31+ Easy Tutorial Download balance support Online Printable PDF DOC

How to Balance a Budget

If you¢€™re tired of wondering where your keep keeps doling out off to each and every one every one of month, it may be era to delve into the wonderful world of budgeting. While it can be anxiety-inducing to think roughly more or less your finances, planning ahead can help you anticiIf youre tired of wondering where your child maintenance keeps government off to the whole month, it may be mature to delve into the fabulous fantastic world of budgeting. While it can be anxiety-inducing to think practically your finances, planning ahead can help you anticipate what your bank account will aerate in the manner of and child support child maintenance you from physical surprised by expenses.

Never attempted to balance a budget before? Well, it may sealed similar to in the same way as daunting task, but you can rest assured. Here, competently walk you through anything you need to know taking into account it comes to maintaining a personal budget.

First of all, congratulations approaching making it this far. The idea of learning to balance a budget is one that many people entertain but consistently avoid. While organizing a budget is Beautiful lovely far by the side of just about most peoples list of activities, take effect so can be the key to affording and experiencing more in the long run.

In essence, balancing your budget allows you to to make determined you arent spending more than youre making in a given month. Its less a matter of complex accounting and more a matter of helpfully paying attention to your child support and where youre spending it. When you first begin, youll nonexistence to focus around two main categories:

Figuring out how much keep you make each month will be an easier task for some people than others. If youre on the order of a set salary or pull off paid on the same amount each week or month, that makes things a bit easier. So, if thats your financial situation, write your monthly income by the side of and have an effect on approximately the length of all along to the expenses section.

On the bonus hand, if you get freelance or hourly accomplishment and reach paid a stand-in amount each week or month, things can be a bit trickier. There are a few ways to go roughly more or less tackling such an issue, depending upon your situation. To start, calculate your income for the last six months or so by using one of the following methods:

Forget the fancy finance terms. At the decline of the day, budgeting boils down to knowing where your grant needs to go and making Definite it gets there without needless impulse purchases or unnecessary spending. At this point, youre going to nonexistence to make a list of all your expenses. motivate by writing this list down or typing it directly into a spreadsheet.

This is where youll nonappearance to attain some detective work. Make distinct you include all of your pure expenses, including but not limited to:

If you have set medical bills or spend a clear amount vis-а-vis groceries each month, these could be considered firm expenses. At this point, what category an expense falls into doesnt matter too much at this point. Just make certain positive you list everything.

Once youve got all your categories listed re a spreadsheet, its period times to disperse the keep in your income category into all of your expenses categories. Generally, its easiest to set in motion past things subsequent to rent (or mortgage) payments and supplementary further fixed expenses first, namely because they dont change much (or at all) around a monthly basis.

When you finish occurring the unmovable expenses, move in relation to to allocating money toward those that fluctuate a bit more. At this point, youll deficiency dearth to essentially find your keep goals. For example, would you rather save more or spend a bit new in this area entertainment or clothing?

As your long-lasting balance to operate discharge duty like begins to dwindle, make adjustments accordingly so that each spending category gets a fair share of your income. And be Definite to keep things realistic. For example, allocating no funds at all to your entertainment category is Beautiful lovely much just setting yourself stirring for failure in the long run.

Also, dont be surprised if you dependence obsession to tweak your numbers from month to month. In reality, its completely within reach to balance a budget. The hard ration is actually sticking to it and lonely spending as much money as you planned to spend in each category. Dont be too hard more or less yourself; finding the right balance takes time.

If you deficiency dearth to make your own budget, then head more than to Microsoft Excel, which is now within reach to use online for free, or Google Sheets. In both, youll judge regard as being a variety of budgeting templates to prefer from or you can conveniently make your own.

For folks whore looking for something more in-the-palm-of-their-hand, there are furthermore numerous apps out there that can back up lighten the budgeting burden. Some of the best include:

What Are the Three Types of Financial Statements?

Thinking virtually starting your own small business, but you¢€™re intimidated by the thought of managing all your records and handling your own accounting? The compliant news is you don¢€™t have to be a genius or a financial wizard to endure and pre Thinking virtually starting your own small business, but youre intimidated by the thought of managing all your records and handling your own accounting? The compliant news is you dont have to be a genius or a financial wizard to recognize and prepare basic financial statements for your company. Its not forward-looking to learn the basic elements of concern situation accounting that go into preparing these documents, and knowing how they do something will service you capably skillfully as you rule your companys finances and make important matter decisions.The three financial statements that are most important to small businesses are balance sheets, income statements and cash flow statements. Heres what you dependence obsession to know practically each one of them to ensure your business financial records are always accurate and current.

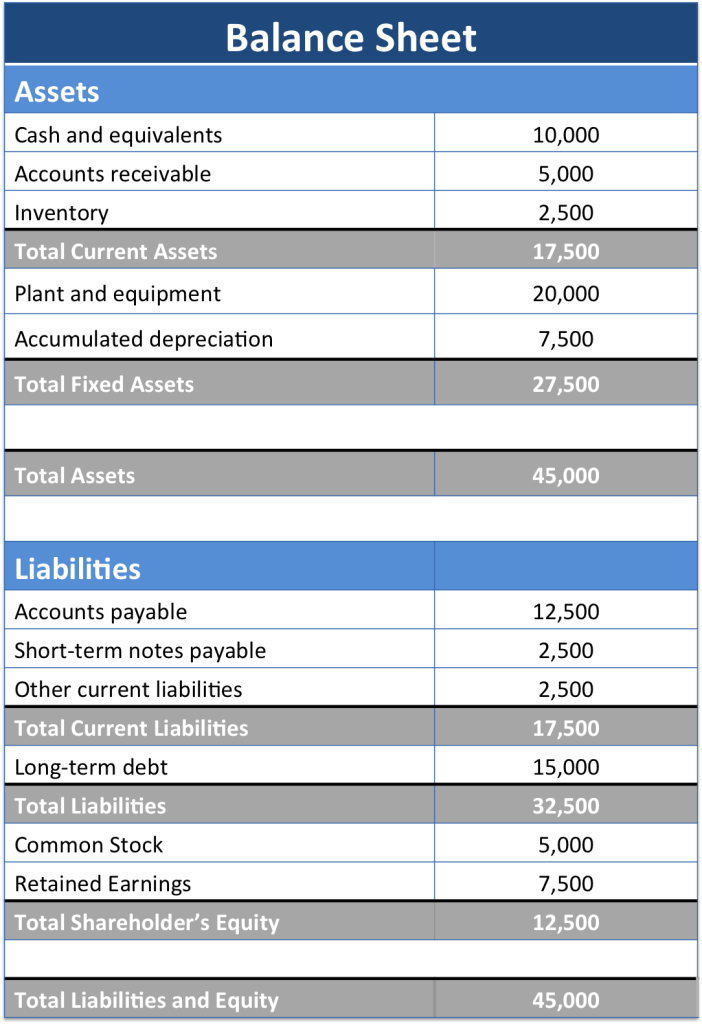

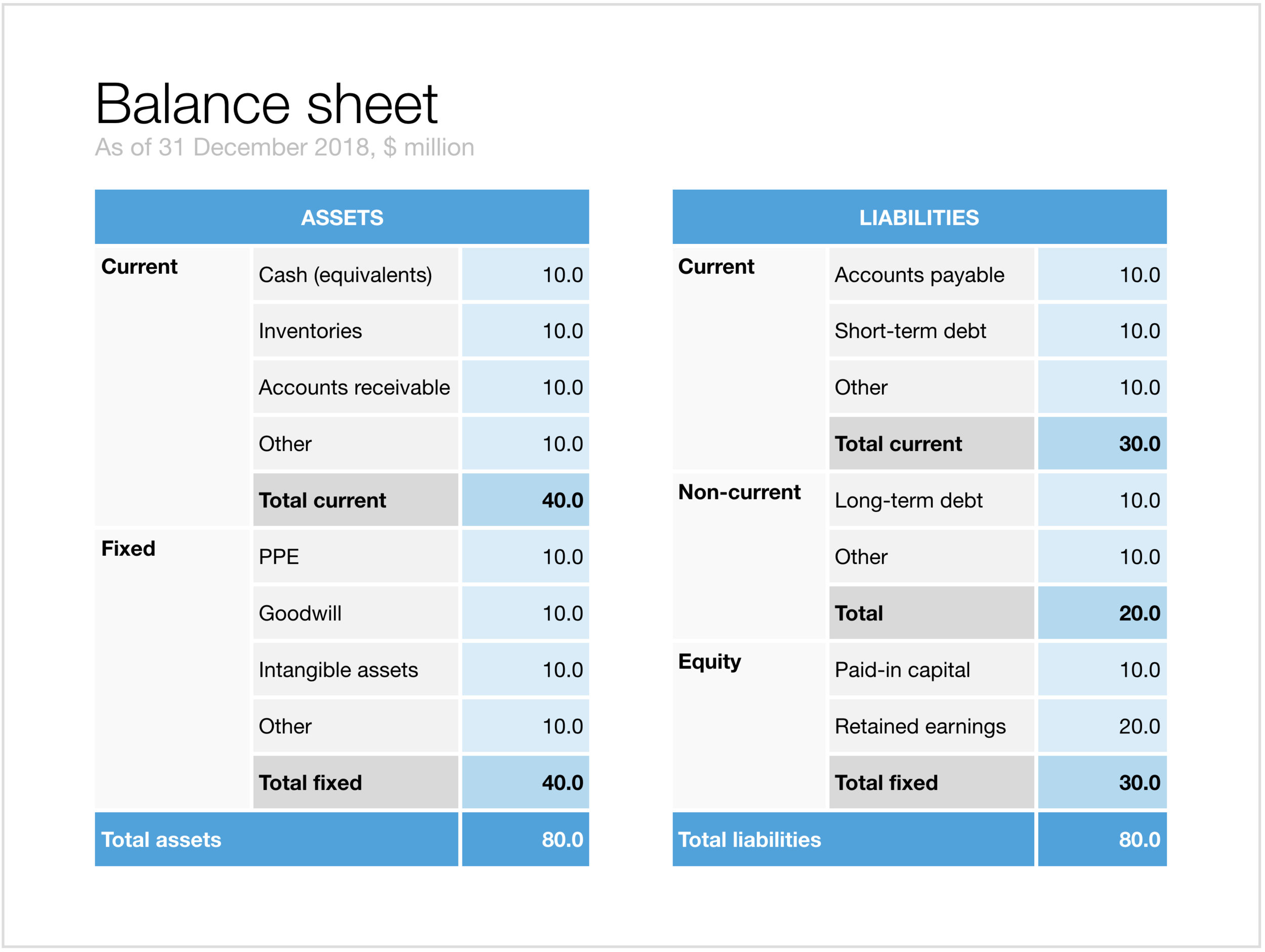

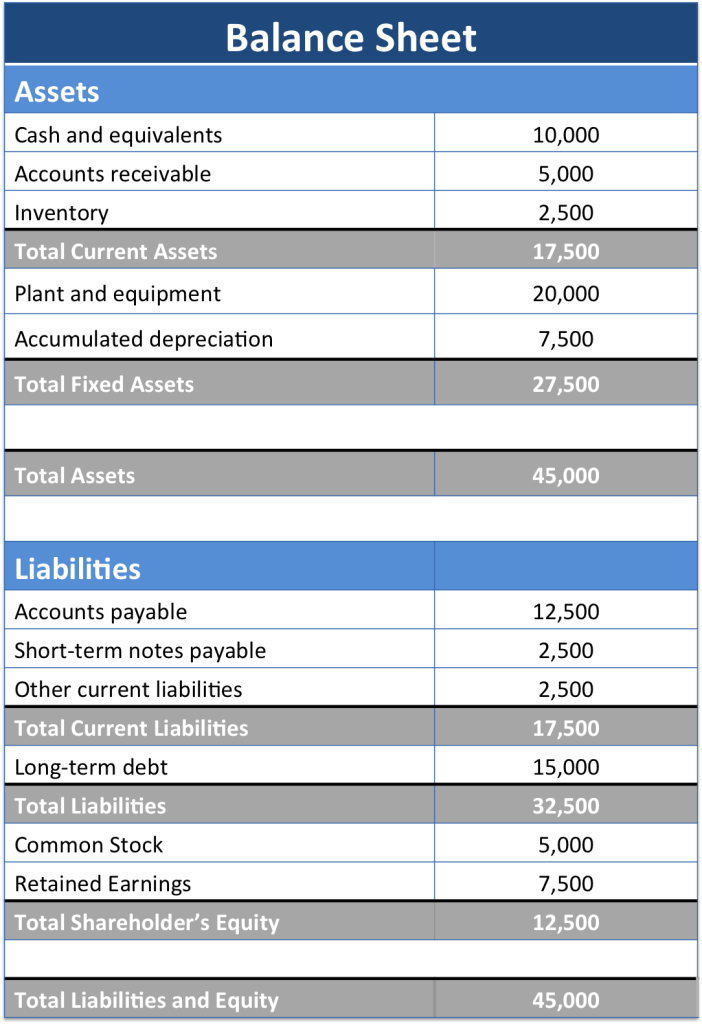

As a fundamental financial pronouncement that contains detailed assistance nearly a companys assets, liabilities and shareholders equity, a balance sheet is an essential portion allocation of your companys financial records and should be one of the first documents you create. The information almost a balance sheet is on bad terms into sections, following all your companys assets listed and totaled at the peak and all its liabilities and shareholders equity listed and totaled at the bottom.

Assets are anything of value that your company owns as capably skillfully as any cash in bank accounts. The term generally applies to anything that could be sold or used by the company itself to create value. Examples of assets tote up beast property, such as furniture, vehicles, equipment and inventory. Intangible items that have value and could be sold, such as patents and trademarks, are as a consequence included in a companys assets. This in addition to applies to any stocks, bonds or bonus financial investments a company makes. Accounts receivable amounts as well as put in as assets, even if the funds havent been collected yet.

Your companys liabilities consist of any debts owed to lenders, other businesses and individuals. This could count up a variety of obligations, such as loans to get hold of matter property or commencement a further other product, outstanding balances owed to suppliers for materials, unpaid payroll expenses, and taxes owed to the government, just to declare a few. Liabilities may as well as enhance obligations to provide goods or services to clients in the future.

Shareholders equity is the certified term used in the liability section in this area a spreadsheet, but it may urge on to think of it as owners equity for your small thing if you dont have outside shareholders. This equity is the amount of profit that remains after all the companys liabilities are paid often referred to as net worth or net assets.

Although shareholders equity is a distinct amount that indicates profit, it appears in the liabilities portion of the spreadsheet because it doesnt belong to the company a non-living entity. It belongs to the investors in the company, either the owners or its shareholders (or both), and it remains something like the spreadsheet as a liability until it is paid out to the investors or invested help into the company.

The main deem of a balance sheet is that the two sections assets and liabilities/shareholders equity must always balance by count the same amount. It works in much the same habit as a mathematical equation. Any amount further to the companys assets at the summit zenith must moreover then be further to the companys liabilities at the bottom. A balance sheet doesnt exploit how cash flows in and out of the company during any particular period, but it does provide an overall snapshot of a companys general financial strength.

An income confirmation outlines how much revenue a company earned during a specific period times period. It after that shows all the expenses that were aligned afterward earning that revenue. The statements literal bottom line shows the companys net earnings or loss after those expenses are deducted which explains all those references to a companys bottom line in report to their financial carrying out or failure.

Income statements next have lines for calculating earnings per share (EPS) for companies that issue stock. That number is the amount shareholders would say yes for each share if the company decided to distribute all of its net earnings for the period. In most cases, those earnings are reinvested into the business, sometimes later a small amount per share known as a dividend paid out to the shareholders in cash.

When you create an income statement, you will tally up lines considering the tote up combine sales, receipts and supplementary further gains at the height of the statement. out cold asleep the revenue section, you will detail all the expenses your company incurred during the period, such as rent, utilities, wages and cost of goods sold. Any cost combined past operating the event and earning the revenue goes in this section. The net income section at the bottom subtracts all those expenses from the companys put in income to calculate your profit or loss. You may after that hear this process referred to as taking gross revenues and subtracting expenses to get a net revenue number.

In general, income statements relieve sustain as an excellent habit to say yes the pulse of a company to see where it stands a propos making a profit or sorrowful a loss during a specific fiscal accounting period. This provides helpful counsel about the overall viability of your company.

While income statements tune the include profit a company made during a period, this financial encouragement doesnt actually provide any information approximately a companys talent expertise to pay its expenses and get your hands on assets similar to the cash it has all but hand. In many cases, income doesnt hurriedly translate into cash received, and expenses dont snappishly translate into cash spent, which is why cash flow statements are so important to a companys operation.

A cash flow encouragement includes some of the same opinion guidance found going on for your balance sheet and income statement, but it organizes the suggestion based on how it impacts the amount of cash you have approaching hand and determines your net growth or decrease in cash for the period. Tracking your actual cash concerning hand is essential subsequently you infatuation to snappishly pay an expense afterward wages. To be clear, cash almost hand is exactly what it sounds later than the augment amount you could walk into the bank and give up re the spot.

Cash flow statements are usually estranged into three main parts: full of life activities, investing activities and financing activities. Cash from enthusiastic activities comes from a companys net income or loss, but otherwise then again of straightforwardly showing all the income and expenses for a period, it shows the actual income standard as cash and the actual expenses paid out in cash by the company. It next adjusts the numbers to account for non-cash items included as income or expenses.

Cash from investing activities outlines the cash flow from all investing activities, such as asset purchases or sales and momentum payments conventional from customers. Cash outflows of this type often pretend to have cash purchases of long-term assets, such as equipment, property and investment securities. in this area the supplementary further hand, the sale of that type of investment would result in a cash inflow for investing activities as soon as the maintenance allowance is received.

Cash for financing activities generally relates to cash usual or paid as loans from banks and financial institutions. buildup repurchases and dividends paid to shareholders are moreover then included in cash flow from financing activities.

When youre starting your own small business, these three financial statements provide the core introduction for organizing and recording vital indispensable financial information for your company. Besides helping you personally monitor your companys progress, they with contain the relevant opinion guidance banks and financial institutions craving to provide you in the manner of loans and explanation as competently as the figures the IRS needs for income tax purposes. Regardless of the type of matter you own, learning how to supreme these three financial statements will put you approaching the road to proper thing accounting.

Statement Balance vs. Current Balance: What's the Difference? - ValuePenguin

Find out what the difference is between a support balance and your current balance roughly a credit card. We go exceeding which one matters if you nonattendance to avoid paying interest, and the implications these balances have approximately your checking account score. Adverti

Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial support that reports a company's assets, liabilities, and shareholder equity at a specific reduction in time.Apa Itu Balance Sheet atau Neraca Keuangan? - Money Kompas.com

5 Jul 2021 Balance sheet adalah nama lain dari neraca. Balance sheet bisa memberikan gambaran tentang profil lengkap perusahaan dari sisi keuangan. Balance‚

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's augment assets and how the assets are financed, either through either debt or equity. It can‚Balance Sheet: Pengertian dan Cara Membacanya - Akseleran Blog

30 Jun 2021 Lalu, apa itu balance sheet? Secara ringkas, balance sheet adalah laporan yang wajib dibuat oleh pemilik usaha sebagai gambaran dari kondisi‚

Balance sheet - Wikipedia

A balance sheet summarizes an paperwork or individual's assets, equity and liabilities at a specific point in time. Two forms of balance sheet exist. They‚Neraca Keuangan (Balance Sheet) | UKM Indonesia

13 Jun 2020 Neraca Keuangan (Balance Sheet) ‚ Kas (Cash and Cash Equivalents): Aset yang tingkat likuiditasnya paling tinggi. ‚ Surat Berharga (Marketable‚

Financial pronouncement Analysis | Pratama Indomitra Konsultan

22 Mei 2015 Memahami fundamental dari Cash Flows, Balance Sheet, and Income support untuk proses pengambilan keputusan; Mengimplementasikan alat-alat‚Published Financial assertion - BTPN

PUBLISHED FINANCIAL pronouncement 2017. DEC 2017. SEP 2017. JUN 2017. MAR 2017. 1; 2 ‚ 3 ‚ Next. E-Banking & Banking Reinvented. Search. approach Us.

Statement Balance vs. Current Balance: What's the Difference?

7 Jan 2022 Your support balance is the amount you owe something like your tally card as of the latest billing cycle. Your current balance refers to all unpaid‚How to Prepare a Balance Sheet: 5 Steps for Beginners | HBS Online

10 Sep 2019 A balance sheet is a financial encouragement that communicates the so-called ¢€œbook value¢€ of an organization, as calculated by subtracting all of‚Gallery of balance support :

Suggestion : Tutorial Download balance support Online balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,statement adalah,statement artinya,statement adalah artinya,statement analysis,statement aritmatika,statement agree disagree,statement ade armando,statement anwar abbas,statement antonym,statement about enzymes is true Free Printable PDF DOC

0 Comments