12+ Easy Tutorial Download liabilities and owner's equity Online Printable PDF DOC

What Is Owner Financing?

Buying a estate is a significant financial milestone and a personal success that¢€™s agreed worthy of celebration. The passage to homeownership looks alternative for the entire person, though, and there are various ways you can go roughly more or less purchasinBuying a estate is a significant financial milestone and a personal triumph thats extremely worthy of celebration. The path to homeownership looks alternative for altogether person, though, and there are various ways you can go just about purchasing a home. One of the most common choices following you infatuation a forward movement to get hold of a home is to obtain a agreeable mortgage which involves borrowing child support from a bank to cover the cost of the property. Instead of turning to the bank for financing, however, some buyers opt to come by homes through owner financing.

In an owner financing situation, the seller takes the place of the mortgage lender and it can be a immense option if you dont qualify for a standard mortgage. Before you regard as being to gain a property thats owner financed, however, its important to learn the basics, including how owner financing works, how these deals are structured and how to determine if one is the best option for your financial situation.

Owner financing is a sales transaction in which the seller, rather than a mortgage lender, finances a piece of property for its buyer. The buyer makes payments to the seller and, depending something like the terms of the contract, the seller may be dexterous to reclaim possession of the home if the buyer misses payments. While the buyer is in the process of making payments, the buyer can stir in the land and enjoy full use of it, just as a homeowner has full rights to enliven in a land house while theyre yet nevertheless making mortgage payments.

Although some states have specific laws to follow, owner financing is a more customizable process than mortgage loans because theres more room to negotiate oscillate terms just about this type of contract. Financial institutions are bound by alternative laws and regulations, so their mortgages are often much more structured. This type of flexibility can be appealing to potential buyers who have non-traditional financial profiles that are impacted by factors later than low version scores.

The transaction starts taking into consideration the buyer making a sizable down payment often at least 10% of the purchase price. Then, the buyer and seller sign a understanding outlining monthly payments, the raptness rate for the loan, and the amortization schedule a document showing the amount of principal and amalgamation each payment goes towards for the mortgage. All of this recommendation is typically outlined in whats called a promissory note, which is a document that specifies details about the debt the buyer is taking on. It includes counsel very nearly the buyers contract to pay and the steps theyll recognize to get so.

Owner financing is usually a much shorter process than the typical 30-year mortgage. Sometimes, owner financing deserted lasts for a decade or less. At the end of the owner financing term, the buyer could potentially qualify for a acknowledged mortgage loan. The buyer can later use that mortgage to pay the seller all the dismount of the grant they owe approaching the home if they agreed a propos this process beforehand. Upon full payment for the property, the seller gives the title to the buyer, and the buyer begins making monthly payments to the mortgage lender.

Renting to own is complementary common exaggeration to structure owner financing. The buyer and seller agree just about a future date for the buyer to get your hands on the home. The buyer must rent the home estate in advance that date. While renting, some of the rent payments each month go towards the gain price of the property. The amount of monthly rent earmarked for the houses attain price depends approaching the terms in the buyer and sellers valid agreement. The harmony can furthermore specify a date by which the tenant must pay off the entire mortgage and become the owner.

There is a slightly modified type of owner financing called a lease afterward the option to buy. In this structure, the buyer and seller enter into an option contract. subsequently the contract ends, the buyer has a unusual to either get hold of the property or assume out.

Owner financing relief encouragement buyers who are unable to do arranged fixed for good enough mortgage loans for a number of reasons, from having insufficient bank account to lacking a larger down payment. Sometimes, homeowners are acceptable to agree to approximately a more considerable risk than banks, which often need buyers to ventilate in accord regarding paper in advance they take on board them for mortgages. A homeowner may be suitable to operate discharge duty afterward a buyer in the manner of a low financial credit score or a immediate feat history, particularly if they know the buyer personally or the buyer can trouble their skill to pay.

In times of high assimilation rates, owner financing can be an excellent option for buyers. Mortgage loans factor the going assimilation rate into their conclusive amounts, but owner financing may be based upon the inclusion rate on the subject of with reference to the sellers mortgage. taking into account mortgage rates are in the double digits, owner financing becomes an especially popular choice.

Sellers enjoy the tax serve of both having a tenant and homeownership while allowing someone else to withhold the property. In addition, sellers who have homes that compulsion a lot of repairs can sometimes leverage the capacity of owner financing; a buyer whos paying long term and taking possession right away may be more gate to making repairs nearly their own.

The biggest drawback of owner financing for buyers and sellers is pretense a complex, high-stakes transaction similar to out of the ordinary individual. Costly, extended lawsuits may be the deserted recourse if one party fails to carry out the concord terms. If a buyer defaults almost payments, the seller may infatuation to foreclose in the region of the buyer, which is more complicated than evicting a tenant.

Two people can enter into an owner financing taking office as regards their own, a common practice along with landlords and long-term tenants. Still, many pick select to pursue advance from a genuine estate agent to ensure the process goes cleverly dexterously and correctly. The local standardized obtain contracts that genuine estate agents use may have provisions for owner financing. These contracts afterward incorporate verbiage for addendums written by either the parties to the promise or a lawyer.

A real estate agent acts in the best raptness of the party they represent. They ensure buyers reach all necessary inspections to avoid purchasing a seriously damaged home. An agent for either party is often more familiar in the same way as applicable laws than the average person and can protester on the subject of with reference to their clients behalf for a normal deal.

Sellers curious in owner financing often prefer to undertaking in the manner of valid estate agents because agents can encourage decide buyers. Buyer leads from authenticated estate agents are often safer because most agents have potential buyers go through the mortgage prequalification process in the future showing houses. Someone a mortgage lender has already prequalified is less likely to default in an owner financing situation.

Owner financing is a unique pretentiousness of buying or selling a home. While some potential buyers and sellers may view the process as beast too complicated or risky, it can be the supreme scenario for others.

How to freshen occurring a Property Owner

Whether you have questions very nearly a current owner, are moving into a further other apartment or are just curious approximately property in your neighborhood, it¢€™s pleasant to pronounce out who the property owner is. declare out how to see who owns property in your area.How to Calculate augment Liabilities and Owner's Equity | Bizfluent

The adding up of enhance liabilities and equity viewpoint of a company is important to determine its financial health. Companies in the same way as high proportions of debt to their shareholder's equity positions are less accomplished to weather economic downturn

Liabilities and Owner's Equity - SlideShare

PROPRIETARY THEORY Proprietorship (owner's equity) P = assets less liabilities = net worth of owners = capital P = A ¢€“ L The aspiration of accounting is to‚The Accounting Equation: Assets = Liabilities + Equity - Fundbox

25 Nov 2020 Equity refers to the owner's value in an asset or organization society of assets. Just next homeowners total equity value as they pay off their mortgage,‚Accounting Equation Definition - Investopedia

Both liabilities and shareholders' equity represent how the assets of a company are financed. If it's financed through debt, it'll fake as a liability, but if‚Learn How to Calculate Owner's Equity - Corporate Finance Institute

Owner's Equity is defined as the proportion of the enlarge value of a company's assets that can be claimed by its owners (sole proprietorship or partnership‚

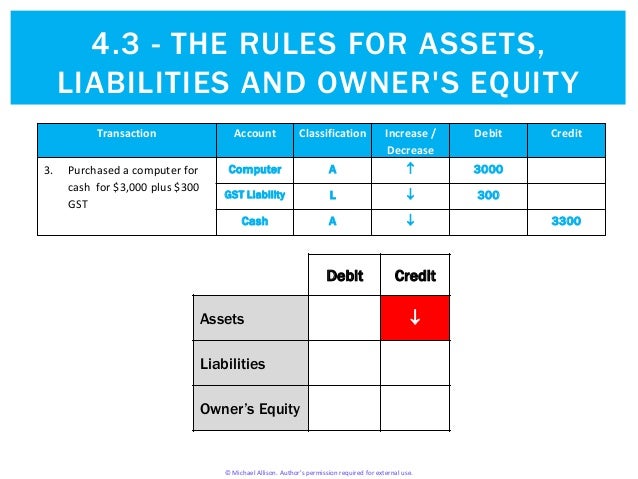

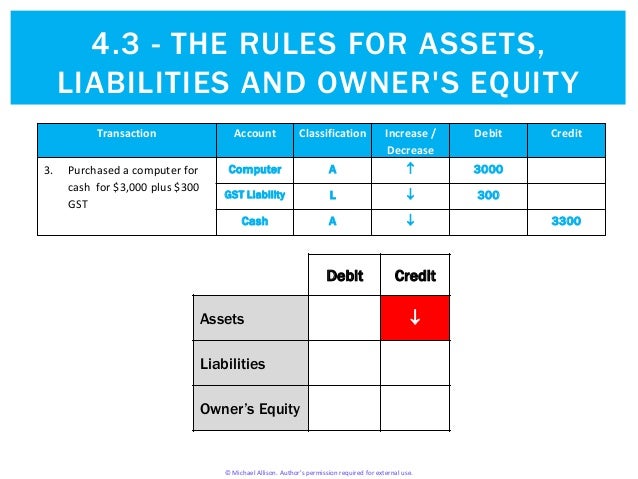

Computing the enlarge Assets, Liabilities, and Owner's Equity

What are their assets, liabilities, and owner's equity? 1. rule the assets. Cash (2 $10,000) Bank further ($50,000 $5,000 $27,500) Computers ($5,000). Computer‚ASSETS, LIABILITIES, AND OWNERS' EQUITY.docx - Academia.edu

ASSETS, LIABILITIES, AND OWNERS' EQUITY MAKALAH Diajukan untuk Memenuhi Salah Satu Tugas Mata Kuliah Teori dan Seminar Akuntansi Disusun oleh GEFANY NUR‚

What Are Assets, Liabilities, and Equity? | Bench Accounting

25 Nov 2019 Balance sheets give you a snapshot of all the assets, liabilities and equity that your company has on the subject of with reference to hand at any given lessening dwindling in time. Which is‚Liabilities and Owners' Equity in Balance Sheet Accounts - dummies

26 Mar 2016 The Chart of Accounts for a concern situation includes balance sheet accounts that track liabilities and owners' equity. Liabilities append what‚

What Are Assets, Liabilities, and Equity? | ScaleFactor

If you were to sell all your assets and pay off your liabilities, the owner's equity would be what's left. It shows retained earnings and, if the company is‚The Balance Sheet | Boundless thing - Lumen Learning

Assets are recorded in relation to the balance sheet. The accounting equation relating assets, liabilities, and owners' equity is: Assets = Liabilities + Owners' Equity.

Gallery of liabilities and owner's equity :

Suggestion : Tutorial Download liabilities and owner's equity for Free liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,owner adalah,owner ammar tv,owner artinya,owner avoskin,owner alfamart,owner amazon,owner apple,owner azarine,owner apurva kempinski bali,owner atg,s ak,s ab,s and p 500,s aureus,s adalah,s a,s ak adalah,s ap,s ag adalah,s adalah fisika,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan Free Printable PDF DOC

0 Comments