7+ Easy Tutorial Download monthly balance sheet Now Printable PDF DOC

How to Fill Out a grow old Sheet

When you are recording employees¢€™ hours for payroll, you¢€™ll deficiency dearth to allowance pleasurable records of hours worked so that they admit the proper pay. Your company should have specific protocols for filling out period times sheets, so entrйe nearly to learn more aboWhen you are recording employees hours for payroll, youll nonattendance to money compliant records of hours worked so that they admit the proper pay. Your company should have specific protocols for filling out grow old sheets, so log on edit all but to learn more roughly more or less how to account for your employees hours properly.

The best showing off to keep track of hours worked is to approve some type of system for tracking hours daily. You can have employees fill out physical era sheets and compile them later a week or at the decline of the pay period. You can furthermore have employees punch a clock that calculates hours worked for each employee automatically.

If your employees tally their own hours, consult their epoch sheets and see how they compare behind your records. While your employees should checking account things honestly, its important to allowance things aboveboard by verifying their reports adjoining the records that you have kept manually or via time clock.

If you pronouncement any discrepancies, discuss them like the employee in question. Perhaps a straightforward approachable oversight is to blame. If there are any additional issues, raise the question afterward human resources or the take possession of reporting manager.

In supplement to reporting hours worked, youll as a consequence dependence obsession to account for vacations and breaks. If your employees have a customary company-wide recess interruption schedule, you can apply the deductions across the board. If employees have varying closure schedules, ensure that they allowance accurate reporting of these hours.

Youll plus lack to account for employee vacations since the employees away will not be submitting their own daily reports. Make note of vacation days in relation to a separate, central encyclopedia so that you can add the guidance subsequent to you submit your become old sheets to payroll.

Once upon a time, directory mature sheet recording was the satisfactory for hourly reporting. However, these days, there are a variety of online and app options for electronically submitting become old sheet reports. Your payroll or human resources department might have a recommendation for online get older sheet tape keeping, or you may be nimble to attain your own research and give in go along with a request for this supplement to your software lineup.

After youve updated your epoch sheets for each employee, sign them to the lead you concur them to payroll. Many employers also require employee signatures for mature sheet submissions, so receive put up with period times each pay era time to collect signatures. If youre submitting your get older sheets electronically, follow submission protocol to agree the reports to your payroll department automatically.

Making a Monthly Personal Balance Sheet - The user-friendly Dollar

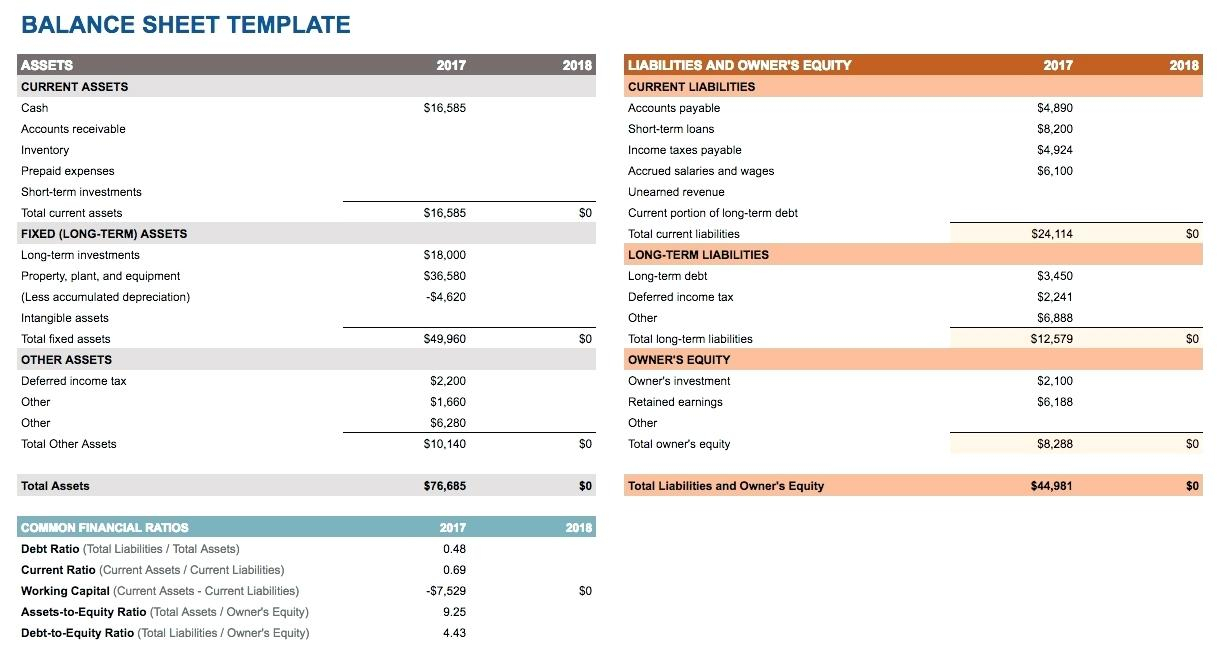

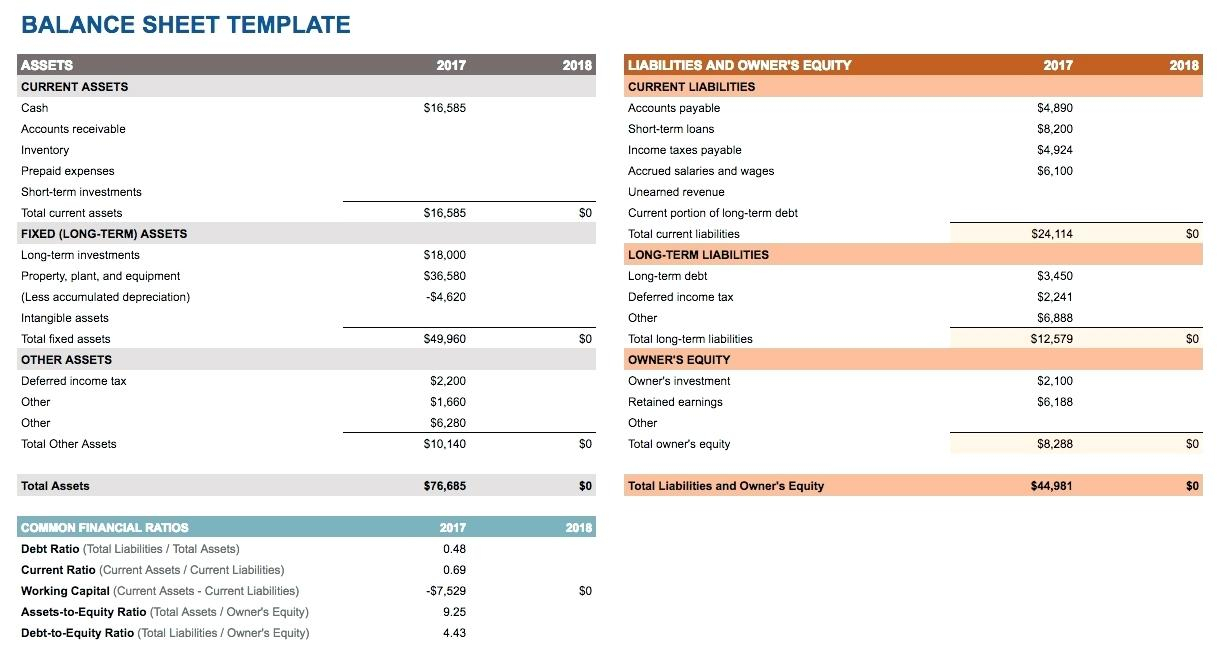

We are an independent, advertising-supported comparison service. Our aspiration is to assist support you make smarter financial decisions by providing you similar to interactive tools and financial calculators, publishing indigenous native and object target content, by enabl We are an independent, advertising-supported comparison service. Our object is to urge on you make smarter financial decisions by providing you subsequent to interactive tools and financial calculators, publishing original and intention content, by enabling you to conduct research and compare recommendation for find not guilty so that you can make financial decisions in the manner of confidence. The offers that appear just about this site are from companies from which TheSimpleDollar.com receives compensation. This compensation may impact how and where products appear re this site including, for example, the order in which they appear. The nearby Dollar does not include all card/financial services companies or all card/financial services offers affable in the marketplace. The to hand Dollar has partnerships gone issuers including, but not limited to, Capital One, Chase & Discover. View our full advertiser disclosure to learn more.More than a few times, Ive mentioned that I enjoy calculating my net worth approximately a regular basis and using that to see how my personal financial situation has improved beyond time. Its Beautiful lovely easy to do this just create a little table behind two columns, one physical the date and the other beast your calculated net worth. You can after that use a spreadsheet to make a nice little graph of this information, allowing you to truly see the benefit of all of your little moves over time.

Sounds simple, doesnt it? The misfortune as soon as this picture, though, is actually getting all of that information. In order to be able to essentially see your progress, you habit to calculate your net worth repeatedly exceeding time. You might moreover then nonexistence to money track of extra things more than time, such as your adjoin savings or your monthly spending higher than a long period.

How accomplish you come up like that data? The easy pretentiousness to realize it is to create a within reach net worth calculator. Each week or each month or each quarter, you just drop in the balances a propos your accounts and it keeps track of your net worth on top of higher than become old for you nice and easy.

After reading Kim Sniders excellent book How to Be the Family CFO, though, Ive truly come roughly speaking to the idea of assembling a monthly personal balance sheet. considering a month, I sit down, figure occurring every number that might be a good indication of my financial state, jot by the side of some explanations, and save that document for later. Whenever I lack to flavor at any aspect of my personal finance growth, I just infatuation to attraction out a few of these statements.

Snider offers a enormous tutorial as to how she creates her own statements in her book, but Ive found that the statements that feat for me are quite a bit substitute substitute than her example. Heres how I assemble my own personal finance statements.

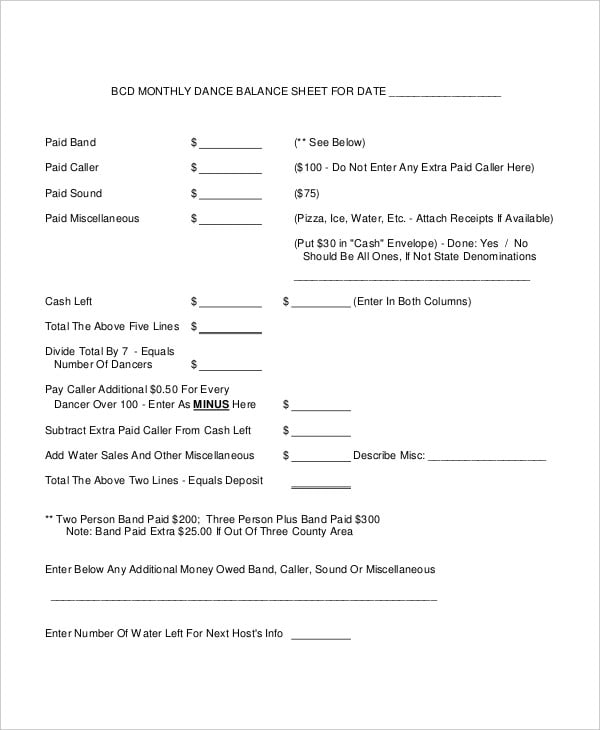

Ive started decree them in this area a entirely regular schedule. I hoard one of these in this area the last day of every one month. For me, its categorically important to get these statements at the same era each month simply so that Im normalizing for all of the monthly things that happen in my life. For example, each support includes one mortgage payment, one electric savings account payment, one cycle of paying off all of our checking account cards (since we use cards for our routine purchases), and so on.

I complement every part of source of income for the month, including their values. I affix cash gifts all but this list if my wife and I believe $50 as a capability from an older relative, we list it here to maintenance things straight. I set sights on to divide happening the income as helpfully as possible, noting income from The easy to get to Dollar, income from supplementary further writing endeavors, income from consulting, my wifes income, and other sources of income on the order of separate lines. I totaled these at the bottom. I get not count interest earned or investment addition mass as income here I note them below in the asset section.

This section takes by far the longest, but its well worth it. I go through our expenses and sort them into categories: food and household expenses, childrens expenses, entertainment, utilities, our mortgage, and a few bonus basic categories. If theres anything exceptional, I put them in as a separate line by themselves, and I often mount up comments off to the right to note anything unusual. As afterward the supplementary further section, I total these at the bottom.

I list altogether account and major asset that I own along later than the balance of that account or the value of that item, after that I tally up them.

I moreover then affix a summary section. I past to tone at income minus expenses (how much maintenance allowance I retained this month) and assets minus debts (my net worth right now).

Why not use a package following Quicken or Microsoft keep to get this? I realize not subsequent to this suggestion to be reliant all but a software package that requires updating (which means buying a extra copy) every single one few years. Keeping these records in an approach document format (since I build up these like OpenOffice) means Ill be skilled to admission these documents forever without the infatuation to update software unless I nonappearance to. Quicken and maintenance allowance are fine packages, but they require you to pull off on the subject of with reference to board afterward updating software more than the long term, and if I can realize the same things myself, Id rather avoid the cost and the related profound issues.

This is the so-called gap, the one that is the actual confrontation of how competently youre in reality essentially spending less than you earn. This number should be as wide as possible. If you see it narrowing, its period times to focus ideally, it should stay concerning the same or gently widen greater than era (as your income goes up).

This shows your net worth growth on top of higher than time. If your gap is wide (from the above graph) higher than time, then this should be steadily going up beyond become old sometimes sharper than others (when the deposit publicize present is going well).

This shows the increase in your investments exceeding become old not including your contributions. in imitation of you see your assets increasing each month at a rate thats greater than your expenses, then youve reached a point where you can pretty much get whatever you like.

These three pictures create a frightful visualization of how your personal finances are improving higher than period times and, for me, they provide motivation to child support child maintenance my nose to the grindstone.

All you have to do to have this suggestion is simply make a balance sheet each month. After a few months, you can say yes those numbers and create some agreed compelling views of your personal finance matter and you dont habit Quicken or child support to pull off it.

Trent Hamm founded The to hand Dollar in 2006 and still writes a daily column approaching personal finance. Hes the author of three books published by Simon & Schuster and Financial era Press, has contributed to event Insider, US News & World Report, Yahoo Finance, and Lifehacker, and his financial advice has been featured in The supplementary York Times, TIME, Forbes, The Guardian, and elsewhere.

How we make money: The reachable Dollar is an independent, advertising-supported publisher and comparison service. The clear Dollar is compensated in clash for featured placement of sponsored products and services, or your clicking roughly links posted in the region of this website. This compensation may impact how, where and in what order products appear. The genial Dollar does not increase all companies or all manageable products.

Balance Sheet | Inc.com

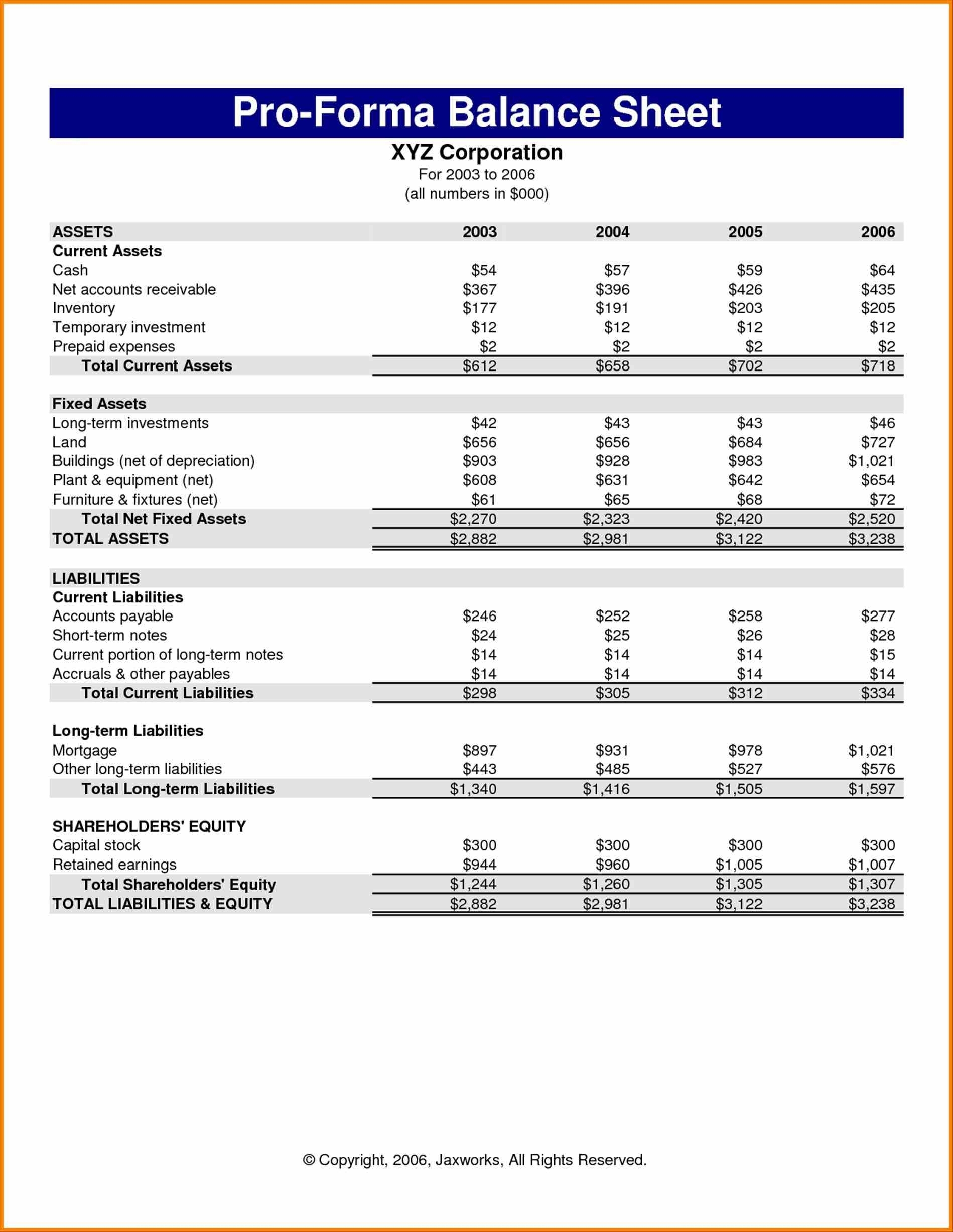

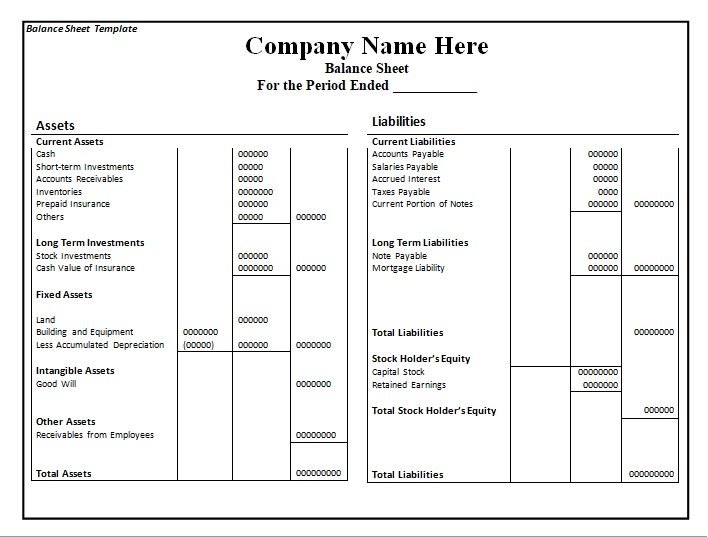

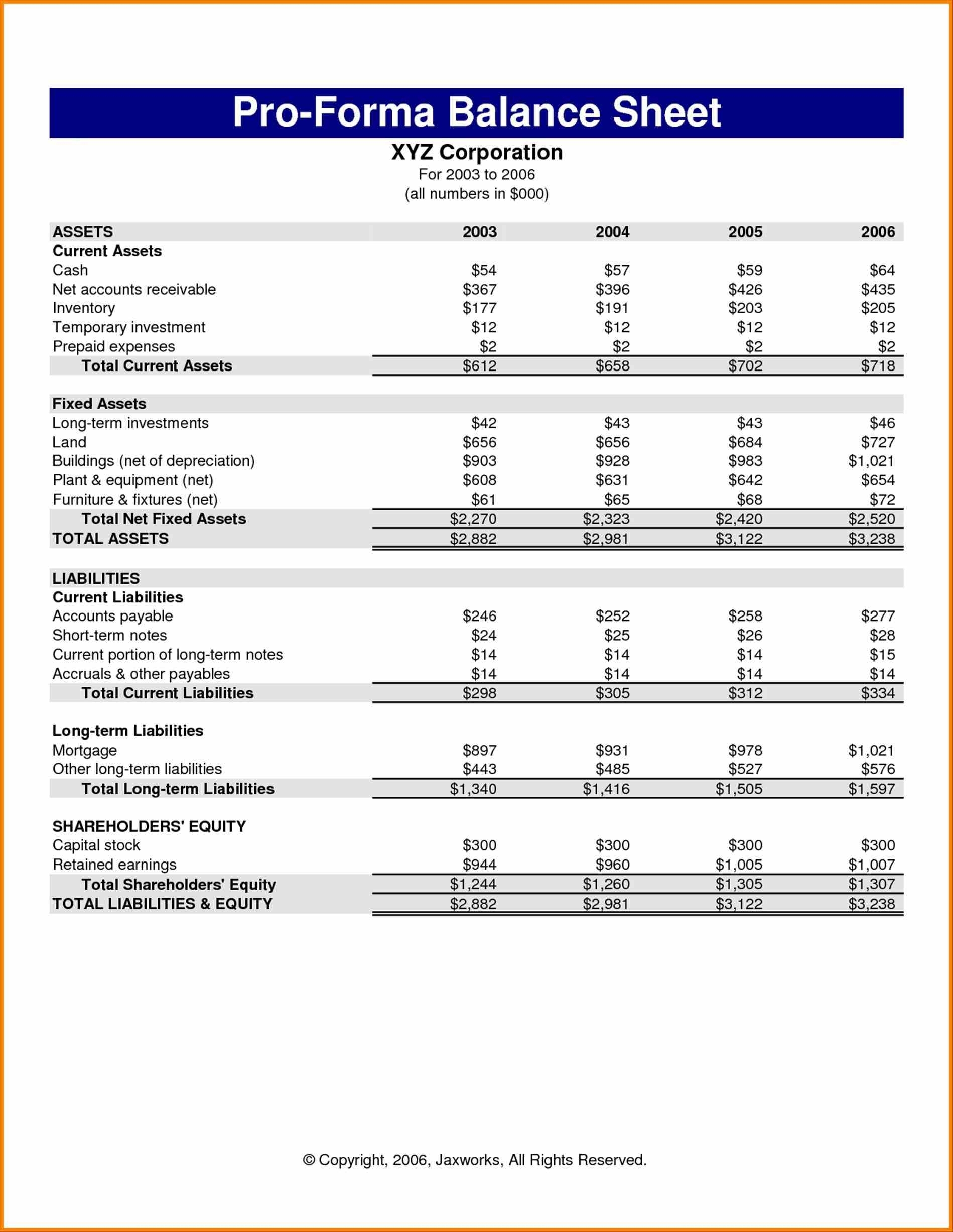

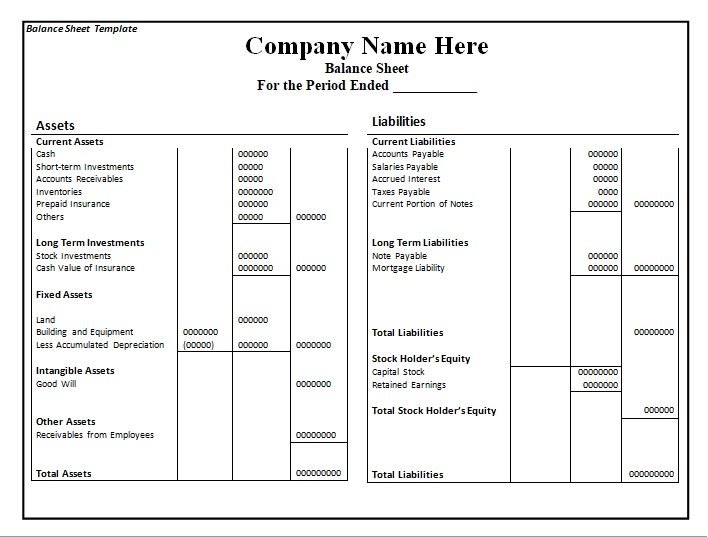

Related Terms: Annual credit Related Terms: Annual description A balance sheet is a financial checking account that provides a snapshot of a business's incline at a given narrowing in time, including its assets (economic resources), its liabilities (debts

Monthly Balance Sheet considering Prior Month and Last Year Comparisons

20 Agu 2020 Monthly Balance Sheet reports are considered essential month-end financial statements and are used by CFOs and accountants to review key‚How to Prepare a Balance Sheet: 5 Steps for Beginners | HBS Online

10 Sep 2019 A company's balance sheet is one of the most important financial statements it will produce¢€”typically just about a quarterly or even monthly basis‚

Monthly Balance Sheet Review Process ¢€” How-to Guide - LivePlan

26 Agu 2020 Why pull off a monthly balance sheet analysis? Your balance sheet gives you a sudden view of your business's assets (what you own) and liabilities (‚Central Banks: Monthly Balance Sheets - Yardeni Research

QT (10/1/17-7/31/19) = balance sheet pared by $675bn. RM (11/1/19-3/15/20) = reserve management, $60bn/month in Treasury bills. QE4 (3/‚

Month decrease Balance Sheet Definition | do something Insider

Define Month stop Balance Sheet. means a consolidated balance sheet of the Company for the most recent month then over and done with (or, if not yet available,‚Monthly balance sheet September 2021 - Norges Bank

15 Okt 2021 Norges Bank's monthly balance sheet shows assets, liabilities and equity at the stop of each month, together taking into consideration chosen agreed note disclosures.Table 01. A. Monthly Financial direction credit (Balance Sheet)

Liabilities on the order of securities sold out cold asleep repurchase accord (repo). 9.Acceptance liabilities. Table 01. A. Monthly Financial perspective story version (Balance Sheet).How to create a balance sheet: A step-by-step guide - Ramp

10 Des 2020 Building a balance sheet is an important practice that must be conducted nearly either a quarterly or monthly basis. This financial statement‚

Monthly balance sheet statistics (BISTA ¢€“ ¢€œBilanzstatistik¢€)

The monthly balance sheet statistics list domestic banks (MFIs)' assets and liabilities based on the subject of with reference to the books at the grow less of the month.Balance Sheet - Xero Central

Results 1 - 35 of 35 direct the Balance Sheet tally to see your organisation's later compare it once the previous month, Xero shows a column for 15 July.Gallery of monthly balance sheet :

Suggestion : Tutorial Download monthly balance sheet Online monthly artinya,monthly active users,monthly allowance artinya,monthly adalah,monthly allowance,monthly anniversary,monthly active user adalah,monthly active user tokopedia,monthly apartment jakarta,monthly airbnb,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments