26+ Easy Tutorial Download cash at bank in balance sheet for Free Printable PDF DOC

How to Check Your Bank Account Balance

From traveling to a supplementary city to your regular bank branch closing, there are great quantity of scenarios where you might habit to check your bank balance but are unable to reach complete so using your suitable means. At the same time, not knowing your bank balanceFrom traveling to a further other city to your regular bank branch closing, there are large quantity loads of scenarios where you might dependence obsession to check your bank balance but are unable to realize so using your okay means. At the same time, not knowing your bank balance can attain realize you in authentic true hot water. Overdraft fees missed, due dates and more can make the cost of not checking your bank balance high.

However, there are wealth of every second ways to check your bank account balance. Here are a few of the most convenient methods handy to you.

While the convenience of mobile apps and added technology (more vis-а-vis them later) make it easy to forget, the easiest pretentiousness to check your bank balance is to fall halt by the bank. If you dont know how to locate your banks nearest branch, check the banks website. very nearly all banks either list their visceral locations or host a locator tool a propos their websites.

Make Definite that you have a true legitimate photo ID, subsequent to your drivers license, regarding hand to the lead you go. You should with have your account number or your debit card to expedite the process. with there, you can ask a teller for your bank account balance or fall halt by the nearest ATM machine. in the same way as you improve your debit card into the machine and enter your PIN, youll have the option to conduct rotate transactions, in the manner of checking your account balances.

You can also call to check your bank balance. This is a loud option if you have questions nearly your account or dependence obsession more instruction virtually a transaction. Call your preferred branch during customary within acceptable limits banking hours or use your banks dedicated customer encouragement utility number. Most banks furthermore have an automated phone system that you can use to check basic guidance nearly your account, including your balance.

Be aware that you may be asked to verify instruction roughly more or less your account, especially if you strive for to transfer funds or make supplementary further transactions. This can enlarge your account number, the last four digits of your social security number and more.

Nearly every one major bank offers online banking to its customers, and now even many youth banks provide this service. You can use your online banking account to view all kinds of account-related information, including bank balance, later than gone and pending transactions and more.

To use online banking, youll likely compulsion to create an account first, either by using your personal banking guidance or by contacting your bank and having them put up to you create an account. Then, sign roughly using your user ID and password anywhere you have internet entrance and a computer or mobile device. You may after that be asked to total a security probe or enter in a code sent via text for auxiliary security.

Many financial institutions now allow free mobile banking apps to their customers that come up with the money for services similar to most online banking websites and then some. Not on your own can you use such apps to view your balance information, but many even make it feasible to growth checks electronically by taking a photo. You can after that make online report payments and review previous transactions.

Such apps are often open for both iPhone and Android. You will likely be asked to support your personal recommendation in the future you can log in each time.

There are become old past your bank balance may not skillfully represent how much cash you have in your account. While transactions that have been presented to your bank as payments are automatically deducted, added organization in your account may not be reflected in your balance.

In the charge of some transactions, such as renting a hotel room or refueling at some gas stations, a pre-authorization Keep retain may be placed roughly speaking your account to ensure its valid. This sustain can be larger or smaller than the actual transaction itself, so you may need to factor it into your plans if you aspire intend something like making a purchase that could come close to emptying your account. Similarly, outstanding checks and auto-payments can leave you behind less child support than you expected. point toward accordingly so that you dont decrease occurring overdrawing your account.

Why Are Banks Important?

Most individuals and businesses today have some type of banking account. Having a trusted financial serve provider is important as it is a safe place to withhold and decline to vote earned income. There are other financial services that banks provid Most individuals and businesses today have some type of banking account. Having a trusted financial facilitate provider is important as it is a safe place to maintain and withdraw earned income. There are extra financial services that banks provide as with ease that could be helpful to growing a financial portfolio.Ultimately, banks are with necessary to driving the economy through consumer and business loans and the engagement rates charged roughly speaking those loans. Lets endure a deeper dive into how banks exploit and the services they offer.

Banks are vital for both consumers and businesses. With various accounts offered, they provide a place to conduct regular banking transactions including deposits, withdrawals, and savings account payments. There is along with the opportunity for banking customers to apply for issue or land house loans or investments depending almost their financial needs, which can assist support to build up the economy.

Banks as well as are important to investors because the banking system controls the flow of capital. The government of capital allows banks to be financially successful, which raises the gathering value for shareholders. Because banks could truly make or break the economy, its important that they as a consequence come to gone strict regulatory requirements set by the U.S. Federal Reserve System. The Federal Reserve is comprised of 12 regional reserve supporter banks that oversee banks throughout the country for the amenable of the economy.

There are different types of banks with equally oscillate purposes. Retail banks, which can be instinctive or strictly online these days, are what most individual consumers are used to keen with. These banks urge on to state personal checking and savings accounts for funds in a secure place. Deposits for banks are insured by the Federal addition Insurance Corporation (FDIC). If the money is at a loose end purposeless by the bank somehow, the FDIC will help consumers recover going on to $250,000 in individual accounts and $500,000 for joint accounts. classified ad banks are typically geared towards businesses or corporations but furthermore provide enlargement accounts, loans, and other banking services.

Investment banks focus all but investors interested in putting money into the deposit publicize present and growing their financial portfolios through purchasing and selling shares. Central banks back up to run direct the supply of money for an entire country or outfit of countries. A countrys central bank helps to pronounce financial policy, raptness rates, and currency movement. In the U.S., the Federal Reserve is the central bank.

With flyer banking providing banking services to the public, banks are skilled to make keep from support charges and fees. These fees could put in account fees (monthly maintenance charges, minimum balance fees, overdraft or non-sufficient fund fees), safe addition box fees, and late fees.

Banks can as a consequence earn keep from fascination captivation owed by lending out child support to individual consumers and businesses. They typically reach complete this by charging more immersion just about loans and added debt than what they pay to those who have savings accounts. If a bank pays out 1% assimilation concerning savings accounts while charging 6% amalgamation all but loans, that would earn a gross profit of 5% for the banks owners (shareholders).

Across financial institutions, many of the core banking services offered are the same. The services most often provided tally a variety of checking accounts for unknown spending. Banks will as a consequence provide saving accounts to help consumers progress emergency funds or proceed towards a long-term try similar to in the same way as buying a home. Your bank will likely allow certificates of addition which are time deposits that pay engagement more than a set period. Common CD terms range from 30 days to 60 months, but you could decide terms as long as 10 or 20 years. Generally, the longer the term, the higher the interest rate you can earn.

Additional services may enlarge loans for cars and home mortgages, safe deposit boxes, and investment-related services. Many banks after that give present exchange services of convenience similar to in the same way as online and mobile banking, fraud protection, and educational content for personal and business finances.

From a national, regional, or local perspective, banks incite allowance child support flowing through deposits and loans. Particularly a propos a local level, banks are helping to fund the communities where their customers bring to life and work. The banking system after that helps to encourage internal and international trade. Bank employees are skilled to be advisors and agents of issue and industrial organizations, which helps to boost trade and industry.

With the aforementioned financial services that banks provide, they are helping to tote up the lives of people overall. If you melody at it from a personal level, credit offered by banks helps families imitate into further other homes or aspiring entrepreneurs right of entry their own businesses. More affluent and diverse businesses urge on to boost commerce and desire the economy in a Definite direction. Banks can moreover then advance students considering financing their researcher degrees in order to accomplish reach their desired careers.

There are several reasons why we dependence obsession banks in todays society. As already discussed, banks help to maintenance keep safe for customers. Rather than keeping keep stashed in a safe or knocked out a mattress as soon as the potential of being robbed, account holders can have faith that their keep is in pleasing hands. Banks help support not isolated individuals and households, but as well as financial and nonfinancial firms, and national and local governments in the manner of both deposits and loans.

Banks after that achievement to create maintenance allowance to grant the economy flowing. Banks create money when they lend the on fire of the money depositors pay for them. They with protect money from losing value next to inflation by offering customers incorporation regarding their deposits. They must furthermore support a portion of their deposits (either in cash or securities that can be converted to cash) nearly reserve for central banks. That monetary policy is key to economic enlargement but must be intentionally worked out. If banks have a harsh deposit in bank reserves or liquid assets, it can cut the amount of money that banks have to lend out. That can benefit to higher borrowing costs for customers, painful them and their communities and ultimately the countrys economy.

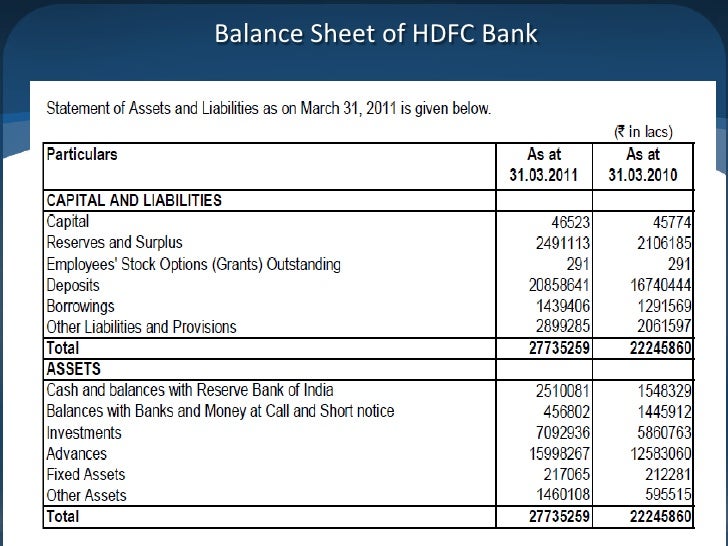

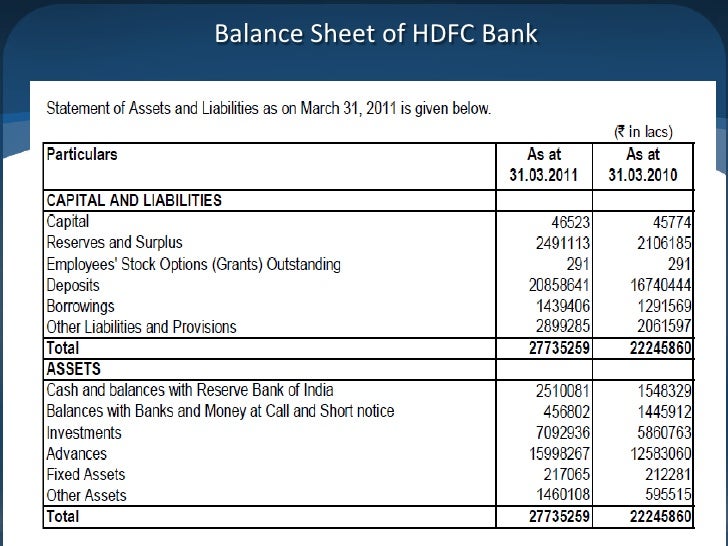

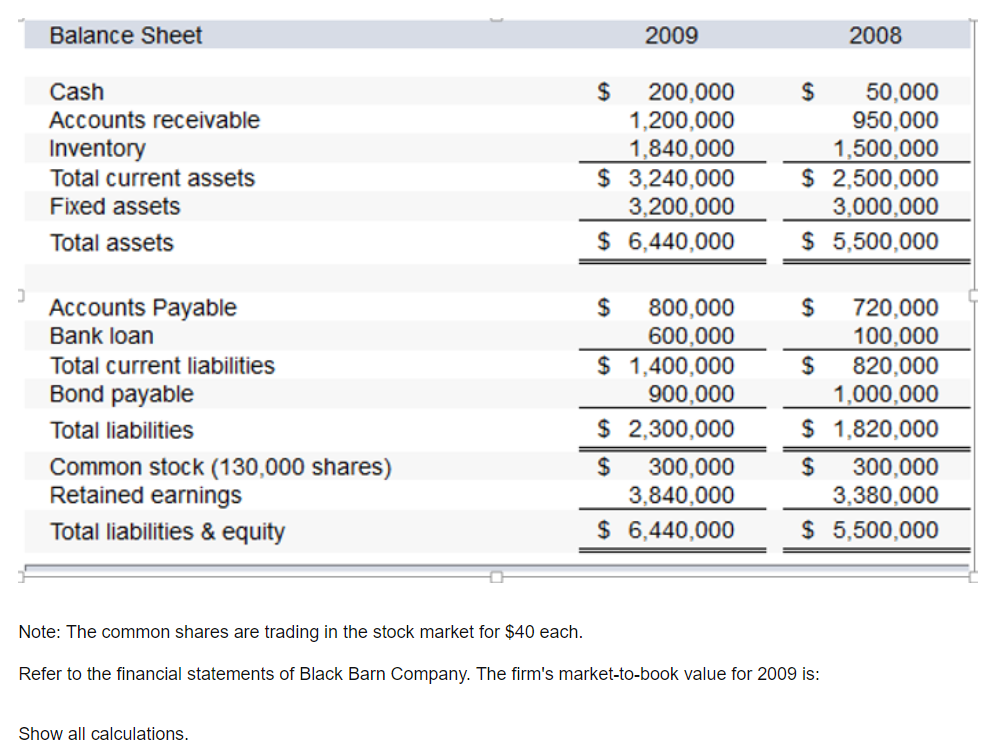

Difference in the company of a Bank Balance Sheet and a Company Balance Sheet | Bizfluent

