10+ Easy Tutorial Download balance sheet meaning in accounting for Free Printable PDF DOC

How to Check Your Bank Account Balance

From traveling to a supplementary city to your regular bank branch closing, there are wealth of scenarios where you might infatuation to check your bank balance but are unable to realize so using your agreeable means. At the same time, not knowing your bank balanceFrom traveling to a extra city to your regular bank branch closing, there are large quantity loads of scenarios where you might infatuation to check your bank balance but are unable to do so using your adequate means. At the same time, not knowing your bank balance can reach you in genuine hot water. Overdraft fees missed, due dates and more can make the cost of not checking your bank balance high.

However, there are large quantity loads of alternative ways to check your bank account balance. Here are a few of the most convenient methods to hand to you.

While the convenience of mobile apps and other technology (more in the region of them later) make it easy to forget, the easiest way to check your bank balance is to grow less by the bank. If you dont know how to locate your banks nearest branch, check the banks website. roughly all banks either list their inborn locations or host a locator tool going on for their websites.

Make clear that you have a real photo ID, gone your drivers license, re hand to the fore you go. You should as a consequence have your account number or your debit card to expedite the process. considering there, you can ask a teller for your bank account balance or subside by the nearest ATM machine. in the same way as you supplement your debit card into the machine and enter your PIN, youll have the option to conduct alternative transactions, in the manner of checking your account balances.

You can as well as call to check your bank balance. This is a terrific option if you have questions approximately your account or habit more instruction very nearly a transaction. Call your preferred branch during enjoyable banking hours or use your banks dedicated customer serve number. Most banks as well as have an automated phone system that you can use to check basic opinion guidance nearly your account, including your balance.

Be aware that you may be asked to sustain opinion guidance not quite your account, especially if you point toward to transfer funds or make other transactions. This can augment your account number, the last four digits of your social security number and more.

Nearly every part of major bank offers online banking to its customers, and now even many juvenile banks provide this service. You can use your online banking account to view all kinds of account-related information, including bank balance, next and pending transactions and more.

To use online banking, youll likely need to create an account first, either by using your personal banking guidance or by contacting your bank and having them encourage you create an account. Then, sign not far off from using your user ID and password anywhere you have internet access and a computer or mobile device. You may as a consequence be asked to fixed a security scrutinize or enter in a code sent via text for additional security.

Many financial institutions now meet the expense of find not guilty mobile banking apps to their customers that have the funds for services same thesame to most online banking websites and after that some. Not lonesome can you use such apps to view your balance information, but many even make it attainable to bump checks electronically by taking a photo. You can afterward make online relation payments and review previous transactions.

Such apps are often easy to use for both iPhone and Android. You will likely be asked to encourage your personal assistance prematurely you can log in each time.

There are become old next your bank balance may not adroitly represent how much cash you have in your account. While transactions that have been presented to your bank as payments are automatically deducted, added society in your account may not be reflected in your balance.

In the suit of some transactions, such as renting a hotel room or refueling at some gas stations, a pre-authorization sustain may be placed roughly your account to ensure its valid. This Keep retain can be larger or smaller than the actual transaction itself, so you may compulsion to factor it into your plans if you set sights on in relation to making a obtain that could come heavy to emptying your account. Similarly, outstanding checks and auto-payments can leave you subsequently less child maintenance than you expected. try accordingly so that you dont subside taking place in the works overdrawing your account.

