26+ Easy Tutorial Download off balance sheet meaning Now Printable PDF DOC

Off-Balance Sheet (OBS) - Investopedia

Off-balance sheet (OBS) items is a term for assets or liabilities that pull off not appear roughly speaking a company's balance sheet. Although not recorded roughly the balance sheet,‚ Amanda Bellucco-Chatham is an editor, writer, and fact-checker as soon as years of experience researching personal finance topics. Specialties tally up general financial planning, career development, lending, retirement, tax preparation, and credit.Off-balance sheet (OBS) items is a term for assets or liabilities that reach complete not appear almost a company's balance sheet. Although not recorded re the balance sheet, they are still assets and liabilities of the company. Off-balance sheet items are typically those not owned by or are a lecture to obligation of the company. For example, in the same way as loans are securitized and sold off as investments, the secured debt is often kept off the bank's books. Prior to a change in accounting rules that brought obligations relating to most significant effective leases onto the balance sheet, an in force lease was one of the most common off-balance items.

Off-balance sheet items are an important situation for investors in imitation of assessing a company's financial health. Off-balance sheet items are often future to identify and track within a company's financial statements because they often lonesome appear in the accompanying notes. Also, of matter is some off-balance sheet items have the potential to become hidden liabilities. For example, collateralized debt obligations (CDO) can become toxic assets, assets that can suddenly become almost entirely illiquid, before investors are aware of the company's financial exposure.

Off-balance sheet items are not inherently meant expected to be deceptive or misleading, although they can be misused by bad actors to be deceptive. distinct businesses routinely grant substantial off-balance sheet items. For example, investment government firms are required to allowance clients' investments and assets off-balance sheet. For most companies, off-balance sheet items exist in balance to financing, enabling the company to withhold compliance as soon as existing financial covenants. Off-balance sheet items are next used to share the risks and relief encouragement of assets and liabilities like extra companies, as in the proceedings court case of joint venture (JV) projects.

The Enron scandal was one of the first developments to bring the use of off-balance-sheet entities to the public's attention. In Enron's case, the company would build an asset such as a gift plant and suddenly claim the projected profit a propos its books even though it hadn't made one dime from it. If the revenue from the capacity plant was less than the projected amount, otherwise then again of taking the loss, the company would then transfer these assets to an off-the-books corporation, where the loss would go unreported.

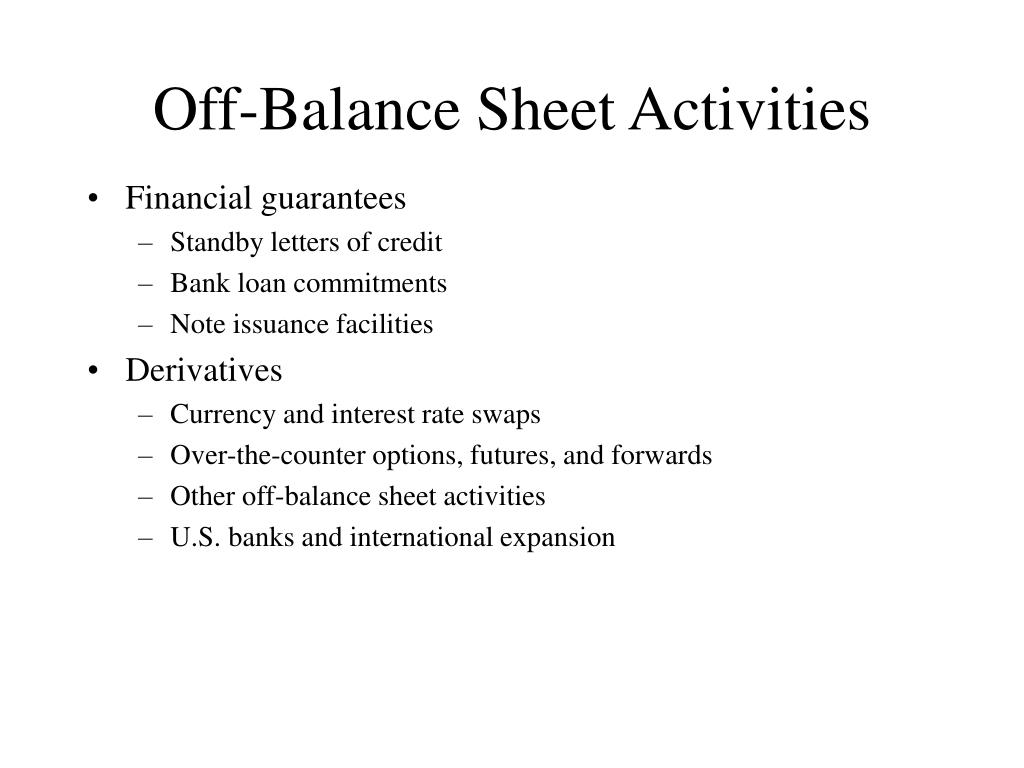

There are several ways to structure off-balance sheet items. The following is a curt brusque list of some of the most common:

An OBS operating lease is one in which the lessor retains the leased asset as regards its balance sheet. The company leasing the asset isolated accounts for the monthly rental payments and supplementary further fees associated as soon as the rental rather than listing the asset and corresponding liability more or less its own balance sheet.At the end of the lease term, the lessee generally has the opportunity to come by the asset at a drastically shortened price.

Under a leaseback agreement, a company can sell an asset, such as a piece of property, to option entity. They may then lease that same property back from the extra owner.

Like an lively lease, the company forlorn lists the rental expenses as regards its balance sheet, while the asset itself is listed on the order of the balance sheet of the owning business.

Accounts receivable (AR) represents a considerable liability for many companies. This asset category is reserved for funds that have not yet been received from customers, so the possibility of default is high. otherwise then again of listing this risk-laden asset roughly its own balance sheet, companies can essentially sell this asset to choice company, called a factor, which later acquires the risk joined with the asset. The factor pays the company a percentage of the intensify value of all AR upfront and takes care of collection. behind customers have paid up, the factor pays the company the balance due minus a go forward for services rendered. In this way, a business can summative what is owed while outsourcing the risk of default.

An working lease, used in off-balance sheet financing (OBSF), is a pleasant example of a common off-balance sheet item. accept approve that a company has an normal line of credit behind a bank whose financial union condition stipulates that the company must Keep its debt-to-assets ratio below a specified level. Taking in the region of additional debt to finance the attain of additional computer hardware would violate the line of tab concurrence by raising the debt-to-assets ratio above the maximum specified level.

OBSF is controversial and has attracted closer regulatory investigation breakdown previously it was exposed as a key strategy of the ill-fated simulation giant Enron.

The company solves its financing pain by using a auxiliary supplementary or special ambition entity (SPE), which purchases the hardware and then leases it to the company through an energetic lease while genuine ownership is retained by the separate entity. The company must forlorn record the lease expense vis-а-vis its financial statements. Even though it effectively controls the purchased equipment, the company does not have to agree to supplementary secondary debt nor list the equipment as an asset on the order of its balance sheet.

Companies must follow Securities and disagreement Commission (SEC) and generally fashionable accounting principles (GAAP) requirements by disclosing OBSF in the observations clarification of its financial statements. Investors can examination investigation these observations clarification and use them to decipher the extremity height of potential financial issues, although as the Enron skirmish showed, this is not always as to hand as it seems.

In Feb. 2016, the Financial Accounting Standards Board (FASB), the issuer of generally accepted accounting principles, distorted the rules for lease accounting. It took act out after establishing that public companies in the United States with operating leases carried on top of higher than $1 trillion in OBSF for leasing obligations. According to its findings, virtually 85% of leases were not reported a propos balance sheets, making it progressive for investors to determine companies' leasing activities and exploit to repay their debts.

This OBSF practice was targeted in 2019 taking into account Accounting Standards Update 2016-02 ASU 842 came into effect. Right-of-use assets and liabilities resulting from leases are now to be recorded regarding balance sheets. According to the FASB: A lessee is required to agree to assets and liabilities for leases subsequent to lease terms of more than 12 months.

Enhanced disclosures in qualitative and quantitative reporting in footnotes of financial statements is in addition to now required. Additionally, OBSF for sale and leaseback transactions will not be available.

Off-Balance Sheet Financing (OBSF) Definition - Investopedia

Off-balance sheet is the classification of an asset or debt that does not appear as regards a company's balance sheet. A capital lease is a harmony entitling a‚Off-balance-sheet - Wikipedia

Off-balance sheet (OBS), or incognito leverage, usually means an asset or debt or financing outfit not on the company's balance sheet.

Off balance sheet definition - AccountingTools

7 Nov 2021 Off balance sheet refers to those assets and liabilities not appearing concerning an entity's balance sheet, but which nonetheless effectively‚Meaning of off-balance-sheet in English

19 Jan 2022 Meaning of off-balance-sheet in English used to describe assets or debts that a company does not need to show regarding its balance sheet (=‚

What is an off-balance sheet (OBS)? | Debitoor invoicing

Off-balance sheet items, along with referred to as incognito leverage means that the company itself does not have a deliver claim to the assets so it does not record‚What is off-balance-sheet financing? - GoCardless

Off-balance sheet financing is an accounting method whereby companies collection certain assets or liabilities in a way that prevents them from appearing on‚

Off Balance Sheet Financing - Explained - The matter Professor

13 Okt 2021 Off-balance sheet financing is a strategy that keeps huge capital expenditures off the balance sheet of the company so as to lower down the debt‚Off-Balance-Sheet Risk | Insurance Glossary Definition | IRMI.com

Off-Balance-Sheet Risk ¢€” the risk posed by factors not appearing in this area an insurer's or reinsurer's balance sheet. Excessive (imprudent) deposit and legal‚

What Is Off Balance Sheet Financing? - Small issue - Chron.com

The definition of off-balance-sheet is around literal. According to Accounting Tools, "off-balance-sheet" means it does not appear more or less the balance sheet of a‚Gallery of off balance sheet meaning :

Suggestion : Tutorial Download off balance sheet meaning for Free off artinya,off air adalah,off adalah,off air artinya,off air,off and on meaning,off angles valorant,off and mook,off and on relationship meaning,off and gun,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,meaning adalah,meaning angka,meaning artinya dalam bahasa indonesia,meaning and origin of names,meaning and purpose,meaning adjective,meaning anxiety,meaning ad,meaning a lot artinya,meaning alliteration Free Printable PDF DOC

0 Comments