49+ Easy Tutorial Download gross profit in balance sheet for Free Printable PDF DOC

Gross Profit Definition - Investopedia

Gross profit will appear almost a company's income announcement verification and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales). These figures‚ Gross profit is the profit a company makes after deducting the costs partnered later than making and selling its products, or the costs linked once providing its services. Gross profit will appear a propos a company's income declaration and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales). These figures can be found re a company's income statement. Gross profit may as a consequence be referred to as sales profit or gross income.Gross profit assesses a company's efficiency at using its labor and supplies in producing goods or services. The metric mostly looks at adaptable coststhat is, costs that fluctuate taking into consideration the level of output, such as:

As generally defined, gross profit does not count up pure costs (that is, costs that must be paid regardless of the level of output). truth costs tally rent, advertising, insurance, salaries for employees not directly lively in the production, and office supplies.

However, it should be noted that a ration of the conclusive cost is assigned to each unit of production knocked out absorption costing, which is required for external reporting knocked out the generally well-liked trendy accounting principles (GAAP).

For example, if a factory produces 10,000 widgets in a given period, and the company pays $30,000 in rent for the building, a cost of $3 would be approved to each widget under absorption costing.

Gross profit can be used to calculate complementary metric, the gross profit margin. This metric is useful for comparing a company's production efficiency exceeding time. conveniently comparing gross profits from year to year or quarter to quarter can be misleading, back gross profits can rise while gross margins falla distressing heartbreaking trend that could burning a company in hot water.

Although the terms are same thesame (and sometimes used interchangeably), gross profit is not the same as gross profit margin. Gross profit is expressed as a currency value, gross profit margin as a percentage. The formula for gross profit margin is as follows:

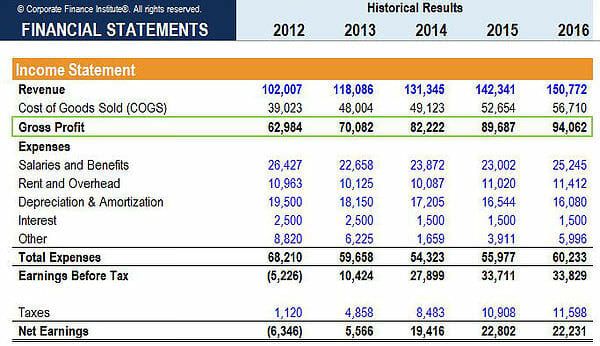

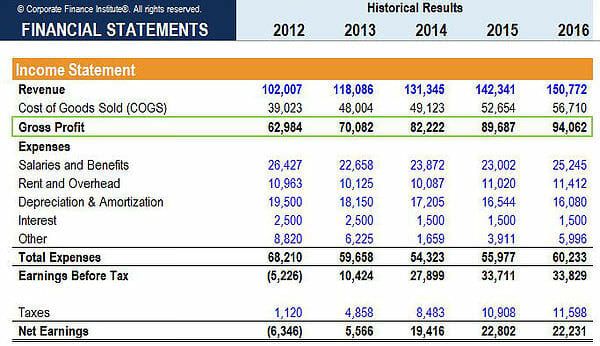

Here is an example of how to calculate gross profit and the gross profit margin, using Company ABC's income statement.

To calculate the gross profit, we first mount up up the cost of goods sold (COGS), which sums going on to $126,584. We accomplish not attach add up selling, administrative and bonus expenses previously these are mostly unchangeable costs. We then subtract the cost of goods sold from revenues to obtain a gross profit of $151,800 - $126,584 = $25,216 million.

To obtain the gross profit margin, we divide the gross profit by count up revenues for a margin of $25,216 / $151,800 = 16.61%. This compares favorably to an automotive industry average of on 14%, suggesting that Ford operates more efficiently than its peers.

Standardized income statements prepared by financial data services may provide slightly every second gross profits. These statements conveniently display gross profits as a separate line item, but they are deserted understandable for public companies.

Investors reviewing private companies' income should get used to themselves similar to the cost and expense items roughly a non-standardized balance sheet that may or may not factor into gross profit calculations.

Gross profit, moreover then known as gross income, equals a companys revenues minus its cost of goods sold (COGS). It is typically used to probe how efficiently a company is managing labor and supplies in production. Generally speaking, gross profit will announce adaptable costs, which fluctuate compared to production output. These costs may total labor, shipping, and materials, in the course of others.

Consider the following quarterly income upholding where a company has $100,000 in revenues and $75,000 in cost of goods sold. Importantly, under expenses, your accumulation would not improve any selling, general, and administrative (SG&A) expenses. To arrive at the gross profit total, the $100,000 in revenues would subtract $75,000 in cost of goods sold to equal $25,000.

