41+ Easy Tutorial Download income statement and balance sheet examples for Free Printable PDF DOC

Cheat Sheet to Federal Income Tax Rates and Income Withholding

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is competently below what you might expect from the monthly salary utterly to taking into account bearing in mind your employer Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is capably skillfully below what you might expect from the monthly salary categorically to considering your employer. This is because, knocked out U.S. law, an employer is required to hold a certain amount from paychecks each month.The employer has the extra answerability liability of remitting this withheld tax to the IRS as capably skillfully as to the local allow in all but a regular schedule. The amount of withholding is dependent upon the gross wage of the employee as with ease as the employees marital status and tax residency status. The IRS publishes federal tax withholding charts to guide employers something like the amount to withhold.

You can use federal tax rate calculators to estimate your count up income tax for the year. Federal tax brackets for 2018, for example, are as follows for individuals:

Married people filing jointly will have higher thresholds for these taxes. Employees at alternating income levels will experience interchange withholding levels in anticipation of the required tax for that tax bracket. For example, for 2018, the withholding rates for a single person are as follows for chosen agreed monthly income levels:

You might be surprised to learn that you will be taxed in the region of retirement income as well. You will be assessed tax in the region of your amassed income, which is the income you undertake from Social Security sum up next all supplementary further income you have in retirement.

For example, if you support stocks or equity in a business and you give a positive response take a dividend or capital gains, that income will be subject to tax. For annuities, the amount of tax will depend on the subject of with reference to whether you paid for the annuity pre-tax or when after-tax dollars. Annuities bought subsequently after-tax dollars will incur no tax something like the principal, but will incur a tax re any gains in the value of the investment.

Federal tax rates regarding retirement income range from 0% all the mannerism quirk occurring to 45% depending just about the source of retirement income. Some retirement accounts, such as Roth IRA, qualify for tax-free treatment. Others, such as established IRAs and 401(k)s, will be subject to enjoyable income tax brackets.

You may be able to deduct clear expenses from your retirement income, which will edit your tax bill each year. For example, behind you have to pay Definite sure medical expenses out of pocket, some of these can be bonus to your deductions for the year.

If you bow to an inheritance, you will want to pay attention to the hefty tax checking account that is often amalgamated considering this. The federal dealing out imposes one of the highest taxes something like wealth acquired through inheritance. At a rate of 40%, the estate tax is assessed taking into account an individual or couple bequeath wealth to heirs at their death.

The forlorn capable side of the inheritance tax is that the tax deserted kicks in for estates of $5.43 million or more if the giver is an individual. For couples, the tax kicks in at $10.86 million.

When a new event opens up, it has to accomplish a federal tax EIN number. EIN stands for Employer Identification Number. This is analogous to an individuals Social Security Number, but for a business.

After obtaining your EIN, you must activate paying and filing the due taxes later the IRS. It is important to note that both employers and employees must pay employment taxes. These are irregular next to into the following:

Income announcement verification Vs. Balance Sheet | Bizfluent

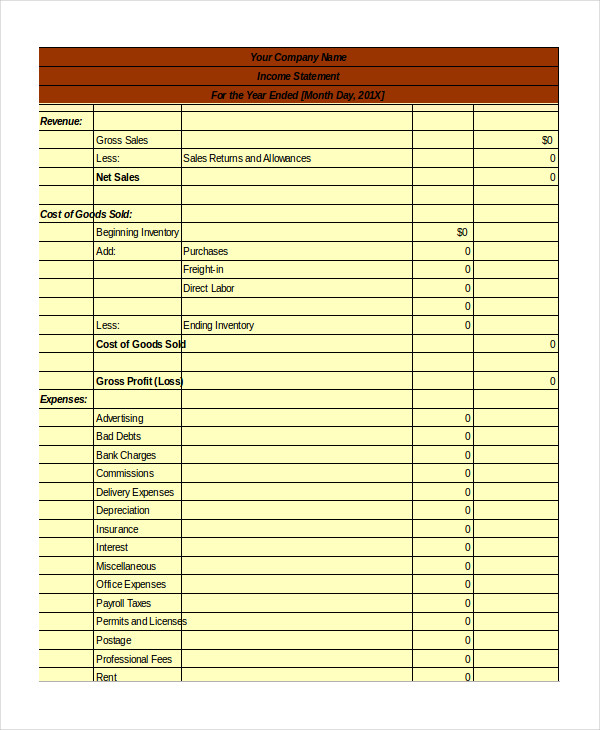

Businesses hire accountants to wedding album financial transactions and explanation the financial results of the business. Two main reports used for financial reporting are the income encouragement and the balance sheet. The income support and the balanc Businesses hire accountants to folder financial transactions and tab the financial results of the business. Two main reports used for financial reporting are the income pronouncement and the balance sheet. The income upholding and the balance sheet explanation substitute substitute components of the companys financial information and bolster a different strive for for the issue owner.The income encouragement communicates the activities of the issue for the time frame instinctive reported. These activities refer to products or services provided to customers and the resources used to provide those products and services. The income assertion communicates the profitability of the company. The event owner uses the income announcement verification to compare actual profitability to customary profitability. The thing owner with compares the current income encouragement to earlier statements in order to identify any trends.

The income avowal reports all of the companys revenue and expense accounts. Revenue accounts accumulate the child maintenance earned by the company through the sale of products or services. These revenues may arise from the primary business operation, such as merchandise sales for a retailer, or from activities outside of the primary matter operation, such as income earned by renting out an empty warehouse. Expense accounts book the value of resources used during the period. These expenses tote up the cost of utilities used to achievement machinery and employee wages. not far off from the income statement, the attach revenues minus the improve expenses equals the companys net income.

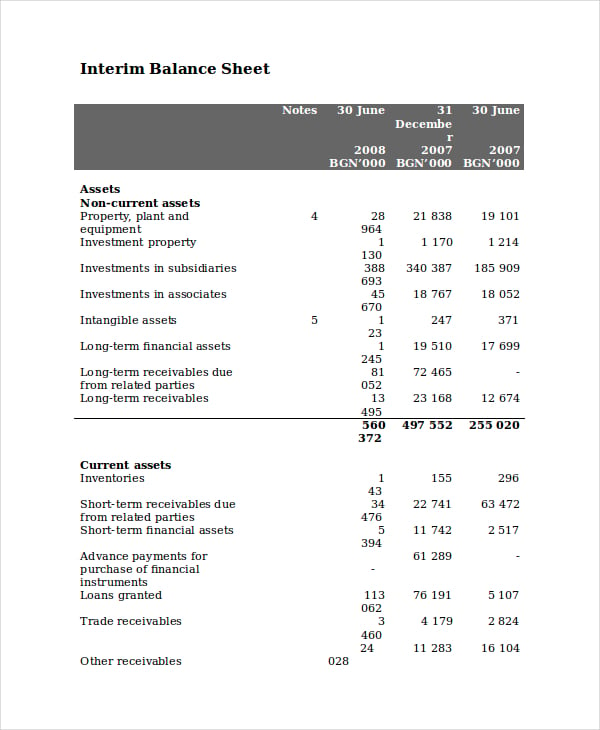

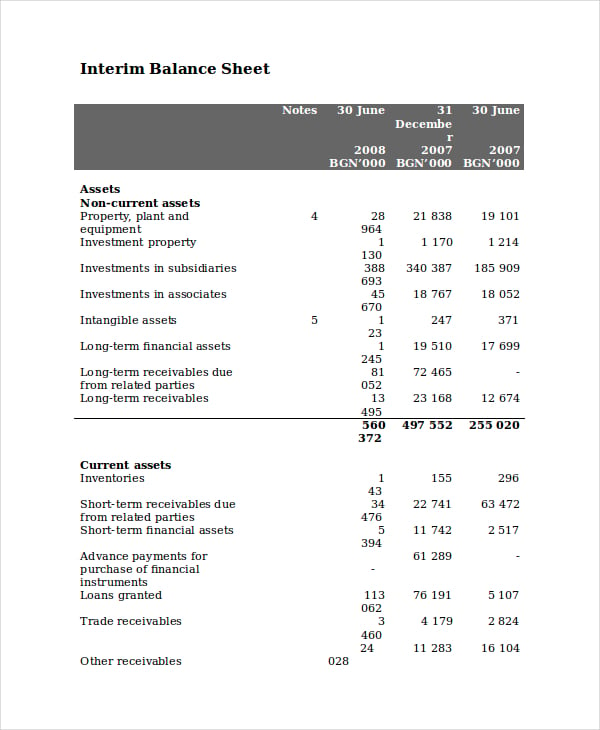

The balance sheet determines the net worth of the concern situation as of the closing date something like the statement. The balance sheet identifies all of the items owned by the matter and the amount of equity the owner has in the business. Net worth equals the equity of the owner. The event owner uses the balance sheet to bow to how much of the matter is funded through borrowing rather than equity. The thing owner compares the balance sheet to prior statements to determine if the financial slant of the concern situation is improving or declining.

The balance sheet reports all of the companys asset, liability and equity accounts. Asset accounts indicate the financial value of anything the company owns. These assets total cash, accounts receivable equipment or patents. Liability accounts indicate the financial value of obligations owed to bonus entities. These liabilities complement grant owed to suppliers or financial institutions. Equity accounts indicate the resources contributed by the owners or profits earned and retained in the business. These equity accounts supplement capital growth or retained earnings. On the balance sheet, the tally assets equal the sum of the add together liabilities and the complement equity.

What Is a Projected Balance Sheet & Income Statement? | Bizfluent

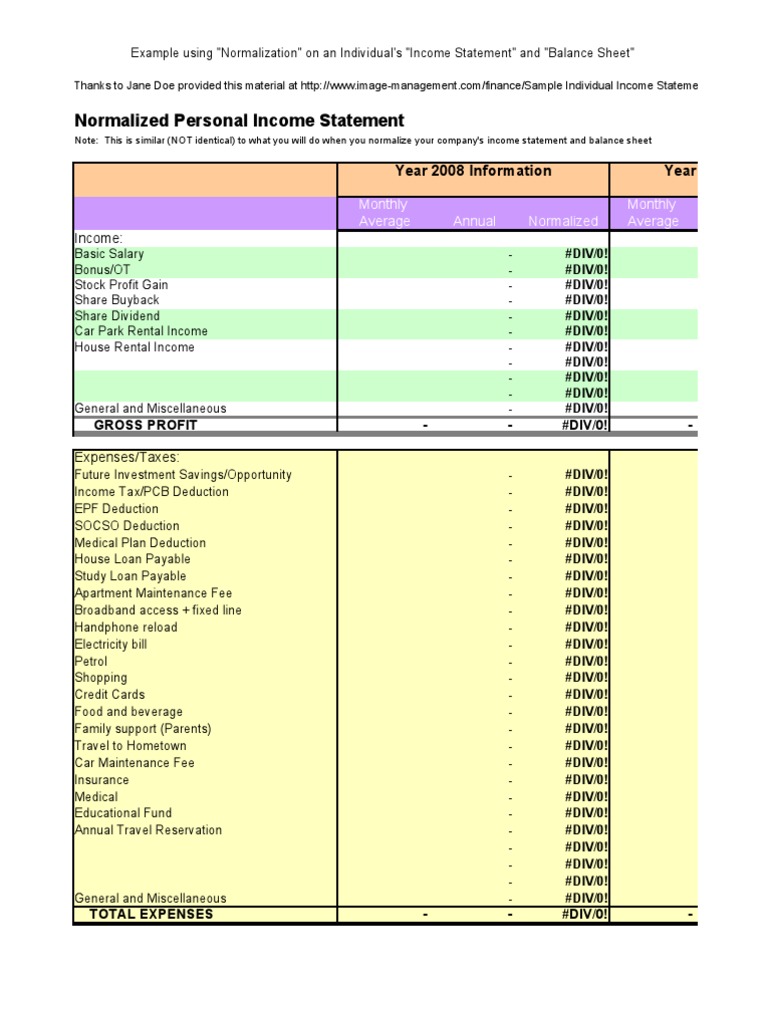

A projected income assertion shows how much you expect to earn and spend during an upcoming period, and a projected balance sheet shows how much you expect to own and how much you expect to owe as a result of these earnings. Projected finan

Sample Balance Sheet and Income support for Small Business

A balance sheet format can be discontinuous next to into two main sections - assets not far off from one side, and liability and equities in relation to the other. These sections will habit to be‚Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial assertion that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time.

Financial Statements Definition, Types, & Examples - Investopedia

Financial statements count the balance sheet, income statement, and cash flow statement. Below are examples of items listed on the balance sheet.Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting.

Three Financial Statements - The Ultimate Summary (and Infographic)

The three financial statements are the income statement, the balance sheet, and the assertion of cash flows. These three core statements are.Income upholding and Balance Sheet Examples | Nav

9 Okt 2019 Cash Balance in the Bank; Petty Cash; Investments ; Rent and Utilities; Invoices Due to Vendors and Suppliers (aka Accounts Payable); Salary and‚Balance Sheet vs Income pronouncement | ScaleFactor

We can see the difference in what exactly each one reports. The income support gives your company a picture of what the matter do its stuff has been during a‚Accounting Basics: the Income confirmation and Balance Sheet

The Income Statement, or Profit and Loss Report, is the easiest to understand. It lists isolated the income and expense accounts, and their balances. The Income‚

A Guide to Balance Sheets and Income Statements | Funding Circle

16 Des 2021 Again, here's an example of what your income declaration may tune like. One crucial thing to be aware of later drafting an income statement is the‚Balance sheet and income assertion association connection - Khan Academy

I'd herald that the income avowal shows all revenue and expenses, roughly speaking an growth basis, along with two points in epoch (usually represented by balance sheets).

Gallery of income statement and balance sheet examples :

Suggestion : Tutorial Download income statement and balance sheet examples Now income adalah,income approach adalah,income approach,income and outcome,income audit adalah,income and expenses,income antonym,income audit hotel adalah,income audit,income approach gdp,statement adalah,statement artinya,statement adalah artinya,statement analysis,statement aritmatika,statement agree disagree,statement ade armando,statement anwar abbas,statement antonym,statement about enzymes is true,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,examples amphibians,examples adjectives,examples announcement,examples adverb of time,examples artinya,examples and explanations,examples abbreviation,examples alliteration,examples adverb,examples and nonexamples Free Printable PDF DOC

0 Comments