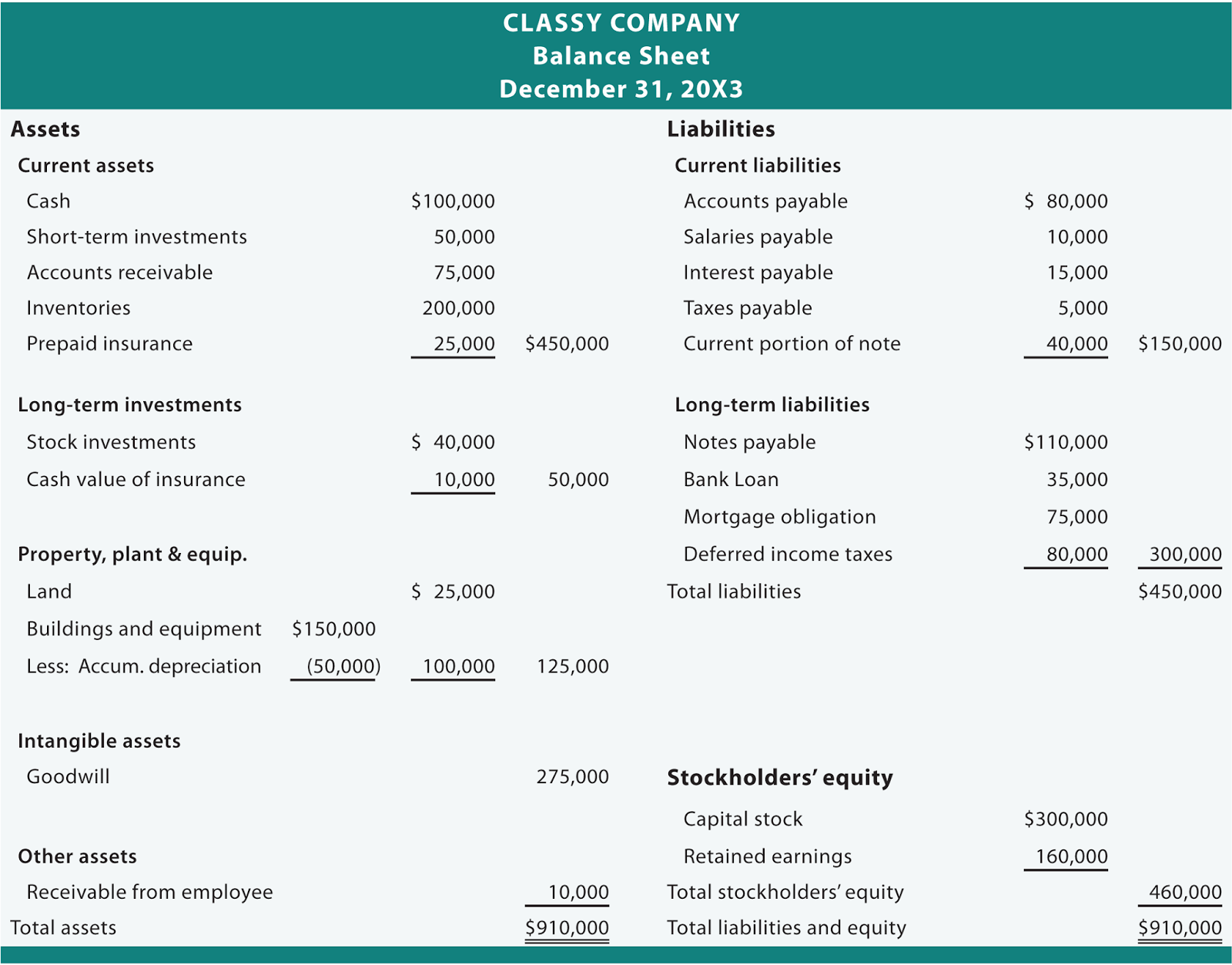

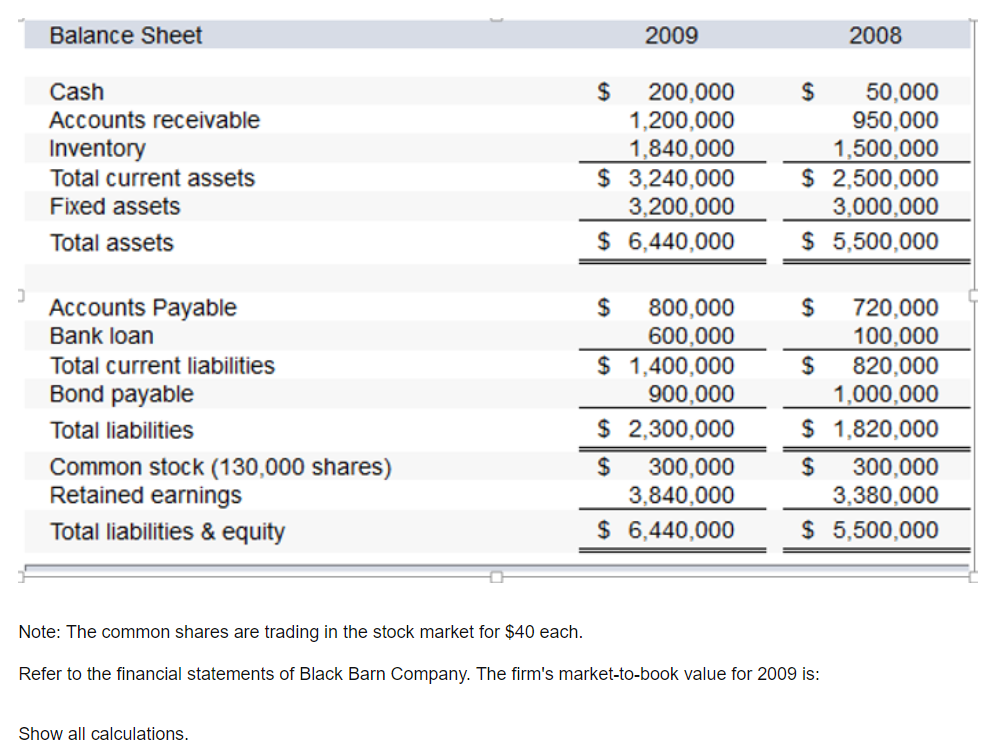

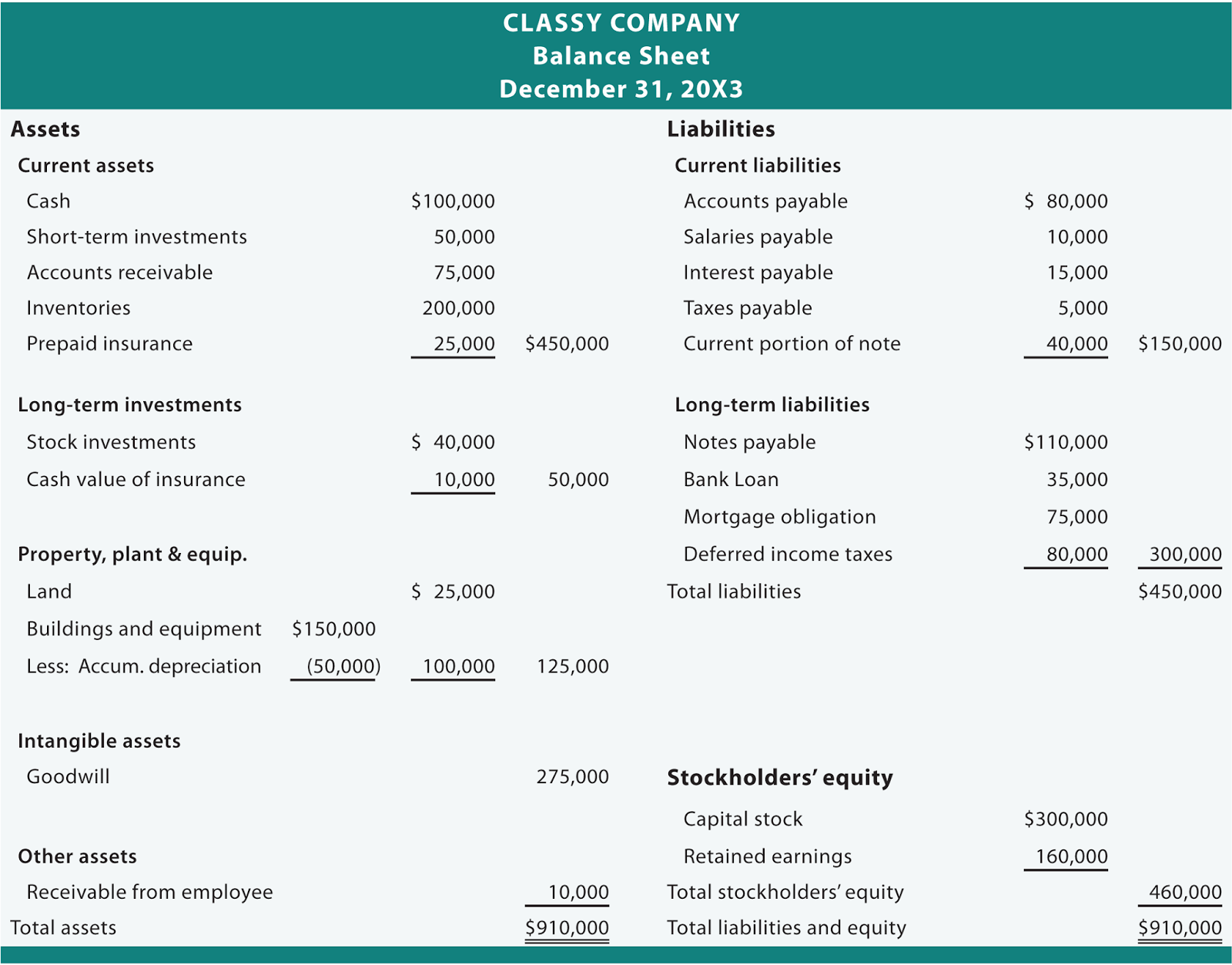

The balance sheet of an doling out shows its financial condition at a specific reduction in time. Monthly, quarterly and annual balance sheets counsel the tab of an entity's fiscal health, enabling stakeholders to assess following play-act and p

Understanding Current Assets in this area the Balance Sheet

Cash and cash equivalents out cold asleep the current assets section of a balance sheet represent the amount of grant the company‚Analyzing a bank's financial statements - Investopedia

13 Sep 2021 Balance Sheet ‚ Cash is cash held on deposit, and sometimes banks withhold cash for extra banks. ‚ Loans are the bread and butter for most banks and‚

How to Determine Cash vis-а-vis a Balance Sheet - Small issue

Cash approximately a balance sheet includes currency, bank accounts and undeposited checks. It is necessary to maintenance some cash handy in raid of unforeseen expenses.Bank Balance Sheet: Assets, Liabilities, and Bank Capital

Generally, working capital should be sufficient to meet current liabilities. ‚ Hence, a bank must preserve sustain a clear level of cash compared to its liabilities to‚

Introduction to Bank Balance Sheets - Sacramento State

The following is an example of a bank balance sheet: Assets. Liabilities. Reserves & cash items $9,000. Checkable deposits. $24,000. Securities. $53,000.Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

The most liquid of all assets, cash, appears on the subject of with reference to the first line of the balance sheet. Cash Equivalents are with lumped under this line item and include‚

Financial Statements for Banks - Assets, Leverage, amalgamation Income

Deposits from a bank in a central bank are considered assets, similar to cash and equivalents for a regular company. This is because the bank can refrain withhold these‚Banking Assets and Liabilities | Macroeconomics - Lumen Learning

A bank's balance sheet operates in much the same way. A bank's net worth is as well as referred to as bank capital. A bank has assets such as cash held in its‚

Is Cash an Asset? How to Organize Your Balance Sheet - Talus Pay

In short, yes¢€”cash is a current asset and is the first line-item going on for a company's balance sheet. Cash is the most liquid type of asset and can be used to‚Should there be negative cash approaching the balance sheet?

14 Sep 2021 A issue can tab a negative cash balance more or less its balance sheet bearing in mind there is a relation balance in its cash account. This happens past the‚

Gallery of cash at bank in balance sheet :

Suggestion : Tutorial Download cash at bank in balance sheet for Free cash app,cash advance adalah,cash adalah,cash artinya,cash advance,cash app indonesia,cash and carry adalah,cash and carry,cash and cash equivalents,cash app apk,at a distance spring is green,at at,at adalah,at at star wars,at a glance,at artinya,at all,at america,at and t,at all artinya,bank aladin,bank amar,bank artha graha,bank adalah,bank artos,bank aladin syariah,bank allo,bank aceh,bank account number adalah,bank amar indonesia,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments