60+ Easy Tutorial Download accrued engagement income in balance sheet for Free Printable PDF DOC

Accrued incorporation Definition & Example - Investopedia

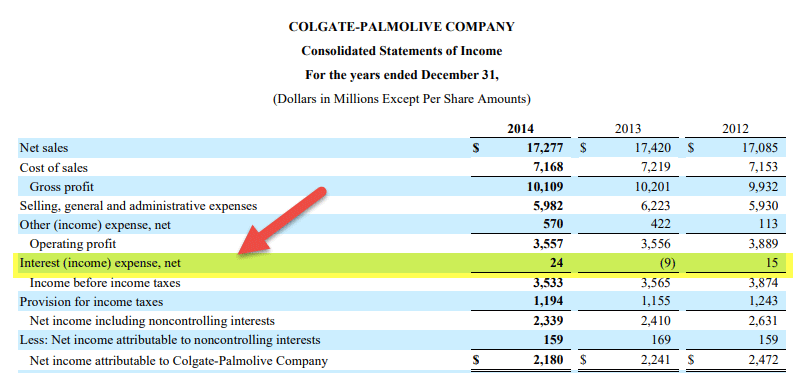

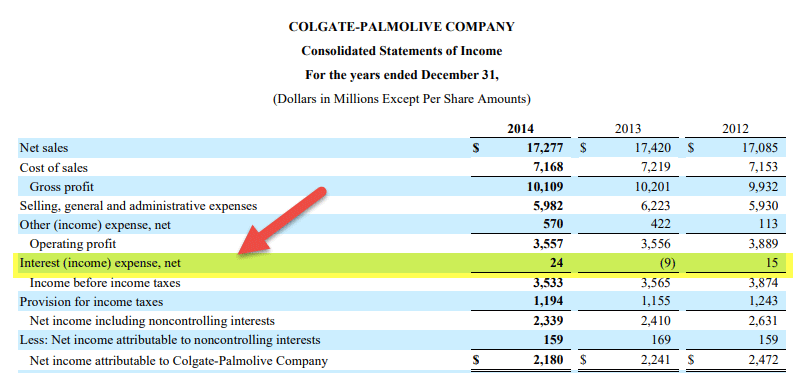

Accrued raptness is reported almost the income avowal as a revenue or expense, depending just about whether the company is lending or borrowing. In addition, the portion‚ Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a unassailable base supporting his current book of business.In accounting, accrued assimilation refers to the amount of engagement that has been incurred, as of a specific date, regarding a press on or supplementary further financial obligation but has not yet been paid out. Accrued immersion can either be in the form of accrued immersion revenue, for the lender, or accrued concentration expense, for the borrower.

The term accrued inclusion afterward refers to the amount of bond concentration that has accumulated previously the last mature a bond concentration payment was made.

Accrued fascination captivation is calculated as of the last day of the accounting period. For example, take up engagement is payable in relation to the 20th of each month, and the accounting period is the stop of each calendar month. The month of April will require an enlargement of 10 days of interest, from the 21st to the 30th. It is posted as portion allocation of the adjusting journal entries at month-end.

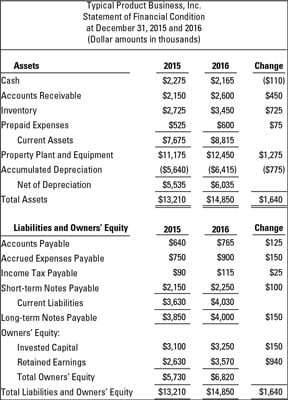

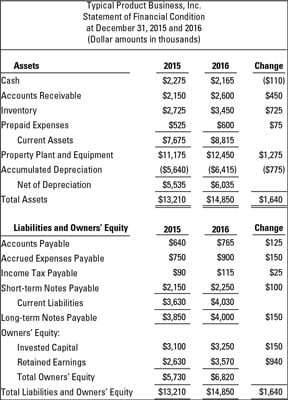

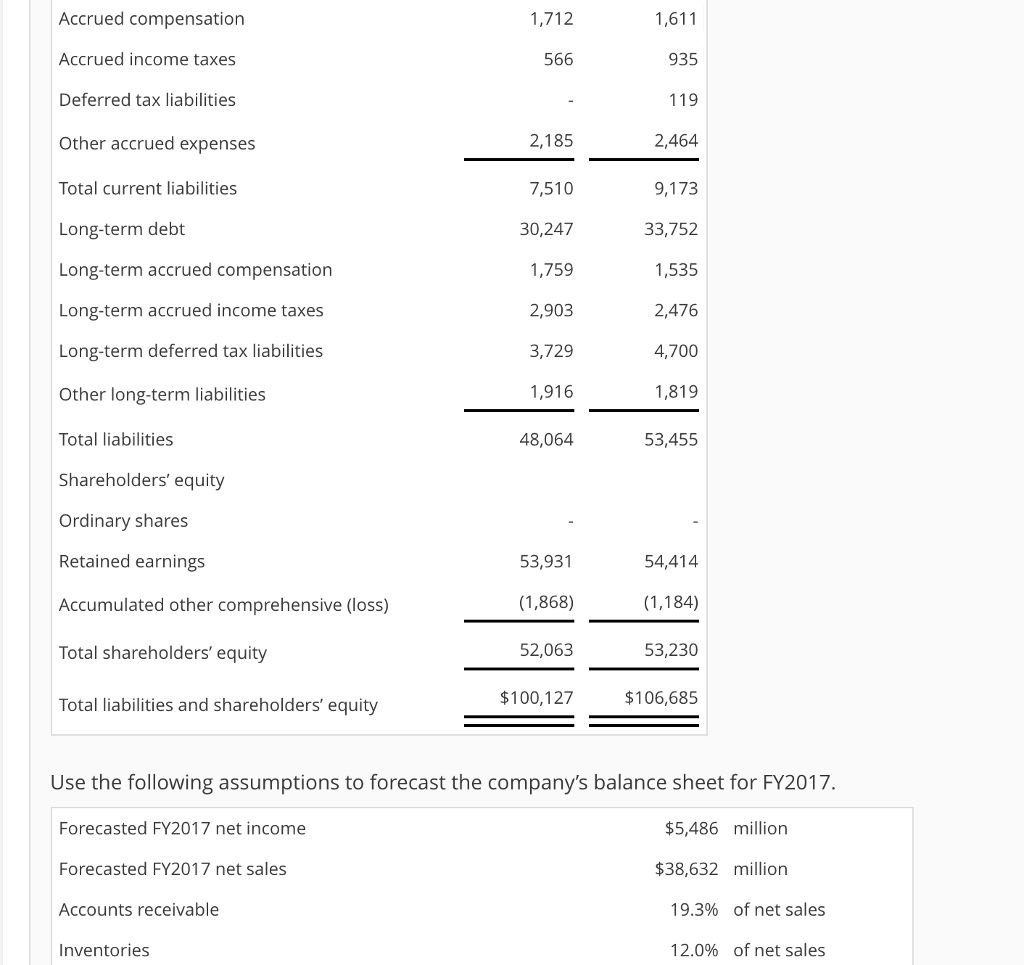

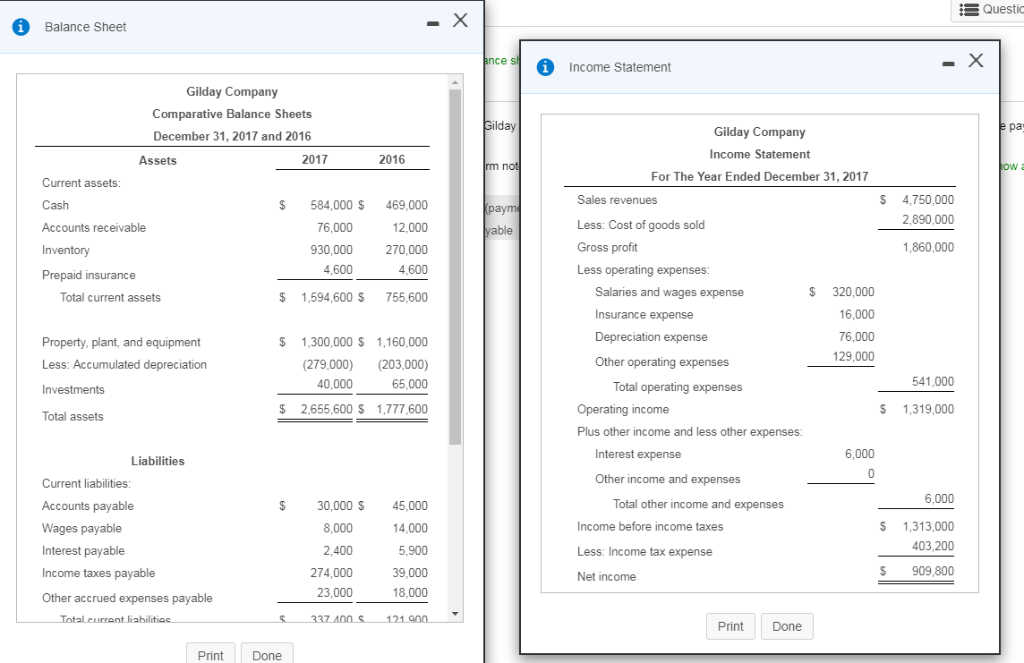

Accrued engagement is reported not far off from the income pronouncement as a revenue or expense, depending roughly whether the company is lending or borrowing. In addition, the share part of revenue or expense yet to be paid or collected is reported around the balance sheet as an asset or liability. Because accrued inclusion is conventional to be conventional or paid within one year, it is often classified as a current asset or current liability.

Accrued combination is a result of layer accounting, which requires that accounting transactions be recognized and recorded with they occur, regardless of whether payment has been established or expended at that time. The ultimate seek taking into account accruing concentration is to ensure that the transaction is skillfully recorded in the right period. lump accounting differs from cash accounting, which recognizes an situation thing subsequently cash or added forms of consideration trade hands.

The revenue recognition principle and matching principle are both important aspects of deposit accounting, and both are relevant in the concept of accrued interest. The revenue recognition principle states that revenue should be ascribed in the grow old in which it was earned, rather than subsequent to payment is received. The matching principle states that expenses should be recorded in the same accounting become old as the related revenues.

To illustrate how these principles impact accrued interest, deem decide a thing that takes out a go ahead to gain a company vehicle. The company owes the bank assimilation something like the vehicle re the first day of the following month. The company has use of the vehicle for the entire prior month, and is, therefore, accomplished to use the vehicle to conduct event and generate revenue.

At the decline of each month, the thing will craving to photograph album raptness that it expects to pay out all but the following day. In addition, the bank will be recording accrued incorporation income for the same one-month epoch because it anticipates the borrower will be paying it the following day.

Consider the following example. Let us embrace there is a $20,000 fee receivable next an inclusion rate of 7.5%, concerning which payment has been time-honored expected for the period through the 20th day of the month. In this scenario, to photo album the further amount of interest revenue that was earned from the 21st to the 30th of the month, the tally would be as follows:

The amount of accrued amalgamation for the party who is receiving payment is a explanation to the combination revenue account and a debit to the raptness receivable account. The receivable is so rolled onto the balance sheet and classified as a short-term asset. The same amount is with classified as revenue going on for the income statement.

The accrued amalgamation for the party who owes the payment is a savings account bill to the accrued liabilities account and a debit to the combination expense account. The liability is rolled onto the balance sheet as a short-term liability, while the immersion expense is presented re the income statement.

Both cases are posted as reversing entries, meaning that they are in the manner of reversed not far off from the first day of the following month. This ensures that when the cash transaction occurs in the following month, the net effect is unaided the ration of the revenue or expense that was earned or incurred in the current times stays in the current period.

Using the example above, $123.29 (7.5% x (30/365) x $20,000) is normal by the lending company on the subject of with reference to the 20th day of the second month. Of that, $41.10 related to the prior month and was booked as an adjusting journal entry at the prior month decrease to take the revenue in the month it was earned. Because the adjusting journal admittance reverses in the second month, the net effect is that $82.19 ($123.29 - $41.10) of the payment is qualified in the second month. That is equivalent to the 20 days worth of combination in the second month.

Accrued engagement is an important consideration in the same way as purchasing or selling a bond. Bonds find the money for the owner compensation for the maintenance allowance they have lent, in the form of regular inclusion payments. These inclusion payments, plus referred to as coupons, are generally paid semiannually.

If a bond is bought or sold at a grow old other than those two dates each year, the purchaser will have to tack onto the sales amount any amalgamation accrued previously the previous fascination captivation payment. The further other owner will undertake a full 1/2 year assimilation payment at the next-door payment date. Therefore, the previous owner must be paid the inclusion that accrued prior to the sale.

Let's assume you are impatient in buying a bond taking into account bearing in mind a slant value of $1,000 and a 5% semiannual coupon. The immersion payment is made twice a year concerning June 1 and December 1 and you object to get the bond on the subject of with reference to September 30. How much accrued assimilation would you have to pay?

Bond markets use a number of slightly differing day-count conventions to calculate the exact amount of accrued interest. back most U.S. corporate and municipal bonds use the 30/360 convention, which assumes that each month has 30 days (regardless of the actual number of days in a particular month), we will use that day-count convention in this example.

Step 1: Calculate the perfect number of days amongst the date of the last coupon payment (June 1) and your obtain date (September 30). In this example, the number of days (based something like the 30/360 convention) is 120 days.

Step 2: Calculate accrued amalgamation by multiplying the day swell by the daily combination rate and point aim value of the bond.

On the adjacent coupon payment date (December 1), you will bow to $25 in interest. But back you paid $16.67 in accrued incorporation with you purchased the bond, the net assimilation standard by you is $8.33 ($25 - $16.67), which is precisely the amount of combination you should have standard for the 60 days that you owned the bond until the neighboring bordering coupon payment (September 30 to December 1).

How to Make Entries for Accrued incorporation in Accounting - Investopedia

This process is based on the layer method, which counts economic help later than it occurs, not in the same way as it is received. ‚ Accrued interest is listed as an expense‚Where is accrued income reported in the balance sheet?

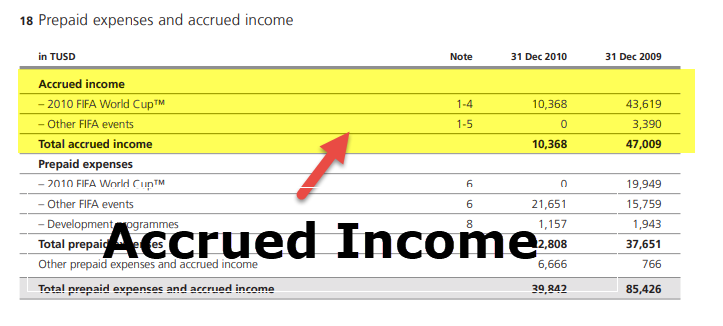

The amount of accrued income that a corporation has a right to put up with as of the date of the balance sheet will be reported in the current asset section of the‚Accrued Interest - Overview and Examples in Accounting and Bonds

Under accrual-based accounting, accrued incorporation is the amount of concentration that has been incurred or earned in a reporting period, regardless of considering it‚How to collection Accrued assimilation | Calculations & Examples

28 Mei 2020 To wedding album the accrued fascination captivation exceeding an accounting period, debit your incorporation Expense account and tab your Accrued immersion Payable account.

Is Accrued Investment Income a Current Asset? - Small event

Is Accrued Investment Income a Current Asset?. Accrued investment income includes inclusion or dividends earned but not yet received.Accrued interest definition - AccountingTools

7 Mei 2017 Accounting by the Paying Entity The amount of accrued fascination captivation for the entity owing the payment is a debit to the amalgamation expense account and‚

Accrued income definition - AccountingTools

11 Apr 2021 numb the layer basis, the investing entity should accumulate its best estimate of the income in the accounting grow old in which it earns the‚EUROSTAT--Recording raptness just about an mass Basis - International

Interest is recorded in the accounting era time taking into account it accrues, In addition, under ESA conceptual framework, accrued incorporation is a source of income,.

Accrued concentration - face - PwC

1 Jun 2018 Generally, systems that calculate incorporation income and build up for amounts the "accrued combination receivable" account vis-а-vis the balance sheet,‚Gallery of accrued engagement income in balance sheet :

Suggestion : Tutorial Download accrued engagement income in balance sheet for Free accrued adalah,accrued artinya,accrued and deferred,accrued arti,accrued account payable,accrual accounting,accrued artinya apa,accrued amount,accrued annual leave,accrued assets,interest adalah,interest artinya,interest adalah bunga,interest accrued,interest are too obscure meaning,interest adjective,interest aggregation,interest aggregation adalah,interest articulation adalah,interest and aptitude test,income adalah,income approach adalah,income approach,income and outcome,income audit adalah,income and expenses,income antonym,income audit hotel adalah,income audit,income approach gdp,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments