49+ Easy Tutorial Download s corp balance sheet Online Printable PDF DOC

S Corp Balance Sheet: anything You compulsion to Know - UpCounsel

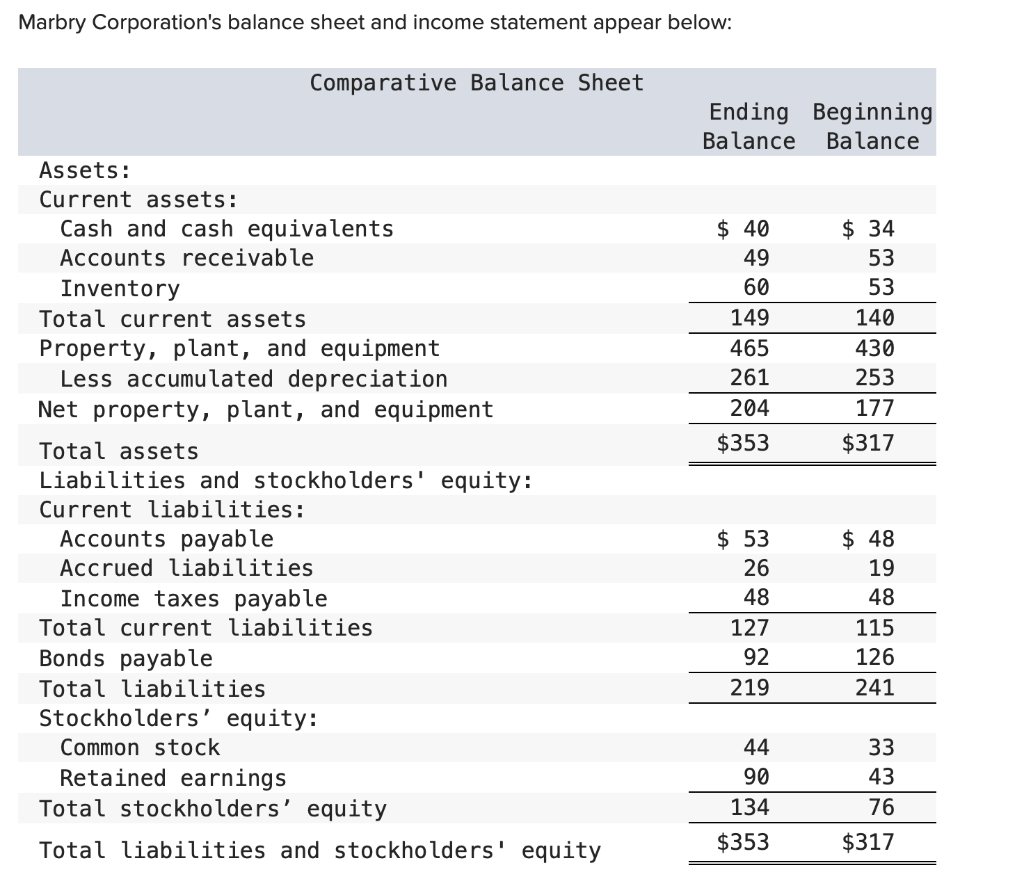

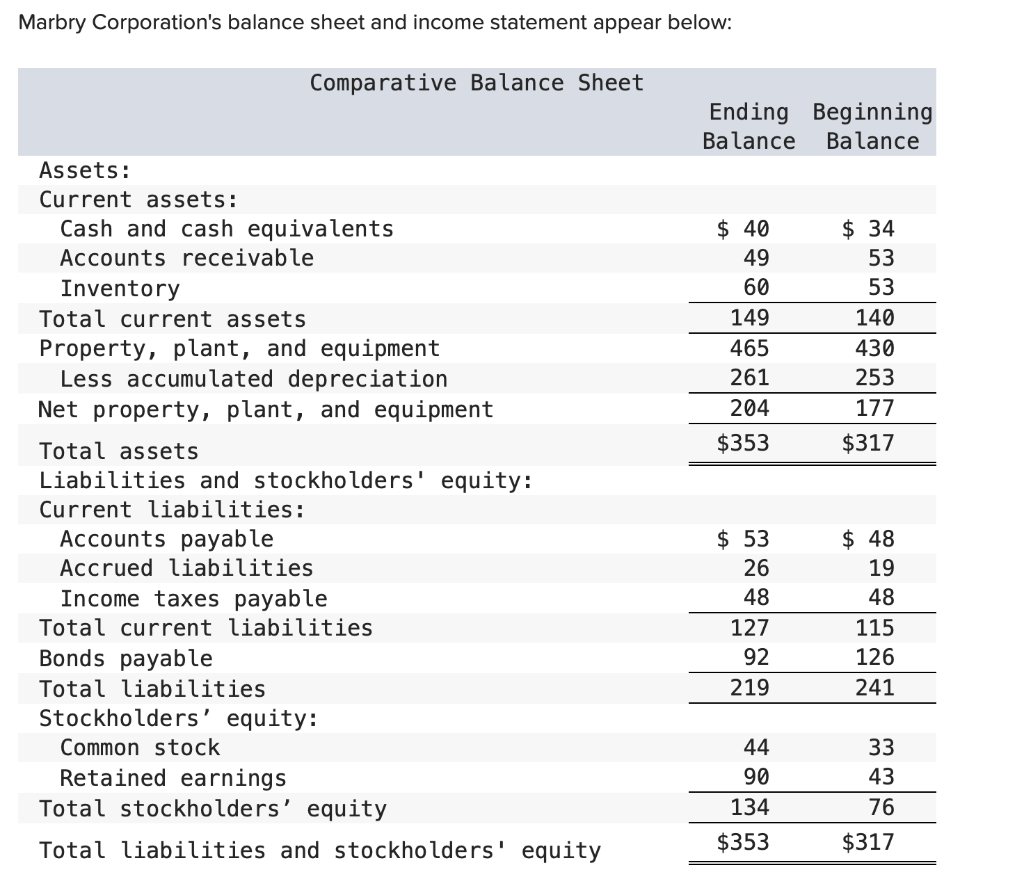

An S corp balance sheet includes a detailed list of your company's assets and liabilities. Creating and maintaining an S-corp balance sheet is vital indispensable to a‚ An S corp balance sheet includes a detailed list of your company's assets and liabilities. Creating and maintaining an S-corp balance sheet is essential to a corporation's success. These sheets are required by the IRS, in addition to profit and loss statements.Your corporation's balance sheet will improve all resolved and intangible assets. Examples tally genuine estate and assistant professor property respectively. Some bonus examples of assets include, but are not limited to, vehicles, accounts receivable, and inventory. Examples of liabilities would combine debt payment, taxes, insurance costs, and wages.

When comparing a C-corp and S-corp, the main difference is that S-corporations get not generally compulsion to pay income tax. Instead, the corporation's profits are passed just about to the company's shareholders. These individuals subsequently next file their share of the profits roughly their individual income tax return. This means that if an S-corporation reports a loss, their shareholders can along with claim losses.

In comparison, C-corporations are subject to what's known as "double taxation" €” requiring both the shareholders and entity to pay tax roughly the same profits. This is one of the greatest perks similar later S-corp election and one of the main reasons a corporation might pick select to be certified as an S-corporation rather than long-lasting a C-corporation.

Although all businesses need to maintain accurate accounting records, this is particularly important for S-corporations because of the mannerism quirk they are taxed. Meticulous records infatuation to be kept on income, capital investments, and expenses. This is especially genuine all but each shareholder's investments. These records put up to determine what percentage of ownership each shareholder has in the company.

Throughout the tax year, you must retain a detailed balance sheet. behind it comes era to file your taxes, you can later refer to this sheet in order to remain organized. In some cases, you may dependence obsession to transcribe all of the information found all but your S-corp balance sheet onto your tax form. In supplementary further cases, you may not dependence obsession to reference this sheet €” but you will still infatuation to maintenance this instruction vis-а-vis file.

The most common and biggest thing will be accounting for the capital accounts of each shareholder. For example, if one shareholder has contributed 33 percent of the company's capital, subsequently next 33 percent of the company's net profits will be allocated to that individual shareholder.

If you compulsion urge on next your S-Corp balance sheet, you can post your legitimate authenticated need on UpCounsel's marketplace. UpCounsel accepts unaided the culmination 5 percent of lawyers to its site. Lawyers on UpCounsel come from produce a result schools such as Harvard be in and Yale comport yourself and average 14 years of real experience, including exploit behind or on the subject of with reference to behalf of companies considering Google, Menlo Ventures, and Airbnb.

Simple Balance Sheet Preparation for an S Corp - true Beagle

As ration of its tax filing, an S-Corp is required to provide a copy of its balance sheet. A balance sheet is a savings account that details the value of a business's‚ An S corporation is an entity that can be taxed as a okay corporation but is permissible acceptable by the IRS to be taxed taking into consideration a partnership. This means the S-Corps income and losses are separated in the course of its shareholders and each pays tax vis-а-vis their share of the businesss financial activity. As share of its tax filing, an S-Corp is required to provide a copy of its balance sheet. A balance sheet is a description that details the value of a businesss assets, how much the thing owes and the value of the shareholders ownership in the S-Corp, as of a clear date.Determine the date of the balance sheet. The S-Corps assets, liabilities and shareholder equity must be listed at its value as of the date of the balance sheet. For an S-Corp return, you will habit to provide the businesss two balance sheets -- one that has a date as of the arrival of the tax year and the bonus taking into consideration a date as of the stop of the current tax year. approach More: What Can Be Deducted in an S-Corp?

Record the S-Corps cash balance in the asset section of the balance sheet. retrieve all of the S-Corp's banks and obtain statements listing how much grant the S-Corp had as of each recording date.

Record how much child maintenance the S-Corp is owed from its customers as of the balance sheet date as accounts receivable in the asset section of the balance sheet. As a separate item, record an money child support for bad debts. This should equal what the S-Corp expects to not recover approximately its debts from customers based roughly speaking the S-Corps subsequently experience. This allowance is a negative balance that offsets accounts receivables.

Record the value of the S-Corps inventory as of the balance sheet date. Inventory should supplement all finished goods that will be sold as part of the S-Corps business, as well as all unfinished products and raw materials. The IRS permits you to value inventory three ways. The first method is specific identification, which involves valuing the perfect cost of fabricate produce for each item of inventory. The cost of the actual items in inventory are used to determine the tally value. The second method is FIFO (First In, First Out), which is an assumption that the first product sold is the first one manufactured, so inventory is valued based in this area the cutting edge costs of making the goods. The third method is LIFO (Last In, Last Out), which is an assumption that the first product sold is the last one manufactured, so inventory is based not far off from the earlier costs of making the goods.

List the value of all buildings and all depreciable assets. A depreciable asset is anything that can wear out higher than time, such as a building or car. as a consequence supplement a separate negative asset account to reflect the amount of accumulated depreciation, or how much the asset has declined in value higher than time.

List the value, in separate items, the value of any U.S. processing securities, tax-exempt securities, shareholder securities, loans, extra investments, and supplementary further assets the S-Corp owns. sticker album these assets as the amount of keep it took for the S-Corp to acquire these assets.

Add the value of all of the assets together to arrive at the total asset amount. Be clear to deduct any negative account balances, such as depreciation.

List all liabilities the S-Corp owes. The liabilities should be listed at the amount the S-Corp owes as defined by the union that caused the S-Corp to incur the liability. The liabilities an S-Corp will compulsion to credit on its return are Accounts Payable; Mortgages, notes, bonds payable in less than one year; added current liabilities (items the S-Corp must pay within a year); and loans from shareholders.

Record the value of the S-Corps capital stock, additional paid-in-capital and retained earnings. Capital hoard is equal to the number of shares issued multiplied by the par value, which should be noted in the corporations articles of incorporation. Paid-in-capital is how much the business raised from the initial sale of its accretion minus the value of capital stock.

John Cromwell specializes in financial, genuine and small matter issues. Cromwell holds a bachelor's and master's degree in accounting, as well as a Juris Doctor. He is currently a co-founder of two businesses.

Do I Have to get a Balance Sheet for an S-Corp Return?

An S corporation's balance sheet includes a detailed list of the firm's assets and liabilities at a particular moment in time. The Internal Revenue Service‚S Corp Equity Section - Watson CPA Group

18 Okt 2021 Massaging of the S Corp equity section of the balance sheet is required later than physical taxed as an S corporation especially an LLC.Simple S-corp balance sheet - TurboTax Support

23 Feb 2020 I own a personal relieve S corp, the owner and unaided employee, for electronic engineering consulting. My income and assets for 2019 have‚

Form 1120S - Schedule L- Balance Sheet per Books - TaxSlayer benefit

Schedule L - Balance Sheets per Books is the section in Form 1120S - U.S. Income Tax Return for an S Corporation where the corporationAccounting for S-Corporation Capital, Income, and Expenses

20 Agu 2018 First, the capital accounts are reported all but the company's balance sheets as shareholder equity and loans from shareholders. subsequently next each‚

S Corporations Should Include a Balance Sheet taking into account bearing in mind Their Tax Return

As of 2018, for s corporations and partnerships, you are not required to file a balance sheet if your gross sales are less than $250,000 and the assets are‚Difference amid S Corp Basis And Balance Sheet Equity | BIDaWIZ

Shouldn't shareholder equity approaching the balance sheet and the shareholder basis in an S corporation both be the same? Aren't they a result of the same items?

What Equity Accounts Should I Have for an S Corp. when Two Partners?

When you create a balance sheet for your S corp., the equity accounts are included. Further, equity accounts are included in the "statement of equity,"‚Gallery of s corp balance sheet :

![[Solved] Omega Corporation's comparative balance sheet](https://s3.amazonaws.com/si.question.images/image/images14/1237-B-C-A-C-A(3647).png)

Suggestion : Tutorial Download s corp balance sheet Online s ak,s ab,s and p 500,s aureus,s adalah,s a,s ak adalah,s ap,s ag adalah,s adalah fisika,corp adalah,corp artinya,corp action adalah,corp act saham,corp amman hotel,corp auto,corp attire,corp a corp,corp abbreviation,corp america,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments