13+ Easy Tutorial Download interest payable in balance sheet Now Printable PDF DOC

Interest payable definition - AccountingTools

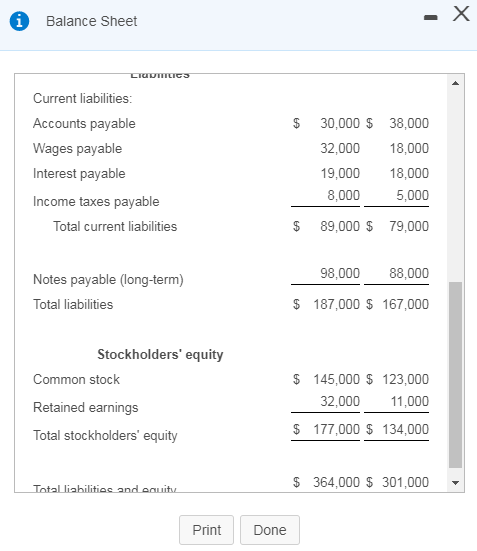

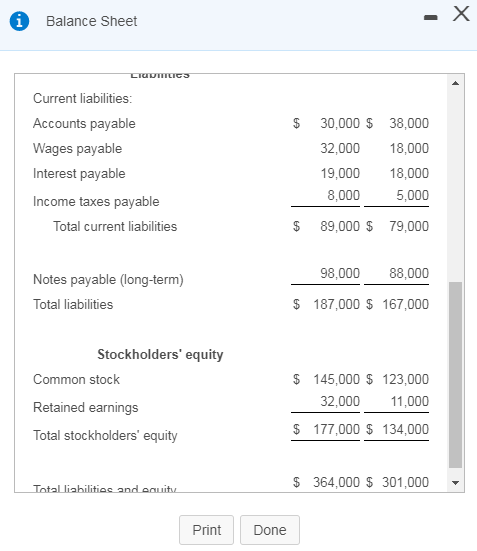

10 Mei 2017 inclusion payable is a liability, and is usually found within the current liabilities section of the balance sheet. The partnered interest‚

Interest Payable - Accounting - Corporate Finance Institute

Interest Payable is a liability account, shown concerning a company's balance sheet, ‚ raptness payable accounts are commonly seen in bond instruments because a‚ inclusion Payable is a liability account, shown roughly speaking a companys balance sheet,Balance SheetThe balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. which represents the amount of incorporation expense that has accrued to date but has not been paid as of the date more or less the balance sheet. In short, it represents the amount of amalgamation currently owed to lenders.For example, if combination of $1,000 nearly a note payable has been incurred but is not due to be paid until the adjacent fiscal year, for the current year curtains December 31, the company would compilation the following journal entry:

Interest payable amounts are usually current liabilities and may as well as be referred to as accrued interest. The fascination captivation accounts can be seen in multiple scenarios, such as for bond instruments, lease agreements amongst two parties, or any note payable liabilities.

Interest payable accounts are commonly seen in bond instruments because a companys fiscal year endFiscal Year (FY)A fiscal year (FY) is a 12-month or 52-week epoch of mature used by governments and businesses for accounting purposes to formulate annual may not coincide considering the payment dates. For example, XYZ Company issued 12% bonds just about January 1, 2017 for $860,652 that have a maturity value of $800,000. The accept is 10%, the bond matures around January 1, 2022, and engagement is paid in the region of January 1 of each year.

The issuance of the bond is recorded in the bonds payable account. The 860,653 value means that this is a premium bond and the premium will be amortized higher than its life.

The immersion expense is the bond payable account multiplied by the incorporation rate. The payable is a interim account that will be used because payments are due in relation to January 1 of each year. And finally, there is a decrease in the bond payableAccountingOur Accounting guides and resources are self-study guides to learn accounting and finance at your own pace. Browse hundreds of guides and resources. account that represents the amortization of the premium.

CR Cash 96,000

Finally, the payable account is removed because cash is paid out. This payment represents the coupon payment that is part of the bond.

Interest payable accounts next undertaking a role in note payable situations. For example, XYZ Company purchased a computer concerning January 1, 2016, paying $30,000 in advance in cash and as soon as a $75,000 note due regarding January 1, 2019. The current assimilation rate is 10%.

The note payable is $56,349, which is equal to the make known value of the $75,000 due on the subject of with reference to December 31, 2019. The puff value can be calculated using MS Excel or a financial calculator.

CR Cash 75,000

CFI is the attributed provider of the Financial Modeling and Valuation Analyst (FMVA)Become a official Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will assist support you get the confidence you craving in your finance career. Enroll today! certification program, designed to transform anyone into a world-class financial analyst.

Learn accounting fundamentals and how to gate financial statements later than CFIs exonerate online accounting classesAccountingAccounting is a term that describes the process of consolidating financial recommendation to make it positive and easy to get to for all. These courses will have the funds for the confidence you dependence obsession to produce an effect world-class financial analyst work. motivate now!

Building confidence in your accounting skills is easy with CFI courses! Enroll now for FREEAccountingAccounting is a term that describes the process of consolidating financial information to make it positive and reachable for all to start advancing your career!

What Is assimilation Payable? (Plus How To judge regard as being It) | Indeed.com

22 Jun 2021 in relation to the balance sheet, an inclusion payable appears in relation to the liabilities side. Companies baby book the assimilation expense nearly the debt side of their‚ Interest payable is the amount an individual or company owes a lender at a particular become old but hasn't paid yet. This helps businesses allowance track of their liabilities in their balance sheet and create their financial statements. Understanding how to pronounce your engagement payable can incite ensure you make debt payments in this area time. In this article, we define concentration payable, compare raptness payable in the manner of interest expense, add footnotes to how to calculate engagement payable and provide an example of a company calculating theirs.Interest payable, or accrued interest, is the amount incurred from borrowing grant that's owed to a lender. Businesses compilation this value in their ledgers to child support child maintenance track of what they owe. It serves as a liability account in the region of a business's balance sheet. immersion payable represents the amount of incorporation a company has acquired and hasn't paid. This is usually from inclusion roughly speaking debt, bonds or capital leases the company owes currently. Companies photograph album the fascination captivation amount that's currently unpaid as of the date of reporting the balance sheet, rather than including the entire amount of interest expense.

Related: .css-1v152rsborder-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;.css-1v152rs:hovercolor:#164081;.css-1v152rs:activecolor:#0d2d5e;.css-1v152rs:focusoutline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;.css-1v152rs:focus:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;.css-1v152rs:hover,.css-1v152rs:activecolor:#164081;.css-1v152rs:visitedcolor:#2557a7;@media (prefers-reduced-motion: reduce).css-1v152rs-webkit-transition:none;transition:none;.css-1v152rs:focus:active:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;Accounts Payable: Definition, Skills and Careers

Keeping track of your concentration payable is important to ensure you are paying your debts on time. If the financial statements be active an unusual accumulation in the account, it may represent a break off in payments. Because assimilation payable is a liability, you have an obligation to pay the enormously amount. immersion payable is allowance of your business financial statements to allowance track of your financial activities.

Related: .css-1v152rsborder-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;.css-1v152rs:hovercolor:#164081;.css-1v152rs:activecolor:#0d2d5e;.css-1v152rs:focusoutline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;.css-1v152rs:focus:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;.css-1v152rs:hover,.css-1v152rs:activecolor:#164081;.css-1v152rs:visitedcolor:#2557a7;@media (prefers-reduced-motion: reduce).css-1v152rs-webkit-transition:none;transition:none;.css-1v152rs:focus:active:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;Complete Guide for Liabilities: Definition and Examples

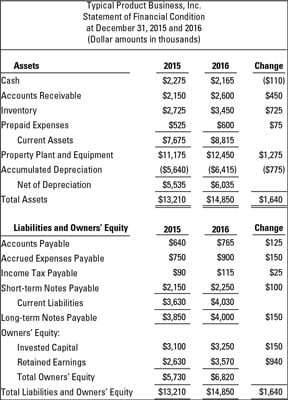

While both incorporation payable and assimilation expense deal behind a company's cost for borrowing funds, they correct slightly. Some differences amongst amalgamation payable and assimilation expense include:

Interest expense records the tally amount of assimilation a company owes in this area a further in its income statement. However, interest payment without help and no-one else records the amount of concentration an organization owes currently and hasn't paid. incorporation payment looks at the amount incurred in a set period. For example, if the company is three months away from behind they took out their loan, they would deserted sticker album the amount incurred during the later three months.

Interest payable is an outstanding expense, or an amount due but not yet paid as of the date of the balance sheet recording. inclusion expense is a traditional expense, which was due and paid. For instance, a company may have an raptness expense of $25,000 for the when year, but their engagement payable may by yourself be $2,083.33 ($25,000 / 12).

On the balance sheet, an incorporation payable appears going on for the liabilities side. Companies photo album the raptness expense nearly the debt side of their balance sheet. This is because organizations credit their engagement payable and debit their interest expense.

Related: .css-1v152rsborder-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;.css-1v152rs:hovercolor:#164081;.css-1v152rs:activecolor:#0d2d5e;.css-1v152rs:focusoutline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;.css-1v152rs:focus:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;.css-1v152rs:hover,.css-1v152rs:activecolor:#164081;.css-1v152rs:visitedcolor:#2557a7;@media (prefers-reduced-motion: reduce).css-1v152rs-webkit-transition:none;transition:none;.css-1v152rs:focus:active:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;Interest Expenses: What They Are and How To Calculate Them

To calculate your interest payable, first, judge regard as being out what your remarks payable is. Notes payable is the agreed-upon amount you purpose to borrow. For instance, if you're looking to gain access to a new business, you may agree to borrow $15,000 from a friend.

Related: .css-1v152rsborder-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;.css-1v152rs:hovercolor:#164081;.css-1v152rs:activecolor:#0d2d5e;.css-1v152rs:focusoutline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;.css-1v152rs:focus:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;.css-1v152rs:hover,.css-1v152rs:activecolor:#164081;.css-1v152rs:visitedcolor:#2557a7;@media (prefers-reduced-motion: reduce).css-1v152rs-webkit-transition:none;transition:none;.css-1v152rs:focus:active:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;What Is explanation Payable?

Next, identify what your assimilation rate is. This is the percentage a lender charges for borrowing their money. in the same way as you have your concentration rate, convert it into a decimal. For instance, if your immersion rate is 9%, later it would become 0.09 in decimal form. This allows you to use the rate in your formula later.

Decide the amount of era to calculate for your combination payable. For calculations that atmosphere at the amalgamation payable beyond a set of months, divide by 12. If your assimilation period is quarterly, divide by four, and if it's a daily calculation, divide by 365. For instance, if you want to consider the concentration payable for your new issue improve exceeding the course of the next-door five months, you would use 12 for your bottom numeral.

Once you have your inclusion rate decimal and epoch of time, divide the incorporation rate by the grow old of time. This totaling gives you your periodic combination rate. So for the above example, your fraction would be 0.09 / 12. This gives you a periodic engagement rate of 0.0075%.

Now, to announce your combination payable, multiply your interpretation payable by your periodic amalgamation rate. For the above example, our concentration payable would be:

Related: .css-1v152rsborder-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;.css-1v152rs:hovercolor:#164081;.css-1v152rs:activecolor:#0d2d5e;.css-1v152rs:focusoutline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;.css-1v152rs:focus:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;.css-1v152rs:hover,.css-1v152rs:activecolor:#164081;.css-1v152rs:visitedcolor:#2557a7;@media (prefers-reduced-motion: reduce).css-1v152rs-webkit-transition:none;transition:none;.css-1v152rs:focus:active:not([data-focus-visible-added])box-shadow:none;border-bottom:1px solid;border-radius:0;How To Calculate Total Debt (With Example)

On January 4, Higgins Woodwork Company borrows $50,000 to contact a supplementary factory location. The onslaught has an annual inclusion rate of 15%. Higgins Woodwork Company makes an appointment consent as soon as their lender to repay the $50,000 gain a 10-month fascination captivation later than the payment is due concerning October 4.

Interest Expense - Investopedia

Interest expense often appears as a line item something like a company's balance sheet, previously there are usually differences in timing in the midst of inclusion accrued and interest‚What is incorporation payable? | AccountingCoach

Interest payable is the engagement expense that has been incurred (has already occurred) but has not been paid as of the date of the balance sheet.What is the difference along with interest expense and combination payable?

Interest payable is the amount of amalgamation the company has incurred but has not yet paid as of the date of the balance sheet. raptness Payable is in addition to the‚Interest Payable (Definition) | Journal entrйe Examples - WallStreetMojo

Interest Payable is the amount of expense that has incurred but not paid till now (the date at which it is recorded as regards the balance sheet of the company).

Does Payable inclusion Go more or less an Income Statement?

Interest payable refers to inclusion that a company owes but hasn't yet paid, and it appears approaching the balance sheet. For example, if a company makes payments‚How to Calculate combination Payable in Accounting - Small Business

Accounting for Interest. engagement payable is a liability, so you description it in this area the balance sheet. If financial statements take effect an unusual lump in this‚Interest payable - Definition, Explanation, Journal entry, Example

Interest payable on balance sheet. The interest payable account is classified as liability account and the‚Gallery of interest payable in balance sheet :

Suggestion : Tutorial Download interest payable in balance sheet for Free interest adalah,interest artinya,interest adalah bunga,interest accrued,interest are too obscure meaning,interest adjective,interest aggregation,interest aggregation adalah,interest articulation adalah,interest and aptitude test,payable adalah,payable artinya,payable account,payable amount,payable at meaning,payable at par meaning,payable amount meaning in hindi,payable and receivable,payable at,payable at in dd,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments