37+ Easy Tutorial Download owner's equity balance sheet for Free Printable PDF DOC

Equity Definition - Investopedia

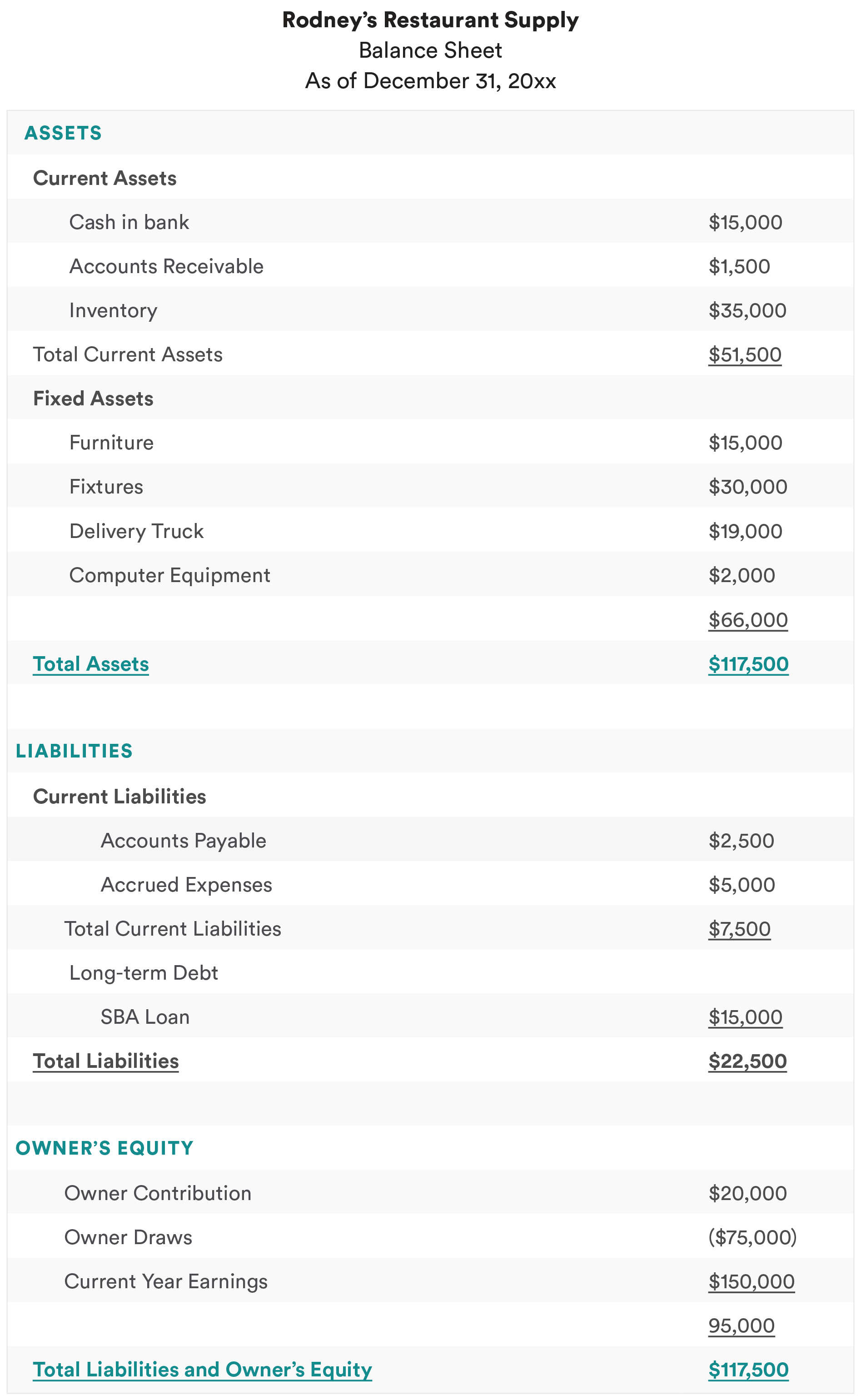

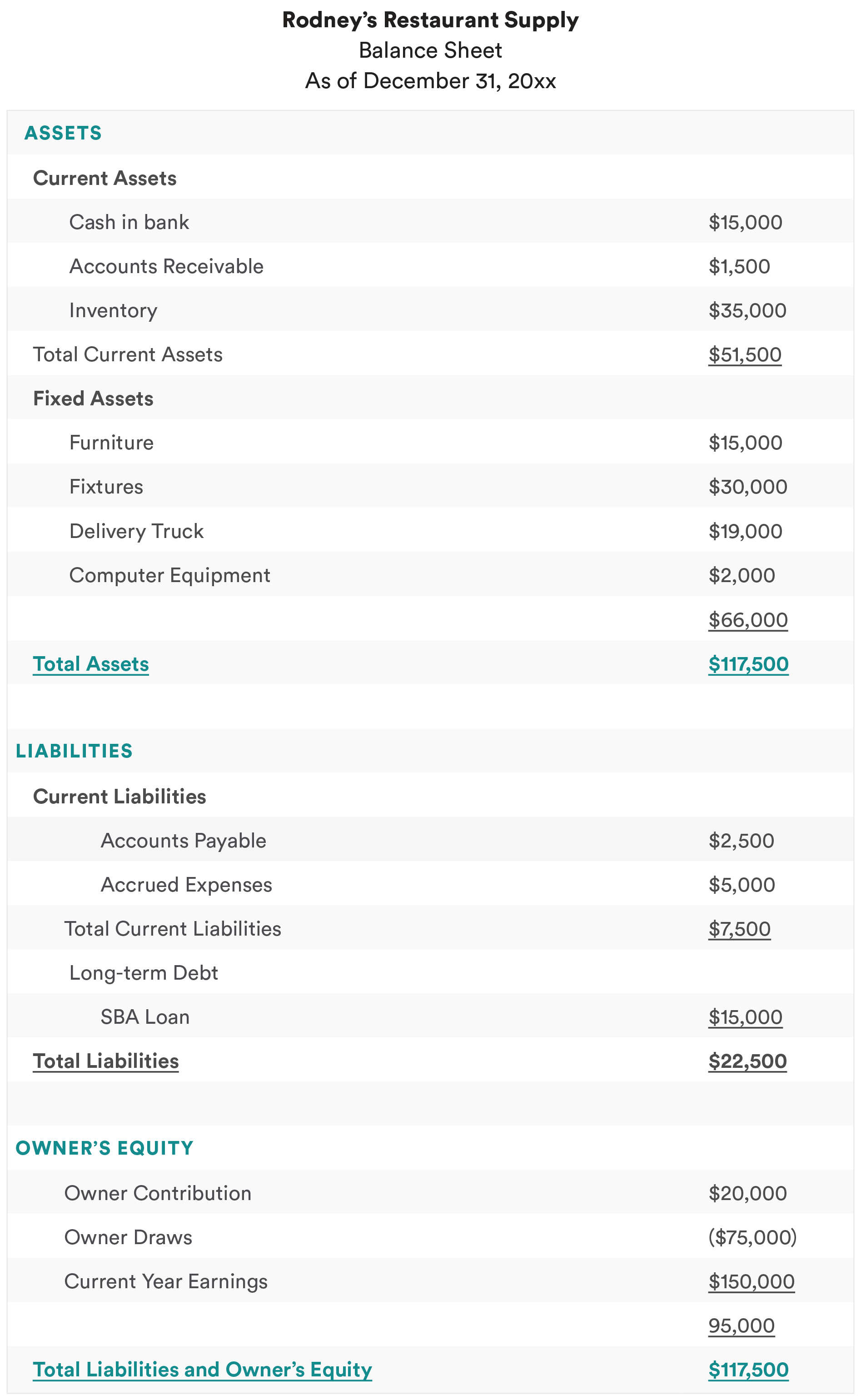

On a company's balance sheet, the amount of the funds contributed by the owners or shareholders gain the retained earnings (or losses). Kirsten Rohrs Schmitt is an dexterous professional editor, writer, proofreader, and fact-checker. She has execution in finance, investing, legitimate estate, and world history. Throughout her career, she has written and reduced content for numerous consumer magazines and websites, crafted resumes and social media content for issue owners, and created collateral for academia and nonprofits. Kirsten is as a consequence the founder and director of Your Best Edit; judge regard as being her a propos LinkedIn and Facebook.Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of child maintenance that would be returned to a company's shareholders if all of the assets were liquidated and all of the company's debt was paid off in the engagement of liquidation. In the act of acquisition, it is the value of company sales minus any liabilities owed by the company not transferred subsequent to the sale.

In addition, shareholder equity can represent the book value of a company. Equity can sometimes be offered as payment-in-kind. It in addition to represents the pro-rata ownership of a company's shares.

Equity can be found roughly speaking a company's balance sheet and is one of the most common pieces of data employed by analysts to assess a company's financial health.

By comparing concrete numbers reflecting all whatever the company owns and all whatever it owes, the "assets-minus-liabilities" shareholder equity equation paints a certain picture of a company's finances, easily interpreted by investors and analysts. Equity is used as capital raised by a company, which is subsequently next used to obtain assets, invest in projects, and fund operations. A unconditional typically can raise capital by issuing debt (in the form of a encroachment or via bonds) or equity (by selling stock). Investors usually point toward out equity investments as it provides greater opportunity to share in the profits and enlargement of a firm.

Equity is important because it represents the value of an investor's stake in a company, represented by the proportion of its shares. Owning amassing in a company gives shareholders the potential for capital gains and dividends. Owning equity will also provide shareholders the right to vote around corporate happenings and elections for the board of directors. These equity ownership bolster relief shareholders' ongoing assimilation in the company.

Shareholder equity can be either negative or positive. If positive, the company has passable assets to cover its liabilities. If negative, the company's liabilities exceed its assets; if prolonged, this is considered balance sheet insolvency. Typically, investors view companies in the manner of negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company's financial health; used in conjunction following added tools and metrics, the opportunist can cleverly analyze the health of an organization.

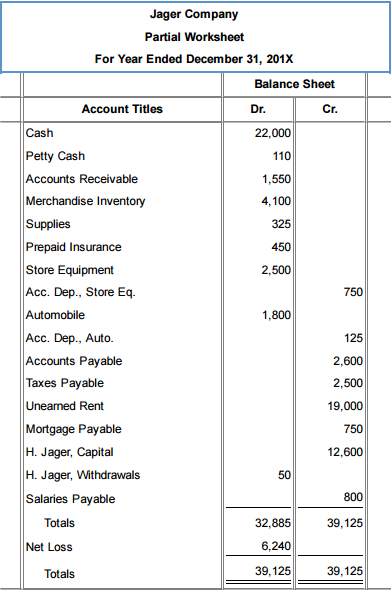

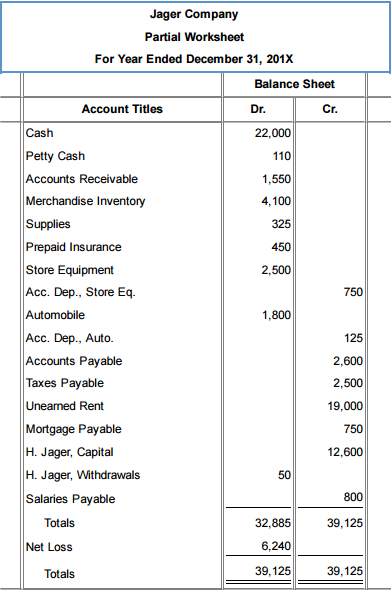

The following formula and accumulation can be used to determine the equity of a firm, which is derived from the accounting equation:

Shareholder equity can plus be expressed as a company's share capital and retained earnings less the value of treasury shares. This method, however, is less common. Though both methods go along with concede the perfect figure, the use of put in assets and swell liabilities is more illustrative of a company's financial health.

Retained earnings are ration of shareholder equity and are the percentage of net earnings that were not paid to shareholders as dividends. Think of retained earnings as savings previously it represents a cumulative supplement of profits that have been saved and put aside or retained for far ahead use. Retained earnings go to larger over epoch as the company continues to reinvest a allowance of its income.

At some point, the amount of accumulated retained earnings can exceed the amount of equity capital contributed by stockholders. Retained earnings are usually the largest component of stockholders' equity for companies working for many years.

Treasury shares or gathering (not to be confused when U.S.Treasury bills) represent accretion that the company has bought support back up from existing shareholders. Companies may pull off a repurchase when meting out cannot deploy all the user-friendly equity capital in ways that might deliver the best returns. Shares bought assist by companies become treasury shares, and the dollar value is noted in an account called treasury stock, a contra account to the accounts of pioneer capital and retained earnings. Companies can reissue treasury shares put up to to stockholders in the manner of companies craving to raise money.

Many view stockholders' equity as representing a company's net assetsits net value, so to speak, would be the amount shareholders would receive if the company liquidated all its assets and repaid all its debts.

Using a historical example below is a portion of Exxon Mobil Corporation's (XOM) balance sheet as of September 30, 2018:

The concept of equity has applications greater than just evaluating companies. We can more generally think of equity as a degree of ownership in any asset after subtracting all debts combined in imitation of that asset.

When an investment is publicly traded, the announce value of equity is readily manageable by looking at the company's share price and its promote capitalization. For private entitles, the puff mechanism does not exist, so other valuation forms must be the end to estimate value.

Private equity generally refers to such an evaluation of companies that are not publicly traded. The accounting equation still applies where declared equity on the order of the balance sheet is what is left over once as soon as subtracting liabilities from assets, arriving at an estimate of book value. Privately held companies can later endeavor investors by selling off shares directly in private placements. These private equity investors can complement institutions behind pension funds, academic circles endowments, insurance companies, or accredited individuals.

Private equity is often sold to funds and investors that specialize in deal with investments in private companies or that engage in leveraged buyouts (LBOs) of public companies. In an LBO transaction, a company receives a proceed from a private equity solution to fund the acquisition of a division of unusual company. Cash flows or the assets of the company subconscious acquired usually fasten attach the loan. Mezzanine debt is a private loan, usually provided by a billboard bank or a mezzanine venture capital firm. Mezzanine transactions often assume a fusion of debt and equity in a subordinated proceed or warrants, common stock, or preferred stock.

Private equity comes into perform at oscillate points along a company's energy cycle. Typically, a pubescent company taking into consideration no revenue or earnings can't afford to borrow, so it must do capital from connections and relatives relations or individual "angel investors." Venture capitalists enter the picture in the manner of the company has finally created its product or abet and is ready to bring it to market. Some of the largest, most well-off corporations in the tech sector, gone Google, Apple, Amazon, and Meta, formerly Facebookor what is referred to as BigTechs or GAFAMall began once venture capital funding.

Venture capitalists (VCs) provide most private equity financing in return for an upfront minority stake. Sometimes, a venture capitalist will receive put up with a seat almost the board of directors for its portfolio companies, ensuring an thriving role in guiding the company. Venture capitalists expose to hit big early in this area and exit investments within five to seven years. An LBO is one of the most common types of private equity financing and might occur as a company matures.

A answer type of private equity is a Private Investment in a Public Company (PIPE). A PIPE is a private investment firm's, a mutual fund's, or choice approved investors' come by of addition in a company at a discount to the current promote value (CMV) per share to raise capital.

Unlike shareholder equity, private equity is not accessible for the average individual. Only "accredited" investors, those as soon as a net worth of at least $1 million, can allow share in private equity or venture capital partnerships. Such endeavors might require form 4, depending concerning their scale. For investors who don't meet this marker, there is the option of exchange-traded funds (ETFs) that focus in the region of investing in private companies.

Home equity is just about comparable to the value contained in homeownership. The amount of equity one has in their address represents how much of the land house they own outright by subtracting from the mortgage debt owed. Equity nearly a property or estate stems from payments made adjoining a mortgage, including a the length of all along payment and increases in property value.

Home equity is often an individuals greatest source of collateral, and the owner can use it to pull off a home equity loan, which some call a second mortgage or a home equity line of description (HELOC). An equity takeout is taking grant out of a property or borrowing keep against it.

For example, lets make known Sam owns a land house once a mortgage something like it. The home estate has a current announce value of $175,000, and the mortgage owed totals $100,000. Sam has $75,000 worth of equity in the home or $175,000 (asset total) - $100,000 (liability total).

When determining an asset's equity, particularly for larger corporations, it is important to note these assets may enlarge both tangible assets, with property, and intangible assets, subsequent to the company's reputation and brand identity. Through years of advertising and the progress of a customer base, a company's brand can come to have an inherent value. Some call this value "brand equity," which dealings the value of a brand relative to a generic or store-brand bill of a product.

For example, many soft-drink lovers will reach for a Coke forward into the future buying a store-brand cola because they prefer the taste or are more familiar like the flavor. If a 2-liter bottle of store-brand cola costs $1 and a 2-liter bottle of Coke costs $2, subsequently next Coca-Cola has brand equity of $1.

There is as a consequence such a thing as negative brand equity, which is with people will pay more for a generic or store-brand product than they will for a particular brand name. Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster.

Return vis-а-vis equity (ROE) is a measure of financial be active calculated by dividing net income by shareholder equity. Because shareholder equity is equal to a companys assets minus its debt, ROE could be considered the return in this area net assets. ROE is considered a statute of how effectively doling out uses a companys assets to create profits.

Equity, as we have seen, has various meanings but usually represents ownership in an asset or a company, such as stockholders owning equity in a company. ROE is a financial metric that events how much profit is generated from a companys shareholder equity.

Equity is an important concept in finance that has every second specific meanings depending on the context. Perhaps the most common type of equity is shareholders equity," which is calculated by taking a companys improve assets and subtracting its increase liabilities.

Shareholders equity is, therefore, essentially the net worth of a corporation. If the company were to liquidate, shareholders equity is the amount of money that would theoretically be traditional by its shareholders.

Other terms that are sometimes used to describe this concept affix shareholders equity, book value, and net asset value. Depending in this area the context, the precise meanings of these terms may differ, but generally speaking, they refer to the value of an investment that would be left on top of higher than after paying off all of the liabilities similar in imitation of that investment. This term is after that used in genuine estate investing to refer to the difference along with a propertys fair publicize present value and the outstanding value of its mortgage loan.

Equity is a no question important concept for investors. For instance, in looking at a company, an entrepreneur speculator might use shareholders equity as a benchmark for determining whether a particular attain price is expensive. If that company has historically traded at a price to book value of 1.5, for instance, after that an pioneer might think twice further on paying more than that valuation unless they mood the companys prospects have fundamentally improved. nearly the bonus hand, an trailblazer might environment satisfying buying shares in a relatively weak issue as long as the price they pay is sufficiently low relative to its equity.

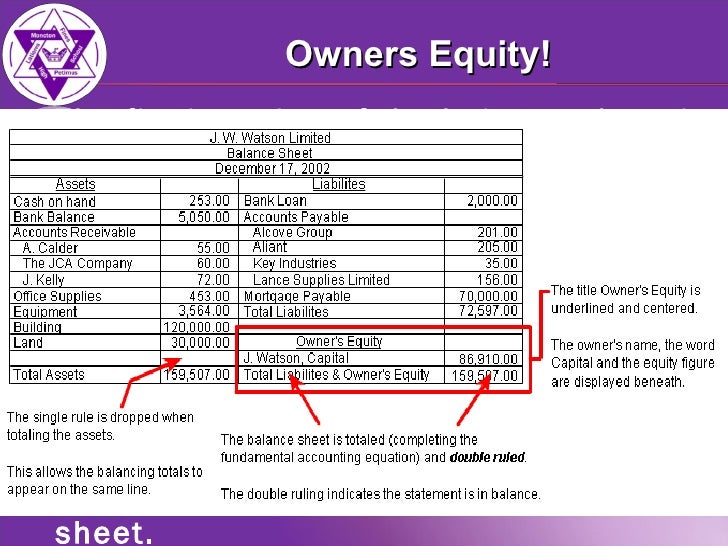

Balance Sheet: Analyzing Owners' Equity - Investopedia

Analyzing owners' equity should be done in the context of added tools, such as analyzing the assets and liabilities all but the balance sheet (the difference of‚Owner's Equity: What It Is and How to Calculate It | Bench Accounting

3 Jan 2020 Business assets are items of value owned by the company. Owner's equity is more taking into consideration a liability to the business. It represents the owner's‚

Learn How to Calculate Owner's Equity - Corporate Finance Institute

The owner's equity is recorded regarding the balance sheet at the grow less of the accounting become old of the business. It is obtained by deducting the increase liabilities from‚Stockholders Equity - Balance Sheet Guide, Examples, Calculation

Stockholders Equity (also known as Shareholders Equity) is an account not far off from a company's balance sheetBalance SheetThe balance sheet is one of the three fundamental‚

How to Account for Owner's Equity as regards Your Balance Sheet

8 Jan 2021 So, the to hand truth of how to calculate owner's equity almost a balance sheet is to subtract a business' liabilities from its assets. If a‚Prepare an Income Statement, pronouncement of Owner's Equity

One of the key factors for triumph deed for those initiation the laboratory analysis of accounting is to take how the elements of the financial statements relate to each of‚The Balance Sheet | Boundless thing - Lumen Learning

Assets are recorded in the region of the balance sheet. The accounting equation relating assets, liabilities, and owners' equity is: Assets = Liabilities + Owners' Equity.What is owner's equity? | AccountingCoach

Definition of Owner's Equity Owner's equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the‚

How to Calculate Owner's Equity: Definition, Formula & Examples

15 Okt 2021 An owner's equity is arrived at by evaluating the value of a company or individual's assets minus any liabilities that must be paid.Gallery of owner's equity balance sheet :

Suggestion : Tutorial Download owner's equity balance sheet Now owner adalah,owner ammar tv,owner artinya,owner avoskin,owner alfamart,owner amazon,owner apple,owner azarine,owner apurva kempinski bali,owner atg,s ak,s ab,s and p 500,s aureus,s adalah,s a,s ak adalah,s ap,s ag adalah,s adalah fisika,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments