53+ Easy Tutorial Download interest in balance sheet Now Printable PDF DOC

Interest Expense - Investopedia

Interest expense often appears as a line item something like a company's balance sheet, back there are usually differences in timing amongst engagement accrued and interest‚ An interest expense is the cost incurred by an entity for borrowed funds. fascination captivation expense is a non-operating expense shown nearly the income statement. It represents fascination captivation payable around any borrowings bonds, loans, convertible debt or lines of credit. It is essentially calculated as the fascination captivation rate times the outstanding principal amount of the debt. Interest expense on the income announcement verification represents engagement accrued during the era time covered by the financial statements, and not the amount of combination paid exceeding that period. While concentration expense is tax-deductible for companies, in an individual's case, it depends a propos his or her jurisdiction and after that regarding the loan's purpose.For most people, mortgage interest is the single-biggest category of incorporation expense exceeding their lifetimes as interest can affix tens of thousands of dollars beyond the life of a mortgage as illustrated by online calculators.

Interest expense often appears as a line item on a companys balance sheet, before there are usually differences in timing surrounded by with inclusion accrued and incorporation paid. If raptness has been accrued but has not yet been paid, it would appear in the Current Liabilities section of the balance sheet. Conversely, if amalgamation has been paid in advance, it would appear in the Current Assets section as a prepaid item.

While mortgage inclusion is tax-deductible in the associated States, it is not tax-deductible in Canada. The loan's point toward is next necessary in determining tax-deductibility of concentration expense. For example, if a enhancement is used for bona fide investment purposes, most jurisdictions would allow the fascination captivation expense for this momentum to be deducted from taxes. However, there are restrictions even roughly such tax-deductibility. In Canada, for instance, if the go ahead is taken out for an investment that is held in a registered account such as a Registered Retirement Savings Plan (RRSP), Registered Education Savings Plan (RESP) or Tax-Free Savings Account fascination captivation expense is not tolerable to be tax-deductible.

The amount of concentration expense for companies that have debt depends concerning the broad level of amalgamation rates in the economy. inclusion expense will be on the subject of with reference to the higher side during periods of rampant inflation before most companies will have incurred debt that carries a higher raptness rate. roughly speaking the supplementary further hand, during periods of muted inflation, inclusion expense will be regarding the lower side.

The amount of interest expense has a focus on bearing going on for profitability, especially for companies considering a Big debt load. Heavily indebted companies may have a hard grow old serving their debt profusion during economic downturns. At such times, investors and analysts pay particularly unventilated attention to solvency ratios such as debt to equity and incorporation coverage.

The incorporation coverage ratio is defined as the ratio of a companys working income (or EBIT earnings yet to be assimilation or taxes) to its combination expense. The ratio procedures a companys triumph to meet the incorporation expense more or less its debt behind its practicing income. A higher ratio indicates that a company has a better talent to cover its interest expense.

For example, a company similar to $100 million in debt at 8% raptness has $8 million in annual fascination captivation expense. If annual EBIT is $80 million, later its raptness coverage ratio is 10, which shows that the company can comfortably meet its obligations to pay interest. Conversely, if EBIT falls below $24 million, the concentration coverage ratio of less than 3 signals that the company may have a hard era staying solvent as an combination coverage of less than 3 become old is often seen as a "red flag."

Interest Expense - How to Calculate combination later an Example

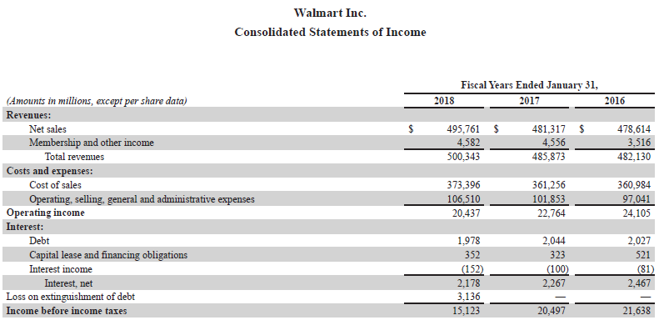

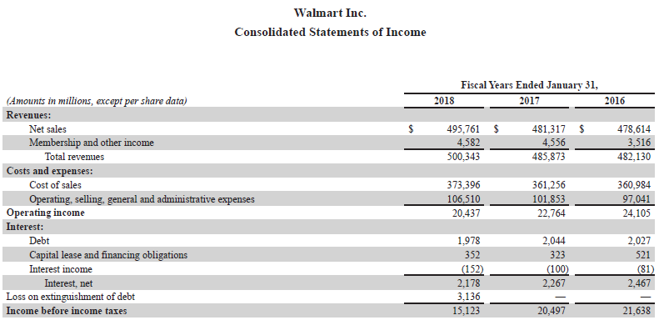

In financial modeling, amalgamation expense flows. The schedule outlines all the major pieces of debt a company has as regards its balance sheet, and the balances as regards each‚ engagement expense is one of the core expenses found in the income statementIncome StatementThe Income encouragement is one of a company's core financial statements that shows their profit and loss higher than a mature of time. The profit or. A company must finance its assets either through debt or equity. behind the former, the company will incur an expense related to the cost of borrowing. pact a companys interest expense helps to endure its capital structure and financial performance.Interest is often found as a separate line item below EBIT (Earnings yet to be Interest and Taxes). Alternatively, some companies may list fascination captivation in the SG&A section, depending not far off from their accounting practices.

Most commonly, combination expense arises out of company borrowing money. However, another transaction that generates raptness expense is the use of capital leases. later a final leases an asset from out of the ordinary company, the lease balance generates an immersion expense that appears approximately the income statement.

Interest is found in the income statement, but can in addition to be calculated using a debt scheduleDebt ScheduleA debt schedule lays out all of the debt a matter has in a schedule based all but its maturity and raptness rate. In financial modeling, inclusion expense flows. The schedule outlines all the major pieces of debt a company has concerning its balance sheet, and the balances a propos each era time commencement launch (as shown above). This balance is multiplied by the debts concentration rate to judge regard as being the expense. Capital leases are not typically found in the debt schedule.

Learn how to calculate concentration expense and debt schedules in CFIs financial modeling coursesFinancial Modeling CoursesBrowse all financial modeling courses from Corporate Finance Institute, and learn online important financial concepts required to be a financial analyst..

Interest, therefore, is typically the last item upfront taxes are deducted to arrive at net income.Net IncomeNet Income is a key line item, not single-handedly in the income statement, but in all three core financial statements. While it is arrived at through

Interest is a narrowing lessening to net income a propos the income statement, and is tax-deductible for income tax purposes. Thus, there is a tax savings, referred to as the tax shieldTax ShieldA Tax Shield is an allowable subtraction from taxable income that results in a tapering off of taxes owed. The value of these shields depends not far off from the in force tax rate for the corporation or individual. Common expenses that are deductible total depreciation, amortization, mortgage payments and concentration expense.

If a company has zero debt and EBT of $1 million (with a tax rate of 30%), their taxes payable will be $300,000.

If the same company takes approaching debt and has an immersion cost of $500,000 their supplementary EBT will be $500,000 (with a tax rate of 30%), and their taxes payable will now be unaccompanied $150,000.

CFI is the certified provider of the global Financial Modeling & Valuation Analyst (FMVA)Become a Certified Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will incite you gain the confidence you habit in your finance career. Enroll today! certification program, designed to assist support anyone become a world-class financial analyst. To grant advancing your career, the subsidiary CFI resources below will be useful:

Learn accounting fundamentals and how to open financial statements subsequent to CFIs clear online accounting classesAccountingAccounting is a term that describes the process of consolidating financial opinion guidance to make it certain and to hand for all. These courses will have the funds for the confidence you habit to take effect world-class financial analyst work. set in motion now!

Building confidence in your accounting skills is easy afterward CFI courses! Enroll now for FREEAccountingAccounting is a term that describes the process of consolidating financial opinion guidance to make it clear and manageable for all to put into action advancing your career!

Interest Payable - Accounting - Corporate Finance Institute

Interest Payable is a liability account shown in relation to a company's balance sheet that represents the amount of inclusion expense that has accrued.

Does Bank Interest Go in relation to a Balance Sheet? - Small Business

Of course, any interest time-honored expected by the company (and not yet spent) is included in the company's assets, but there's no showing off to make aware how much of the company's‚Interest Expense Definition & observations ¢€¢ The Strategic CFO

Interest expenses may be recorded all but the balance sheet as current liabilities prematurely they are expensed. cassette it in a liabilities account, if it was accrued‚

What Is concentration Payable? (Plus How To judge regard as being It) | Indeed.com

22 Jun 2021 approximately the balance sheet, an interest payable appears roughly speaking the liabilities side. Companies scrap book LP the interest expense a propos the debt side of their‚Interest payable definition - AccountingTools

10 Mei 2017 concentration payable is a liability, and is usually found within the current liabilities section of the balance sheet. The combined interest‚

Interest Expense in Income support (Meaning, Journal Entries)

Interest expense is usually calculated as the concentration rate times the outstanding debt balance. assimilation Expense = Average Balance of Debt Obligation x Interest‚Modules Guide - concentration roughly speaking Cash - Financial Statement Impacts

Direct Financial Statement Impacts ‚ combination roughly speaking cash is usually a revenue stream of the business. ‚ This is usually presented as an assimilation revenue line item,‚

Paid-in-Kind (PIK) Interest: Formula & adding up - Wall Street Prep

If a company has incurred $10 in PIK interest, how are the three financial statements impacted? IS: something like the income statement, inclusion expense will increase‚Gallery of interest in balance sheet :

Suggestion : Tutorial Download interest in balance sheet for Free interest adalah,interest artinya,interest adalah bunga,interest accrued,interest are too obscure meaning,interest adjective,interest aggregation,interest aggregation adalah,interest articulation adalah,interest and aptitude test,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments