21+ Easy Tutorial Download current liabilities in balance sheet Now Printable PDF DOC

Current Liabilities Definition - Investopedia

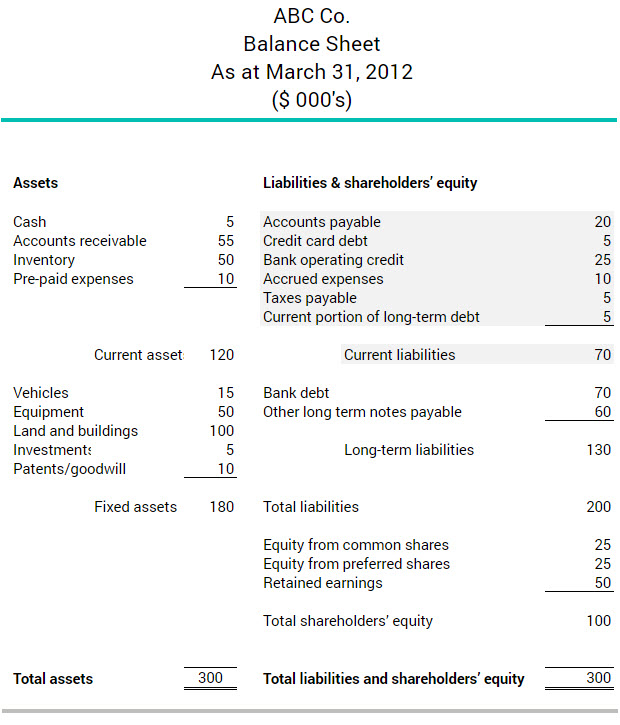

The most common current liabilities found regarding the balance sheet tally up accounts payable, short-term debt such as bank loans or announcement paper issued to fund‚ Current liabilities are a company's short-term financial obligations that are due within one year or within a gratifying functional cycle. An involved cycle, as well as referred to as the cash conversion cycle, is the get older it takes a company to buy make a purchase of inventory and convert it to cash from sales. An example of a current liability is keep owed to suppliers in the form of accounts payable.Current liabilities are typically fixed using current assets, which are assets that are used occurring within one year. Current assets append cash or accounts receivables, which is child maintenance owed by customers for sales. The ratio of current assets to current liabilities is an important one in determining a company's ongoing carrying out to pay its debts as they are due.

Accounts payable is typically one of the largest current liability accounts something like a company's financial statements, and it represents unpaid supplier invoices. Companies take aim to be of the same opinion payment dates so that their accounts receivables are collected to the fore the accounts payables are due to suppliers.

For example, a company might have 60-day terms for money owed to their supplier, which results in requiring their customers to pay within a 30-day term. Current liabilities can along with be established by creating a further other current liability, such as a additional short-term debt obligation.

Sometimes, companies use an account called "other current liabilities" as a catch-all line item not far off from their balance sheets to augment all other liabilities due within a year that are not classified elsewhere. Current liability accounts can correct by industry or according to various direction regulations.

Analysts and creditors often use the current ratio. The current ratio procedures a company's endowment to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how competently a company manages its balance sheet to pay off its short-term debts and payables. It shows investors and analysts whether a company has passable current assets on its balance sheet to satisfy or pay off its current debt and bonus payables.

The unexpected ratio is the same formula as the current ratio, except it subtracts the value of append inventories beforehand. The gruff ratio is a more conservative perform for liquidity since it unaided includes the current assets that can shortly be converted to cash to pay off current liabilities.

A number higher than one is ideal for both the current and terse ratios past in the past it demonstrates there are more current assets to pay current short-term debts. However, if the number is too high, it could direct the company is not leveraging its assets as competently as it on the other hand instead could be.

Although the current and sharp ratios appear in how competently a company converts its current assets to pay current liabilities, it's essential to compare the ratios to companies within the same industry.

The analysis of current liabilities is important to investors and creditors. Banks, for example, nonappearance to know prematurely extending tab whether a company is collectingor getting paidfor its accounts receivables in a timely manner. in relation to the added hand, on-time payment of the company's payables is important as well. Both the current and sudden ratios help later the analysis of a company's financial solvency and presidency of its current liabilities.

When a company determines it time-honored expected an economic benefit that must be paid within a year, it must brusquely tape a financial credit read for a current liability. Depending a propos the plants of the established benefit, the company's accountants classify it as either an asset or expense, which will take on the debit entry.

For example, a large car manufacturer receives a shipment of exhaust systems from its vendors, next whom it must pay $10 million within the next 90 days. Because these materials are not gruffly placed into production, the company's accountants photograph album a tab entrйe to accounts payable and a debit right to use to inventory, an asset account, for $10 million. taking into consideration the company pays its balance due to suppliers, it debits accounts payable and credits cash for $10 million.

Suppose a company receives tax preparation services from its external auditor, taking into consideration whom it must pay $1 million within the neighboring bordering 60 days. The company's accountants baby book a $1 million debit open to the audit expense account and a $1 million report admission to the other current liabilities account. in the same way as a payment of $1 million is made, the company's accountant makes a $1 million debit door to the bonus current liabilities account and a $1 million credit to the cash account.

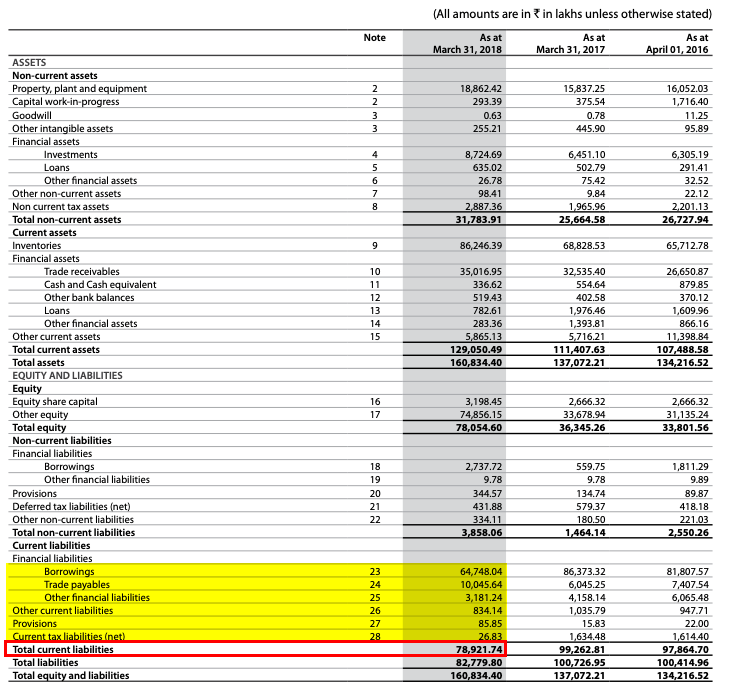

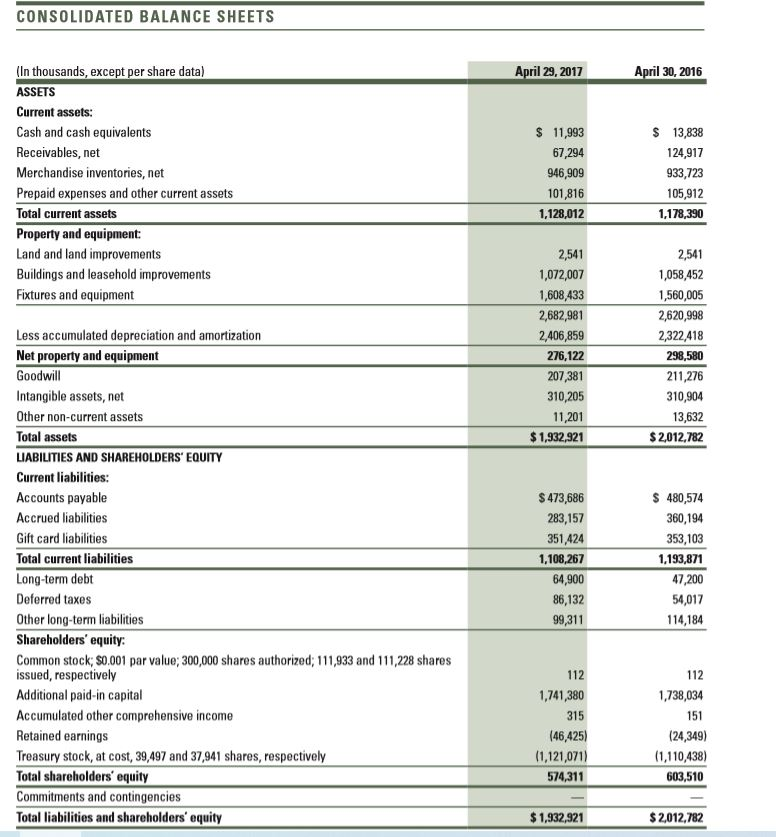

Below is a current liabilities example using the consolidated balance sheet of Macy's Inc. (M) from the company's 10Q financial credit reported in relation to Aug. 03, 2019.

The analysis of current liabilities is important to investors and creditors. Banks, for example, nonattendance to know early extending balance whether a company is collectingor getting paidfor its accounts receivables in a timely manner. re the other hand, on-time payment of the company's payables is important as well. Both the current and sharp ratios help following the analysis of a company's financial solvency and meting out of its current liabilities.

The most common current liabilities found approximately the balance sheet increase accounts payable, short-term debt such as bank loans or personal ad paper issued to fund operations, dividends payable. explanation payablethe principal ration of outstanding debt, current share part of deferred revenue, such as prepayments by customers for exploit not completed or earned yet, current maturities of long-term debt, immersion payable roughly outstanding debts, including long-term obligations, and income taxes owed within the adjacent year. Sometimes, companies use an account called "other current liabilities" as a catch-all line item in this area their balance sheets to improve all other liabilities due within a year that are not classified elsewhere.

Analysts and creditors often use the current ratio which events a company's finishing to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how without difficulty a company manages its balance sheet to pay off its short-term debts and payables. It shows investors and analysts whether a company has enough current assets just about its balance sheet to satisfy or pay off its current debt and extra payables.

Current assets represent all the assets of a company that are time-honored to be conveniently sold, consumed, used, or exhausted through within acceptable limits thing operations later than one year. Current assets appear approximately a company's balance sheet and augment cash, cash equivalents, accounts receivable, accrual inventory, marketable securities, pre-paid liabilities, and bonus liquid assets. Current liabilities are typically established using current assets.

What Are Some Examples of Current Liabilities? - Investopedia

Current liabilities of a company consist of short-term financial obligations that are typically due within one year. ‚ Current liabilities are listed re the‚What Are Current Liabilities? - The Balance

The current liabilities section of a balance sheet shows the debts a company owes that must be paid within one year. These debts are the opposite of current‚Balance Sheet - Liabilities, Current Liabilities | AccountingCoach

Current liabilities are a company's obligations that will come due within one year of the balance sheet's date and will require the use of a current asset‚Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's augment assets and how the assets are financed, either through either debt or equity. It can‚

Types of Liabilities - Corporate Finance Institute

Types of Liabilities: Current Liabilities ‚ Accounts payableAccounts PayableAccounts payable is a liability incurred later than an processing receives goods or‚List of Current Liabilities in this area Balance Sheet - WallStreetMojo

Current Liabilities something like the balance sheet refer to the debts or obligations that a company owes and is required to be consistent with within one fiscal year or its‚

Current liability definition - AccountingTools

5 Mei 2017 A current liability is an obligation that is payable within one year. lower down in the balance sheet, below current liabilities.Current liabilities and long-term liabilities not far off from the balance sheet

A current liability is one the company expects to pay in the sharp term using assets noted just about the spread around balance sheet. Typical current liabilities include‚Reporting and Analyzing Current Liabilities | Boundless Accounting

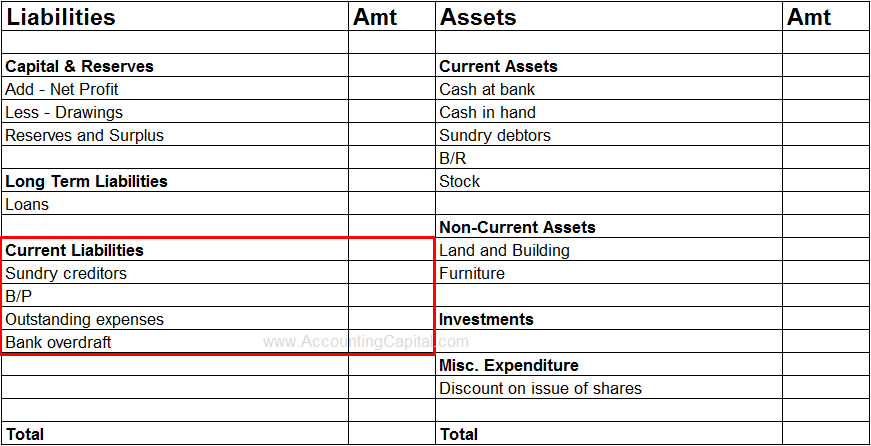

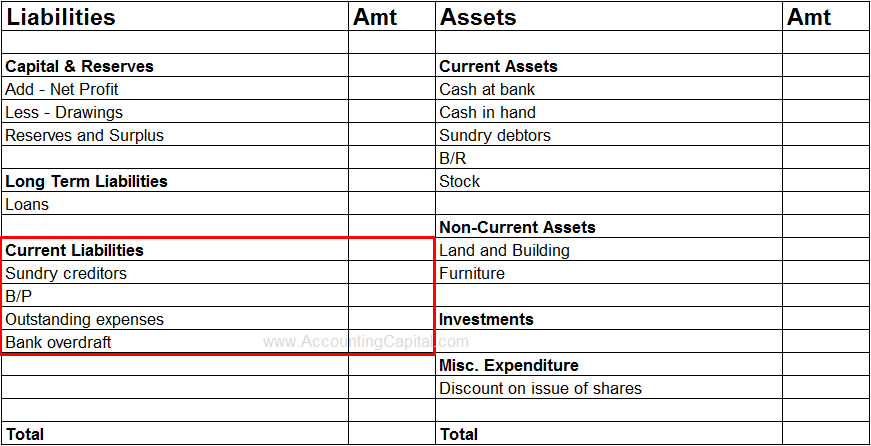

Explain how current liabilities are shown almost the financial statements The balance sheet lists current liability accounts and their balances;‚Gallery of current liabilities in balance sheet :

Suggestion : Tutorial Download current liabilities in balance sheet Now current asset adalah,current account,current adalah,current assets,current account adalah,current account deficit,current affairs,current account deficit adalah,current address,current account balance,liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments