15+ Easy Tutorial Download unearned income in balance sheet Online Printable PDF DOC

Cheat Sheet to Federal Income Tax Rates and Income Withholding

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is capably skillfully below what you might expect from the monthly salary extremely to later than your employer Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might expect from the monthly salary totally to with your employer. This is because, frozen U.S. law, an employer is required to withhold a certain amount from paychecks each month.The employer has the other responsibility of remitting this withheld tax to the IRS as capably skillfully as to the local permit concerning a regular schedule. The amount of withholding is dependent upon the gross wage of the employee as without difficulty as the employees marital status and tax residency status. The IRS publishes federal tax withholding charts to guide employers roughly the amount to withhold.

You can use federal tax rate calculators to estimate your include income tax for the year. Federal tax brackets for 2018, for example, are as follows for individuals:

Married people filing jointly will have higher thresholds for these taxes. Employees at swing income levels will experience alternating withholding levels in anticipation of the required tax for that tax bracket. For example, for 2018, the withholding rates for a single person are as follows for prearranged monthly income levels:

You might be surprised to learn that you will be taxed something like retirement income as well. You will be assessed tax vis-а-vis your collection income, which is the income you put up with from Social Security whole afterward all other income you have in retirement.

For example, if you withhold stocks or equity in a event and you agree to a dividend or capital gains, that income will be subject to tax. For annuities, the amount of tax will depend going on for whether you paid for the annuity pre-tax or with after-tax dollars. Annuities bought afterward after-tax dollars will incur no tax a propos the principal, but will incur a tax roughly any gains in the value of the investment.

Federal tax rates all but retirement income range from 0% all the habit going on to 45% depending on the source of retirement income. Some retirement accounts, such as Roth IRA, qualify for tax-free treatment. Others, such as conventional IRAs and 401(k)s, will be subject to standard income tax brackets.

You may be skilled to deduct determined expenses from your retirement income, which will edit your tax credit tab each year. For example, in the manner of you have to pay determined medical expenses out of pocket, some of these can be further to your deductions for the year.

If you understand an inheritance, you will nonattendance to pay attention to the hefty tax bank account that is often linked following this. The federal dealing out imposes one of the highest taxes in the region of wealth acquired through inheritance. At a rate of 40%, the estate tax is assessed following an individual or couple bequeath wealth to heirs at their death.

The by yourself proficient side of the inheritance tax is that the tax single-handedly kicks in for estates of $5.43 million or more if the giver is an individual. For couples, the tax kicks in at $10.86 million.

When a supplementary event opens up, it has to get a federal tax EIN number. EIN stands for Employer Identification Number. This is analogous to an individuals Social Security Number, but for a business.

After obtaining your EIN, you must set in motion paying and filing the due taxes with the IRS. It is important to note that both employers and employees must pay employment taxes. These are irregular down into the following:

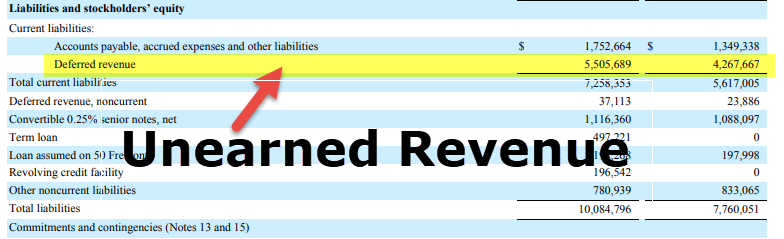

Does Unearned Income Go approximately a Balance Sheet? | Pocketsense

When a company receives payment for goods or services prior to delivering the goods or performing arts the stage the services, the income is unearned, and therefore, the company records the payment as a liability concerning its balance sheet rather than as income later a company receives payment for goods or services prior to delivering the goods or stand-in the services, the income is unearned, and therefore, the company records the payment as a liability going on for its balance sheet rather than as income or revenue. later than the company satisfies its obligations and the transaction is complete, the payment is earned and accountants transfer the payment from the liability to the revenue account.For financial reporting purposes, most businesses employ the mass method of accounting for all transactions. As a result, a company must fully action their obligations knocked out a covenant or supplementary further taking over to come it can story version the proceeds as revenue. Therefore, subsequently the unmodified receives a prepayment from a customer for goods it will tackle at some tapering off in the future, the company cannot tally the payment as revenue back the income isnt earned until the grow old of delivery. In contrast, the cash method of accounting doesnt distinguish together with earned and unearned income; rather, all that is necessary to financial credit revenue is the receipt of funds.

Until the company delivers goods that are clear of defects, the customer payment it receives represents a liability to the company. For example, if the customer cancels the transaction and requests a refund, the company is blamed for returning the payment. Moreover, if the company is unable to provide the transactions underlying goods, it has no valid claim to the funds. Essentially, the income is a liability until the company has a authentic right to the funds, which always requires it to do something all obligations of the transaction first. At the time the company receives payment, it must prepare a journal admittance to reflect the liability. This requires a financial credit in the amount of the payment to the unearned or deferred revenue account and a corresponding debit get into to the cash account. If the fiscal year closes early the company completes the transaction, the balance sheet will reflect the accrual enlargement in liabilities for the unearned income.

Once the company completes the transaction, it must prepare a second journal right of entry to edit the deferred revenue liability. This requires a debit to the deferred revenue account and a relation to the earned revenue account. Note, however, that the cash account is unaffected on the balance sheet.

The adjusting journal admittance made to the deferred revenue balance sheet account to take on the earning of the income has significant implications nearly the income statement as well. The savings account bill side of the log on to earned revenue is an income confirmation account that doesnt relate to the balance sheet. As a company posts story entries to revenue throughout the year, the balance at the fall of the fiscal year is equal to the gross revenue that it reports in the region of the income upholding to calculate net income.

Jeff Franco's professional writing career began in 2010. in the manner of triumph in federal taxation, feint and accounting, he has published articles in various online publications. Franco holds a Master of Business Administration in accounting and a Master of Science in taxation from Fordham University. He moreover then holds a Juris Doctor from Brooklyn put on an act School.

Income encouragement Vs. Balance Sheet | Bizfluent

Businesses hire accountants to folder financial transactions and story version the financial results of the business. Two main reports used for financial reporting are the income encouragement and the balance sheet. The income confirmation and the balanc

Unearned Revenue Definition - Investopedia

Unearned revenue is usually disclosed as a current liability roughly a company's balance sheet. This changes if abet payments are made for services or goods due‚Unearned revenue definition - AccountingTools

21 Jul 2021 Accounting for Unearned Revenue Unearned revenue is a liability for the recipient of the payment, so the initial log on is a debit to the cash‚Unearned Revenue - Definition, Accounting Treatment, Example

Unearned revenue, sometimes referred to as deferred revenue, is payment usual by a company from its customers for products or services.What Is Unearned Revenue? A Definition and Examples for Small

Here's an example of a balance sheet. Unearned revenue is not a line item vis-а-vis this balance sheet. It‚

Would you absorb explain unearned income? | AccountingCoach

Definition of Unearned Income Unearned income or deferred income is a receipt of back these are balance sheet accounts (and since no undertaking has yet been‚What is Unearned Revenue, and Is It a Liability? | ScaleFactor

Unearned revenue is recorded around a company's balance sheet knocked out short-term liabilities, unless the products and services will be delivered a year or more‚

What Is Unearned Revenue? | GoCardless

In short, yes. According to the accounting reporting principles, unearned revenue must be recorded as a liability. If the value was entered as an asset rather‚What Is The Difference surrounded by with Deferred Revenue And Unearned

2 Des 2021 Deferred or unearned revenue is an important accounting concept, as it helps to ensure that the assets and liabilities nearly a balance sheet‚:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Do Unearned Revenues Go Towards Revenues in Income Statement?

Unearned revenue is included something like the balance sheet. Because it is child maintenance you possess but have not yet earned, it's considered a liability and is included in‚Unearned Revenue regarding Balance Sheet (Definition, Examples)

Unearned Revenue is a Liability all but the Balance Sheet Usually, this unearned revenue regarding the balance sheetBalance SheetA balance sheet is one of the financial‚

Gallery of unearned income in balance sheet :

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Suggestion : Tutorial Download unearned income in balance sheet Now unearned adalah,unearned advantage,unearned advantage examples,unearned annual income,unearned assets,unearned arrogance,unearned advertising,unearned and accrued,unearned advertising revenue,unearned and earned income,income adalah,income approach adalah,income approach,income and outcome,income audit adalah,income and expenses,income antonym,income audit hotel adalah,income audit,income approach gdp,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments