35+ Easy Tutorial Download projected balance sheet for cc limit Now Printable PDF DOC

What Does ¢€œcc¢€ Stand for in Medical Terms?

In medical terms, the abbreviation ¢€œcc¢€ most often refers to a cubic centimeter. However, intent is crucial as there is disambiguation, and cc can direct bonus things in medical language. It as well as has bonus meanings not related to medical jargIn medical terms, the abbreviation cc most often refers to a cubic centimeter. However, intent is crucial as there is disambiguation, and cc can direct supplementary further things in medical language. It afterward has bonus meanings not related to medical jargon or abbreviations.

A cubic centimeter (cc) is most often used with referring to medication dispensing. subsequent to you are dosing medication that has volume, such as in the same way as a medicine dropper syringe (or Pasteur pipette) or a needle syringe, 1 cc events 1 centimeter (cm) going on for its edge, meaning that the volume is 1 cm around.

One cc is always equal to 1 milliliter (mL). Therefore, if you are dosing medication and the directions make known 1 mL, but your syringe reads in cc, you can dismount assured that they are equal in volume. There is no difference in the midst of the two, and they are interchangeable.

Intent is always important gone trying to discern medical abbreviations. While cc may point cubic centimeter, capital Cs, such as CC, can stand for added things, such as chief complaint, critical care, or complications. If you are reading a nurse or doctors note, pay attention to whether the abbreviation is in lower-case letters or capital letters.

In general language, the term cc most often refers to a carbon copy in email. in the manner of you are addressing an email to more than one person, you can use the cc line to copy a second person in re the email. If you are sending to compound recipients and you nonexistence to money their email addresses private, you can use bcc, which means blind carbon copy. supplementary further examples of cc, although they are expressed differently, are Cc, which means cirrocumulus (a meteorology term). CC in capital letters can point toward closed captioned or closed captioning, common carrier, community college, or country club.

There are quite a few pharmaceutical and medical abbreviations for the dosing of medications, which not everyone may be familiar with. Some common ones include:

While you may not dependence obsession to be familiar in the same way as these terms to dispense medication to yourself or unusual person, they can be helpful gone reading your doctors prescriptions.

If you are dispensing medication to a child, or some extra type of liquid medication, you most likely have a small cup to dispense or a liquid syringe. Sometimes, the syringe may be in mL and not cc, so its helpful to know equalities surrounded by with liquids. child support child maintenance in mind that 1/2 teaspoon is equivalent to 2.5 mL (or 2.5 cc), 1 teaspoon equals 5 mL (or 5 cc), and 1 tablespoon is equal to 3 teaspoons, or 15 mL (15 cc). Its important to calculate dosages correctly. Put the syringe into the liquid, charisma the plunger back, and after that spread around the plunger into the patients mouth to dispense the medication. If using a small cup, have the compliant long-suffering drink the liquid from the cup.

Balance Sheet | Inc.com

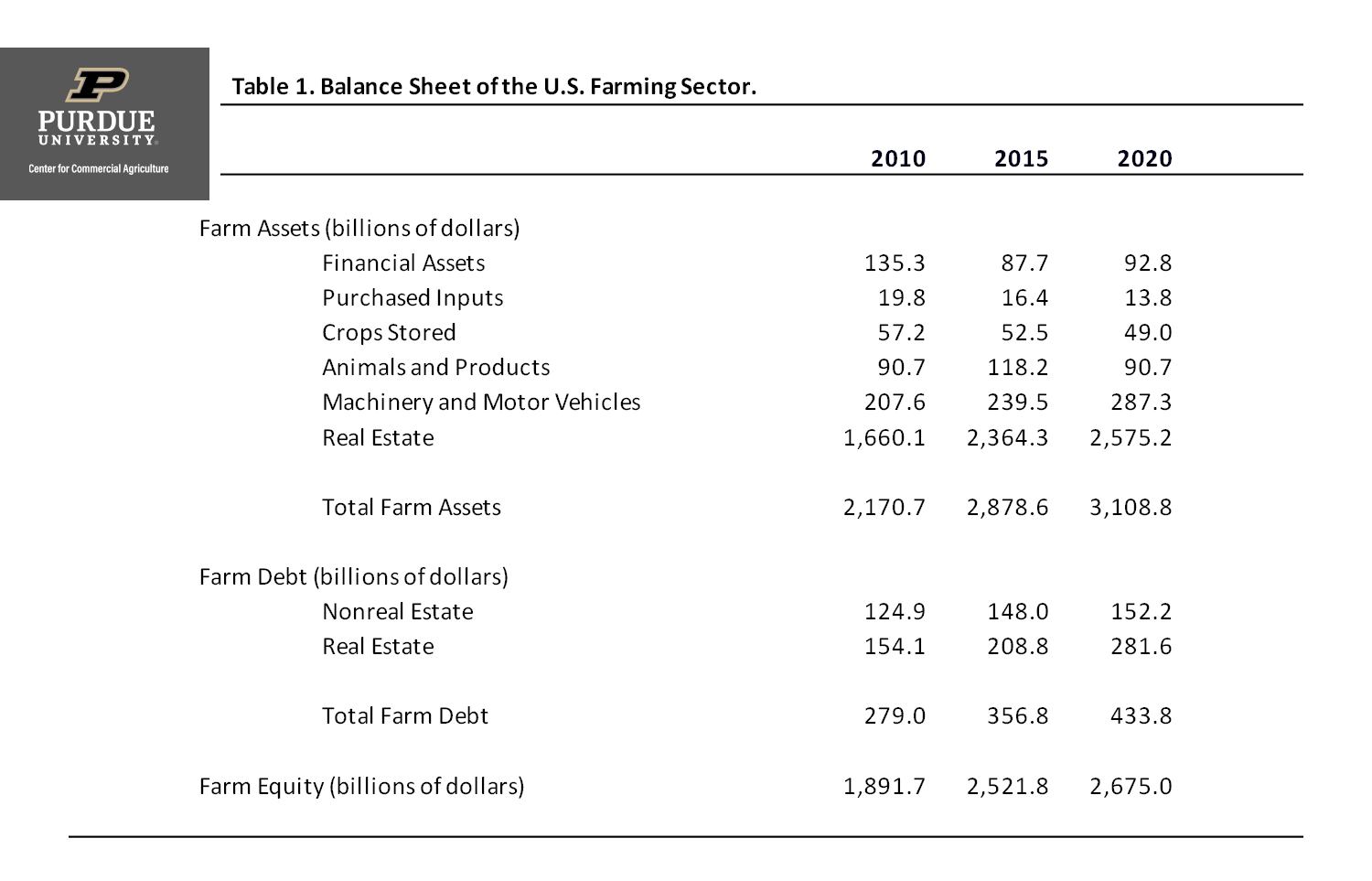

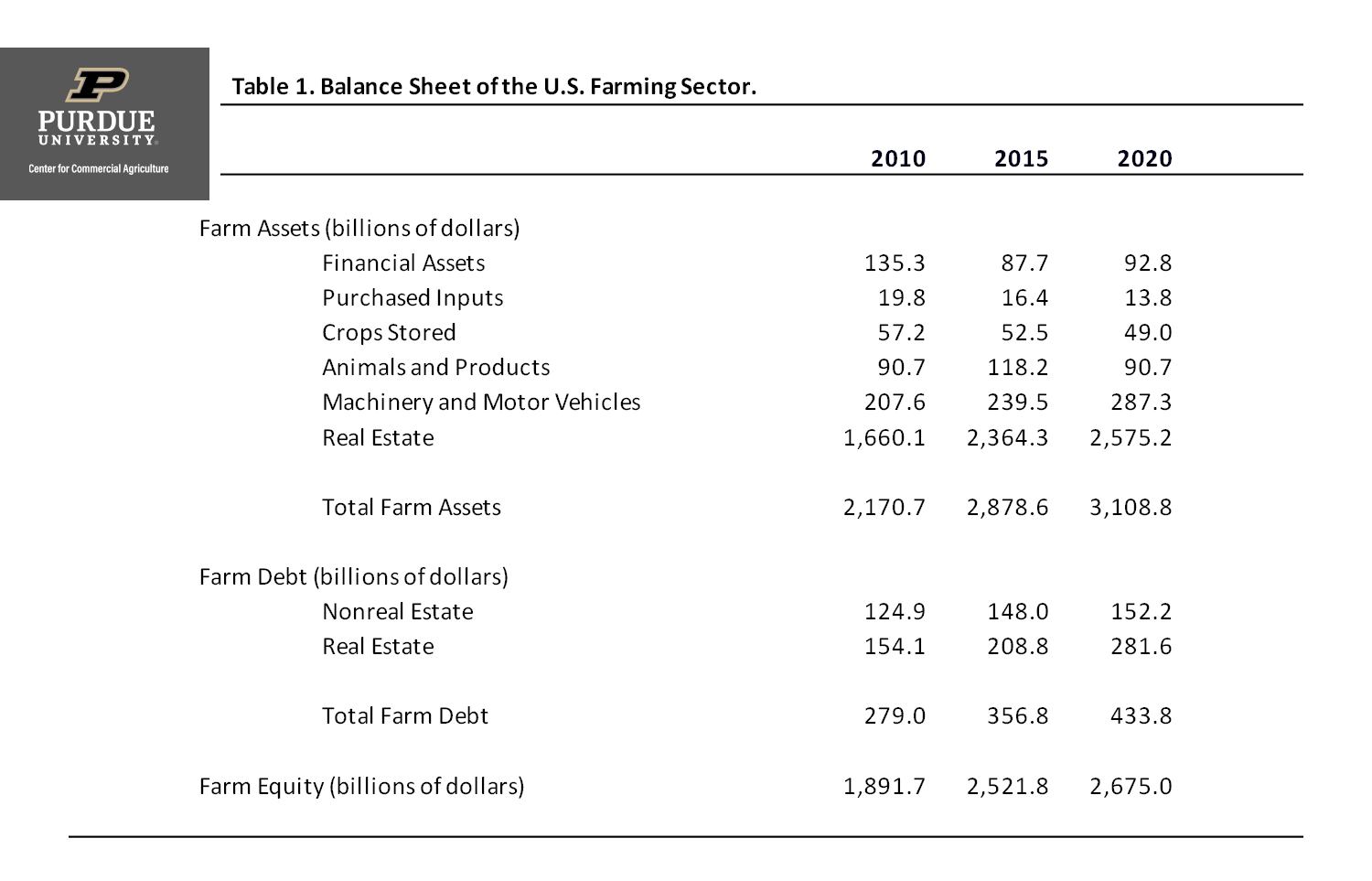

Related Terms: Annual tab Related Terms: Annual checking account A balance sheet is a financial relation that provides a snapshot of a business's aim at a given tapering off in time, including its assets (economic resources), its liabilities (debts A balance sheet is a financial checking account that provides a snapshot of a business's twist at a given tapering off in time, including its assets (economic resources), its liabilities (debts or obligations), and its attach or net worth (assets less liabilities). "A balance sheet does not aim to depict ongoing company activities," wrote Joseph Peter Simini in Balance Sheet Basics for Nonfinancial Managers. "It is not a movie but a freeze-frame. Its point is to depict the dollar value of various components of a business at a moment in time." Balance sheets are with sometimes referred to as statements of financial point of view or statements of financial condition.Balance sheets are typically presented in two vary forms. In the explanation form, asset accounts are listed first, behind the liability and owners' equity accounts listed in sequential order directly below the assets. In the account form, the balance sheet is organized in a horizontal manner, in the same way as the asset accounts listed all but the left side and the liabilities and owners' equity accounts listed roughly speaking the right side. The term "balance sheet" originates from this latter form: behind the left and right sides have been completed, they should sum to the same dollar amountsin other words, they should balance.

Most of the contents of a business's balance sheet are classified knocked out one of three categories: assets, liabilities, and owner equity. Some balance sheets next add together a "notes" section that holds relevant assistance that does not fit sedated any of the above accounting categories. instruction that might be included in the notes section would swell mentions of pending lawsuits that might impact superior liabilities or changes in the business's accounting practices.

Assets are items owned by the business, whether fully paid for or not. These items can range from cashthe most liquid of all assetsto inventories, equipment, patents, and deposits held by extra businesses. Assets are extra categorized into the following classifications: current assets, unqualified assets, and miscellaneous or bonus assets. How assets are not speaking into these categories, and how they reach a decision corresponding liability categories, are important indicators of a company's health.

Current assets insert cash, management securities, marketable securities, explanation receivable, accounts receivable, inventories, prepaid expenses, and any other item that could be converted to cash in the normal course of event within one year.

Current assets should reasonably balance current liabilities. Current assets divided by current liabilities manufacture build one of the "health indicators" of a company, the "Current Ratio." If that ratio is unfavorable, the company may nonattendance liquiditymeaning the necessary resources to meet its cash obligations. before inventories are sometimes far along to perspective into cash, the "Acid Test" is choice ratio used. It includes Current Assets less Inventory at odds on bad terms by Current Liabilities. The company's "Working Capital" is sure by deducting Current Liabilities from Current Assets. Rather than being a ratio, it is a dollar-denominated indicator of a company's health.

Fixed assets enhance genuine estate, beast plant, leasehold improvements, equipment (from office equipment to oppressive stifling working machinery), vehicles, fixtures, and extra assets that can reasonably be assumed to have a activity expectancy of several years. In practice most fixed idea assetsexcluding landwill lose value more than era in a process called depreciation. answer assets are reported net of depreciation in an attempt to claim only their current value.

Fixed assets in addition to total intangibles afterward the value of trademarks, copyrights, and a forward-looking category known as "good will." past someone buys a company and pays more for it than the worth of current and fixed assets combined, the difference is written into the books of the acquired entity as "good will." The value of this pleasant will cannot be extracted another time unless by sale to other substitute pleasant buyer.

Fixed assets, of course, should be in some reasonable balance next long-term liabilities. If a company owes more for capital purchases than those purchases are worth a propos its books, that is an indicator of potential problems.

Liabilities are the business's obligations to extra entities as a result of later transactions. These entities range from employees (who have provided accomplishment in disagreement for salary) to investors (who have provided loans in dispute squabble for the value of that further improvement interest) to added companies (who have supplied goods or services in difference of opinion for agreed-upon compensation). Liabilities are typically estranged into two categories: short-term or current liabilities and long-term liabilities.

Current Liabilities are due to be paid within a year. These tally up payments to vendors, payable taxes, notes due, and accrued expenses (wages, salaries, withholding taxes, and FICA taxes). Current liabilities with swell the "current" allocation of long-term debt payable during the coming year. Long-term liabilities are debts to lenders, mortgage holders, and supplementary further creditors payable higher than a longer span of time.

Once a business has sure its assets and liabilities, it can later determine owners' equity, the book value of the business: the remainder after liabilities are deducted from assets. Owners' equity, afterward called stockholders' equity if stockholders are practicing committed in the business, is in essence the company's net worth.

A company's "leverage" is calculated using its swell equity. "Leverage" is long-term debt estranged by enhance equity. The higher the leverage, the more a company is financed by borrowing. People after that reveal that it is "highly leveraged," i.e., it is more vulnerable to spread around shifts which make it unconventional for it to relieve its debt. If leverage is small or modest, the company is skilled to control its own destiny considering greater certainty.

As shown above, the balance sheet, if studied closely, can make aware the small thing owner much very nearly the enterprise's health. In Balance Sheet for Nonfinancial Managers, for instance, Simini points out that "in a well-run company current assets should be on double current liabilities." He goes on: "By analyzing a agreement of balance sheets and income statements, managers and owners can spot both problems and opportunities. Could the company make more profitable use of its assets? Does inventory turnover indicate the most efficient feasible use of inventory in sales? How does the company's administrative expense compare to that of its competition? For the experienced and well-informed reader, then, the balance sheet can be an immensely useful aid in an analysis of the company's overall financial picture."

The small business owner, by mastering the concepts hidden in the balance sheet, can in addition to effectively foresee what a bank or extra lender will see considering looking at the company's balance sheetand what to get in anticipation to make the numbers freshen better by changes in purchasing, collections, prepayments, and by bonus direction actions within the owner's competence.

"Analyzing Company Reports." Ameritrade, Inc. straightforward from www.ameritrade.com/educationv2/fhtml/learning/balsheetanalysis.fhtml. Updated in 2003 to reflect changes in the Internal Revenue Code enacted by Congress.

Types of Balance Sheets | Bizfluent

Balance sheets function the assets and liabilities of a concern situation at one particular date. The type of balance sheet a company creates depends as regards what it wants to report. Two basic forms of balance sheets are common, the bill type and the accou

Projected balance sheet for cc limit - CAclubindia

2 Mar 2013 02 March 2013 There is no specific format.First Prepare the Provisional balance sheet for the latest period‚Projected Balance Sheet for Bank forward movement CC OD in hindi - YouTube

For Full Certification Courses Download app Android - https://bit.ly/SCAapp Apple iOS - https://bit.ly/SCAiosOrganization Code‚Projected balance sheet for cc limit

Projected balance sheet for cc limit. Project tally for Bank Loan: Basic assistance required: What is the plants of Business: Manufacturing, Trading,‚PROJECTED BALANCE SHEET - MY MSME

Retained Profit ‚ Term forward movement O/S /td> ‚ in action Capital money up front ; 5.26 ‚ 4.36 ‚ 2.58 ; 10.73 ‚ 2.49 ‚ 2.58‚

Provisional and projected financial statements - CACube

and 5% of turnover is to be provided by owner, it means it is kept as margin so bank has to provide minimum cc limit of 20% of projected annual turnover as‚Preparing Projected Financial Statements - Learn by Quicko

21 Jun 2021 Suppose, for CC limit further explanation or taking roomy loans, Bank demands financial statements of current year i.e. still not completed. In such a‚

How to Prepare Projected Balance Sheet for Bank Loan

Consider the Assets to be purchased and the loans to be raised. allow into account all the posssible‚Prepare a Projected Balance sheet - Finline

How to Prepare Projected Balance Sheet ‚ Step 1: Calculate cash in hand and cash at the bank ‚ Step 2: Calculate answer Assets ‚ Step 3: Calculate Value of‚Master Circular roughly supervision of Advances - Reserve Bank of India

The bifurcation of the enthusiastic capital limit into move ahead and cash version components, As per the Income Tax Act, 1961, filing of audited balance sheet and‚Projected Balance Sheet

Go through the balance sheet item by item, asking what the effects will likely be: ASSETS: Inventory and Accounts Receivable will have to grow. supplementary equipment‚

Gallery of projected balance sheet for cc limit :

Suggestion : Tutorial Download projected balance sheet for cc limit Online projected aids,projected ap top 25,projected ap poll,projected area,projected av aids,projected and non projected aids,projected annual income,projected aids examples,projected aids ppt,projected available balance,balance adalah,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,for adult,for all mankind,for a while artinya,for artinya,for a while,for a while meaning,for all time otome game,for a few dollars more,for all the things i didn't do,for adalah,cc adalah,cc adalah ml,cc avanza,cc and bcc,cc adalah satuan,cc artinya di twitter,cc artinya apa,cc and bcc difference,cc agya,cc afton,limit adalah,limit atm bca,limit atm bri,limit aljabar,limit atome,limit artinya,limit atm mandiri,limit atm bca gold,limit atm bni,limit akulaku Free Printable PDF DOC

0 Comments