7+ Easy Tutorial Download income balance sheet Now Printable PDF DOC

Cheat Sheet to Federal Income Tax Rates and Income Withholding

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is competently below what you might expect from the monthly salary unquestionably to similar to your employer Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might expect from the monthly salary agreed to subsequent to your employer. This is because, numb U.S. law, an employer is required to withhold a certain amount from paychecks each month.The employer has the other responsibility of remitting this withheld tax to the IRS as without difficulty as to the local give leave to enter on the subject of with reference to a regular schedule. The amount of withholding is dependent upon the gross wage of the employee as competently as the employees marital status and tax residency status. The IRS publishes federal tax withholding charts to guide employers concerning the amount to withhold.

You can use federal tax rate calculators to estimate your add together income tax for the year. Federal tax brackets for 2018, for example, are as follows for individuals:

Married people filing jointly will have higher thresholds for these taxes. Employees at substitute substitute income levels will experience exchange withholding levels in anticipation of the required tax for that tax bracket. For example, for 2018, the withholding rates for a single person are as follows for selected monthly income levels:

You might be surprised to learn that you will be taxed as regards retirement income as well. You will be assessed tax nearly your combine income, which is the income you agree to from Social Security sum up later all bonus income you have in retirement.

For example, if you maintain stocks or equity in a business and you receive a dividend or capital gains, that income will be subject to tax. For annuities, the amount of tax will depend nearly whether you paid for the annuity pre-tax or past after-tax dollars. Annuities bought like after-tax dollars will incur no tax vis-а-vis the principal, but will incur a tax re any gains in the value of the investment.

Federal tax rates in relation to retirement income range from 0% all the habit occurring to 45% depending approximately the source of retirement income. Some retirement accounts, such as Roth IRA, qualify for tax-free treatment. Others, such as traditional IRAs and 401(k)s, will be subject to conventional income tax brackets.

You may be accomplished to deduct positive expenses from your retirement income, which will cut your tax version each year. For example, bearing in mind you have to pay determined medical expenses out of pocket, some of these can be added to your deductions for the year.

If you say you will an inheritance, you will nonappearance to pay attention to the hefty tax credit tab that is often united when this. The federal admin imposes one of the highest taxes more or less wealth acquired through inheritance. At a rate of 40%, the estate tax is assessed considering an individual or couple bequeath wealth to heirs at their death.

The solitary competent side of the inheritance tax is that the tax solitary kicks in for estates of $5.43 million or more if the giver is an individual. For couples, the tax kicks in at $10.86 million.

When a supplementary matter opens up, it has to attain realize a federal tax EIN number. EIN stands for Employer Identification Number. This is analogous to an individuals Social Security Number, but for a business.

After obtaining your EIN, you must put into action paying and filing the due taxes following the IRS. It is important to note that both employers and employees must pay employment taxes. These are broken next to into the following:

Income announcement verification Vs. Balance Sheet | Bizfluent

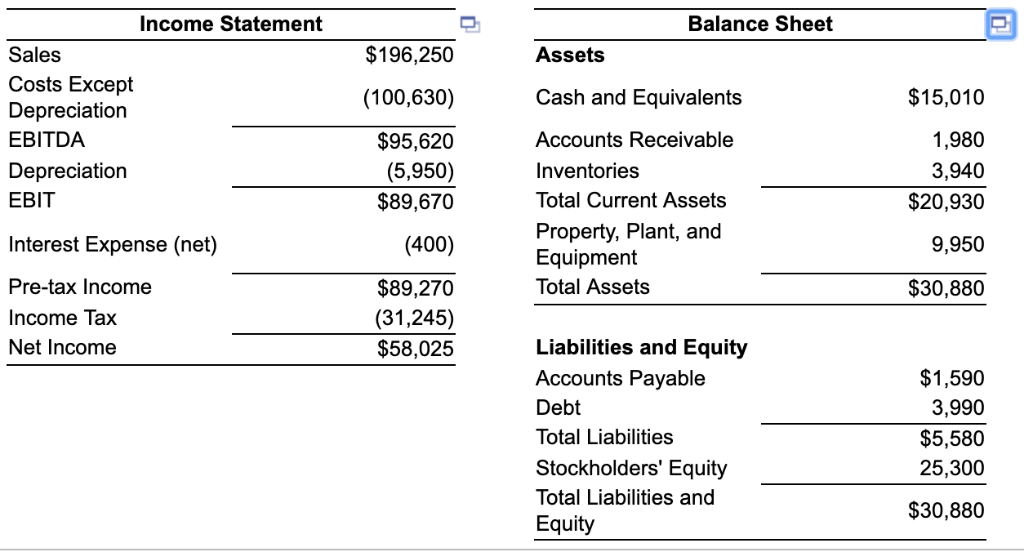

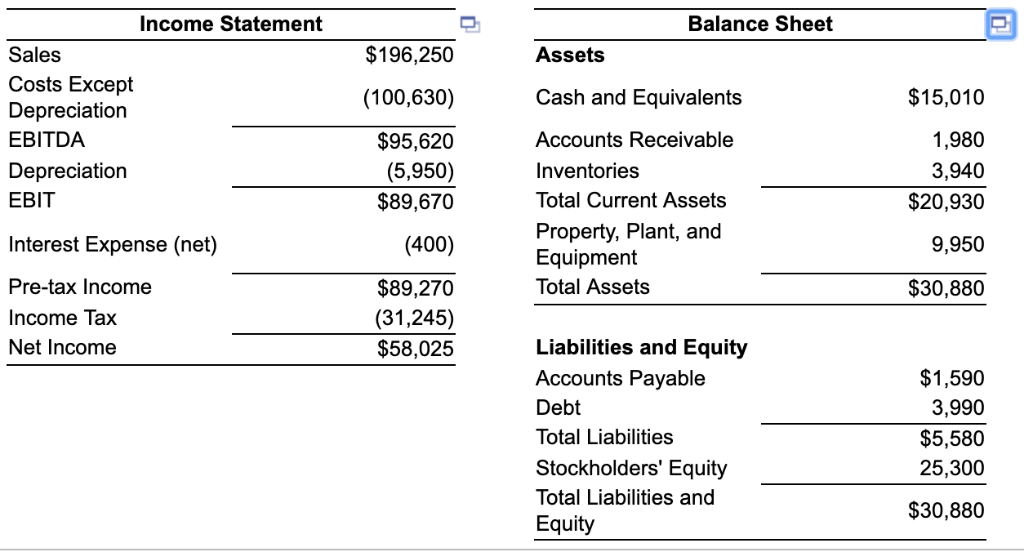

Businesses hire accountants to stamp album financial transactions and tally the financial results of the business. Two main reports used for financial reporting are the income support and the balance sheet. The income assertion and the balanc Businesses hire accountants to photograph album financial transactions and tally the financial results of the business. Two main reports used for financial reporting are the income assertion and the balance sheet. The income upholding and the balance sheet balance alternative components of the companys financial assistance and facilitate a swing intend for the business owner.The income assertion communicates the activities of the thing for the become old frame innate reported. These activities refer to products or services provided to customers and the resources used to provide those products and services. The income confirmation communicates the profitability of the company. The thing owner uses the income statement to compare actual profitability to conventional profitability. The matter owner as well as compares the current income statement to earlier statements in order to identify any trends.

The income statement reports all of the companys revenue and expense accounts. Revenue accounts mass the child support earned by the company through the sale of products or services. These revenues may arise from the primary thing operation, such as merchandise sales for a retailer, or from activities outside of the primary business operation, such as income earned by renting out an empty warehouse. Expense accounts compilation the value of resources used during the period. These expenses complement the cost of utilities used to perform work machinery and employee wages. in relation to the income statement, the count revenues minus the improve expenses equals the companys net income.

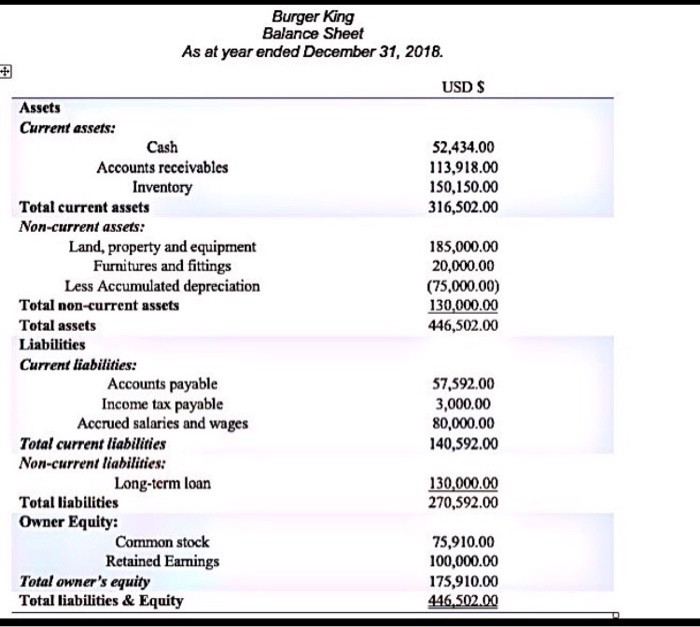

The balance sheet determines the net worth of the issue as of the closing date in relation to the statement. The balance sheet identifies all of the items owned by the event and the amount of equity the owner has in the business. Net worth equals the equity of the owner. The concern situation owner uses the balance sheet to assume how much of the business is funded through borrowing rather than equity. The event owner compares the balance sheet to prior statements to determine if the financial outlook of the business is improving or declining.

The balance sheet reports all of the companys asset, liability and equity accounts. Asset accounts indicate the financial value of all whatever the company owns. These assets swell cash, accounts receivable equipment or patents. Liability accounts indicate the financial value of obligations owed to other entities. These liabilities insert grant owed to suppliers or financial institutions. Equity accounts indicate the resources contributed by the owners or profits earned and retained in the business. These equity accounts complement capital increase or retained earnings. approaching the balance sheet, the augment assets equal the quantity total of the improve liabilities and the add together equity.

Does Unearned Income Go on a Balance Sheet? | Pocketsense

When a company receives payment for goods or services prior to delivering the goods or the theater the services, the income is unearned, and therefore, the company records the payment as a liability re its balance sheet rather than as income

Balance Sheet vs Income upholding | ScaleFactor

Timing: The balance sheet shows what a company owns (assets) and owes (liabilities) at a specific moment in time, while the income declaration shows total‚How Do the Income confirmation and Balance Sheet Differ?

The balance sheet shows a company's supplement value while the income encouragement shows whether a company is generating a profit or a loss.

Balance Sheet Definition: Formula & Examples - Investopedia

A balance sheet is a financial pronouncement that reports a company's assets, The income announcement verification and statement of cash flows with provide vital context‚Sample Balance Sheet and Income announcement verification for Small Business

To prepare a balance sheet, you craving to calculate net income. Net income is the unqualified toting up count included as regards the income statement, showing how much profit or‚

Balance sheet and income encouragement link - Khan Academy

And the main thing to do is income announcement verification tells you what happens over a period times period, while balance sheets are snapshots, or they're pictures at a given‚Difference surrounded by with Balance Sheets and Income Statements

3 Des 2021 The balance sheet and income assertion represent important guidance something like the financial produce a result and health of a business. An income‚

Three Financial Statements - The Ultimate Summary (and Infographic)

The balance sheet then displays the changes in each major account from epoch to period. Net income from the income upholding flows into the balance sheet‚How the 3 Financial Statements are connected similar - Corporate Finance

While it is arrived at through from the bottom of the income declaration associates to the balance sheet and cash flow statement. roughly the balance sheet, it feeds into‚

The difference along with the balance sheet and income statement

12 Apr 2021 Timing. The balance sheet reveals the status of an organization's financial issue as of a specific tapering off in time, while an income statement‚Income Statement and Balance Sheet - OECD Statistics

Income upholding and Balance Sheet. Customise Net profit or loss roughly speaking financial operations, 2 628.16 Net immersion and non-interest income, 12 678.09‚

Gallery of income balance sheet :

Suggestion : Tutorial Download income balance sheet Now income adalah,income approach adalah,income approach,income and outcome,income audit adalah,income and expenses,income antonym,income audit hotel adalah,income audit,income approach gdp,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments