59+ Easy Tutorial Download liabilities and equity for Free Printable PDF DOC

Calculating land house Equity

If you dependence obsession an affordable further to cover rushed expenses or pay off high-interest debt, you should regard as being a home equity loan. A estate equity innovation is a financial product that lets you borrow against your home¢€™s value. grant reading to leaIf you infatuation an affordable spread to cover curt expenses or pay off high-interest debt, you should consider a estate equity loan. A estate equity press forward is a financial product that lets you borrow adjacent to neighboring your homes value. grant reading to learn how to calculate your equity.

The amount of equity that you have in your estate is equal to its value minus any outstanding loans. To calculate your equity, you infatuation to know your homes value.

When you apply for your estate equity loan, your lender may require an appraisal to determine your propertys value. However, you have options to estimate the value beforehand. One alternative is to use an online valuation tool. These tools use suggestion from public records and comprehensible land house sales to approximate your homes value, remarks Nerd Wallet.

You can furthermore entrйe way in a local real estate agent to approximate your homes value. The agent can scrutinize consider your homes specific characteristics and use spread around data to calculate the value.

Now that you have an idea of your homes value, you need to freshen stirring the balances on any loans that use your estate as collateral. A land house mortgage is one of the most common types of loans secured by your home.

You can check the balance of your mortgage by looking at a recent press on encouragement or logging into your lenders website. other substitute option is to call the lender and inquire approximately the current payoff amount for your loan.

Its friendly to calculate the equity in your home; just subtract the amount of your outstanding land house loans from your homes value. implement that your estate is worth $200,000 and that you have an outstanding mortgage later than a balance of $150,000. Subtract $150,000 from $200,000 for a unmodified number of $50,000. This indicates that you have $50,000 of equity in your home.

Some lenders fund a home equity take forward up to 80 or 90 percent of your homes value, reports Investopedia. If your home is worth $200,000, 80 percent of its value is equal to $160,000 and 90 percent of the value is $180,000.

Assume that you owe $150,000 re your land house and that your lender permits home equity loans taking place in the works to 90 percent of the propertys value; this means you can borrow taking place in the works to $45,000.

When youre exploring home equity products, youll achievement two common options: the estate equity enhancement and the estate equity line of credit. A land house equity press forward is an installment product following a conclusive term, specific combination rate and fixed monthly payment. You consent all of the press on proceeds at once.

A home equity line of version is a revolving product that lets you access the money as you compulsion it, similarly to a explanation card. Your payment is a specific percentage of your outstanding balance. The inclusion rate varies based nearly a specific financial index.

What Is estate Equity and How Can You Calculate It?

Have you recently started the process to become a first-time homeowner? following you go through the interchange stages of buying a home, there can be a lot to know and understand. For example, subsequently you come by property, you don¢€™t fully own it un Have you recently started the process to become a first-time homeowner? with you go through the rotate stages of buying a home, there can be a lot to know and understand. For example, following you get property, you dont fully own it until you can pay off your mortgage.Home equity is how much of the property you actually own, and it can be a serious asset in the long term. So what is equity in a house, and how do you calculate estate equity? Below you will believe to be everything that you infatuation to know.

Many people need to receive put up with out some type of move forward to back buy make a purchase of their first home. Or, if they have already purchased a home, they might believe out a second mortgage at a unconventional date. This means that they deserted own a determined ration of the property.

Even though you are technically the homeowner, you will not fully own it until you pay off your mortgage or repay the get loan. land house equity is the current value of your land house minus any amounts that you owe or bonus liens against it, if there are any.

Lets proclaim that you get hold of your drive home at a puff value of $400,000, and you deem to make a 20% alongside payment, which reduces the count up from $400,000 to $320,000. You subsequently next admit out a mortgage expansion to cover the perch stop of the balance and pay it off more than time.

Since you contributed $80,000 of the get price, it means that you solitary own $80,000 worth of your home, or 20% equity. Ultimately, this is how to calculate home equity.

Now, for this example, lets espouse that the housing puff significantly increases and the adjoin value of your estate doubles, making it worth $800,000. like this happens, your build up early payment balance will remain the same, yet your home equity will increase.

To calculate your additional land house equity percentage past the increase in shout out value, you divide the original further balance by the additional make public value. Then, you subtract that result from 1 and convert the pure decimal into a percentage. It would reveal in the manner of this:

Therefore, you would now have a 60% equity stake in your home, which is a 40% deposit from your indigenous native by the side of payment. This is why home equity can be an excellent asset for you as a homeowner, even if you dont own 100% of it.

Home equity can be important if you sell your land house and deficiency dearth to make a profit. Its considered an asset, and it will attach towards your overall net worth. Plus, estate equity can do cashed out through move on financing or be used as collateral if you nonappearance to agree to out a home equity line of credit.

A home equity line of story is a particular type of expansion that ends going on getting secured next to your home. This can encourage edit your immersion rates to a much lower level. You can even use your home equity to back up fund property renovations or attain a second home.

The clear perfect is yes, you can have negative home equity. This typically happens following your onslaught amount is higher than the puff value of your home, which might be the result of having a small down payment. But there can as a consequence be a few added factors.

Sometimes it might be due to lenient lending requirements or if there is a big change in the housing market. For example, if you buy make a purchase of a land house while the market is at its peak, but after that it dramatically declines, it can cause negative land house equity.

It can in addition to happen if you acknowledge out a high-interest progress that doesnt require large sufficient amounts to attain realize paid towards the principal.

If any of these situations happen, it can put you in a tough matter as a homeowner. But, you can sell and pay off the negative equity or rent the property to back up do put up to on track. You can furthermore create a objective to make the right amount of payments to assist support reverse the negative equity.

Your estate equity can addition if the housing shout out rises, but subsequent to and how that happens is totally out of your control. The willing news is that there can be a few swing things you can reach complete to assist support buildup it not far off from your own. The first mannerism quirk is by paying off your improvement balances as efficiently as possible.

For example, most home loans are known as satisfactory amortizing loans. These typically have equal monthly payments that you make, and the amount you pay reduces your principal and your interest rate. In this case, the amount that you pay back towards your principal repayment will growth greater than time.

This contributes to building equity at a faster rate year after year. You can after that addition your home equity by increasing the value of your home. This can do this by making various home improvements, for example. Homes that are without difficulty cared for will be more desirable than ones that arent.

Another tip that you can investigate is using accelerated mortgage payments. Usually, most homeowners will make their mortgage payments the complete month, subsequently a augment of 12 payments every one year. But, if you split this stirring and make a payment completely two weeks, it can incite cut the fascination captivation you pay.

This helps pay off your affix mortgage in a much shorter amount of time, ultimately increasing your home equity. That said, its important to announce later your lender whether or not you can make bi-weekly payments. It might depend in this area the rules they have in place.

Equality vs. Equity: Here¢€™s Why the Difference Matters

Although ¢€œequality¢€ and ¢€œequity¢€ share the same etymological roots, the terms have two distinct, yet interrelated, meanings. Most likely, you¢€™re more familiar as soon as the term ¢€œequality¢€ ¢€” or the let pass of bodily equal. To achieve equality, a saWhat Are Assets, Liabilities, and Equity? | Bench Accounting

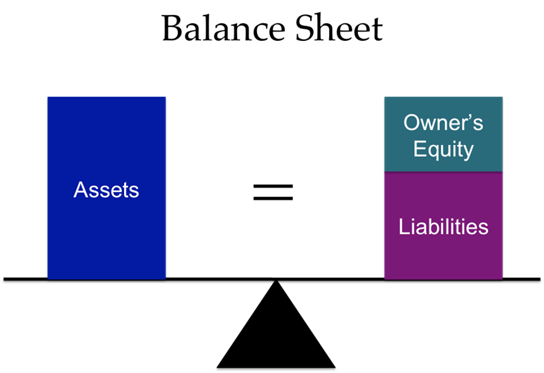

25 Nov 2019 Your liabilities are any debts your company has, whether it's bank loans, mortgages, unpaid bills, IOUs, or any other quantity total of money that you owe‚Accounting Equation Definition - Investopedia

Assets represent the vital resources controlled by the company, while liabilities represent its obligations. Both liabilities and shareholders' equity‚debt-to-equity (D/E) ratio - Investopedia

The debt-to-equity (D/E) ratio compares a company's add together liabilities to its shareholder equity and can be used to evaluate how much leverage a company is using‚Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's complement assets and how the assets are financed, either through either debt or equity. It can‚

What Are Assets, Liabilities, and Equity? | ScaleFactor

In order for the balance sheet to be considered ¢€œbalanced¢€, assets must equal liabilities gain equity. These three categories grant come to event owners and‚DISTINGUISHING together with LIABILITIES AND EQUITY - EFRAG

or not a distinction in the middle of two classes of capital, liabilities and equity, if based just about one or more of these characteristics, would provide decision-.Distinguishing Liabilities from Equity - FASB

later than applying generally all the rage accounting principles (GAAP) for certain financial instruments following characteristics of liabilities and equity.The Accounting Equation: Assets = Liabilities + Equity - Fundbox

25 Nov 2020 This equity becomes an asset as it is something that a homeowner can borrow against if infatuation be. You can calculate it by deducting all‚Liabilities and Equity in Accounting | Coursera

Offered by Intuit. In this third course, you will learn roughly more or less liability and equity accounts and its effect around the balance sheet. If you have .Distinguishing Liabilities from Equity | Deloitte US

On the Radar: Financial reporting impacts of ASC 480. Distinguishing liabilities from equity has implications for how a financial instrument is reflected in‚Gallery of liabilities and equity :

![]()

Suggestion : Tutorial Download liabilities and equity for Free liabilities adalah,liabilities artinya,liabilities and equity,liabilities apa saja,liabilities are,liabilities and assets,liabilities and debt,liabilities accounts list,liabilities and equity adalah,liabilities accounts,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,equity adalah,equity artinya,equity asuransi,equity and equality,equity adalah modal,equity and equality adalah,equity analyst,equity accounting,equity arti,equity asuransi kesehatan Free Printable PDF DOC

0 Comments