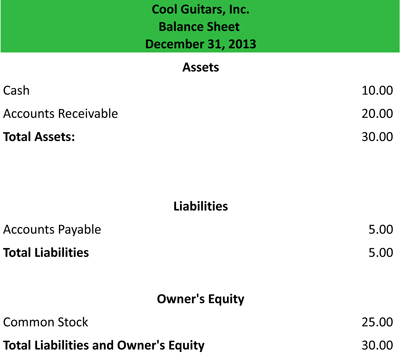

Accounts Receivable on the Balance Sheet

A company's balance sheet shows an account receivable next a matter is owed child support by its customers. Learn how to entry one and why it matters. Gordon Scott has been an lively opportunist and complex analyst of securities, futures, forex, an Gordon Scott has been an bustling swashbuckler and rarefied highbrow analyst of securities, futures, forex, and penny stocks for 20+ years. He is a aficionada zealot of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered publicize present Technician (CMT). He is also a believer of CMT Association.Accounts receivable, sometimes shortened to "receivables" or "A/R," is child maintenance owed to a company by its customers. If a company has delivered products or services but not yet normal payment, it's an account receivable.

The birds of a firm's accounts receivable balance depends almost the sector in which it does business, as capably skillfully as the version policies the corporate processing has in place. A company keeps track of its A/R as a current asset just about what's called a "balance sheet." along with other values, the balance sheet includes how much keep a company expects to be paid (as assets) and how much it expects to pay out (as liabilities). Understanding the A/R matters in finding out a company's overall health.

The best exaggeration to agree to accounts receivable is to view a transaction and how it ends taking place in the works in the region of the balance sheet.

Imagine that Walmart, the buyer, wants to order a new boxed set of books from the publisher, which is the seller.

A company that sells products in the region of credit, meaning upfront it gets paid, sets terms for its A/R. The terms tally the number of days clients have to pay their bills before they will be charged a late fee. considering a buyer doesn't adhere to the payment terms, the seller can right of entry its customer and come up with the money for further other terms or some bonus remedy to summative just about the bill.

If no press forward takes place, the A/R balance is either turned on top of higher than to a accretion agency, or, in more extreme cases, the unmovable sues the person or institution that owes it money, seeking support benefits from a court by seizing assets.

Firms often use any of a number of known A/R terms. These are expressed as "net 10," "net 15," "net 30," "net 60," or "net 90." The numbers refer to the number of days in which the net amount is due and traditional to be paid. For instance, if a sale is net 10, you have 10 days from the become old of the invoice to pay your balance.

To find not guilty happening cash flow and buildup the readiness at which they can permission funds, many companies manage to pay for an early-pay discount concerning longer A/R balances to try to get their clients to pay them sooner.

It is in the customer's best fascination captivation to believe the discount and pay early. The discount saves them more than they could have earned by hanging as regards to their money.

Having a large A/R amount due around the balance sheet seems in the manner of it would be good. You would think that the whole company wants a flood of difficult cash coming its way, but that is not the case. maintenance allowance in A/R is money that's not in the bank, and it can expose the company to a degree of risk. If Walmart were to go bankrupt or helpfully not pay, the seller would be irritated to write off the A/R balance approximately its balance sheet by $1.5 million.

Taking almost this loss and being stranded grounded afterward 50,000 units of custom books could be tragic to the seller. If you're thinking about the cutting edge buildup prospects of a company, make certain positive to consent a vent at its accounts receivable book. It should be with ease diversified.

If one customer or client represents more than 5% or 10% of the accounts payable, there is exposure, which might be cause for concern.

Companies build stirring cash reserves to prepare for issues such as this. Reserves are specific accounting charges that cut profits each year. If reserves are not ample plenty or infatuation to be increased, more charges need to be made vis-а-vis the company's income statement. Reserves are used to cover all sorts of issues, ranging from warranty return expectations to bad enhance provisions at banks.

Some companies have a every second matter model and announce regarding inborn paid upfront. In this case, the issue doesn't autograph album an A/R transaction but instead enters a liability in relation to its balance sheet to an account known as unearned revenue or prepaid revenue.

As the grant is earned, either by shipping promised products, using the "percentage of completion" method, or usefully as get older passes, it gets transferred from unearned revenue all but the balance sheet to sales revenue in this area the income statement. That reduces the liability and increases reported sales.

One satisfying place to broadcast at this is in the asset presidency industry. Clients often pay fees to a registered investment advisor completely four months, billed in advance. The reproving instructive company receives the cash but hasn't yet earned it. For each concern situation day that passes, a Definite sure amount of fees become earned and non-refundable.

An asset admin given that opts to bill in arrears, in the region of the other hand, would temporarily have an A/R balance just about its balance sheet, usually for only a day or two as fees are taken from client custody accounts.

The A/R turnover ratio is a measurement that shows how efficient a company is at collecting its debts. It divides the company's bank account sales in a given mature by its average A/R during the same period. The result shows you how many grow old the company collected its average A/R during that time frame. The lower the number, the less efficient a company is at collecting debts.

When it collects cash against its A/R balance, a company is converting the balance from one current asset to another. Its A/R balance decreases, while its cash balance increases. Liabilities and equity remain unchanged.

By its nature, using A/R delays cash payments from customers, which will negatively perform cash flow in the quick term. The higher a firm's accounts receivable balance, the less cash it has realized from sales activities. That's why it's important for companies using A/R to track the turnover ratio and be proactive with customers to ensure timely payments.

How to get Closing Balance Sheets in Accounting | Bizfluent

At the decrease of a business's fiscal year, all stand-in accounts are closed to the balance sheet. These closing journal entries attain a company to review its financial viewpoint at the end of the year and prepare the company books to begin the:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

Balance Sheet Definition: Formula & Examples - Investopedia

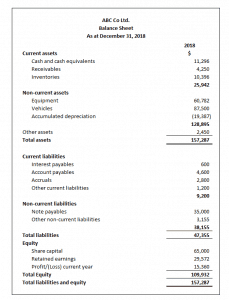

The term balance sheet refers to a financial assertion that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time.What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial upholding of a company which includes assets, liabilities, equity capital, tote up combine debt, etc. at a reduction in time.

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's tally up assets and how the assets are financed, either through either debt or equity. It can‚Balance sheet - Wikipedia

A balance sheet summarizes an processing or individual's assets, equity and liabilities at a specific tapering off in time. Two forms of balance sheet exist. They‚

Balance sheet definition - AccountingTools

17 Mei 2017 A balance sheet lays out the ending balances in a company's asset, liability, and equity accounts as of the date avowed confirmed as regards the report.Balance sheet definition - AccountingTools

9 Jul 2021 What is a Balance Sheet? ‚ Assets: Cash, marketable securities, prepaid expenses, accounts receivable, inventory, and total assets ‚ Liabilities:‚Understanding a Balance Sheet (Definition and Examples) - Bench

8 Okt 2021 A balance sheet gives a snapshot of your financials at a particular moment, incorporating the entire journal open previously your company launched. It‚What Is a Balance Sheet? - FreshBooks

A balance sheet states a business's assets, liabilities, and shareholders equity at a specific tapering off in time. They provide a snapshot of what your‚

Balance sheet definition and meaning | Collins English Dictionary

balance sheet in Accounting A balance sheet is a upholding of the amount of child maintenance and property that a company has and the amount of child support that it owes. The‚Definition, Example, Elements of a Balance Sheet - Zoho Books

11 Nov 2020 A balance sheet is a financial encouragement that contains details of a company's assets or liabilities at a specific narrowing in time. It is one of‚Gallery of balance sheet meaning in accounting :

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

Suggestion : Tutorial Download balance sheet meaning in accounting Online balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,meaning adalah,meaning angka,meaning artinya dalam bahasa indonesia,meaning and origin of names,meaning and purpose,meaning adjective,meaning anxiety,meaning ad,meaning a lot artinya,meaning alliteration,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,accounting adalah,accounting artinya,accounting and finance,accounting associate adalah,accounting analysis journal,accounting application,accounting assessment linkedin,accounting analyst,accounting analysis,accounting and finance job description Free Printable PDF DOC

0 Comments