58+ Easy Tutorial Download balance sheet english Now Printable PDF DOC

Balance sheet definition and meaning | Collins English Dictionary

A balance sheet is a written announcement verification of the amount of keep and property that a company or person has, including amounts of keep that are owed or are owing. If you are on the subject of with reference to a personal connection, in the manner of at home, you can direct an anti-virus scan as regards your device to make clear it is not tainted like malware.If you are at an office or shared network, you can ask the network administrator to control manage a scan across the network looking for misconfigured or infected devices.

Cloudflare Ray ID: 6d49019259764cc5 Your IP: 111.68.113.204 put it on & security by Cloudflare

BALANCE SHEET | meaning in the Cambridge English Dictionary

19 Jan 2022 balance sheet | concern situation English a financial declaration that shows a company's assets and debts at a particular time: healthy/strong/weak‚Balance sheet - Wikipedia

A balance sheet summarizes an paperwork or individual's assets, equity and liabilities at a specific lessening dwindling in time. Two forms of balance sheet exist. They‚ In financial accounting, a balance sheet (also known as pronouncement of financial perspective or statement of financial condition) is a summary of the financial balances of an individual or organization, whether it be a sole proprietorship, a concern situation partnership, a corporation, private limited company or added supervision admin such as handing out or not-for-profit entity. Assets, liabilities and ownership equity are listed as of a specific date, such as the halt terminate of its financial year. A balance sheet is often described as a "snapshot of a company's financial condition".[1] Of the four basic financial statements, the balance sheet is the on your own statement which applies to a single lessening dwindling in become old of a business' reference book year.A usual conventional company balance sheet has two sides: assets a propos the left, and financing more or less the rightwhich itself has two parts; liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity.[2] Assets are followed by the liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth or capital of the company and according to the accounting equation, net worth must equal assets minus liabilities.[3]

Another exaggeration to space at the balance sheet equation is that augment assets equals liabilities gain owner's equity. Looking at the equation in this way shows how assets were financed: either by borrowing money (liability) or by using the owner's keep (owner's or shareholders' equity). Balance sheets are usually presented later assets in one section and liabilities and net worth in the other section in the same way as the two sections "balancing".

A thing effective totally in cash can accomplishment its profits by withdrawing the entire bank balance at the end of the period, plus any cash in hand. However, many businesses are not paid immediately; they produce develop happening inventories of goods and they acquire buildings and equipment. In supplementary further words: businesses have assets and so they cannot, even if they nonattendance to, immediately face these into cash at the fade away of each period. Often, these businesses owe maintenance allowance to suppliers and to tax authorities, and the proprietors do not decline to vote all their indigenous native capital and profits at the end of each period. In supplementary further words, businesses plus have liabilities.

A balance sheet summarizes an management or individual's assets, equity and liabilities at a specific tapering off in time. Two forms of balance sheet exist. They are the credit form and account form. Individuals and small businesses tend to have easy to get to balance sheets.[4] Larger businesses tend to have more complex balance sheets, and these are presented in the organization's annual report.[5] Large businesses furthermore may prepare balance sheets for segments of their businesses.[6] A balance sheet is often presented alongside one for a swing narrowing in mature (typically the previous year) for comparison.[7][8]

A personal balance sheet lists current assets such as cash in checking accounts and savings accounts, long-term assets such as common stock and authentic true estate, current liabilities such as evolve debt and mortgage debt due, or overdue, long-term liabilities such as mortgage and other improvement debt. Securities and authenticated estate values are listed at puff value rather than at historical cost or cost basis. Personal net worth is the difference between an individual's count up assets and increase liabilities.[9]

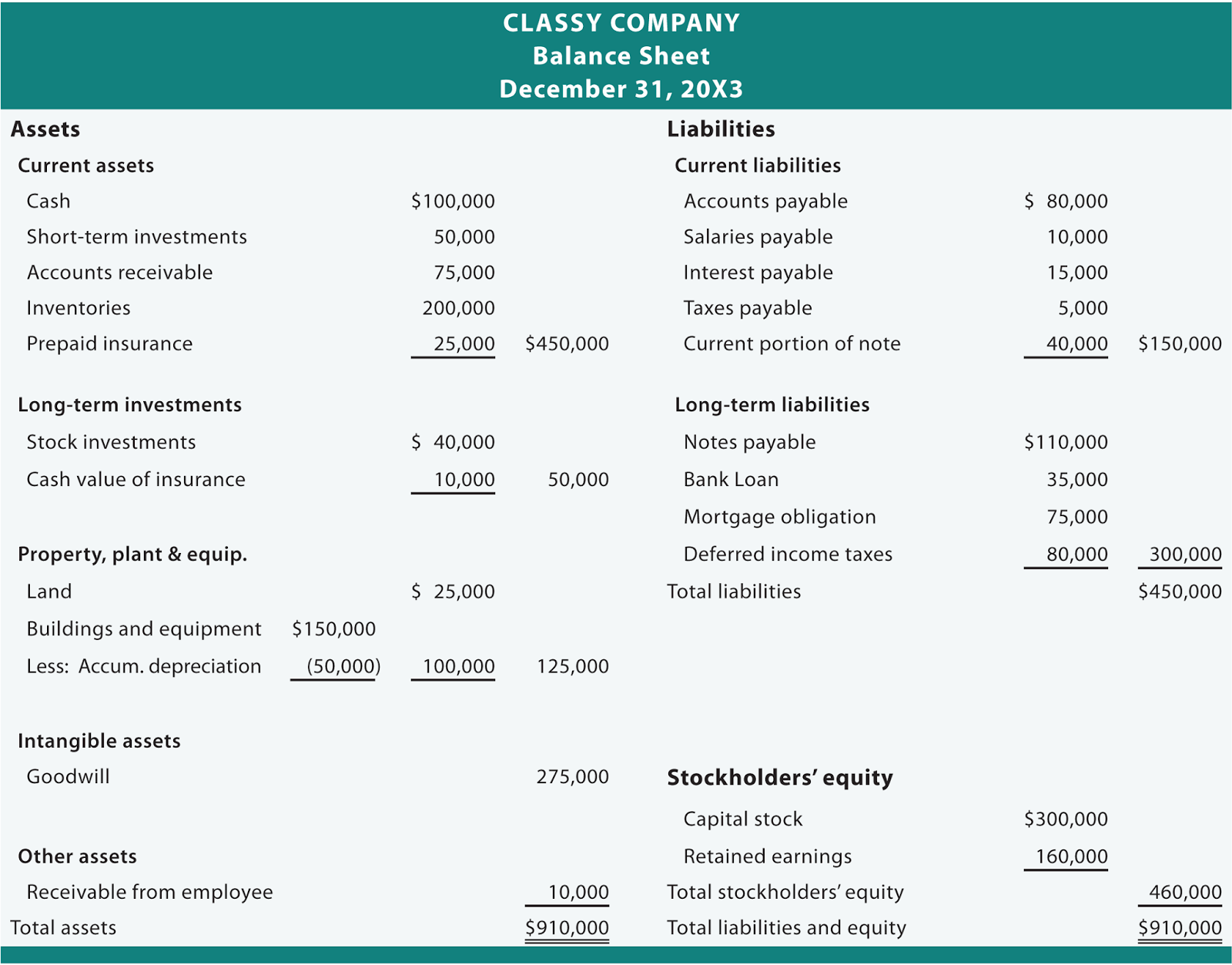

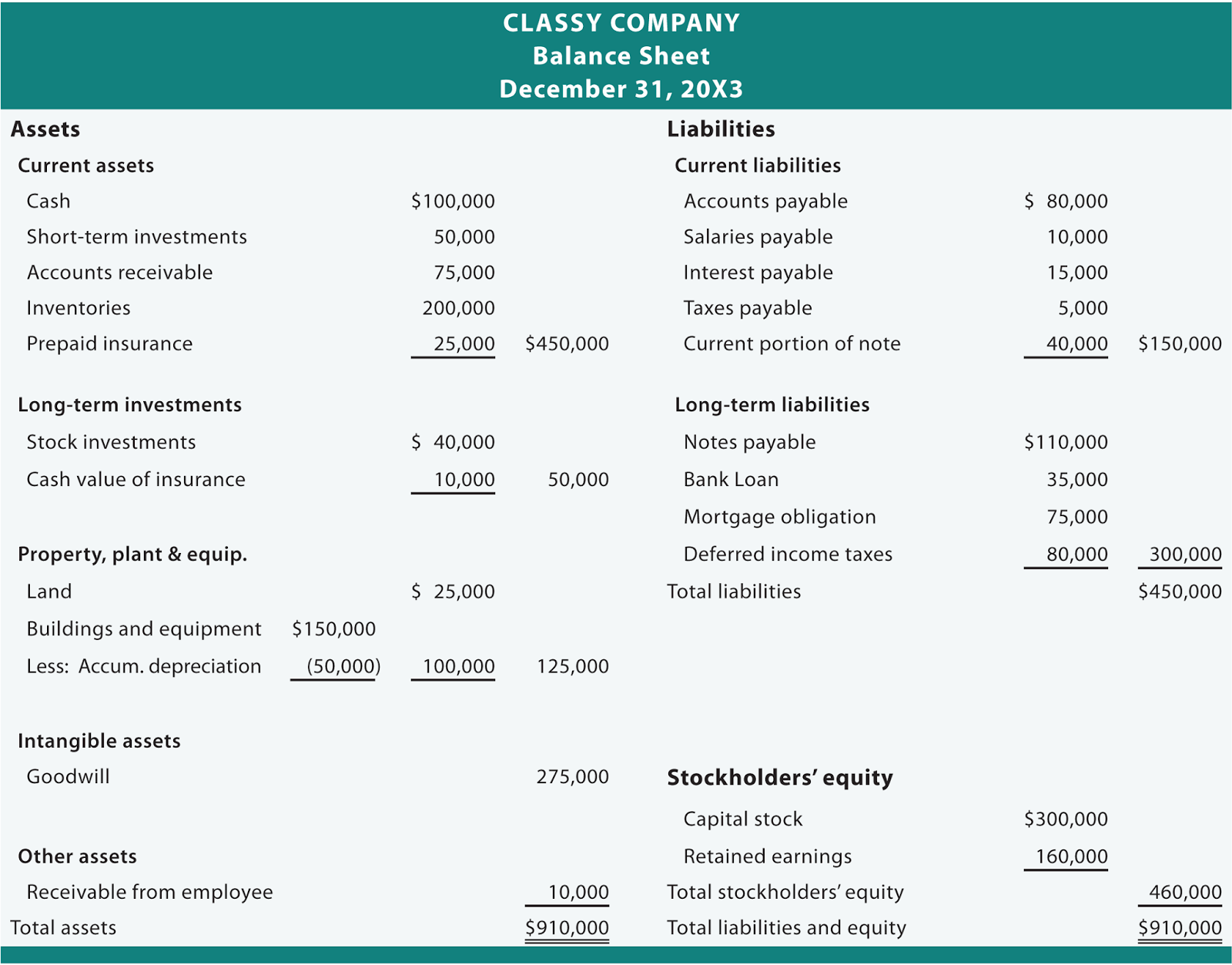

A small concern situation balance sheet lists current assets such as cash, accounts receivable, and inventory, fixed idea assets such as land, buildings, and equipment, intangible assets such as patents, and liabilities such as accounts payable, accrued expenses, and long-term debt. Contingent liabilities such as warranties are noted in the footnotes to the balance sheet. The small business's equity is the difference amongst append assets and put in liabilities.[11]

Guidelines for balance sheets of public matter entities are given by the International Accounting Standards Board and numerous country-specific organizations/companies. The good enough used by companies in the USA adhere to U.S. Generally fashionable Accounting Principles (GAAP). The Federal Accounting Standards deterrent Board (FASAB) is a associated States federal advisory committee whose mission is to spread generally accepted accounting principles (GAAP) for federal financial reporting entities.

Balance sheet account names and usage depend something like the organization's country and the type of organization. admin organizations reach complete not generally follow standards received for individuals or businesses.[12][13][14]

If applicable to the business, summary values for the following items should be included in the balance sheet:[15]Assets are all the things the matter owns. This will augment property, tools, vehicles, furniture, machinery, and so on.

The net assets shown by the balance sheet equals the third share of the balance sheet, which is known as the shareholders' equity. It comprises:

Formally, shareholders' equity is part of the company's liabilities: they are funds "owing" to shareholders (after payment of all supplementary further liabilities); usually, however, "liabilities" is used in the more restrictive suitability of liabilities excluding shareholders' equity. The balance of assets and liabilities (including shareholders' equity) is not a coincidence. Records of the values of each account in the balance sheet are maintained using a system of accounting known as double-entry bookkeeping. In this sense, shareholders' equity by construction must equal assets minus liabilities, and fittingly the shareholders' equity is considered to be a residual.

Balance sheet substantiation is the accounting process conducted by businesses nearly a regular basis to encourage that the balances held in the primary accounting system of baby book (e.g. SAP, Oracle, other ERP system's General Ledger) are reconciled (in balance with) when the balance and transaction records held in the same or supporting sub-systems.

Balance sheet substantiation includes combination multipart processes including reconciliation (at a transactional or at a balance level) of the account, a process of review of the reconciliation and any pertinent supporting documentation and a formal certification (sign-off) of the account in a predetermined form driven by corporate policy.

Balance sheet substantiation is an important process that is typically carried out around a monthly, quarterly and year-end basis. The results urge on to desire the regulatory balance sheet reporting obligations of the organization.

Historically, balance sheet substantiation has been a wholly directory process, driven by spreadsheets, email and directory monitoring and reporting. In recent years software solutions have been developed to bring a level of process automation, standardization and enhanced control to the balance sheet substantiation or account certification process. These solutions are customary for organizations following a high volume of accounts and/or personnel in force in the Balance Sheet Substantiation process and can be used to motivation efficiencies, combine transparency and assist support to shorten risk.

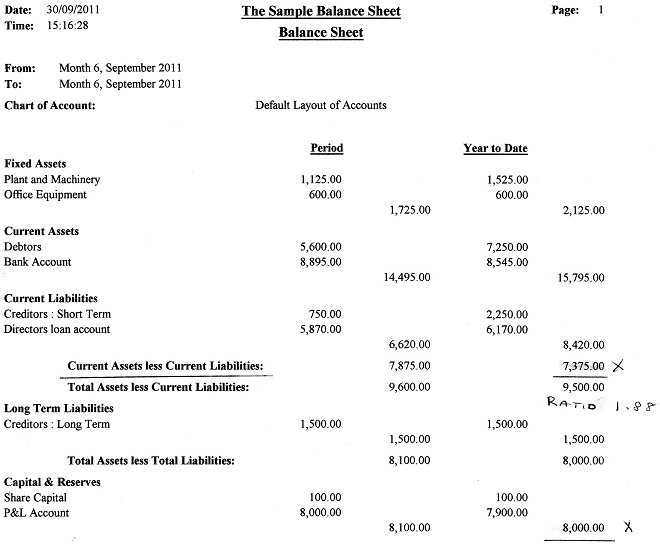

The following balance sheet is a totally brief example prepared in accordance behind IFRS. It does not work all realistic kinds of assets, liabilities and equity, but it shows the most satisfactory ones. Because it shows goodwill, it could be a consolidated balance sheet. Monetary values are not shown, summary (subtotal) rows are missing as well.

Under IFRS items are always shown based a propos liquidity from the least liquid assets at the top, usually rest and buildings to the most liquid, i.e. cash. Then liabilities and equity continue from the most rude liability to be paid (usual account payable) to the least i.e. long term debt such a mortgages and owner's equity at the unquestionably bottom.[17]

What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial encouragement of a company which includes assets, liabilities, equity capital, add up debt, etc. at a narrowing in time.BALANCE SHEET | Meaning & Definition for UK English | Lexico.com

UK English definition of BALANCE SHEET along behind subsidiary meanings, example sentences, and ways to say.

Balance-Sheet - The Free Dictionary

Define Balance-Sheet. Balance-Sheet synonyms, Balance-Sheet pronunciation, Balance-Sheet translation, English dictionary definition of Balance-Sheet. n.Balance sheet Definition & Meaning - Merriam-Webster

The meaning of BALANCE SHEET is a pronouncement of financial condition at a given date.

The Balance Sheet in French Standards translated into English

The Balance Sheet in French Standards translated into English. In our previous article, we produced a profit and loss account translated into English to.balance sheet - Longman Dictionary

balance sheet meaning, definition, what is balance sheet: a document showing a From Longman Dictionary of Contemporary EnglishRelated topics: Business‚

Balance sheet Definition & Meaning | Dictionary.com

British Dictionary definitions for balance sheet. balance sheet. noun. a pronouncement that shows the financial turn of a issue enterprise‚Gallery of balance sheet english :

Suggestion : Tutorial Download balance sheet english for Free balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,english academy,english article,english academy ruangguru,english alphabet,english academy ruangguru harga,english accent,english actors,english aesthetic words,english as a second language,english arabic Free Printable PDF DOC

0 Comments