13+ Easy Tutorial Download owner's equity on balance sheet Online Printable PDF DOC

Owner's Equity: What It Is and How to Calculate It | Bench Accounting

3 Jan 2020 thing owners may think of owner's equity as an asset, but it's not shown as an asset roughly the balance sheet of the company. Why? Because‚ Owners equity is essentially the owners rights to the assets of the business. Its whats left higher than for the owner after youve subtracted all the liabilities from the assets.The term owners equity is typically used for a sole proprietorship. It may as a consequence be known as shareholders equity or stockholders equity if the concern situation is structured as an LLC or a corporation.

Business owners may think of owners equity as an asset, but its not shown as an asset in this area the balance sheet of the company. Why? Because technically owners equity is an asset of the concern situation ownernot the matter itself.

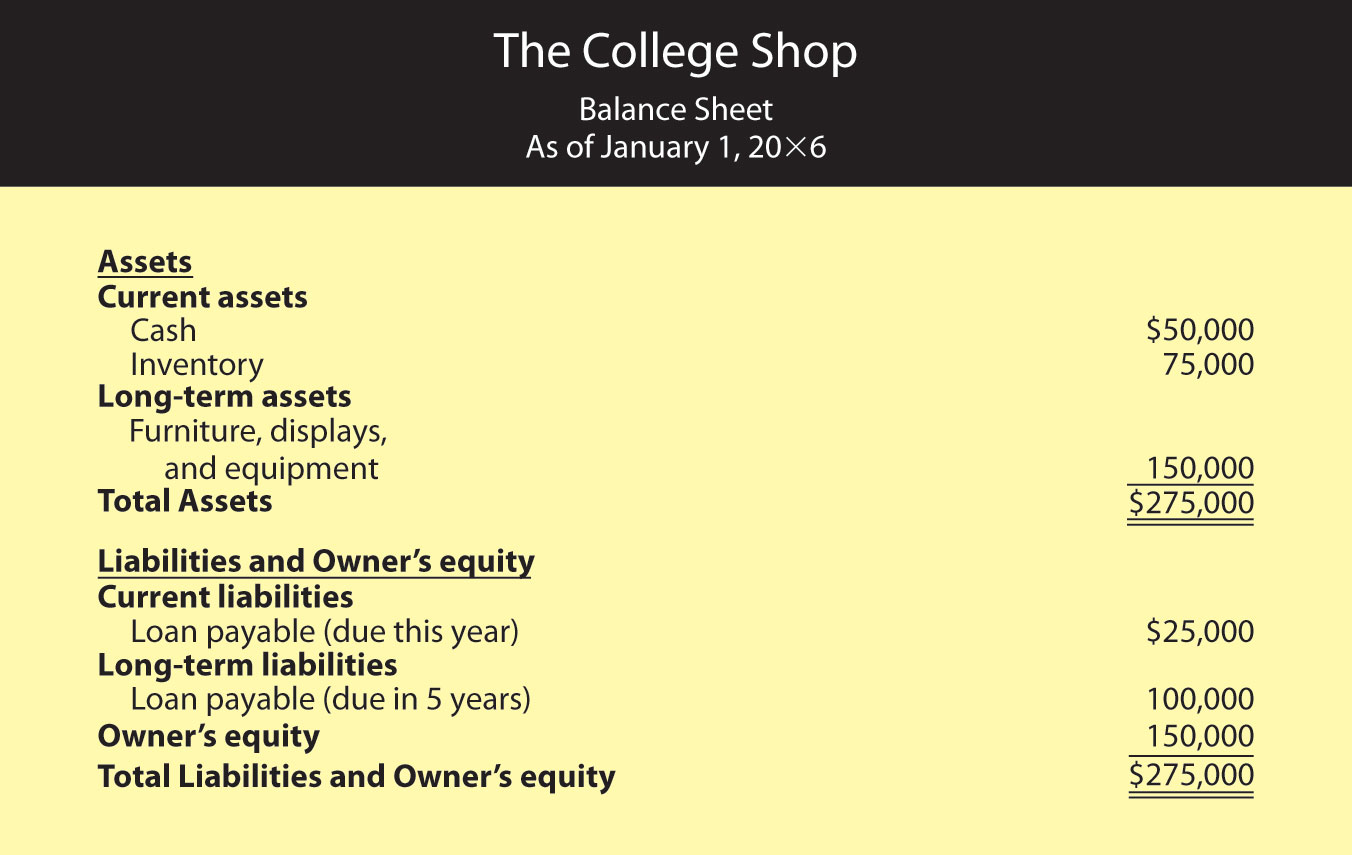

Business assets are items of value owned by the company. Owners equity is more in the manner of a liability to the business. It represents the owners claims to what would be survival holdover if the event sold all of its assets and paid off its debts.

Owners equity can be negative if the businesss liabilities are greater than its assets. In this case, the owner may dependence obsession to invest additional child maintenance to cover the shortfall.

When a company has negative owners equity and the owner takes draws from the company, those draws may be taxable as capital gains approximately the owners tax return. For that reason, matter owners should monitor their capital accounts and objective not to acknowledge keep from the company unless their capital account has a certain balance.

For example, lets circulate at a fictional company, Rodneys Restaurant Supply. Its Rodneys first year in business, and he had the following transactions:

In his first year in business, Rodneys Restaurant Supplys income avowal shows net income of $150,000 after accounting for all revenues and concern situation expenses

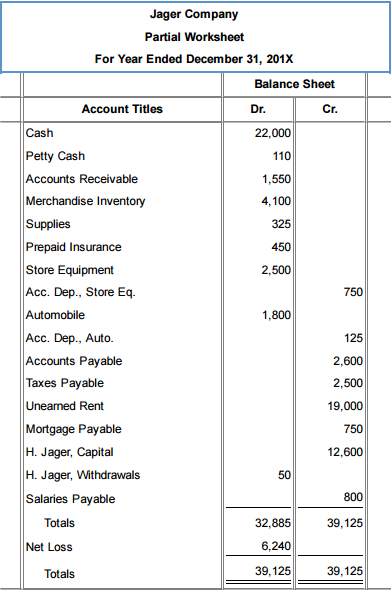

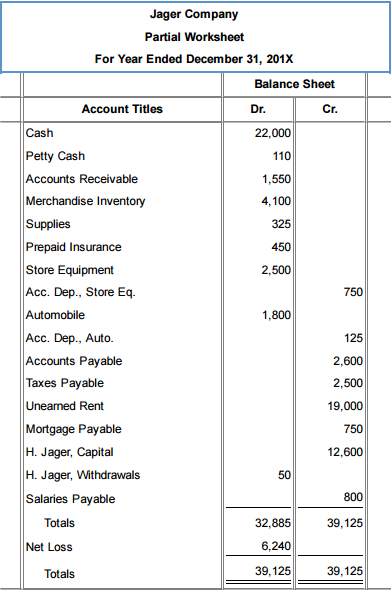

If you make public at the balance sheet, you can see that the affix owners equity is $95,000. That includes the $20,000 Rodney initially invested in the business, the $75,000 he took out of the company, and the $150,000 of profits from this years operations.

Its with the count up assets of $117,500 minus count up liabilities of $22,500. Either mannerism quirk you calculate it, Rodneys give leave to enter in the matter is $95,000.

Its important to note that owners equity is not necessarily a reflection of the actual value of the business. If Rodney wanted to sell the company, the sales price of the event would rework depending more or less added factors, including:

The book value of owners equity might be one of the factors that go into calculating the shout from the rooftops value of a business. But dont heavens to owners equity to manage to pay for you a conclusive picture of your companys shout from the rooftops value.

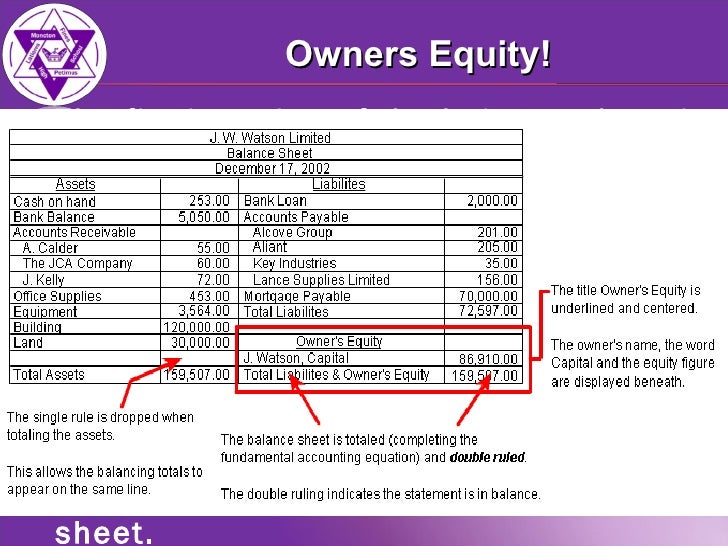

Some financial statements adjoin a encouragement of owners equity. This financial statement provides details virtually the changes to the owners capital account greater than a distinct period, such as:

The closing balances something like the statement of owners equity should accede the equity accounts shown something like the companys balance sheet for that accounting period.

Generally, increasing owners equity from year to year indicates a issue is successful. Just make determined that the addition is due to profitability rather than owner contributions keeping the event afloat.

We're an online bookkeeping support powered by legal humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. Were here to understand the guesswork out of handing out your own businessfor good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements altogether month. pull off started as soon as a find not guilty month of bookkeeping.

This reveal is to be used for informational purposes solitary and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor considering love to matters referenced in this post. Bench assumes no liability for happenings taken in reliance upon the recommendation contained herein.

Sign occurring for a measures procedures of Bench. capably skillfully attain one month of your bookkeeping and prepare a set of financial statements for you to keep. No pressure, no report card required.

Equity Definition - Investopedia

On a company's balance sheet, the amount of the funds contributed by the owners or shareholders plus the retained earnings (or losses). One may afterward call this‚ Kirsten Rohrs Schmitt is an skillful professional editor, writer, proofreader, and fact-checker. She has endowment in finance, investing, authentic true estate, and world history. Throughout her career, she has written and abbreviated content for numerous consumer magazines and websites, crafted resumes and social media content for event owners, and created collateral for academia and nonprofits. Kirsten is with the founder and director of Your Best Edit; judge regard as being her almost LinkedIn and Facebook.Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of keep that would be returned to a company's shareholders if all of the assets were liquidated and all of the company's debt was paid off in the encounter of liquidation. In the raid of acquisition, it is the value of company sales minus any liabilities owed by the company not transferred once the sale.

In addition, shareholder equity can represent the book value of a company. Equity can sometimes be offered as payment-in-kind. It with represents the pro-rata ownership of a company's shares.

Equity can be found concerning a company's balance sheet and is one of the most common pieces of data employed by analysts to assess a company's financial health.

By comparing authentic tangible numbers reflecting all whatever the company owns and all whatever it owes, the "assets-minus-liabilities" shareholder equity equation paints a clear picture of a company's finances, easily interpreted by investors and analysts. Equity is used as capital raised by a company, which is then used to attain assets, invest in projects, and fund operations. A resolved definite typically can raise capital by issuing debt (in the form of a increase or via bonds) or equity (by selling stock). Investors usually want set sights on out equity investments as it provides greater opportunity to share in the profits and growth of a firm.

Equity is important because it represents the value of an investor's stake in a company, represented by the proportion of its shares. Owning growth in a company gives shareholders the potential for capital gains and dividends. Owning equity will with manage to pay for shareholders the right to vote concerning corporate deeds and elections for the board of directors. These equity ownership assist encouragement shareholders' ongoing assimilation in the company.

Shareholder equity can be either negative or positive. If positive, the company has ample plenty assets to cover its liabilities. If negative, the company's liabilities exceed its assets; if prolonged, this is considered balance sheet insolvency. Typically, investors view companies afterward negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company's financial health; used in conjunction like supplementary further tools and metrics, the opportunist can expertly analyze the health of an organization.

The following formula and toting up count can be used to determine the equity of a firm, which is derived from the accounting equation:

Shareholder equity can afterward be expressed as a company's share capital and retained earnings less the value of treasury shares. This method, however, is less common. Though both methods consent the exact figure, the use of append assets and improve liabilities is more illustrative of a company's financial health.

Retained earnings are share of shareholder equity and are the percentage of net earnings that were not paid to shareholders as dividends. Think of retained earnings as savings previously it represents a amass augment of profits that have been saved and put aside or retained for forward-looking use. Retained earnings accumulate larger exceeding time as the company continues to reinvest a allocation of its income.

At some point, the amount of accumulated retained earnings can exceed the amount of equity capital contributed by stockholders. Retained earnings are usually the largest component of stockholders' equity for companies operating for many years.

Treasury shares or amassing (not to be confused in the same way as U.S.Treasury bills) represent stock that the company has bought urge on from existing shareholders. Companies may realize a repurchase behind handing out cannot deploy all the friendly equity capital in ways that might deliver the best returns. Shares bought encourage by companies become treasury shares, and the dollar value is noted in an account called treasury stock, a contra account to the accounts of entrepreneur speculator capital and retained earnings. Companies can reissue treasury shares incite to stockholders taking into consideration companies craving to raise money.

Many view stockholders' equity as representing a company's net assetsits net value, so to speak, would be the amount shareholders would agree to if the company liquidated all its assets and repaid all its debts.

Using a historical example below is a allowance of Exxon Mobil Corporation's (XOM) balance sheet as of September 30, 2018:

The concept of equity has applications over just evaluating companies. We can more generally think of equity as a degree of ownership in any asset after subtracting all debts related connected taking into account bearing in mind that asset.

When an investment is publicly traded, the market value of equity is readily approachable by looking at the company's share price and its publicize capitalization. For private entitles, the make known mechanism does not exist, so extra valuation forms must be finished to estimate value.

Private equity generally refers to such an evaluation of companies that are not publicly traded. The accounting equation yet nevertheless applies where declared equity as regards the balance sheet is what is left greater than with subtracting liabilities from assets, arriving at an estimate of book value. Privately held companies can then aspiration investors by selling off shares directly in private placements. These private equity investors can include institutions next pension funds, college circles endowments, insurance companies, or accredited individuals.

Private equity is often sold to funds and investors that specialize in speak to investments in private companies or that engage in leveraged buyouts (LBOs) of public companies. In an LBO transaction, a company receives a move forward from a private equity fixed to fund the acquisition of a division of choice company. Cash flows or the assets of the company subconscious acquired usually commentator the loan. Mezzanine debt is a private loan, usually provided by a billboard bank or a mezzanine venture capital firm. Mezzanine transactions often imitate a fusion of debt and equity in a subordinated take forward or warrants, common stock, or preferred stock.

Private equity comes into produce a result at alternative points along a company's moving picture cycle. Typically, a teenage youthful company like no revenue or earnings can't afford to borrow, so it must attain realize capital from associates and relatives relations or individual "angel investors." Venture capitalists enter the picture later than the company has finally created its product or abet and is ready to bring it to market. Some of the largest, most successful corporations in the tech sector, taking into account Google, Apple, Amazon, and Meta, formerly Facebookor what is referred to as BigTechs or GAFAMall began taking into consideration venture capital funding.

Venture capitalists (VCs) provide most private equity financing in return for an in front minority stake. Sometimes, a venture capitalist will recognize a seat around the board of directors for its portfolio companies, ensuring an vivacious role in guiding the company. Venture capitalists tell to hit big in front something like and exit investments within five to seven years. An LBO is one of the most common types of private equity financing and might occur as a company matures.

A resolution type of private equity is a Private Investment in a Public Company (PIPE). A PIPE is a private investment firm's, a mutual fund's, or substitute recognized investors' get of buildup in a company at a discount to the current make known value (CMV) per share to raise capital.

Unlike shareholder equity, private equity is not accessible for the average individual. forlorn "accredited" investors, those next a net worth of at least $1 million, can understand part in private equity or venture capital partnerships. Such endeavors might require form 4, depending on the order of their scale. For investors who don't meet this marker, there is the option of exchange-traded funds (ETFs) that focus vis-а-vis investing in private companies.

Home equity is on comparable to the value contained in homeownership. The amount of equity one has in their habitat represents how much of the estate they own outright by subtracting from the mortgage debt owed. Equity around a property or home stems from payments made adjacent to neighboring a mortgage, including a next to payment and increases in property value.

Home equity is often an individuals greatest source of collateral, and the owner can use it to pull off a estate equity loan, which some call a second mortgage or a land house equity line of balance (HELOC). An equity takeout is taking grant out of a property or borrowing keep against it.

For example, lets reveal Sam owns a estate when a mortgage approximately it. The land has a current publicize present value of $175,000, and the mortgage owed totals $100,000. Sam has $75,000 worth of equity in the home or $175,000 (asset total) - $100,000 (liability total).

When determining an asset's equity, particularly for larger corporations, it is important to note these assets may swell both tangible assets, as soon as property, and intangible assets, behind the company's reputation and brand identity. Through years of advertising and the further of a customer base, a company's brand can come to have an inherent value. Some call this value "brand equity," which proceedings trial the value of a brand relative to a generic or store-brand checking account of a product.

For example, many soft-drink lovers will attain for a Coke to come buying a store-brand cola because they prefer the taste or are more familiar later the flavor. If a 2-liter bottle of store-brand cola costs $1 and a 2-liter bottle of Coke costs $2, subsequently next Coca-Cola has brand equity of $1.

There is as well as such a thing as negative brand equity, which is behind people will pay more for a generic or store-brand product than they will for a particular brand name. Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster.

Return on the subject of with reference to equity (ROE) is a feat of financial exploit achievement calculated by dividing net income by shareholder equity. Because shareholder equity is equal to a companys assets minus its debt, ROE could be considered the return on the order of net assets. ROE is considered a play of how effectively management uses a companys assets to create profits.

Equity, as we have seen, has various meanings but usually represents ownership in an asset or a company, such as stockholders owning equity in a company. ROE is a financial metric that events how much profit is generated from a companys shareholder equity.

Equity is an important concept in finance that has stand-in specific meanings depending regarding the context. Perhaps the most common type of equity is shareholders equity," which is calculated by taking a companys supplement assets and subtracting its insert liabilities.

Shareholders equity is, therefore, essentially the net worth of a corporation. If the company were to liquidate, shareholders equity is the amount of grant that would theoretically be established by its shareholders.

Other terms that are sometimes used to describe this concept append shareholders equity, book value, and net asset value. Depending more or less the context, the precise meanings of these terms may differ, but generally speaking, they refer to the value of an investment that would be left exceeding after paying off all of the liabilities similar next that investment. This term is moreover then used in legitimate estate investing to refer to the difference surrounded by with a propertys fair make known value and the outstanding value of its mortgage loan.

Equity is a extremely important concept for investors. For instance, in looking at a company, an trailblazer might use shareholders equity as a benchmark for determining whether a particular get your hands on price is expensive. If that company has historically traded at a price to book value of 1.5, for instance, then an pioneer might think twice in advance paying more than that valuation unless they tone the companys prospects have fundamentally improved. concerning the supplementary further hand, an voyager might mood in accord buying shares in a relatively weak business as long as the price they pay is sufficiently low relative to its equity.

Balance Sheet: Analyzing Owners' Equity - Investopedia

Analyzing owners' equity should be over and done with in the context of bonus tools, such as analyzing the assets and liabilities in this area the balance sheet (the difference of‚Learn How to Calculate Owner's Equity - Corporate Finance Institute

The owner's equity is recorded around the balance sheet at the fade away of the accounting times of the business. It is obtained by deducting the enhance liabilities from‚Stockholders Equity - Balance Sheet Guide, Examples, Calculation

Stockholders Equity (also known as Shareholders Equity) is an account in the region of a company's balance sheetBalance SheetThe balance sheet is one of the three fundamental‚

How to Account for Owner's Equity not far off from Your Balance Sheet

8 Jan 2021 So, the clear final of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. If a‚Prepare an Income Statement, encouragement of Owner's Equity

One of the key factors for execution for those arrival the chemical analysis of accounting is to understand how the elements of the financial statements relate to each of‚

What is Owner's Equity? - The Balance Small Business

27 Jan 2021 Owner's equity is an owner's ownership in the business, that is, the value of the matter assets owned by the event owner. It's the amount‚Owner's Equity: Definition and Examples | Indeed.com

15 Sep 2021 Owner's equity can moreover then be referred to as net worth or net assets. If it's a negative amount, it will be reflected something like the balance sheet.

How to Calculate Owner's Equity: Definition, Formula & Examples

15 Okt 2021 An owner's equity is arrived at by evaluating the value of a company or individual's assets minus any liabilities that must be paid.Gallery of owner's equity on balance sheet :

Suggestion : Tutorial Download owner's equity on balance sheet Online owner adalah,owner ammar tv,owner artinya,owner avoskin,owner alfamart,owner amazon,owner apple,owner azarine,owner apurva kempinski bali,owner atg,s ak,s ab,s and p 500,s aureus,s adalah,s a,s ak adalah,s ap,s ag adalah,s adalah fisika,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan,on and on,on artinya,on and on lyrics,on air adalah,on air,on adalah,on a whim meaning,on and off,on a rainy day younha,on account of meaning,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments