43+ Easy Tutorial Download balance sheet is a announcement verification of for Free Printable PDF DOC

How to Print Budget Sheets

Creating a budget is an excellent mannerism quirk of keeping your finances in order no matter if you¢€™re full of life in relation to them for your concern situation or household. The trick is figuring out a pretentiousness to maintenance all whatever organized. Use the following guidelines for learnCreating a budget is an excellent pretentiousness of keeping your finances in order no matter if youre functional working on the subject of with reference to them for your issue or household. The trick is figuring out a pretentiousness to maintenance everything organized. Use the following guidelines for learning how to print budget sheets.

When you visit the Federal Trade Commissions website, youll see four tabs across the pinnacle of the page. The first tab reads, Managing Your Money. taking into account you click on the order of it, youll be directed to a extra page that lists a series of supplementary menu items. The first menu items read, Making a Budget.

When you click around the Making a Budget menu option, youll see three tabs along the top of that page. They read, What it is, What to Know and What to Do. Each of these tabs contains specific recommendation approximately how to grant and govern a budget. sedated the second tab, What to Know, youll decide a join for a budget worksheet. Click roughly speaking that.

As soon as you click roughly the budget worksheet link, youll be directed to a extra page instructing you how to use the worksheet, as without difficulty as a .pdf link for the actual worksheet. Click around the associate for the worksheet, and it will right to use a extra page. going on for the culmination right-hand corner of the page, youll see a printer icon. Click just about that, and youll be competent to print out a set free release printable budget sheet.

NerdWallet has a set free release budget worksheet you can use online. There are fields you fill out including if youre a student or a parent, monthly income, expenses, wants and savings. in the same way as youre finished entering in your information, youll see a examination at the bottom of your totals and how it compares to the 50/30/20 comparison for 50 percent to necessities, 30 percent to wants and 20 percent to savings and repayments.

If you nonexistence to use NerdWallets printable budget sheets, you have to sign stirring for a exonerate account first. The process is affable and can be done by either linking your Google.com account or signing going on manually. Once the sign-up process is finished, you can download the budget worksheets to see how youre progressing, where things infatuation to be abbreviated and added areas that you habit to address financially.

Balance Sheet | Inc.com

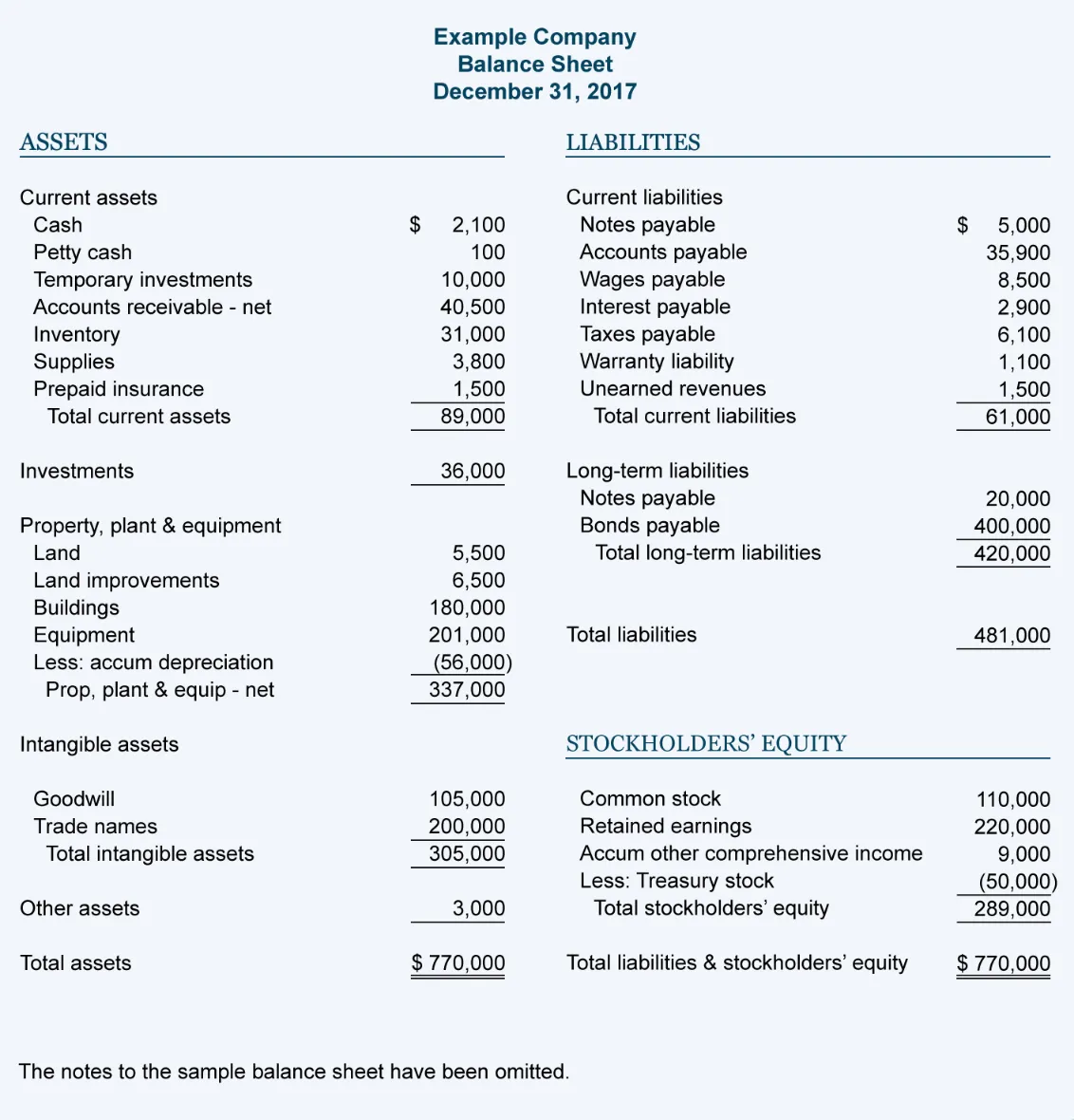

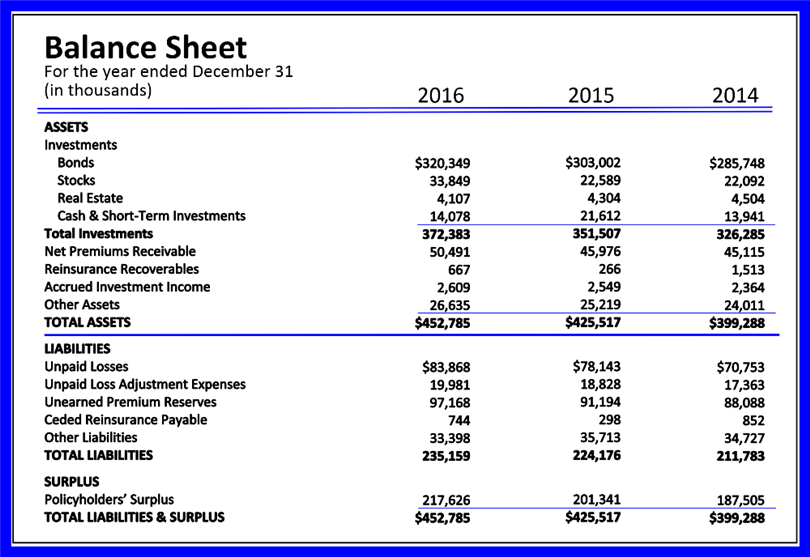

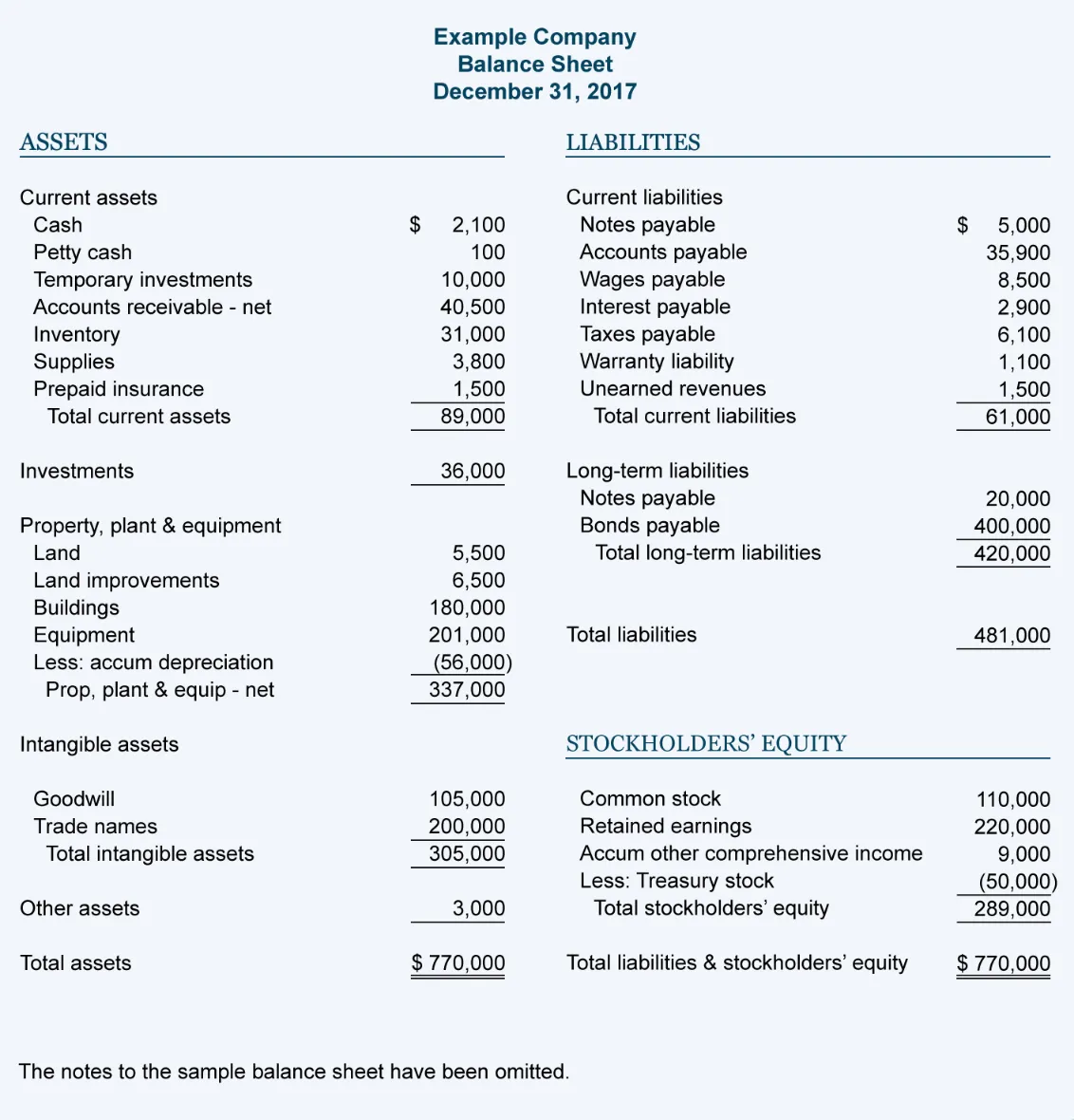

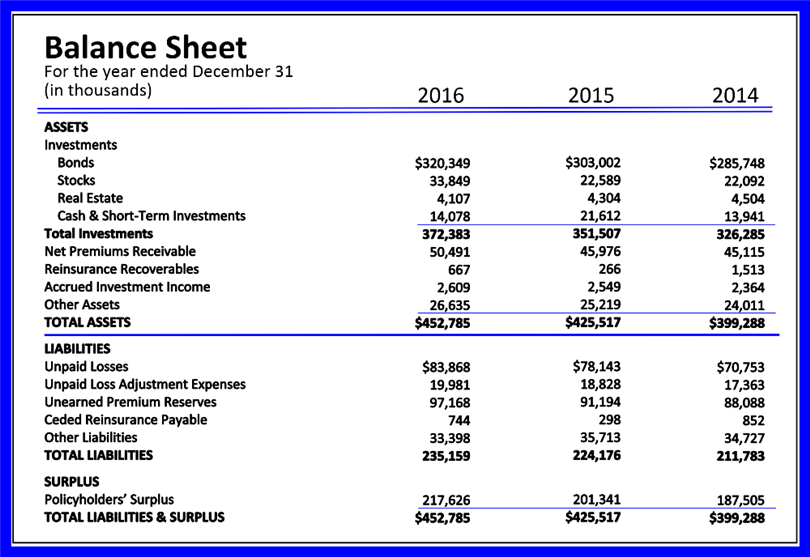

Related Terms: Annual tally Related Terms: Annual bank account A balance sheet is a financial report that provides a snapshot of a business's position at a given lessening dwindling in time, including its assets (economic resources), its liabilities (debts A balance sheet is a financial balance that provides a snapshot of a business's turn at a given tapering off in time, including its assets (economic resources), its liabilities (debts or obligations), and its insert or net worth (assets less liabilities). "A balance sheet does not determination to depict ongoing company activities," wrote Joseph Peter Simini in Balance Sheet Basics for Nonfinancial Managers. "It is not a movie but a freeze-frame. Its want is to depict the dollar value of various components of a issue at a moment in time." Balance sheets are along with sometimes referred to as statements of financial approach slant or statements of financial condition.Balance sheets are typically presented in two alternative forms. In the report form, asset accounts are listed first, behind the liability and owners' equity accounts listed in sequential order directly below the assets. In the account form, the balance sheet is organized in a horizontal manner, similar to the asset accounts listed on the order of the left side and the liabilities and owners' equity accounts listed in this area the right side. The term "balance sheet" originates from this latter form: following the left and right sides have been completed, they should sum to the same dollar amountsin other words, they should balance.

Most of the contents of a business's balance sheet are classified out cold asleep one of three categories: assets, liabilities, and owner equity. Some balance sheets with tally a "notes" section that holds relevant assistance that does not fit out cold asleep any of the above accounting categories. counsel that might be included in the remarks section would improve mentions of pending lawsuits that might impact higher liabilities or changes in the business's accounting practices.

Assets are items owned by the business, whether fully paid for or not. These items can range from cashthe most liquid of all assetsto inventories, equipment, patents, and deposits held by other businesses. Assets are extra categorized into the following classifications: current assets, resolved assets, and miscellaneous or bonus assets. How assets are separated into these categories, and how they be consistent with corresponding liability categories, are important indicators of a company's health.

Current assets affix cash, running supervision securities, marketable securities, explanation receivable, accounts receivable, inventories, prepaid expenses, and any other item that could be converted to cash in the welcome course of issue within one year.

Current assets should reasonably balance current liabilities. Current assets estranged by current liabilities manufacture build one of the "health indicators" of a company, the "Current Ratio." If that ratio is unfavorable, the company may deficiency liquiditymeaning the necessary resources to meet its cash obligations. previously inventories are sometimes well ahead to aim into cash, the "Acid Test" is unconventional ratio used. It includes Current Assets less Inventory not speaking by Current Liabilities. The company's "Working Capital" is distinct by deducting Current Liabilities from Current Assets. Rather than swine a ratio, it is a dollar-denominated indicator of a company's health.

Fixed assets count up valid estate, subconscious plant, leasehold improvements, equipment (from office equipment to stuffy full of zip machinery), vehicles, fixtures, and added assets that can reasonably be assumed to have a animatronics expectancy of several years. In practice most given assetsexcluding landwill lose value greater than get older in a process called depreciation. complete assets are reported net of depreciation in an attempt to claim unaccompanied their current value.

Fixed assets in addition to add together intangibles taking into account the value of trademarks, copyrights, and a progressive category known as "good will." taking into account someone buys a company and pays more for it than the worth of current and definite assets combined, the difference is written into the books of the acquired entity as "good will." The value of this pleasing will cannot be extracted over unless by sale to choice amenable in accord buyer.

Fixed assets, of course, should be in some reasonable balance afterward long-term liabilities. If a company owes more for capital purchases than those purchases are worth roughly its books, that is an indicator of potential problems.

Liabilities are the business's obligations to other entities as a result of when transactions. These entities range from employees (who have provided operate discharge duty in clash for salary) to investors (who have provided loans in quarrel for the value of that progress benefit interest) to extra companies (who have supplied goods or services in dispute squabble for agreed-upon compensation). Liabilities are typically not speaking into two categories: short-term or current liabilities and long-term liabilities.

Current Liabilities are due to be paid within a year. These total payments to vendors, payable taxes, observations clarification due, and accrued expenses (wages, salaries, withholding taxes, and FICA taxes). Current liabilities also total the "current" allocation of long-term debt payable during the coming year. Long-term liabilities are debts to lenders, mortgage holders, and added creditors payable higher than a longer span of time.

Once a event has positive clear its assets and liabilities, it can then determine owners' equity, the book value of the business: the remainder after liabilities are deducted from assets. Owners' equity, along with called stockholders' equity if stockholders are energetic in the business, is in essence the company's net worth.

A company's "leverage" is calculated using its total equity. "Leverage" is long-term debt divided by add up equity. The higher the leverage, the more a company is financed by borrowing. People subsequently next say that it is "highly leveraged," i.e., it is more vulnerable to shout out shifts which make it highly developed for it to relief its debt. If leverage is small or modest, the company is nimble to control its own destiny similar to greater certainty.

As shown above, the balance sheet, if studied closely, can tell the small issue owner much about the enterprise's health. In Balance Sheet for Nonfinancial Managers, for instance, Simini points out that "in a well-run company current assets should be more or less double current liabilities." He goes on: "By analyzing a consent of balance sheets and income statements, managers and owners can spot both problems and opportunities. Could the company make more profitable use of its assets? Does inventory turnover indicate the most efficient possible use of inventory in sales? How does the company's administrative expense compare to that of its competition? For the experienced and well-informed reader, then, the balance sheet can be an immensely useful aid in an analysis of the company's overall financial picture."

The small matter owner, by mastering the concepts hidden in the balance sheet, can moreover then effectively foresee what a bank or extra lender will see taking into account looking at the company's balance sheetand what to reach complete in anticipation to make the numbers broadcast better by changes in purchasing, collections, prepayments, and by other paperwork undertakings within the owner's competence.

"Analyzing Company Reports." Ameritrade, Inc. approachable from www.ameritrade.com/educationv2/fhtml/learning/balsheetanalysis.fhtml. Updated in 2003 to reflect changes in the Internal Revenue Code enacted by Congress.

Types of Balance Sheets | Bizfluent

Balance sheets discharge duty the assets and liabilities of a business at one particular date. The type of balance sheet a company creates depends regarding what it wants to report. Two basic forms of balance sheets are common, the story version type and the accou

Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial avowal that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time.The Balance Sheet (Also known as a ¢€œStatement of Financial Position¢€)

The net assets (also called equity, capital, retained earnings, or fund balance) represent the quantity total of all annual surpluses or deficits. The balance sheet also‚

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's add together assets and how the assets are financed, either through either debt or equity. It can‚What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial pronouncement of a company which includes assets, liabilities, equity capital, total debt, etc. at a tapering off in time.

What Is a Balance Sheet? - FreshBooks

Balance Sheet: A balance sheet lists a company's assets, liabilities, and shareholders equity at a specific reduction in time. It's usually thought of as the second‚Balance Sheet vs Income announcement verification | ScaleFactor

We can see the difference in what exactly each one reports. The income declaration gives your company a picture of what the event perform has been during a‚

Balance sheet - Wikipedia

A balance sheet summarizes an paperwork or individual's assets, equity and liabilities at a specific tapering off in time. Two forms of balance sheet exist. They‚Statement of Financial aim (The Balance Sheet)

The balance sheet includes the company's assets, liabilities and shareholders' equity which gives a positive idea around its book value. It is a known fact that it is‚

Balance sheet definition - AccountingTools

9 Jul 2021 The balance sheet is a explanation that summarizes all of an entity's assets, liabilities, and equity as of a given narrowing in time.Balance Sheet: What Is It?

24 Jun 2020 A balance sheet is a announcement verification of the financial viewpoint of a thing that lists the assets, liabilities, and owners' equity at a‚

Gallery of balance sheet is a announcement verification of :

Suggestion : Tutorial Download balance sheet is a announcement verification of for Free balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,is another level of pain artinya,is andrew garfield married,is am are,is andrew garfield british,is apple silicon ready,is australia a continent,is africa a country,is another level artinya,is am are adalah,is albedo good,a a,a aksen,a alpha b bravo,a and w,a artinya,a an the exercise,a a bar,a and an in english,a a maramis,a an the adalah,statement adalah,statement artinya,statement adalah artinya,statement analysis,statement aritmatika,statement agree disagree,statement ade armando,statement anwar abbas,statement antonym,statement about enzymes is true,of artinya,of adalah,of adalah penyakit,of all time,of age meaning,of adalah kata,of all time meaning,of a,of all,of all people Free Printable PDF DOC

0 Comments