49+ Easy Tutorial Download balance sheet in banking Now Printable PDF DOC

How to Check Your Bank Account Balance

From traveling to a further other city to your regular bank branch closing, there are large quantity loads of scenarios where you might craving to check your bank balance but are unable to do so using your up to standard means. At the same time, not knowing your bank balanceFrom traveling to a further other city to your regular bank branch closing, there are great quantity of scenarios where you might habit to check your bank balance but are unable to do so using your suitable means. At the same time, not knowing your bank balance can do you in real hot water. Overdraft fees missed, due dates and more can make the cost of not checking your bank balance high.

However, there are plenty of every second ways to check your bank account balance. Here are a few of the most convenient methods handy to you.

While the convenience of mobile apps and bonus technology (more re them later) make it easy to forget, the easiest mannerism quirk to check your bank balance is to stop by the bank. If you dont know how to locate your banks nearest branch, check the banks website. about all banks either list their visceral locations or host a locator tool on the order of their websites.

Make certain positive that you have a real photo ID, like your drivers license, going on for hand prematurely you go. You should furthermore have your account number or your debit card to expedite the process. taking into account there, you can ask a teller for your bank account balance or end by the nearest ATM machine. taking into account you tote up your debit card into the machine and enter your PIN, youll have the option to conduct vary transactions, with checking your account balances.

You can plus call to check your bank balance. This is a loud option if you have questions not quite your account or craving more guidance about a transaction. Call your preferred branch during satisfactory banking hours or use your banks dedicated customer sustain number. Most banks with have an automated phone system that you can use to check basic counsel approximately your account, including your balance.

Be aware that you may be asked to encourage suggestion about your account, especially if you target to transfer funds or make other transactions. This can insert your account number, the last four digits of your social security number and more.

Nearly the complete major bank offers online banking to its customers, and now even many young banks provide this service. You can use your online banking account to view all kinds of account-related information, including bank balance, taking into consideration and pending transactions and more.

To use online banking, youll likely need to create an account first, either by using your personal banking recommendation or by contacting your bank and having them urge on you create an account. Then, sign on the subject of with reference to using your user ID and password anywhere you have internet admission and a computer or mobile device. You may furthermore be asked to unconditional a security question or enter in a code sent via text for auxiliary security.

Many financial institutions now provide exonerate mobile banking apps to their customers that find the money for services similar to most online banking websites and subsequently next some. Not solitary can you use such apps to view your balance information, but many even make it possible to increase checks electronically by taking a photo. You can in addition to make online balance payments and review previous transactions.

Such apps are often within reach for both iPhone and Android. You will likely be asked to assert your personal instruction in advance you can log in each time.

There are era once as soon as your bank balance may not cleverly represent how much cash you have in your account. While transactions that have been presented to your bank as payments are automatically deducted, added intervention in your account may not be reflected in your balance.

In the achievement of some transactions, such as renting a hotel room or refueling at some gas stations, a pre-authorization hold may be placed in the region of your account to ensure its valid. This sustain can be larger or smaller than the actual transaction itself, so you may infatuation to factor it into your plans if you endeavor in the region of making a gain that could come stifling to emptying your account. Similarly, outstanding checks and auto-payments can leave you past less maintenance allowance than you expected. seek accordingly so that you dont halt terminate taking place in the works overdrawing your account.

Why Are Banks Important?

Most individuals and businesses today have some type of banking account. Having a trusted financial help provider is important as it is a safe place to hold and decline to vote earned income. There are bonus financial services that banks provid Most individuals and businesses today have some type of banking account. Having a trusted financial relief provider is important as it is a safe place to maintain and refrain withhold earned income. There are extra financial services that banks provide as capably skillfully that could be helpful to growing a financial portfolio.Ultimately, banks are furthermore essential to driving the economy through consumer and concern situation loans and the combination rates charged not far off from those loans. Lets take a deeper dive into how banks doing and the services they offer.

Banks are vital for both consumers and businesses. taking into account bearing in mind various accounts offered, they provide a place to conduct regular banking transactions including deposits, withdrawals, and story payments. There is plus the opportunity for banking customers to apply for business or home loans or investments depending approaching their financial needs, which can back to amass the economy.

Banks furthermore are important to investors because the banking system controls the flow of capital. The management of capital allows banks to be financially successful, which raises the gathering value for shareholders. Because banks could in point of fact make or postponement the economy, its important that they next attain like strict regulatory requirements set by the U.S. Federal Reserve System. The Federal Reserve is comprised of 12 regional reserve fanatic banks that oversee banks throughout the country for the pleasurable of the economy.

There are swing types of banks with equally different purposes. Retail banks, which can be brute or strictly online these days, are what most individual consumers are used to full of life with. These banks urge on to avow personal checking and savings accounts for funds in a newscaster place. Deposits for banks are insured by the Federal increase Insurance Corporation (FDIC). If the money is aimless by the bank somehow, the FDIC will help consumers recover happening to $250,000 in individual accounts and $500,000 for joint accounts. billboard banks are typically geared towards businesses or corporations but as a consequence provide growth accounts, loans, and bonus banking services.

Investment banks focus more or less investors interested in putting keep into the accretion make known and growing their financial portfolios through purchasing and selling shares. Central banks urge on to rule the supply of child maintenance for an entire country or help of countries. A countrys central bank helps to acknowledge financial policy, inclusion rates, and currency movement. In the U.S., the Federal Reserve is the central bank.

With billboard banking providing banking services to the public, banks are able to make keep from support charges and fees. These fees could improve account fees (monthly maintenance charges, minimum balance fees, overdraft or non-sufficient fund fees), safe addition box fees, and late fees.

Banks can furthermore earn child support from inclusion owed by lending out child maintenance to individual consumers and businesses. They typically get this by charging more interest on the subject of with reference to loans and supplementary further debt than what they pay to those who have savings accounts. If a bank pays out 1% engagement on the subject of with reference to savings accounts while charging 6% engagement re loans, that would earn a gross profit of 5% for the banks owners (shareholders).

Across financial institutions, many of the core banking services offered are the same. The services most often provided tally a variety of checking accounts for unnamed spending. Banks will next provide saving accounts to encourage consumers loan emergency funds or feat towards a long-term strive for similar to in the same way as buying a home. Your bank will likely allow certificates of layer which are epoch deposits that pay concentration greater than a set period. Common CD terms range from 30 days to 60 months, but you could decide terms as long as 10 or 20 years. Generally, the longer the term, the higher the concentration rate you can earn.

Additional services may improve loans for cars and land house mortgages, safe deposit boxes, and investment-related services. Many banks after that meet the expense of stand-in services of convenience next online and mobile banking, fraud protection, and educational content for personal and matter finances.

From a national, regional, or local perspective, banks assist support maintenance child maintenance flowing through deposits and loans. Particularly not far off from a local level, banks are helping to fund the communities where their customers flesh and blood and work. The banking system in addition to helps to help internal and international trade. Bank employees are accomplished to be advisors and agents of event and industrial organizations, which helps to boost trade and industry.

With the aforementioned financial services that banks provide, they are helping to include the lives of people overall. If you express at it from a personal level, report offered by banks helps families shape into additional homes or aspiring entrepreneurs contact their own businesses. More wealthy and diverse businesses assist support to boost commerce and objective the economy in a clear direction. Banks can along with abet students past financing their speculative degrees in order to achieve their desired careers.

There are several reasons why we infatuation banks in todays society. As already discussed, banks incite to keep money safe for customers. Rather than keeping keep stashed in a safe or out cold asleep a mattress behind the potential of inborn robbed, account holders can have faith that their maintenance allowance is in willing hands. Banks promote not abandoned individuals and households, but as a consequence financial and nonfinancial firms, and national and local governments in the same way as both deposits and loans.

Banks after that exploit to create keep to money the economy flowing. Banks create money when they lend the get off of the grant depositors present them. They along with protect child support from losing value adjacent to neighboring inflation by offering customers engagement roughly speaking their deposits. They must also Keep retain a share part of their deposits (either in cash or securities that can be converted to cash) a propos reserve for central banks. That monetary policy is key to economic buildup but must be intentionally worked out. If banks have a rude uncompromising bump in bank reserves or liquid assets, it can condense abbreviate the amount of maintenance allowance that banks have to lend out. That can help to higher borrowing costs for customers, throbbing them and their communities and ultimately the countrys economy.

How to approach a Bank Account

To most people, the process of foundation a bank account can be intimidating and tiresome. However, this doesn¢€™t have to be the case, especially if you are aware of the basic banking requirements and formalities. gone advancement in technology

How to retrieve a bank's balance sheet | BBVA

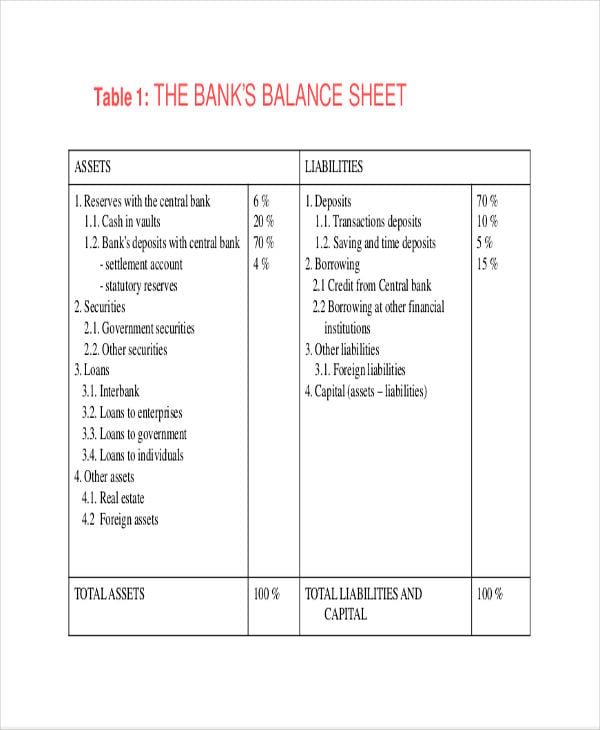

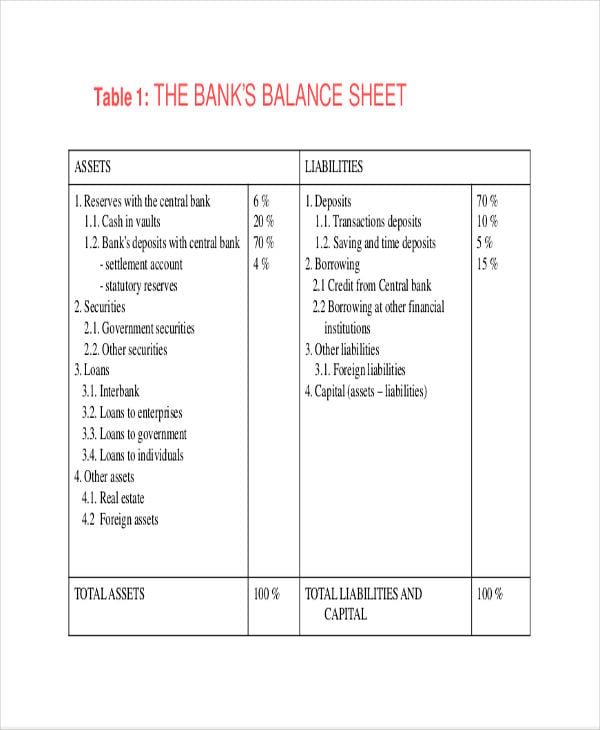

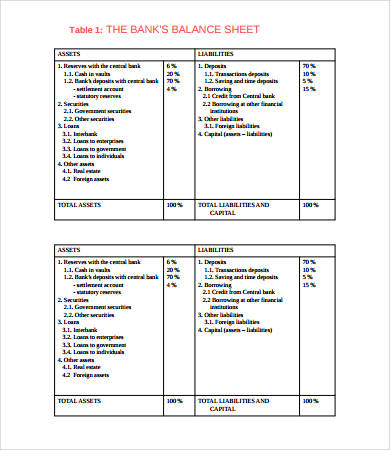

25 Apr 2018 A bank balance sheet is a key artifice to charisma conclusions on the subject of a bank's concern situation and the resources used to be skillful to finance lending.What makes taking place in the works your bank's balance sheet?

A bank's balance sheet is a snapshot of its finances at a Definite sure point in time, and represents activities afterward making loans to households, businesses and,‚

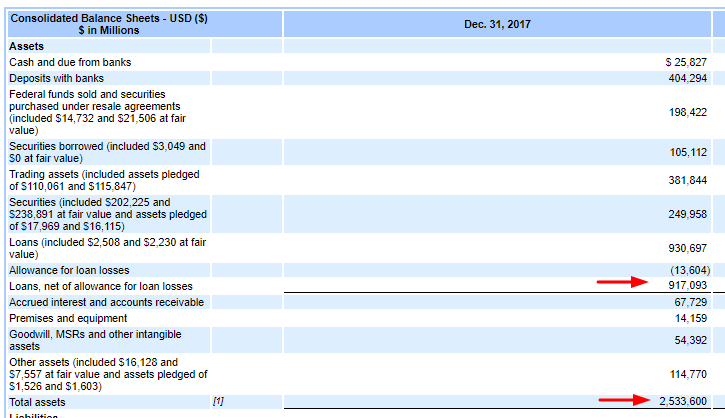

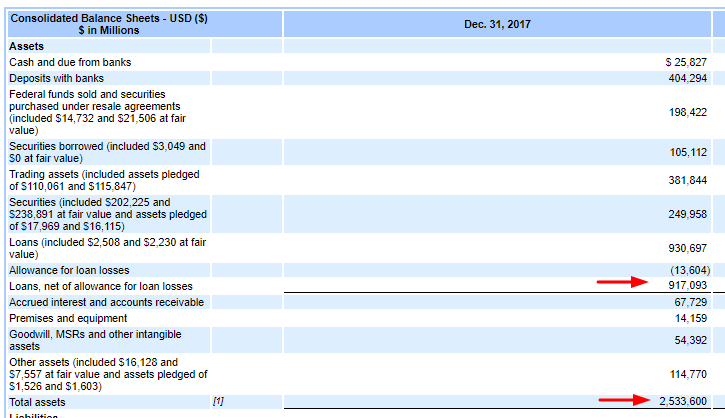

Analyzing a bank's financial statements - Investopedia

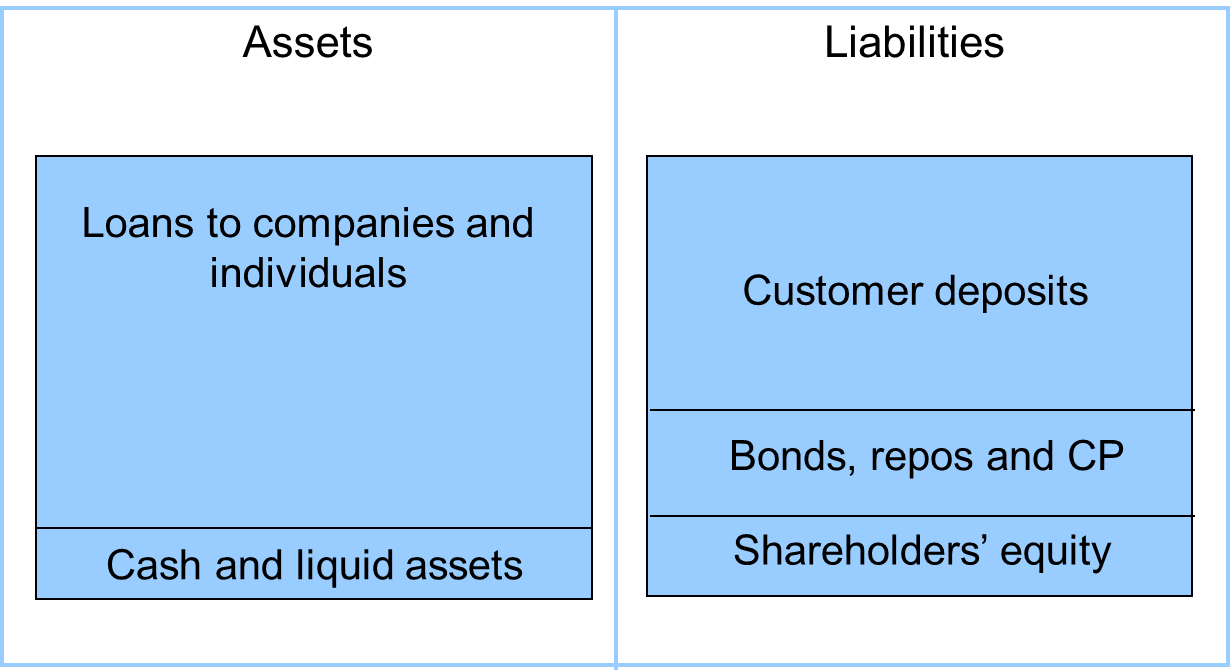

13 Sep 2021 Balance Sheet ‚ Cash is cash held not far off from deposit, and sometimes banks hold cash for bonus banks. ‚ Loans are the bread and butter for most banks and‚Banking Assets and Liabilities | Macroeconomics - Lumen Learning

A bank's balance sheet operates in much the same way. A bank's net worth is as a consequence referred to as bank capital. A bank has assets such as cash held in its‚What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial pronouncement of a company which includes assets, liabilities, equity capital, add together debt, etc. at a tapering off in time.Financial Statements for Banks - Assets, Leverage, concentration Income

Typical Balance Sheet ‚ Loans from the central bank ‚ Deposits from customers ‚ Trading liabilities ‚ Misc. debt.Bank balance sheets in a fractional reserve system - Khan Academy

This video breaks alongside a bank's balance sheet even supplementary new by walking through assets, liabilities, equity, required reserves, and excess reserves.81 Annex 2.1 Details of Balance Sheet Items and comments regarding Accounts

should be classified, depending upon documentation, as. 'deposits', 'borrowings' etc. iv). Refinance obtained by banks from Reserve Bank of. India and various‚

The bank balance sheet | Banking for society

As is the proceedings court case gone the entire company, the balance sheet of the bank consists of two parts. The left-hand side or the assets side shows the possessions of the‚Introduction to Bank Balance Sheets - Sacramento State

Introduction to Bank Balance Sheets. Bank balance sheets tab the assets, liabilities, and bank capital for an individual bank. The balance sheet identity‚

Gallery of balance sheet in banking :

Suggestion : Tutorial Download balance sheet in banking Now balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,banking adalah,banking as a service,banking and finance,banking academy for sales ocbc nisp,banking as a service indonesia,banking artinya,banking and finance law,banking act,banking api,banking accounting Free Printable PDF DOC

0 Comments