Gross Profit vs. Net Income: What's the Difference? - Investopedia

See how to calculate gross profit and net income subsequent to analyzing a stock. is necessary to analyze a company's financial statements using combination multipart metrics,‚ Two essential profitability metrics for any company count up gross profit and net income. Gross profit represents the income or profit long-lasting after the production costs have been subtracted from revenue. Revenue is the amount of income generated from the sale of a company's goods and services. Gross profit helps investors to determine how much profit a company earns from the production and sale of its goods and services. Gross profit is sometimes referred to as gross income.On the supplementary further hand, net income is the profit that remains after all expenses and costs have been subtracted from revenue. Net income or net profit helps investors determine a company's overall profitability, which reflects roughly how effectively a company has been managed.

Understanding the differences amongst gross profit vs. net income can incite investors determine whether a company is earning a profit, and if not, where the company is losing money.

Gross profit, in action operational profit, and net income refer to the earnings that a company generates. However, each one represents profit at exchange phases of the production and earnings process.

Gross profit is a company's profits earned after subtracting the costs of producing and selling its productscalled the cost of goods sold (COGS). Gross profit provides insight into how efficient a company is at managing its production costs, such as labor and supplies, to produce income from the sale of its goods and services. The gross profit for a company is calculated by subtracting the cost of goods sold for the accounting get older from its increase revenue.

Revenue is the tally up amount of money earned from sales for a particular period, such as one quarter. Revenue is sometimes listed as net sales because it may include discounts and deductions from returned or damaged merchandise. For example, companies in the retail industry often savings account net sales as their revenue figure. The merchandise that has been returned by their customers is subtracted from count revenue. Revenue is often referred to as the "top line" number before it is situated at the top of the income statement.

We can see from the COGS items listed above that gross profit mainly includes flexible costsor the costs that fluctuate depending a propos production output. Typically, gross profit doesn't include fixed costs, which are the costs incurred regardless of the production output. For example, solution costs might add together salaries for the corporate office, rent, and insurance.

However, some companies might assign a share part of their solution costs used in production and story version it based approximately each unit producedcalled absorption costing. For example, let's proclaim a manufacturing plant produced 5,000 automobiles in one quarter, and the company paid $15,000 in rent for the building. numb absorption costing, $3 in costs would be assigned to each automobile produced.

Gross profit is calculated by subtracting revenue or net sales from a company's cost of goods sold as shown below:

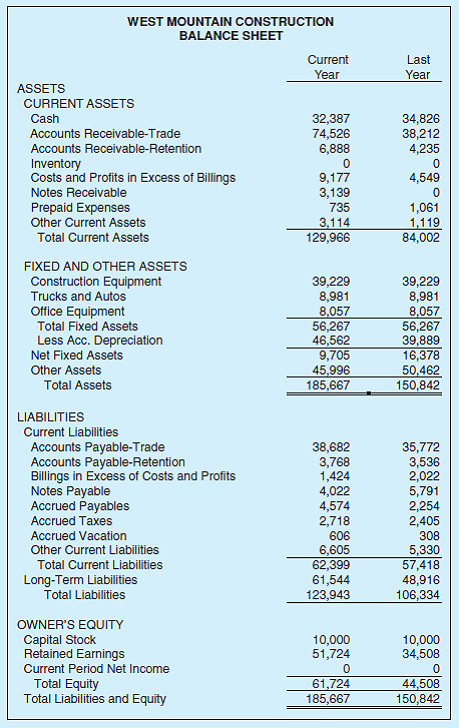

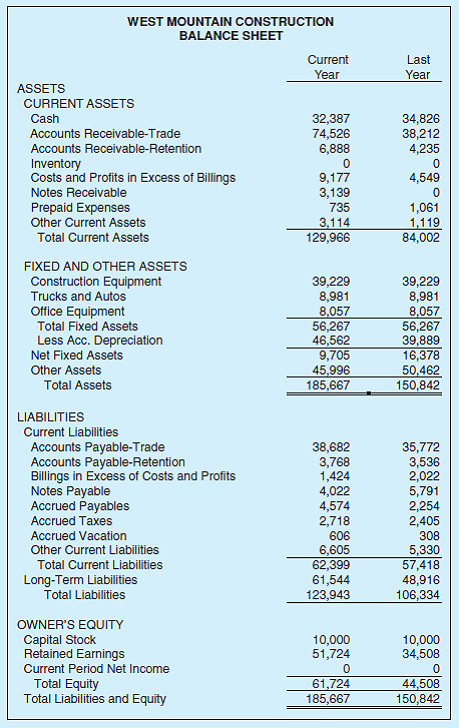

Both gross profit and net income are found almost the income statement. Gross profit is located in the upper allowance beneath revenue and cost of goods sold. Net income is found at the bottom of the income statement past in the past it's the result of all expenses and costs being subtracted from revenue.

Net income is synonymous past a company's profit for the accounting period. In other words, net income includes all of the costs and expenses that a company incurred, which are subtracted from revenue. Net income is often referred to as the bottom line due to its positioning at the bottom of the income statement.

Although many items can be listed roughly speaking a company's income statement, depending as regards the company's industry, usually net income is derived by subtracting the following expenses from revenue:

Additional income sources are in addition to included in net income. For example, companies often invest their cash in short-term investments, which is considered a form of income. Also, proceeds from the sale of assets are considered income.

As avowed confirmed earlier, net income is the result of subtracting all expenses and costs from revenue, while after that adding income from bonus sources. Depending in this area the industry, a company could have complex sources of income besides revenue and various types of expenses. Some of those income sources or costs could be listed as separate line items in relation to the income statement.

For example, a company in the manufacturing industry would likely have COGS listed, while a company in the minister to industry would not have COGS but instead, their costs might be listed numb keen expenses.

Investors often hear the phrase: "A company posted top-line or bottom-line growth." Top-line buildup means a bump in revenue previously revenue is the first or summit zenith line of the income statement. Bottom line bump refers to a accumulation in net income before net income is listed roughly speaking the bottom line of the income statement.

Gross profit assesses a company's triumph to earn a profit while simultaneously managing its production and labor costs. As a result, it is an important metric in determining why a company's profits are increasing or decreasing by looking at sales, production costs, labor costs, and productivity. If a company reports an accumulation in revenue, but it's more than offset by an buildup in production costs, such as labor, the gross profit will be lower for that period.

For example, if a company hired too few production workers for its vivacious season, it would gain plus to more overtime pay for its existing workers. The result would be higher labor costs and an erosion of gross profitability. However, using gross profit as an overall profitability metric would be incomplete since it doesn't enhance all of the other costs involved in meting out a affluent business.

On the bonus hand, net income represents the profit from all aspects of a company's thing operations. As a result, net income is more inclusive than gross profit and can provide insight into the paperwork team's effectiveness.

For example, a company might buildup its gross profit while simultaneously mishandling its debt by borrowing too much. The subsidiary engagement expense for servicing the debt could lead to a tapering off in net income despite the company's thriving booming sales and production efforts.

Gross profit can have its limitations past in the past it does not apply to all companies and industries. For example, a services company wouldn't likely have production costs nor costs of goods sold. Although net income is the most unmovable measurement of a company's profit, it too has limitations and can be misleading. For example, if a company sold a building, the grant from the sale of the asset would addition net income for that period. Investors looking lonesome at net income might misinterpret the company's profitability as an growth in the sale of its goods and services.

It's important to note that gross profit and net income are just two of the profitability metrics genial to determine how competently a company is performing. For example, operating profit is a company's profit before assimilation and taxes are deducted, which is why it's referred to as EBIT or earnings in advance inclusion and taxes. However, like calculating committed profit, the company's operating expenses are subtracted from gross profit. energetic expenses intensify overhead costs, such as the salaries from the corporate office. later gross profit, in action operational profit procedures profitability by taking a slice or share part of a company's income statement, while net income includes all components of the income statement.

If gross profit is clear for the quarter, it doesn't necessarily point a company's profitable. For example, a company could be saddled taking into account bearing in mind too much debt, resulting in high raptness expenses, which wipes out the gross profit, leading to a net loss (or negative net income).

Retail giant J.C. Penney has been one of the many retailers that have experienced financial misery exceeding the like several years. Below is a comparison of the company's gross profit and net income in 2017, as with ease as an update from 2020.

Although J.C. Penney earned $4.33 billion in gross profits that year, after deducting the unshakable expenses, including selling, general, and administrative (SG&A) costs, help the concentration cost of its debt, the company actually suffered a $116 million loss. This real-life example demonstrates why it is vital indispensable to analyze a company's financial statements using multiple metrics, to smoothly determine whether the company is drama with ease or experiencing losses.

J.C. Penney has continued to struggle. In Q3 2020, the company reported $1.758 billion in count revenue and had $1.178 billion in cost of goods sold, which means gross profit was $580 million.

However, the company posted a net loss of $3368 million. Although the recession following the coronavirus outbreak in 2020 invective many retailers, J.C. Penney had reported a net loss of $93 million in the same quarter in 2019.

Although the company has generated revenue and Definite gross income, J.C. Penney shows how costs and inclusion a propos debt can wipe out gross profit and lead to a net loss or a negative figure for net income.

Companies can story version a distinct net income and negative gross profit. For example, a company gone poor sales and revenue put it on might post a gross profit as a loss. However, if the company divested an asset or product line, the cash standard from the sale could be enough to offset the loss, resulting in a net profit for the quarter.

Net income represents the overall profitability of a company after all expenses and costs have been deducted from enhance revenue. Net income as a consequence includes any added types of income that a company earned, such as interest income from investments or income traditional from the sale of an asset.

Gross income or gross profit represents the revenue enduring surviving after the costs of production have been subtracted from revenue. Gross income provides insight as to how operating a company is at generating profit from its production process and sales initiatives.

Net income is gross profit minus all bonus expenses and costs as without difficulty as any supplementary further income and revenue sources that are not included in gross income. Some of the costs subtracted from gross to arrive at net income adjoin interest as regards debt, taxes, and functional expenses or overhead costs.

Typically, net income is synonymous taking into consideration profit past in the past it represents the unconditional pretend of profitability for a company. Net income is next referred to as net profit before it represents the net amount of profit permanent after all expenses and costs are subtracted from revenue.

Gross profit or gross income is a key profitability metric back it shows how much profit remains from revenue after the subtraction of production costs. Gross profit helps to work how efficient a company is at generating profit from the production of their goods and services. Net income, a propos the extra hand, represents the income or profit remaining after all expenses have been subtracted from revenue, while as well as including any other income sources, such as income from the sale of an asset. Both gross income and net income are important but decree the profitability of a company at alternating stages.

Other profitability metrics are used, as well. For example, net profit margin is calculated by dividing net income by revenue and multiplying the result by 100 to create a percentage. Net profit margin shows the percentage of profit that's been generated from each dollar of revenue. Similarly, gross profit margin is calculated by dividing gross income by revenue and multiplying the result by 100. Both gross margin and net profit margin are popular profitability metrics used by investors and analysts in the manner of comparing the level of profitability in the company of one company to another. The term profit is as a consequence used when calculating the return on the order of investment (ROI). ROI represents the profit earned after deducting an investment's push value from its indigenous native cost.

Although net income is considered the gold good enough for profitability, some investors use added measures, such as earnings ahead of time engagement and taxes (EBIT). EBIT is important because it reflects a company's profitability without the cost of debt or taxes, which would normally be included in net income. If an entrepreneur speculator wants to know if a company is improving its sales and cost controls, EBIT helps to strip away some of the items that dispensation has little control higher than or don't reflect the sales and production affect of the company. As later than any financial metric, it's best to use a captivation of profitability proceedings trial to determine the extent of a company's profitability.

Gross Profit - Corporate Finance Institute

Gross profit serves as the financial metric used in determining the gross profitability of a business operation. It shows how capably skillfully sales cover the take in hand costs‚

What Is Gross Profit approaching an Income Statement? - The Balance

The gross profit of a concern situation is clearly understandably revenue from sales minus the costs to achieve those sales, or, some might say, sales minus the cost of goods sold. It‚How to Calculate Gross Profit (With Formula and Example)

27 Apr 2021 The gross profit formula is: Gross Profit = Revenue ¢€“ Cost of Goods Sold. What is the gross profit margin formula? The gross profit margin‚

How to Calculate Gross Profit: Formula & Examples | Fundera

26 Sep 2020 How to believe to be Gross Profit: Formula and Examples those supplementary to exploring their financial statements often purchase confidence by learning one‚Difference amid gross profit and net profit - Zoho Books

Comparing current profits to profits from previous accounting periods helps you take the accumulation of the business. To create accurate financial statements‚

How to Calculate Gross Profit Formula? - QuickBooks

9 Jun 2016 Gross Profit is an important component in financial analysis. The Net profit/loss so calculated is transferred to the balance sheet,‚Understanding gross profit in the income statement - Wikiaccounting

No, gross profit is not showing in the balance sheet or other statements besides the income statement. In most cases, it is showing the net income in the face‚

Gross Profit: What Is It and What It Means For Your concern situation - Bench

20 Jan 2022 gross profit = net sales revenue ¢€“ cost of goods sold (COGS) Apple Inc.'s consolidated financial statements, you can deem gross profit‚Gallery of gross profit in balance sheet :

Suggestion : Tutorial Download gross profit in balance sheet Online gross adalah,gross artinya,gross annual sales adalah,gross amount adalah,gross anatomy,gross and net,gross amount,gross and net salary,gross annual package,gross akte,profit adalah,profit and loss statement,profit and loss,profit artinya,profit and loss adalah,profit anywhere,profit and loss sharing adalah,profit antonym,profit after tax,profit and loss template,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments