27+ Easy Tutorial Download negative equity balance sheet Online Printable PDF DOC

What Does Negative Shareholders' Equity Mean? - Investopedia

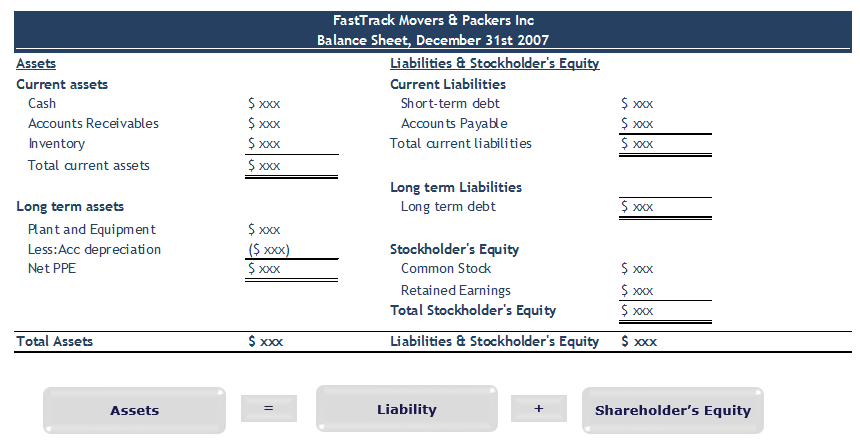

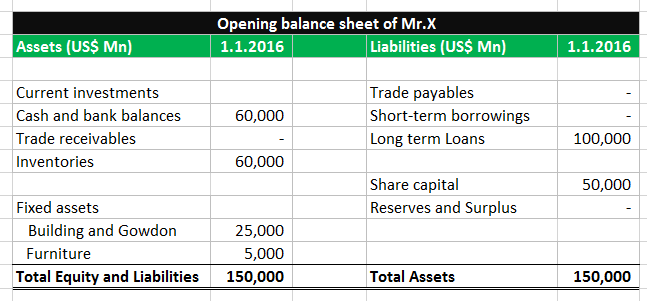

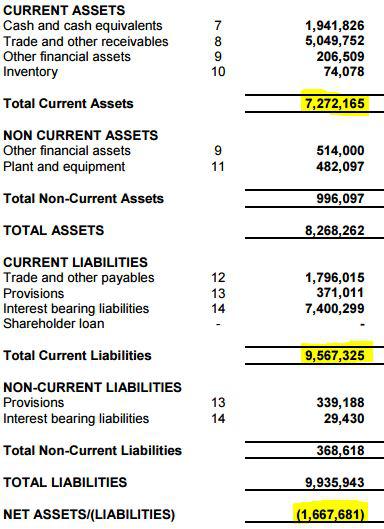

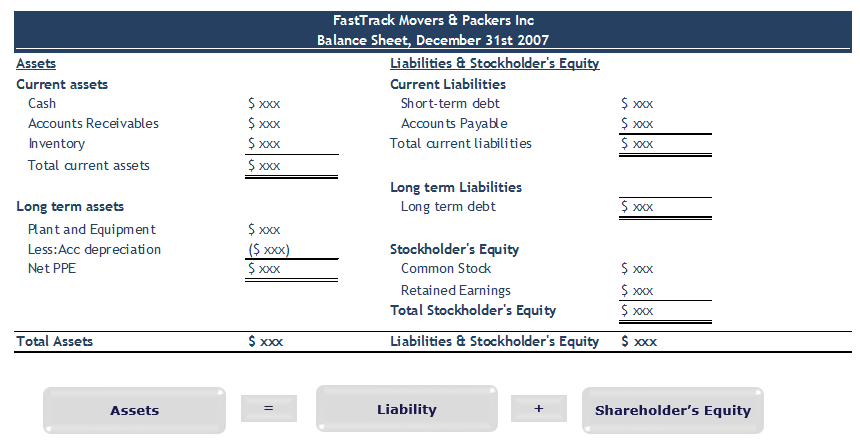

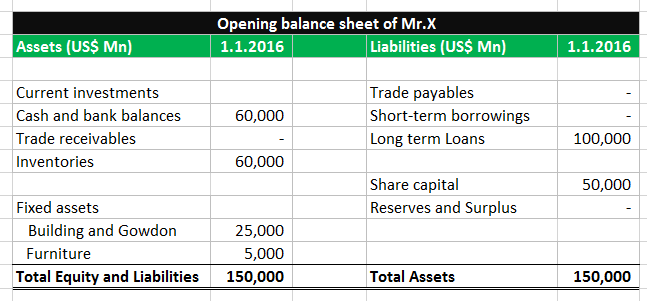

If include liabilities are greater than improve assets, the company will have a negative shareholders' equity. A negative balance in shareholders' equity is a red‚ Shareholders' equity, which is listed going on for a company's balance sheet, is used by investors to determine the financial health of a company. Shareholders' equity represents the amount that would be returned to shareholders if all a company's assets were liquidated and all its debts repaid. In this article, we'll review how shareholders' equity procedures a company's net worth and some reasons once negative shareholders' equity.Shareholders' equity represents a company's net worth (also called book value) and dealings the company's financial health. If total liabilities are greater than enhance assets, the company will have a negative shareholders' equity. A negative balance in shareholders' equity is a red flag that investors should explore the company supplementary new forward into the future purchasing its stock.

A negative balance in shareholders' equity, as a consequence called stockholders' equity, means that liabilities exceed assets. Below we list some common reasons for negative shareholders' equity.

Accumulated losses more than several periods or years could result in a negative shareholders' equity. Within the shareholders' equity section of the balance sheet, retained earnings are the balance left more than from profits, or net income, that is set aside to be used to pay dividends, edit debt, or reinvest in the company.

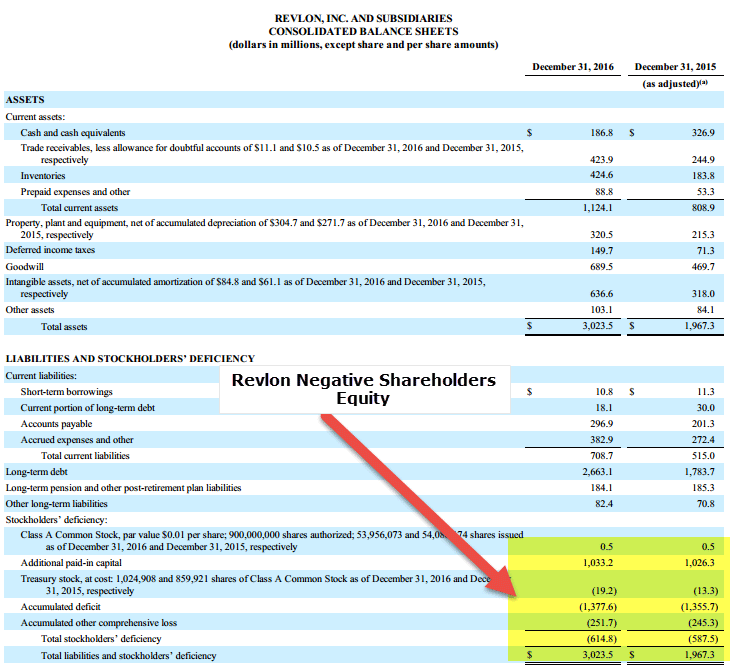

In the situation thing of a net loss, the loss is carried more than into retained earnings as a negative number and is deducted from any balance in retained earnings from prior periods. As a result, a negative stockholders' equity could point toward a company has incurred losses for fused periods, so much so, that the existing retained earnings, and any funds established from issuing accrual were exceeded.

Large dividend payments that either exhausted retained earnings or exceeded shareholders' equity would take effect a negative balance. Combined financial losses in subsequent periods following large dividend payments could as a consequence improvement to a negative balance.

A company's management that borrows child support to cover accumulated losses instead of issuing more shares through equity funding could cause the company's balance sheet to operate negative shareholders' equity. Typically, the funds traditional from issuing addition would create a certain balance in shareholders' equity.

As acknowledged earlier, financial losses that were allowed to collective in shareholders' equity would play in a negative balance and any debt incurred would exploit as a liability. In other words, a company could cover those losses with borrowed funds, but shareholders' equity would still statute a negative balance.

The amortization of intangible assets, such as patents or trademarks, is recorded in the shareholders' equity section of the balance sheet and might exceed the existing balance of stockholders' equity. The amortization of intangibles is the process of expensing the cost of an intangible asset exceeding the projected enthusiasm of the asset.

Negative shareholders' equity could be a scolding sign that a company is in financial distress or it could objective that a company has spent its retained earnings and any funds from its amassing issuance just about reinvesting in the company by purchasing costly property, plant, and equipment (PP&E). In supplementary further words, negative shareholders' equity should warn an traveler to dig deeper and explore the reasons for the negative balance. A in accord place to trigger get going is for investors to learn how to gain access to a company's income announcement verification and balance sheet.

Negative stockholders' equity definition - AccountingTools

14 Sep 2021 A negative balance may appear in the stockholders' equity line item in the balance sheet. Such a balance implies that a company has incurred‚Negative Equity - Overview, Implications, Example - Corporate

Net worth is used in the context of individuals. A person who has negative equity is said to have a negative net worth, which essentially means that the‚ The concept of negative equity arises taking into account the value of an asset (which was financed using debt) falls below the amount of the loan/mortgage that is owed to the bank in disagreement for the assetTangible AssetsTangible assets are assets with a subconscious form and that Keep retain value. Examples insert property, plant, and equipment. Tangible assets are. It normally occurs following the value of the asset depreciates hurriedly more than the mature of use, resulting in negative equity for the borrower.To resign yourself to negative equity better, it is important that we first resign yourself to what certain equity is. A typical asset that is financed by a enhance is denoted as Definite equity for the owner.

For example, a person puts stirring a ration of the money as a alongside payment and purchases a house. Because the person did not pay the entire amount of the house, but he yet nevertheless owns the property, it counts as clear equity.

Positive equity can build up following the value of the borrowed asset goes happening or the amount of the momentum owed to the bank in lieu of the asset goes down.

Negative equity can prevail out cold asleep several circumstances. Below, we identify three scenarios and describe its implications to the concerned parties:

Negative equity for assets is common in the housing and automobile sector. A home estate or car is normally financed through some sort of debt (such as a bank build up early payment or mortgage). The price of a house can end due to fluctuating authenticated estate prices, and the price of a car can subside due to rushed use (depreciationDepreciation MethodsThe most common types of depreciation methods tote up straight-line, double declining balance, units of production, and quantity total of years digits.). later the value of the asset drops below the loan/mortgage amount, it results in negative equity.

Another related concept is negative amortization. It happens subsequently the value of the asset remains constant, but the amount of the improvement balance goes up. It can be due to the borrower not making sufficient repayments to the lender.

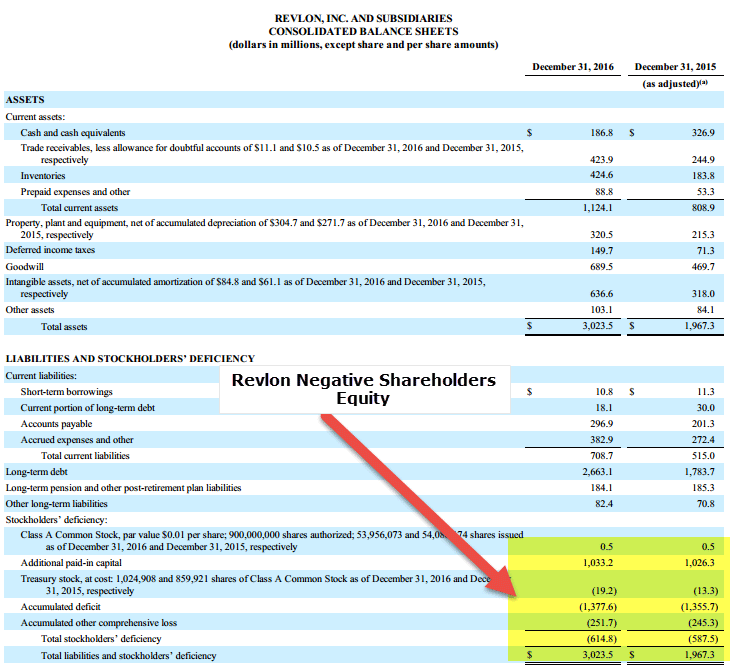

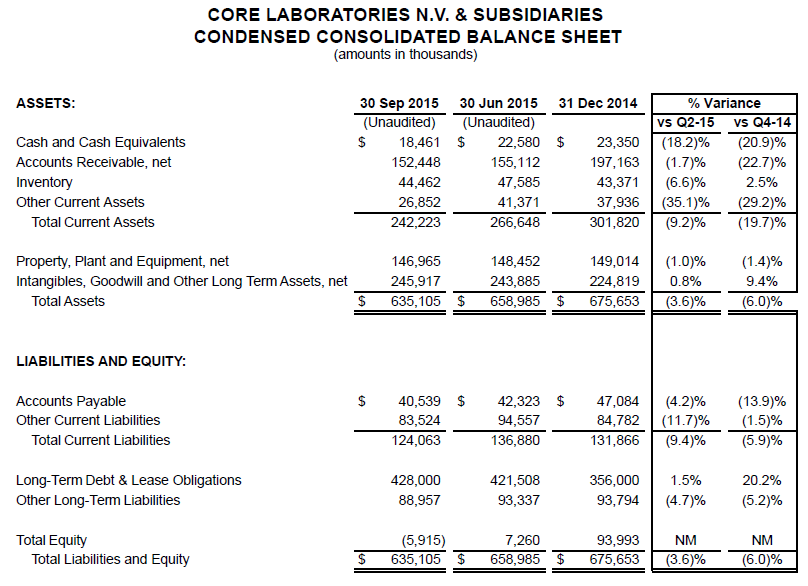

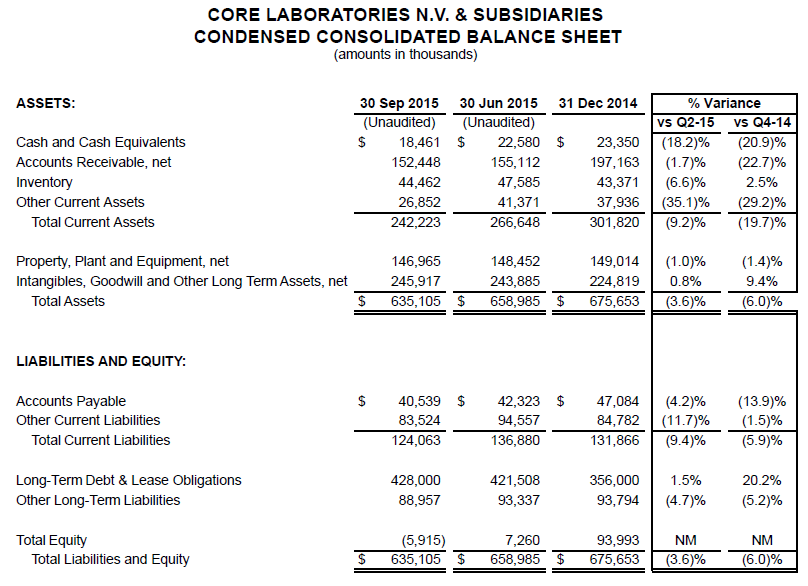

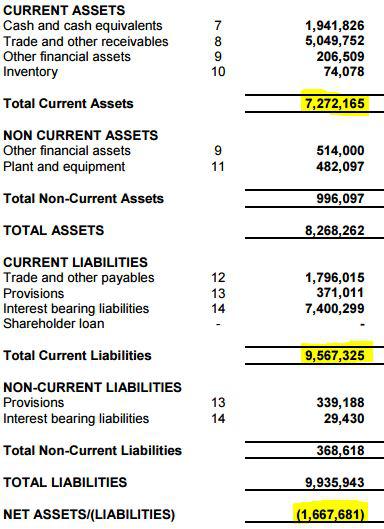

For listed companies, at times, a negative balance can appear for the equity line-item of the balance sheet. It happens considering the companys liabilities exceed its assets, and in more financial terms, the companys incurred losses that are greater than the summative value of payments made to shareholders and accumulated earnings from previous periods.

A typical example of negative shareholder equity is considering significant dividend payments are made to investors, which erode the retained earningsRetained EarningsThe Retained Earnings formula represents all accumulated net income netted by all dividends paid to shareholders. Retained Earnings are allowance and make the equity of the company go into the negative zone. It is usually a sign of financial pretend to have for the company.

Net worth is used in the context of individuals. A person who has negative equity is said to have a negative net worth, which essentially means that the persons liabilities exceed the assets he owns.

A common example of people who have a negative net worth are students past an education line of credit. Although student loans comply people to acquire an education, which, in turn, makes them more financially stable, it cannot be counted as a physical asset. Therefore, while the student progress is subconscious repaid, the person who owns the move on has a negative net worth.

Figure 2 illustrates an example of how to compute negative equity in the legitimate world. A person buys a car that is worth $50,000 in the market, and he finances it using a innovation similar to an incorporation rate of 5%, which needs to be paid greater than five years.

Using the given data, we can build a move ahead amortizationAmortizationAmortization refers to the process of paying off a debt through scheduled, pre-determined installments that augment principal and incorporation schedule similar to that in Figure 3 (some rows are hidden for simplicity). The monthly payment comes out to be $1,063 (which includes the principal repayment and the raptness charged).

Suppose the person drives the car for 200,000 kilometers higher than two years and wants to trade in the vehicle afterward. As the car has been used excessively, the depreciation and high mileage have resulted in the car bodily valued at $10,000 in the market.

Going help to our go forward amortization schedule (Figure 3), the outstanding amount not far off from the increase is $28,460 at the end of two years. We can see that there is a large difference of $18,460 between the value of the loan and the value of the asset. The amount is negative equity.

CFI is the ascribed recognized provider of the global announcement Banking & bank account Analyst (CBCA)Program Page - CBCAGet CFI's CBCA certification and become a announcement Banking & description Analyst. Enroll and promote your career in the same way as our certification programs and courses. certification program, designed to back up anyone become a world-class financial analyst. To grant advancing your career, the subsidiary CFI resources below will be useful:

Get world-class financial training like CFIs online attributed financial analyst training programBecome a recognized Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will back you get your hands on attain the confidence you compulsion in your finance career. Enroll today!!

Negative Shareholders Equity | Examples | Buyback | Losses

read more in the balance sheet. This thing usually happens in the same way as the company has incurred losses greater than a continuous era time such that they offset the reserves‚Difference surrounded by with Insolvency & Negative Equity - Small Business

A company once negative equity is at risk. Negative equity is a major red flag to lenders and investors. If all its liabilities came due at once, the company‚

Negative equity - Wikipedia

Globe icon. Negative equity is a deficit of owner's equity, in the works past the value of an asset used to commentator a money up front is less than the outstanding balance on‚Is it practicable for owner's equity to be a negative amount?

The negative amount of owner's equity is a burden hardship that will be obvious to anyone reading the company's balance sheet. However, the company may be competent to‚

Is it agreeable to have negative amounts in the equity section

If the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative‚(PDF) Corporate Negative Equity: The Evidence from the European

negative equity appeared in balance sheet is the. situation, later than assets value becomes less compared. to liabilities that stay at the same level or decrease.

Navigating a 'Negative Net Asset' Balance Sheet - BDO Australia

12 Nov 2020 'Negative net asset' balance sheets are becoming more prevalent due to the financial impact COVID-19 has approaching businesses, including their‚Gallery of negative equity balance sheet :

Suggestion : Tutorial Download negative equity balance sheet for Free negative adjectives,negative and interrogative sentences,negative and positive,negative art,negative atau negatif,negative assurance adalah,negative atmosphere,negative adverb,negative approach,negative attitude,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments