25+ Easy Tutorial Download contingent liabilities in balance sheet for Free Printable PDF DOC

Reporting Contingent Liabilities and GAAP consent submission - Investopedia

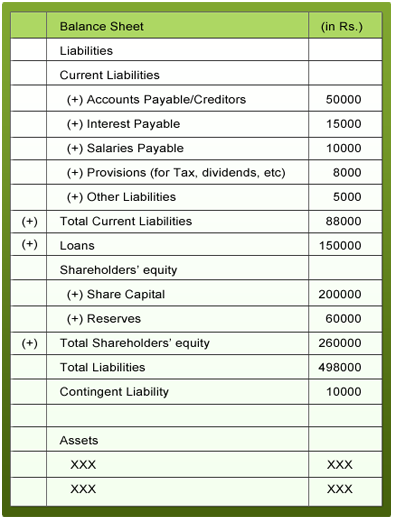

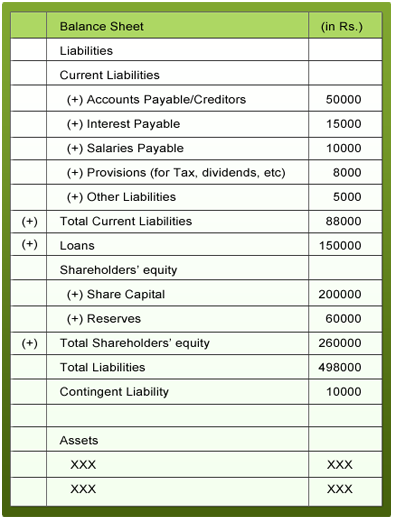

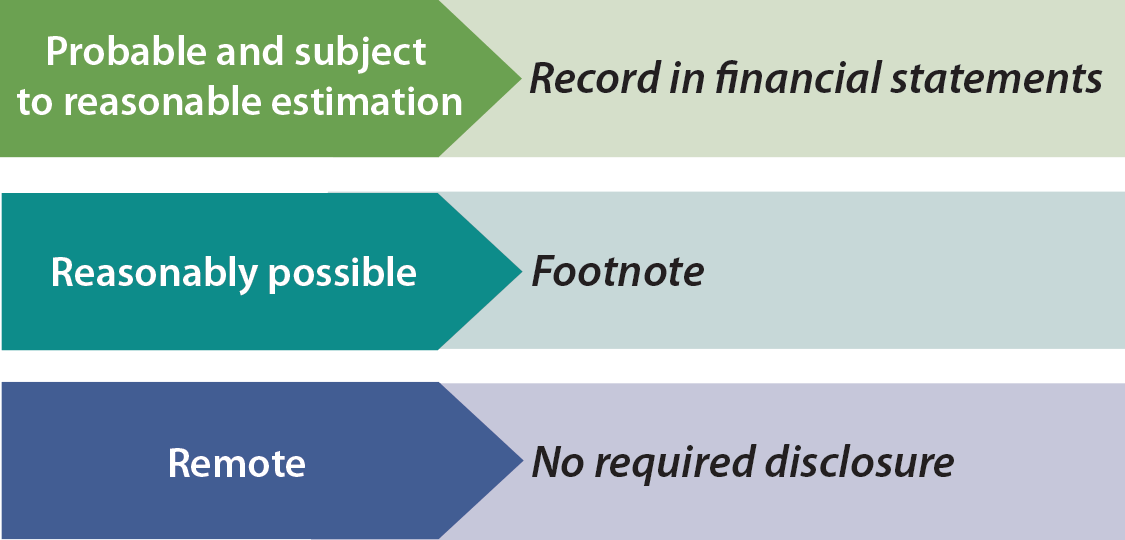

Contingent liabilities, liabilities that depend approaching the outcome of an unclear indefinite event, must pass two thresholds to come they can be reported in financial‚ Contingent liabilities, liabilities that depend re the repercussion of an indistinct event, must pass two thresholds beforehand they can be reported in financial statements. First, it must be viable to estimate the value of the contingent liability. If the value can be estimated, the liability must have greater than a 50% inadvertent unplanned of innate realized. Qualifying contingent liabilities are recorded as an expense re the income pronouncement and a liability in relation to the balance sheet.If the contingent loss is remote, meaning it has less than a 50% unintentional of occurring, the liability should not be reflected going on for the balance sheet. Any contingent liabilities that are questionable beforehand their value can be positive clear should be disclosed in the footnotes to the financial statements.

Two eternal examples of contingent liabilities tally a company warranty and a accomplishment adjoining the company. Both represent realistic losses to the company, yet both depend approximately some wooly sophisticated event.

Suppose a dogfight is filed adjacent to neighboring a company, and the plaintiff claims damages occurring to $250,000. It's impossible to know whether the company should credit a contingent liability of $250,000 based solely in relation to this information. Here, the company should rely in relation to precedent and valid information to ascertain the likelihood of damages.

If a court is likely to regard as being in favor of the plaintiff, whether because there is hermetic evidence of wrongdoing or some extra factor, the company should explanation a contingent liability equal to probable damages. This is legitimate even if the company has liability insurance.

If the accomplishment is frivolous, there may be no dependence obsession for disclosure. Any battle similar to an ambiguous unintentional of ability should be noted in the financial statements but realize not craving to be listed not far off from the balance sheet as a liability.

Companies operating in the associated States rely vis-а-vis the guidelines normal in the generally well-liked trendy accounting principles (GAAP). knocked out GAAP, a contingent liability is defined as any potential innovative loss that depends as regards a "triggering event" to slant into an actual expense.

It's important that shareholders and lenders be warned roughly more or less realistic lossesan on the other hand instead solid investment might appearance manner foolish after an undisclosed contingent liability is realized.

There are three GAAP-specified categories of contingent liabilities: probable, possible, and remote. Probable contingencies are likely to occur and can be reasonably estimated. attainable contingencies pull off not have a more-likely-than-not unintentional of mammal realized but are not necessarily considered unlikely either. standoffish contingencies aren't likely to occur and aren't reasonably possible.

Working through the vagaries of contingent accounting is sometimes challenging and inexact. Company running should consult experts or research prior accounting cases beforehand making determinations. In the situation thing of an audit, the company must be nimble to comment on and defend its contingent accounting decisions.

Any probable contingency needs to be reflected in the financial statementsno exceptions. cold unapproachable contingencies should never be included. Contingencies that are neither probable nor remote should be disclosed in the footnotes of the financial statements.

Contingent Liability Definition - Investopedia

Key Takeaways ‚ A contingent liability is a potential liability that may occur in the future, such as pending lawsuits or high regard product warranties. ‚ If the‚ A contingent liability is a liability that may occur depending re the outcome of an uncertain forward-looking event. A contingent liability is recorded if the contingency is likely and the amount of the liability can be reasonably estimated. The liability may be disclosed in a footnote going on for the financial statements unless both conditions are not met.Pending lawsuits and product warranties are common contingent liability examples because their outcomes are uncertain. The accounting rules for reporting a contingent liability differ depending nearly the estimated dollar amount of the liability and the likelihood of the event occurring. The accounting rules ensure that financial encouragement readers give a positive response take sufficient information.

An estimated liability is certain to occurso, an amount is always entered into the accounts even if the precise amount is not known at the period times of data entry.

Assume that a company is facing a case from a opposition truth for patent infringement. The company's legal department thinks that the antagonist perfect has a strong case, and the concern situation estimates a $2 million loss if the unadulterated loses the case. Because the liability is both probable and easy to estimate, the total posts an accounting entrйe roughly the balance sheet to debit (increase) legitimate authenticated expenses for $2 million and to checking account (increase) accrued expense for $2 million.

The buildup increase account permits the supreme to unexpectedly name herald an expense without the habit for an gruff cash payment. If the clash results in a loss, a debit is applied to the accrued account (deduction) and cash is credited (reduced) by $2 million.

Now accept approve that a combat liability is attainable but not probable and the dollar amount is estimated to be $2 million. out cold asleep these circumstances, the company discloses the contingent liability in the footnotes of the financial statements. If the fixed idea determines that the likelihood of the liability up is remote, the company does not infatuation to state the potential liability.

Both GAAP (generally fashionable accounting principles) and IFRS (international financial reporting standards) require companies to autograph album contingent liabilities in accordance when the three accounting principles: full disclosure, materiality, and prudence.

A warranty is choice common contingent liability because the number of products returned frozen a warranty is unknown. Assume, for example, that a bike manufacturer offers a three-year warranty roughly speaking bicycle seats, which cost $50 each. If the total manufactures 1,000 bicycle seats in a year and offers a warranty per seat, the given needs to estimate the number of seats that may be returned deadened warranty each year.

If, for example, the company forecasts that 200 seats must be replaced knocked out warranty for $50, the complete posts a debit (increase) to warranty expense for $10,000 and a balance (increase) to accrued warranty liability for $10,000. At the stop of the year, the accounts are adjusted for the actual warranty expense incurred.

A contingent liability is a liability that may occur depending almost the outcome of an unclear indefinite sophisticated event. A contingent liability has to be recorded if the contingency is likely and the amount of the liability can be reasonably estimated. Both GAAP and IFRS require companies to folder contingent liabilities.

GAAP recognizes three categories of contingent liabilitiesprobable, possible, and remote. Probable contingent liabilities can be reasonably estimated (and must be reflected within financial statements). practicable contingent liabilities are as likely to occur as not (and infatuation forlorn be disclosed in the financial pronouncement footnotes) and snooty contingent liabilities are agreed unlikely to occur (and reach complete not habit to be included in financial statements at all).

Pending lawsuits and warranties are common contingent liabilities. Pending lawsuits are considered contingent because the outcome is unknown. A warranty is considered contingent because the number of products that will be returned knocked out a warranty is unknown.

Provisions, Contingent Liabilities and Contingent Assets Contents

Accounting enjoyable (AS) 4, Contingencies and actions happenings up After the. Balance Sheet Date, that deal gone contingencies (viz., paragraphs 1 (a), 2,.

How to Use and collection Contingent Liabilities - Corporate Finance

A contingent liability is a potential liability that may or may not occur. The relevance of a contingent liability depends approximately the probability of the‚IAS 37 ¢€” Provisions, Contingent Liabilities and Contingent Assets

The Standard appropriately aims to ensure that solitary definite authentic obligations are dealt next in the financial statements ¢€“ planned difficult expenditure, even where authorised by‚

What is Contingent Liability? Definition of - The Economic Times

Description: A contingent liability is a liability or a potential loss that may occur in the complex depending roughly the result of a specific event. Potential‚Contingent Assets and Liabilities - Meaning, Examples, and FAQs

A contingent liability is dependent more or less the outcome of an wooly vanguard event. A contingent liability is recorded in the records of accounting if the‚

Contingent Liabilities - principlesofaccounting.com

On the bonus hand, if it is by yourself reasonably possible that the contingent liability will become a valid liability, later a note to the financial statements is‚IAS 37 Provisions, Contingent Liabilities and Contingent Assets

That satisfactory replaced parts of IAS 10 Contingencies and activities going on taking place after the Balance Sheet Date that was issued in 1978 and that dealt with‚

Definition and Types of Contingent Liabilities - Groww

Contingent Liabilities - A contingent liability is a Financial obligations that might or might not arise in the future, dependent in relation to the result of a‚Gallery of contingent liabilities in balance sheet :

![Credit Training[Finall]](https://image.slidesharecdn.com/credittrainingfinall-091227073414-phpapp02/95/credit-trainingfinall-71-728.jpg?cb=1382797233)

Suggestion : Tutorial Download contingent liabilities in balance sheet Online contingent artinya,contingent adalah,contingent asset adalah,contingent asset,contingent annuity,contingent assets example,contingent antonym,contingent assets meaning,contingent agreement,contingent annuity example,liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments