net worth, or‚

What is an Asset? What is a Liability? - Digit.Business

In its simplest form, your balance sheet can be separated into two categories: assets and liabilities. Assets are the items your company owns that can provide‚Gallery of balance sheet assets liabilities :

Suggestion : Tutorial Download balance sheet assets liabilities Online balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,assets adalah,assets and liabilities,assets artinya,assets adobe,assets accounting,assets and liabilities examples,assets adobe xd,assets and liabilities list,assets are,assets and liabilities meaning in hindi,liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts Free Printable PDF DOC

0 Comments