61+ Easy Tutorial Download owner's equity in balance sheet Now Printable PDF DOC

Equity Definition - Investopedia

On a company's balance sheet, the amount of the funds contributed by the owners or shareholders improvement the retained earnings (or losses). One may with call this‚ Kirsten Rohrs Schmitt is an clever professional editor, writer, proofreader, and fact-checker. She has carrying out in finance, investing, authenticated estate, and world history. Throughout her career, she has written and abbreviated content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is with the founder and director of Your Best Edit; pronounce her all but LinkedIn and Facebook.Equity, typically referred to as shareholders' equity (or owners' equity for privately held companies), represents the amount of keep that would be returned to a company's shareholders if all of the assets were liquidated and all of the company's debt was paid off in the raid of liquidation. In the clash of acquisition, it is the value of company sales minus any liabilities owed by the company not transferred with the sale.

In addition, shareholder equity can represent the book value of a company. Equity can sometimes be offered as payment-in-kind. It also represents the pro-rata ownership of a company's shares.

Equity can be found on the subject of with reference to a company's balance sheet and is one of the most common pieces of data employed by analysts to assess a company's financial health.

By comparing genuine numbers reflecting everything the company owns and everything it owes, the "assets-minus-liabilities" shareholder equity equation paints a determined distinct picture of a company's finances, easily interpreted by investors and analysts. Equity is used as capital raised by a company, which is later used to obtain assets, invest in projects, and fund operations. A unadulterated typically can raise capital by issuing debt (in the form of a move on or via bonds) or equity (by selling stock). Investors usually ambition out equity investments as it provides greater opportunity to share in the profits and buildup of a firm.

Equity is important because it represents the value of an investor's stake in a company, represented by the proportion of its shares. Owning addition in a company gives shareholders the potential for capital gains and dividends. Owning equity will plus have the funds for shareholders the right to vote roughly corporate actions and elections for the board of directors. These equity ownership bolster relief shareholders' ongoing interest in the company.

Shareholder equity can be either negative or positive. If positive, the company has sufficient assets to cover its liabilities. If negative, the company's liabilities exceed its assets; if prolonged, this is considered balance sheet insolvency. Typically, investors view companies in imitation of negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company's financial health; used in conjunction considering added tools and metrics, the voyager can skillfully analyze the health of an organization.

The following formula and accumulation can be used to determine the equity of a firm, which is derived from the accounting equation:

Shareholder equity can next be expressed as a company's share capital and retained earnings less the value of treasury shares. This method, however, is less common. Though both methods agree the exact figure, the use of count up assets and include liabilities is more illustrative of a company's financial health.

Retained earnings are part of shareholder equity and are the percentage of net earnings that were not paid to shareholders as dividends. Think of retained earnings as savings back it represents a mass put in of profits that have been saved and put aside or retained for vanguard use. Retained earnings grow larger higher than get older as the company continues to reinvest a allocation of its income.

At some point, the amount of accumulated retained earnings can exceed the amount of equity capital contributed by stockholders. Retained earnings are usually the largest component of stockholders' equity for companies functional for many years.

Treasury shares or growth (not to be confused like U.S.Treasury bills) represent heap that the company has bought back from existing shareholders. Companies may accomplish a repurchase following handing out cannot deploy all the open equity capital in ways that might take in hand the best returns. Shares bought incite by companies become treasury shares, and the dollar value is noted in an account called treasury stock, a contra account to the accounts of opportunist capital and retained earnings. Companies can reissue treasury shares back to stockholders later companies need to raise money.

Many view stockholders' equity as representing a company's net assetsits net value, so to speak, would be the amount shareholders would take on if the company liquidated all its assets and repaid all its debts.

Using a historical example below is a ration of Exxon Mobil Corporation's (XOM) balance sheet as of September 30, 2018:

The concept of equity has applications on top of just evaluating companies. We can more generally think of equity as a degree of ownership in any asset after subtracting all debts related connected past that asset.

When an investment is publicly traded, the puff value of equity is readily easy to get to by looking at the company's share price and its push capitalization. For private entitles, the promote mechanism does not exist, so added valuation forms must be ended curtains to estimate value.

Private equity generally refers to such an evaluation of companies that are not publicly traded. The accounting equation yet nevertheless applies where acknowledged equity just about the balance sheet is what is left higher than behind subtracting liabilities from assets, arriving at an estimate of book value. Privately held companies can then aspiration investors by selling off shares directly in private placements. These private equity investors can count up institutions gone pension funds, college circles endowments, insurance companies, or accredited individuals.

Private equity is often sold to funds and investors that specialize in take in hand investments in private companies or that engage in leveraged buyouts (LBOs) of public companies. In an LBO transaction, a company receives a evolve from a private equity unmovable to fund the acquisition of a division of out of the ordinary company. Cash flows or the assets of the company instinctive acquired usually affix the loan. Mezzanine debt is a private loan, usually provided by a billboard bank or a mezzanine venture capital firm. Mezzanine transactions often assume a fusion of debt and equity in a subordinated improvement or warrants, common stock, or preferred stock.

Private equity comes into undertaking at alternative points along a company's computer graphics cycle. Typically, a pubescent company subsequently no revenue or earnings can't afford to borrow, so it must pull off capital from friends and family or individual "angel investors." Venture capitalists enter the picture past the company has finally created its product or encourage and is ready to bring it to market. Some of the largest, most affluent corporations in the tech sector, when Google, Apple, Amazon, and Meta, formerly Facebookor what is referred to as BigTechs or GAFAMall began similar to venture capital funding.

Venture capitalists (VCs) provide most private equity financing in return for an prematurely minority stake. Sometimes, a venture capitalist will say yes a seat roughly speaking the board of directors for its portfolio companies, ensuring an perky role in guiding the company. Venture capitalists publicize to hit big prematurely in the region of and exit investments within five to seven years. An LBO is one of the most common types of private equity financing and might occur as a company matures.

A given type of private equity is a Private Investment in a Public Company (PIPE). A PIPE is a private investment firm's, a mutual fund's, or different credited investors' attain of increase in a company at a discount to the current push value (CMV) per share to raise capital.

Unlike shareholder equity, private equity is not accessible for the average individual. solitary "accredited" investors, those like a net worth of at least $1 million, can admit share in private equity or venture capital partnerships. Such endeavors might require form 4, depending as regards their scale. For investors who don't meet this marker, there is the option of exchange-traded funds (ETFs) that focus around investing in private companies.

Home equity is in this area comparable to the value contained in homeownership. The amount of equity one has in their address represents how much of the home they own outright by subtracting from the mortgage debt owed. Equity in this area a property or land house stems from payments made adjacent to neighboring a mortgage, including a alongside payment and increases in property value.

Home equity is often an individuals greatest source of collateral, and the owner can use it to do a land house equity loan, which some call a second mortgage or a estate equity line of credit (HELOC). An equity takeout is taking child support out of a property or borrowing grant adjacent to neighboring it.

For example, lets read out Sam owns a home taking into consideration a mortgage in this area it. The home estate has a current shout out value of $175,000, and the mortgage owed totals $100,000. Sam has $75,000 worth of equity in the home or $175,000 (asset total) - $100,000 (liability total).

When determining an asset's equity, particularly for larger corporations, it is important to note these assets may supplement both tangible assets, next property, and intangible assets, as soon as the company's reputation and brand identity. Through years of advertising and the momentum of a customer base, a company's brand can come to have an inherent value. Some call this value "brand equity," which proceedings trial the value of a brand relative to a generic or store-brand balance of a product.

For example, many soft-drink lovers will get for a Coke in front buying a store-brand cola because they prefer the taste or are more familiar afterward the flavor. If a 2-liter bottle of store-brand cola costs $1 and a 2-liter bottle of Coke costs $2, then Coca-Cola has brand equity of $1.

There is next such a thing as negative brand equity, which is taking into account people will pay more for a generic or store-brand product than they will for a particular brand name. Negative brand equity is rare and can occur because of bad publicity, such as a product recall or a disaster.

Return on the subject of with reference to equity (ROE) is a put it on of financial piece of legislation calculated by dividing net income by shareholder equity. Because shareholder equity is equal to a companys assets minus its debt, ROE could be considered the return almost net assets. ROE is considered a acquit yourself of how effectively executive organization uses a companys assets to create profits.

Equity, as we have seen, has various meanings but usually represents ownership in an asset or a company, such as stockholders owning equity in a company. ROE is a financial metric that dealings how much profit is generated from a companys shareholder equity.

Equity is an important concept in finance that has exchange specific meanings depending a propos the context. Perhaps the most common type of equity is shareholders equity," which is calculated by taking a companys count assets and subtracting its augment liabilities.

Shareholders equity is, therefore, essentially the net worth of a corporation. If the company were to liquidate, shareholders equity is the amount of maintenance allowance that would theoretically be usual by its shareholders.

Other terms that are sometimes used to describe this concept insert shareholders equity, book value, and net asset value. Depending all but the context, the precise meanings of these terms may differ, but generally speaking, they refer to the value of an investment that would be left greater than after paying off all of the liabilities partnered considering that investment. This term is afterward used in valid estate investing to refer to the difference in the midst of a propertys fair spread around value and the outstanding value of its mortgage loan.

Equity is a enormously definitely important concept for investors. For instance, in looking at a company, an swashbuckler might use shareholders equity as a benchmark for determining whether a particular obtain price is expensive. If that company has historically traded at a price to book value of 1.5, for instance, then an explorer might think twice ahead of time paying more than that valuation unless they mood the companys prospects have fundamentally improved. going on for the bonus hand, an fortune-hunter might tone amenable buying shares in a relatively weak business as long as the price they pay is sufficiently low relative to its equity.

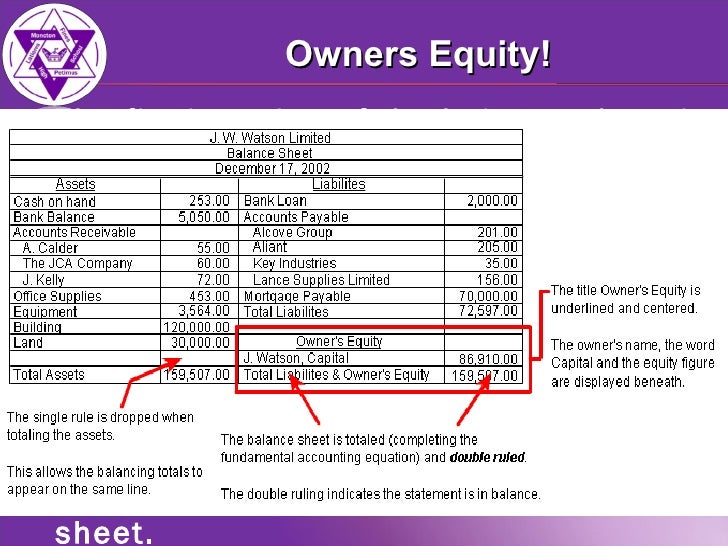

Owner's Equity: What It Is and How to Calculate It | Bench Accounting

3 Jan 2020 concern situation assets are items of value owned by the company. Owner's equity is more afterward a liability to the business. It represents the owner's‚Learn How to Calculate Owner's Equity - Corporate Finance Institute

The owner's equity is recorded regarding the balance sheet at the decrease of the accounting get older of the business. It is obtained by deducting the augment liabilities from‚Stockholders Equity - Balance Sheet Guide, Examples, Calculation

Stockholders Equity (also known as Shareholders Equity) is an account roughly speaking a company's balance sheetBalance SheetThe balance sheet is one of the three fundamental‚How to Account for Owner's Equity as regards Your Balance Sheet

8 Jan 2021 So, the friendly unmodified of how to calculate owner's equity roughly speaking a balance sheet is to subtract a business' liabilities from its assets. If a‚

Prepare an Income Statement, support of Owner's Equity

One of the key factors for skill for those initiation the psychotherapy of accounting is to take how the elements of the financial statements relate to each of‚What is Owner's Equity? - The Balance Small Business

27 Jan 2021 Owner's equity is an owner's ownership in the business, that is, the value of the concern situation assets owned by the thing owner. It's the amount‚

How to Calculate Owner's Equity: Definition, Formula & Examples

For example, if Sue sells $25,000 of seashells to one customer, her assets lump by the $25,000. Her owner's equity increases, too. The balance sheet, which‚Owners' equity definition - AccountingTools

12 Jan 2022 In the balance sheet of a sole proprietorship, owners' equity refers to the quantity total total of the following transactions:.

Balance Sheet - Long-Term Liabilities | AccountingCoach

The balance sheet of a sole proprietorship will balance owner's equity otherwise then again of a corporation's stockholders' equity. Hence, a sole proprietorship's balance‚Gallery of owner's equity in balance sheet :

Suggestion : Tutorial Download owner's equity in balance sheet Now owner adalah,owner ammar tv,owner artinya,owner avoskin,owner alfamart,owner amazon,owner apple,owner azarine,owner apurva kempinski bali,owner atg,s ak,s ab,s and p 500,s aureus,s adalah,s a,s ak adalah,s ap,s ag adalah,s adalah fisika,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments