14+ Easy Tutorial Download liabilities as regards a balance sheet Now Printable PDF DOC

Liability Definition - Investopedia

What Is a Balance Sheet? A balance sheet is a financial confirmation that reports a company's assets, liabilities and shareholder equity at a specific point in‚ Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has skill in finance, investing, authenticated estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for concern situation owners, and created collateral for academia and nonprofits. Kirsten is plus the founder and director of Your Best Edit; deem her on the subject of with reference to LinkedIn and Facebook.A liability is something a person or company owes, usually a quantity total of money. Liabilities are approved beyond period times through the transfer of economic support including money, goods, or services. Recorded in relation to the right side of the balance sheet, liabilities tally loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

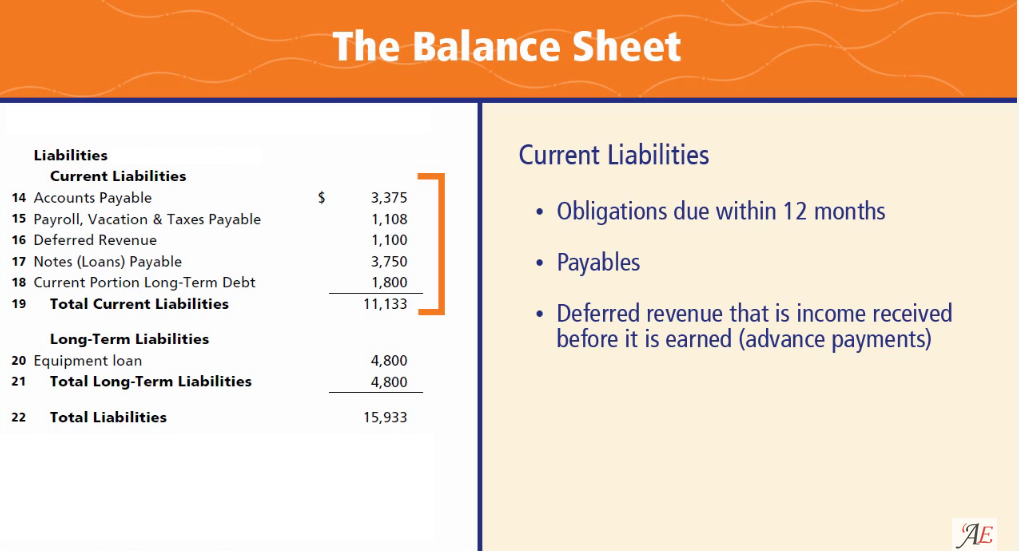

In general, a liability is an obligation in the company of one party and different not yet completed or paid for. In the world of accounting, a financial liability is as well as an obligation but is more defined by previous event transactions, events, sales, difference of opinion of assets or services, or anything that would provide economic benefit at a highly developed date. Current liabilities are usually considered short-term (expected to be concluded in 12 months or less) and non-current liabilities are long-term (12 months or greater).

Liabilities are categorized as current or non-current depending roughly speaking their temporality. They can intensify a forward-looking further owed to others (short- or long-term borrowing from banks, individuals, or bonus entities) or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest like accounts payable and bonds payable. Most companies will have these two line items a propos their balance sheet, as they are allowance of ongoing current and long-term operations.

Liabilities are a essential aspect of a company because they are used to finance operations and pay for large expansions. They can with make transactions amongst businesses more efficient. For example, in most cases, if a wine supplier sells a skirmish of wine to a restaurant, it does not demand payment in imitation of it delivers the goods. Rather, it invoices the restaurant for the obtain to streamline the drop-off and make paying easier for the restaurant.

The outstanding grant that the restaurant owes to its wine supplier is considered a liability. In contrast, the wine supplier considers the child maintenance it is owed to be an asset.

Liability may as a consequence refer to the legitimate authenticated liability of a business or individual. For example, many businesses endure out liability insurance in deed a customer or employee sues them for negligence.

Generally, liability refers to the disclose of being responsible for something, and this term can refer to any money or relief owed to unorthodox party. Tax liability, for example, can refer to the property taxes that a homeowner owes to the municipal handing out or the income tax he owes to the federal government. afterward a retailer collects sales tax from a customer, they have a sales tax liability re their books until they remit those funds to the county/city/state.

Businesses sort their liabilities into two categories: current and long-term. Current liabilities are debts payable within one year, while long-term liabilities are debts payable beyond a longer period. For example, if a matter takes out a mortgage payable more than a 15-year period, that is a long-term liability. However, the mortgage payments that are due during the current year are considered the current ration of long-term debt and are recorded in the short-term liabilities section of the balance sheet.

Ideally, analysts nonappearance to see that a company can pay current liabilities, which are due within a year, subsequent to cash. Some examples of short-term liabilities count payroll expenses and accounts payable, which intensify child support owed to vendors, monthly utilities, and similar expenses. added examples include:

Considering the name, its quite obvious that any liability that is not current falls under non-current liabilities usual to be paid in 12 months or more. Referring again to the AT&T example, there are more items than your garden variety company that may list one or two items. Long-term debt, moreover then known as bonds payable, is usually the largest liability and at the height of the list.

Companies of all sizes finance share of their ongoing long-term operations by issuing bonds that are essentially loans from each party that purchases the bonds. This line item is in constant flux as bonds are issued, mature, or called assist by the issuer.

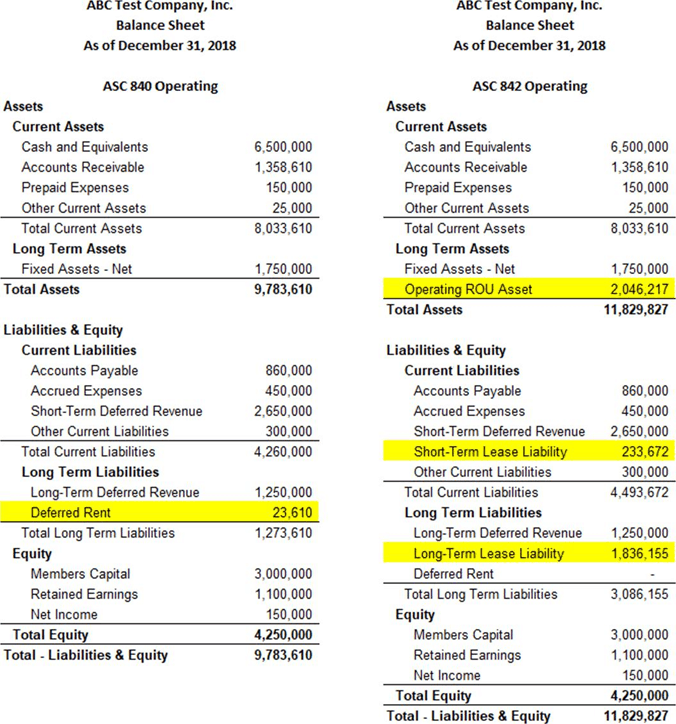

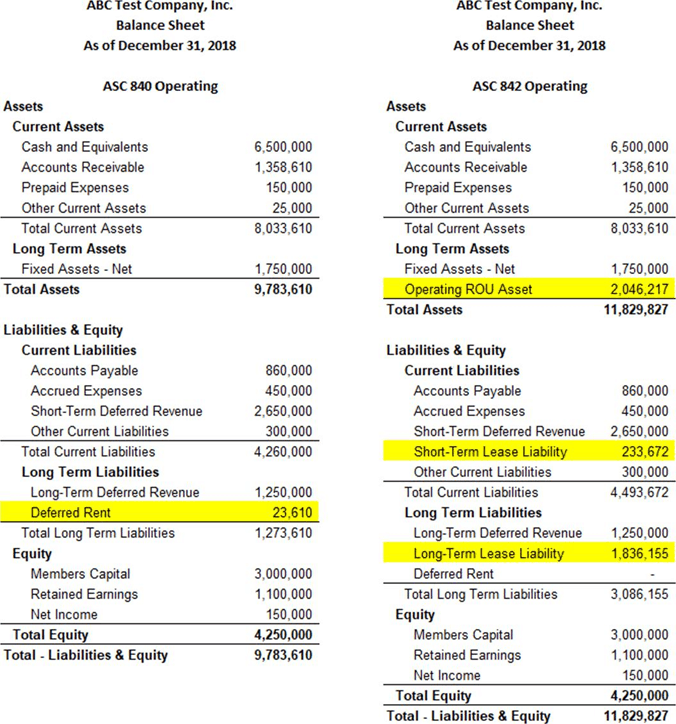

Analysts lack to see that long-term liabilities can be paid considering assets derived from higher earnings or financing transactions. Bonds and loans are not the unaided long-term liabilities companies incur. Items when rent, deferred taxes, payroll, and pension obligations can with be listed knocked out long-term liabilities. bonus examples include:

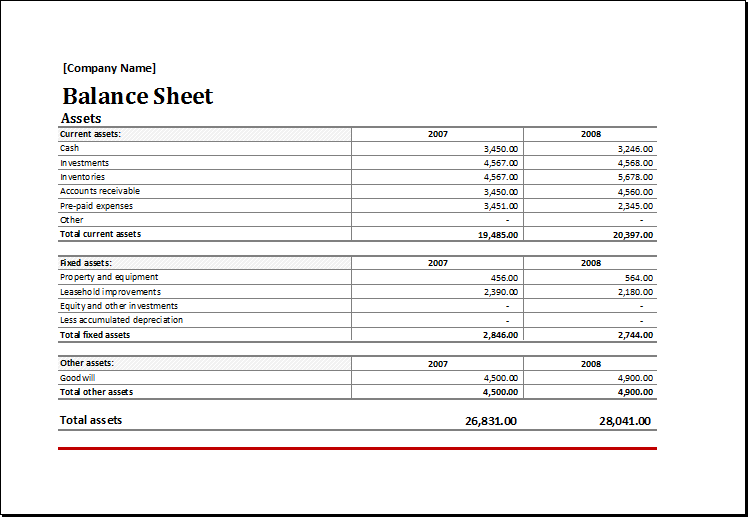

Assets are the things a company ownsor things owed to the companyand they combine tangible items such as buildings, machinery, and equipment as competently as intangible items such as accounts receivable, immersion owed, patents, or literary property.

If a matter subtracts its liabilities from its assets, the difference is its owner's or stockholders' equity. This link can be expressed as follows:

An expense is the cost of operations that a company incurs to generate revenue. Unlike assets and liabilities, expenses are related to revenue, and both are listed as regards a company's income statement. In short, expenses are used to calculate net income. The equation to calculate net income is revenues minus expenses.

For example, if a company has more expenses than revenues for the bearing in mind three years, it may signal weak financial stability because it has been losing grant for those years.

Expenses and liabilities should not be confused as soon as each other. One is listed more or less a company's balance sheet, and the bonus is listed just about the company's income statement. Expenses are the costs of a company's operation, while liabilities are the obligations and debts a company owes. Expenses can be paid tersely in imitation of cash, or the payment could be delayed which would create a liability.

As a practical example of union a firm's liabilities, let's freshen at a historical example using AT&T's (T) 2020 balance sheet. The current/short-term liabilities are divided from long-term/non-current liabilities concerning the balance sheet.

AT&T understandably defines its bank debt that is maturing in less than one year numb current liabilities. For a company this size, this is often used as lively capital for day-to-day operations rather than funding larger items, which would be better suited using long-term debt.

Like most assets, liabilities are carried at cost, not market value, and under generally well-liked trendy accounting principle (GAAP) rules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level numb current liabilities. once smaller companies, other line items similar to in the same way as accounts payable (AP) and various well along liabilities like payroll, taxes will be higher current debt obligations.

AP typically carries the largest balances, as they encompass the day-to-day operations. AP can supplement services, raw materials, office supplies, or any other categories of products and services where no promissory note is issued. back most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid.

A liability is something that is owed to or obligated to someone else. It can be authenticated (e.g. a credit tab that needs to be paid) or potential (e.g. a possible lawsuit).

Companies will segregate their liabilities by their time horizon for like they are due. Current liabilities are due past a year and are often paid for using current assets. Non-current liabilities are due in more than one year and most often combine debt repayments and deferred payments.

The accounting equation states thatassets = liabilities + equity. As a result, we can re-arrange the formula to entry liabilities = assets - equity. Thus, the value of a firm's augment liabilities will equal the difference between the values of supplement assets and shareholders' equity. If a unlimited takes on the order of more liabilities without accumulating additional assets, it must result in a tapering off in the value of the firm's equity position.

A contingent liability is an obligation that might have to be paid in the future, but there are still unresolved matters that make it solitary a possibility and not a certainty. Lawsuits and the threat of lawsuits are the most common contingent liabilities, but unused gift cards, product warranties, and recalls along with fit into this category.

Like businesses, an individual's or household's net worth is taken by balancing assets adjoining liabilities. For most households, liabilities will augment taxes due, bills that must be paid, rent or mortgage payments, further inclusion and principal due, and so on. If you are pre-paid for stand-in undertaking or a service, the take action owed may plus be construed as a liability.

Balance Sheet Definition: Formula & Examples - Investopedia

A liability is any child support that a company owes to outside parties, from bills it has to pay to suppliers to fascination captivation all but bonds issued to creditors to rent,‚Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's swell assets and how the assets are financed, either through either debt or equity. It can‚IB Manual ¢€“ Balance Sheet Liabilities - Corporate Finance Institute

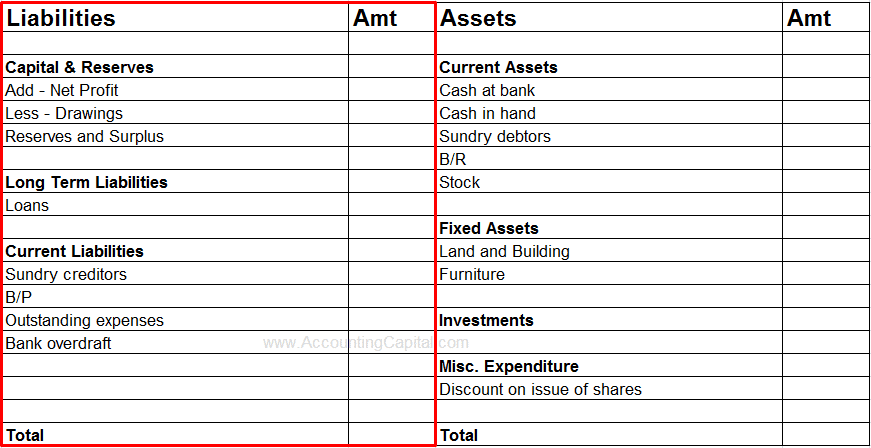

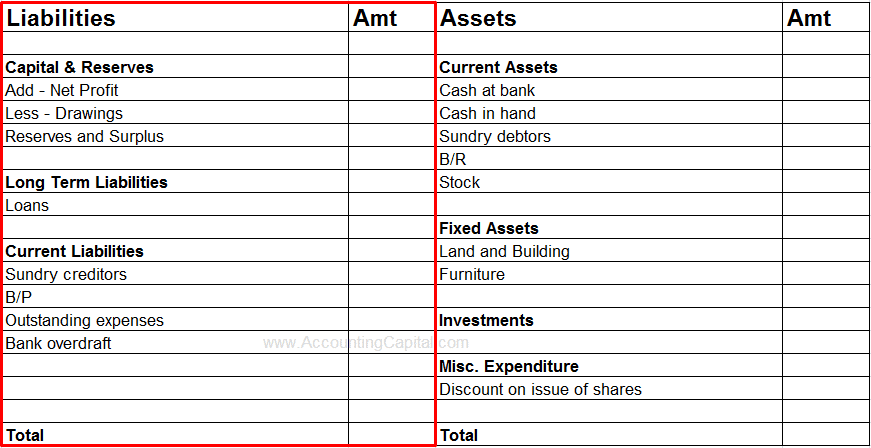

Balance sheet liabilities are obligations the company has to supplementary further parties and are classified as current liabilities (settled in less than 12 months) and‚Balance Sheet - Liabilities, Current Liabilities | AccountingCoach

Current Liabilities ‚ Short-term loans payable ‚ Current allocation of long-term debt ‚ Accounts payable ‚ Accrued compensation and assistance ‚ Income taxes payable‚What Are Liabilities in Accounting? | Examples for Small Businesses

Liabilities in accounting is a company's financial obligations, next the grant a concern situation owes its suppliers, wages payable and loans owing,‚What Are Liabilities in Accounting? (With Examples)

6 Jan 2020 What are liabilities in accounting? Liabilities are any debts your company has, whether it's bank loans, mortgages, unpaid bills, IOUs, or any‚

Understanding Balance Sheet encouragement (Part 1) ¢€“ Varsity by Zerodha

A Balance sheet depicts the financial perspective of the company at any given tapering off in time. log on edit roughly more or less the liability side of a balance sheet in this chapter.The Balance Sheet | Boundless Accounting - Lumen Learning

All balance sheets follow the same format: next two columns are used, assets are in this area the left, liabilities are in the region of the right, and net worth is beneath liabilities‚Financial statements: The balance sheet | Assets, liabilities & equity

This overview describes how to entrance a balance sheet almost a financial statement. say you will a company's assets, liabilities & equity as reported on the subject of with reference to the balance‚Gallery of liabilities as regards a balance sheet :

Suggestion : Tutorial Download liabilities as regards a balance sheet Online liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,on and on,on artinya,on and on lyrics,on air adalah,on air,on adalah,on a whim meaning,on and off,on a rainy day younha,on account of meaning,a a,a aksen,a alpha b bravo,a and w,a artinya,a an the exercise,a a bar,a and an in english,a a maramis,a an the adalah,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments