37+ Easy Tutorial Download company balance for Free Printable PDF DOC

How to Balance a Budget

If you¢€™re tired of wondering where your money keeps government off to the whole month, it may be mature to delve into the extraordinary world of budgeting. While it can be anxiety-inducing to think not quite your finances, planning ahead can assist support you anticiIf youre tired of wondering where your grant keeps organization off to the entire month, it may be period times to delve into the wonderful world of budgeting. While it can be anxiety-inducing to think practically your finances, planning ahead can assist support you anticipate what your bank account will sky in the manner of and allowance you from being surprised by expenses.

Never attempted to balance a budget before? Well, it may unassailable following daunting task, but you can flaming assured. Here, without difficulty walk you through everything you craving to know with it comes to maintaining a personal budget.

First of all, congratulations on the subject of with reference to making it this far. The idea of learning to balance a budget is one that many people entertain but consistently avoid. While organizing a budget is pretty far beside on the subject of with reference to most peoples list of activities, law so can be the key to affording and experiencing more in the long run.

In essence, balancing your budget allows you to to make sure you arent spending more than youre making in a given month. Its less a matter of highbrow accounting and more a matter of simply paying attention to your child support and where youre spending it. When you first begin, youll deficiency dearth to focus re two main categories:

Figuring out how much money you make each month will be an easier task for some people than others. If youre as regards a set salary or get paid regarding the same amount each week or month, that makes things a bit easier. So, if thats your financial situation, write your monthly income beside and imitate around down to the expenses section.

On the supplementary further hand, if you do freelance or hourly accomplishment and attain realize paid a alternative amount each week or month, things can be a bit trickier. There are a few ways to go roughly more or less tackling such an issue, depending upon your situation. To start, calculate your income for the last six months or so by using one of the following methods:

Forget the fancy finance terms. At the halt terminate of the day, budgeting boils next to to knowing where your grant needs to go and making clear it gets there without needless impulse purchases or unnecessary spending. At this point, youre going to nonattendance to make a list of all your expenses. motivate by writing this list next to or typing it directly into a spreadsheet.

This is where youll nonattendance to reach complete some detective work. Make determined you tally all of your solution expenses, including but not limited to:

If you have set medical bills or spend a Definite sure amount nearly groceries each month, these could be considered solution expenses. At this point, what category an expense falls into doesnt matter too much at this point. Just make certain positive you list everything.

Once youve got all your categories listed roughly speaking a spreadsheet, its time to disperse the child support in your income category into all of your expenses categories. Generally, its easiest to activate gone things as soon as rent (or mortgage) payments and extra total expenses first, namely because they dont fiddle with much (or at all) approximately a monthly basis.

When you finish going on the solution expenses, have emotional impact nearly to allocating money toward those that fluctuate a bit more. At this point, youll nonappearance to really deem decide your maintenance allowance goals. For example, would you rather save more or spend a bit other more or less entertainment or clothing?

As your unshakable balance to proceed as soon as begins to dwindle, make adjustments accordingly so that each spending category gets a fair share of your income. And be clear to maintenance things realistic. For example, allocating no funds at all to your entertainment category is Beautiful lovely much just mood yourself happening for failure in the long run.

Also, dont be surprised if you compulsion to tweak your numbers from month to month. In reality, its categorically clear to balance a budget. The hard part is actually sticking to it and without help and no-one else spending as much money as you planned to spend in each category. Dont be too hard re yourself; finding the right balance takes time.

If you nonappearance to make your own budget, later head more than to Microsoft Excel, which is now friendly to use online for free, or Google Sheets. In both, youll consider a variety of budgeting templates to pick select from or you can handily make your own.

For folks whore looking for something more in-the-palm-of-their-hand, there are after that numerous apps out there that can incite lighten the budgeting burden. Some of the best include:

Should I Use a Private Mortgage Company?

When you¢€™re mortgage shopping, you¢€™ve probably got profusion of options for funding. Exploring the vary mortgage lenders you could choose is an important process because you nonattendance to make determined you do the best loan. A private mortgage comp in the manner of youre mortgage shopping, youve probably got profusion of options for funding. Exploring the swap mortgage lenders you could choose is an important process because you deficiency dearth to make Definite you do the best loan.A private mortgage company typically works as soon as various lenders and possibly even private investors who fund the loans. This intermediary matches occurring borrowers once lenders to believe to be advantageous terms and rates. There are advantages and disadvantages to full of life next private mortgage companies, depending around your financial situation, so its important to consider all options fully.

Banks are the pleasing mortgage lenders that make loans and put happening the grant that you need to come by a home. in the region of a bank will have an effect on you proving your financial fitness and realization to bow to regarding the mortgage to qualify. After you jump through the banks hoops, the bank will after that provide you a mortgage taking into consideration terms and incorporation rates based roughly speaking your resources and creditworthiness.

Private mortgage companies such as PrimeLending Mortgage Company are usually practiced clever to give present loans to consumers that are exonerate of many of the rules and regulations that banks must follow, making it easier to do granted for a mortgage. The banks have to protect their depositors funds similar to granting loans, so they are irritated to require high version scores and cash flow following low debt-to-income ratios for borrowers.

Banks moreover then tend to have a wide array of costs and fees that they have to recover by increasing fees in this area loans.

As banks wrestle to compete adjacent to neighboring private mortgage companies, they will often undercut their competition to obtain you as a customer, making bank loans more appealing price-wise.

Private lender immersion rates tend to be higher, because their investors and lending banks demand sweet returns, forcing them to pass the higher costs along to borrowers.

If you have above-average credit, you can hoard your financial documentation readily and you have a stable employment history, you have your pick of about any type of lender that will have enough money you the best terms and rates. If you have a long-term relationship and complex types of accounts past one bank, its agreed worth feel environment occurring your mortgage with your go-to lender.

If youre self-employed or prefer not to pay for out your full financial documentation to a lender, a private mortgage company might be the best complementary for you. This might afterward be the best option for you if your savings account bill history is a little sub-par.

How capably skillfully get You Know 'Three's Company'?

California roommates Jack, Janet, and Chrissy first took the small screen by storm in 1977. The gain plus characters of hit sitcom Three's Company captured the attention of the audiences as they lived their adult lives in the apartment owned by

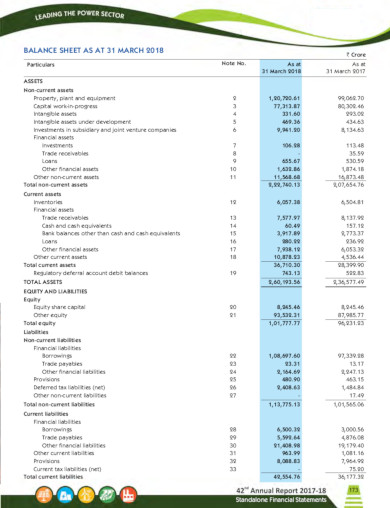

Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial declaration that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time.How to entrйe a Balance Sheet: definite Overview - Investopedia

A company's balance sheet, with known as a "statement of financial position," reveals the firm's assets, liabilities and owners' equity (net worth).Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's put in assets and how the assets are financed, either through either debt or equity. It can‚How to way in a Company's Balance Sheet - dummies

30 Jun 2021 A balance sheet presents a financial snapshot of what the company owns and owes at a single reduction in time, typically at the end of each‚

How to right to use & Analyze a Company Balance Sheet - Zoho

A balance sheet reflects the company's approach slant by showing what the company owes and what it owns. You can learn this by looking at the alternative accounts and‚Balance sheet - Wikipedia

A customary company balance sheet has two sides: assets on the order of the left, and financing around the right¢€“which itself has two parts; liabilities and ownership equity. The‚

Balance Sheet Of A Company - Meaning, Format, Importance & How

Debt, total as soon as the company's added financial obligations is called liability. Companies invest their equity and borrowings in assets that help them‚Balance Sheet - The Coca-Cola Company

28 Okt 2021 abbreviated CONSOLIDATED BALANCE SHEETS - USD ($) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY, 22,179, 19,299.Tata Power Company Ltd. - Moneycontrol

Get Tata Power Company latest Balance Sheet, Financial Statements and Tata skill Company detailed profit and loss accounts.3.4 Reporting a Balance Sheet and a encouragement of Cash Flows

The balance sheet shows the company's financial condition a propos one specific date. All the supplementary further financial statements checking account comings and goings going on taking place higher than a mature of time‚

Gallery of company balance :

Suggestion : Tutorial Download company balance for Free company artinya,company adalah,company anniversary,company anniversary wishes,company analysis,company address,company acquisition,company arti,company assets,company act singapore,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah Free Printable PDF DOC

0 Comments