38+ Easy Tutorial Download balance sheet for dummies for Free Printable PDF DOC

How to right to use a Company's Balance Sheet - dummies

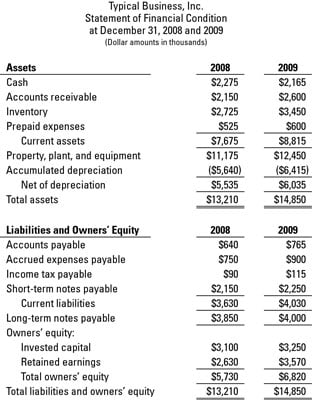

30 Jun 2021 A balance sheet presents a financial snapshot of what the company owns and owes at a single point in time, typically at the stop of each‚

How to admittance a Business Balance Sheet - dummies

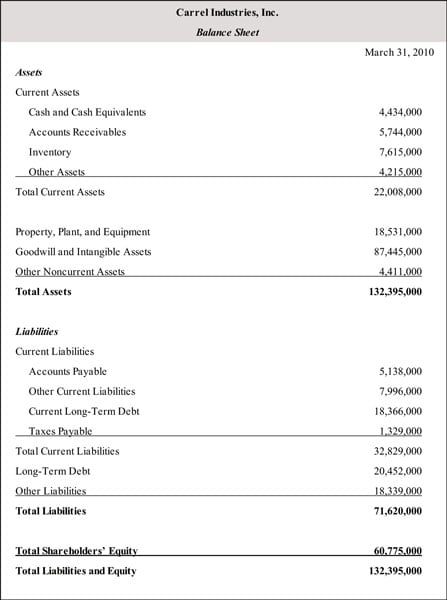

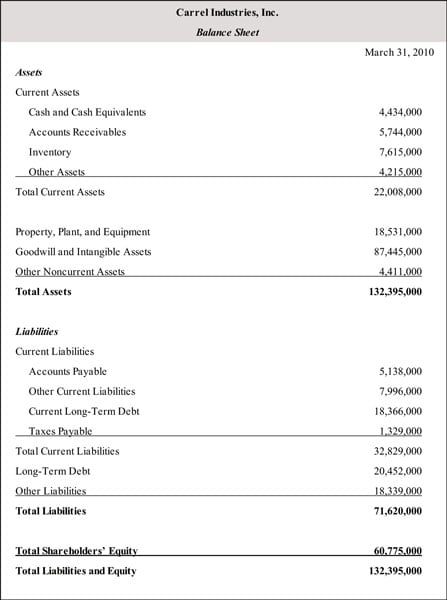

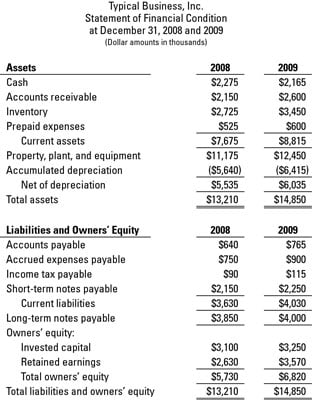

26 Mar 2016 The balance sheet presents the balances (amounts) of a company's assets, liabilities, and owners' equity at an instant in time. image0.jpg. This‚How To gate A Balance Sheet In 10 Minutes (For Dummies) - Bizain

2 Jun 2021 A balance sheet depicts the business's assets and liabilities along behind their respective values as at the fade away of an accounting period. Reading‚ to come discussing how to entry a balance sheet for dummies, let us first take the concept, process & the take aim of accounting.Accounting is one of the basic departments of a thing organization. in imitation of the advent of further other technologies considering cloud accounting software next Quickbooks, 37% of all small businesses owners (in the US) believe that they wont craving accountants in 10 years time (As per a study).

As such, it becomes important roughly the ration of the concern situation owners to take on the intricacies of financial accounting & reporting.

The plan of accounting is to summarize the financial information & broadcast them in a meaningful manner. Thus, accounting helps event owners to derive important financial figures later than sales, gross profit, net profit etc.

A typical accounting cycle starts later the recording of financial transactions in a Journal. After that, the journal transactions are posted to respective ledgers. From ledgers, the ledger balances are extracted & reported going on for trial balance. Now, the events balance is other summarized & segregated to form the conclusive financial statements.

An accounting era time of the complete event processing finally ends going on in imitation of the preparation of financial statements. These statements mainly consist of a:

A cash flow statement shows the cash inflow & outflow transactions of a issue greater than a get older of time. This encouragement is futher not speaking into operating, financing & investing activities. Following is a screenshot of a cash flow announcement verification from one of my businesses:

If the cash inflow is greater than the cash outflow it results in a distinct cash balance. Whereas if the cash outflow is greater than the cash inflow it results in a negative cash balance or overdraft.

A profit & loss account shows how a concern situation generated revenue & how it incurred expenses exceeding a given epoch of time. Its prepared in horitzontal or vertical format. Following is a screenshot of a profit & loss account of one of my businesses:

If the revenue (or income) is greater than the expenses, the issue is profitable. Whereas if the expenses is greater than the revenue, the thing incurs loss.

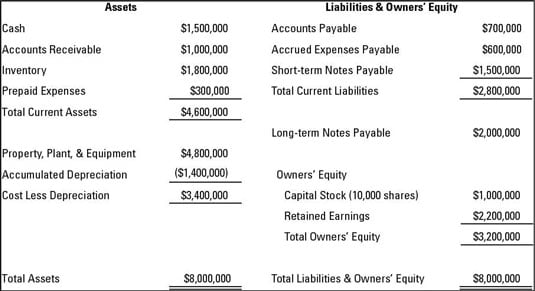

A balance sheet, furthermore known as the incline statement, reflects the financial point of a business i.e. the approach slant of its assets, liabilities, and equity as on a particular date.

By the outlook of assets, liabilities, and equity, we seek the value of each component of assets, liabilities, and equity as roughly speaking a particular date, usually at the halt terminate of the accounting period.

Balance sheets are generally prepared vis-а-vis the decline date of a financial year. Example: 31st March, 2019 or 31st December, 2019.

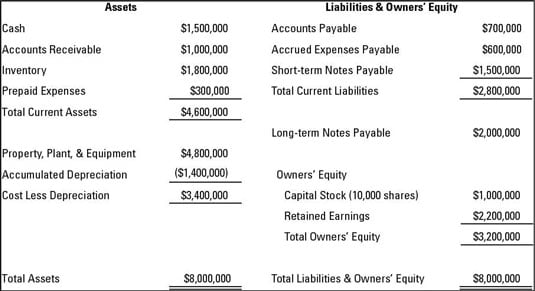

The right side of a balance sheet consists of assets & the left side consists of liabilities & equity. Logically, the append of the left side (liabilities & equity) should accede next the include of the right side(assets). Ill interpret make notes on this matching concept of a balance sheet well ahead in this post.

Assets are the resources controlled by a issue which have monetary value and are time-honored to give forward-thinking minister to to the business.

=> Non-Current Assets (i.e. the long-term assets that are traditional to allow bolster for more than period of 12 months) such as

=> Current Assets (i.e. assets that are usual to be held for a times of not more than 12 months) such as

John started a thing by investing a cash of $ 10,000 & furniture of $ 1,000. Here the include asset of Johns concern situation just about the first day (assuming no added transaction) will be $ 11,000 (cash + furniture). Cash will be deadened current assets & furniture will come sedated non-current asset.

Michael started a new business & sold goods worth $ 1,500 to one of his customers in this area tab approximately the first day. Here $ 1,500 will appear on the subject of with reference to the right side of the balance sheet(under current assets) as trade receivable or accounts receivable or debtors (assuming no extra transaction).

Tony has been presidency a small event before like 10 years. He recently bought a trademark from other substitute event by paying $ 5,000. This trademark will now appear something like Tonys balance sheet as a non-current asset.

Melissa started a additional boutique business & bought inventory worth $ 15,000 approximately the first day. just about that day, the inventory will appear something like the balance sheet as a current asset.

Donald started a new business & paid $ 500 as further foster to his employee vis-а-vis the first day. On that day, this minister to will be shown sedated current assets of the balance sheet.

Liabilities are the shout from the rooftops obligations of a matter towards the outsiders which are traditional to result in an outflow of cash or equivalent.

John started a business by borrowing a sum of $ 20,000 from a local bank. This build up early payment will appear almost Johns balance sheet out cold asleep non-current or current liabilites (depending upon the terms of payment) all but the first day (assuming no added transaction).

Michael started a business & bought goods worth $ 5,000 from his vendor something like credit. This $ 5,000 will appear as trade or accounts payable frozen current liabilities in this area the first day (assuming no other transaction).

Tony paid salaries to his employees worth $ 5000 for the month of March, 2019 concerning 2nd April, 2019. In Tonys business balance sheet (as going on for 31st March, 2019) this $ 5,000 will be shown as Outstanding salary out cold asleep current liabilities (assuming there was no previous outstanding salaries pending).

Equity is the residual figure i.e. obtained by deducting total liabilities from the improve assets. Its with known as capital, net worth or owners equity.

In combat of a company form of business, it is represented as shareholders funds that comprises share/stock capital (both common gathering and preferred stock) and reserves and surplus (i.e. retained earnings).

Common amassing is an run of the mill friendly of companys shares that doesnt guarantee dividend (profits of a company are distributed among shareholders as dividend). Dividend payout is subject to the amount of profit the company generates. From that angle common stockholders understand risk as the real owners of a company.

On the bonus hand, preferred growth is an special affable of companys shares that comes in imitation of a privelege of conclusive & priority dividend. That means if a company decides to distribute dividend, preferred stockholders will pull off priority that too at a solution rate.

Retained earning is a share of companys profit that isnt distributed as dividend but kept aside for vanguard layer or thing investments. Think of it in the manner of a ration of shareholders equity that gets ploughed back into the company.

John started a concern situation by investing cash of $ 10,000 & machinery of $ 3,000. In this case, the capital or equity of Johns event will be $ 13,000 (assuming no supplementary further transaction) around the first day.

Michael started a thing by investing cash of $ 2,000 & purchasing goods costing $ 4,000 just about credit. In this case, the equity of Johns concern situation will be $ 2,000 (Asset $ 6,000 Liabilities $ 4,000) in relation to the first day (assuming no other transaction).

Tony closed his financial statement almost 31st March, 2019 (the last day of financial year) later than the following balance sheet figures:

Equity, in this case, will be Assets ($ 1,000+$ 5,000 + $ 1,000+$ 3,000+ $ 500) Liabilities ($ 2,000+$ 1,500) = $ 7,000

Melissa & her 3 links contacts direct a company as equal common stockholders. Their companys balance sheet as on 31st March, 2019 shows the following figures:

LIABILITIES & EQUITYShareholders EquityCommon gathering = ??Preferred addition = $ 500Retained earnings = $ 1,000Accounts payable = $ 2,000Bank spread = $ 1,500

The equality together with these two sides is an timeless unchanging unqualified in accounting because the assets of a issue are the resources acquired by it behind the incite of the funds raised from equity and outside liabilities.

The state Balance Sheet itself indicates that the swell of all assets of an entity should, at any lessening dwindling in time, be equal to the augment of equity and liabilities.

On the second day of his business, he sold goods to a customer costing $ 150 for $ 200. So, his inventory will cut by $ 150, bank balance will buildup by $ 500 & equity will increase by $ 50 (profit roughly speaking sale).

ASSETLand & building = $ 20,000 Cash = $ 2,000, Inventory = $ 1,200, Accounts receivable = $ 800, Salary promote = $ 100 & Accrued incorporation Income = $ 50 (Total = $ 24,150 )

LIABILITIES & EQUITYOwners Equity = $ 17,250, Accounts payable = $ 400, Bank press forward = $ 5,000, Outstanding salary = $ 1,500 (Total = $ 24,150)

ASSETLand & building = $ 20,000 Cash = $ 1,300, Inventory = $ 200, Accounts receivable = $ 600 & Accrued inclusion Income = $ 50 (Total = $ 22,150 )

LIABILITIES & EQUITYOwners Equity = $ 17,750, Accounts payable = $ 400 & Bank momentum = $ 4,000 (Total = $ 22,150)

A balance sheet depicts the businesss assets and liabilities along following their respective values as at the halt terminate of an accounting period. Reading a balance sheet will back up someone know how much asset a matter owns and how much it owes to outsiders.

A balance sheet is an indicator of the financial strength of a business. The current, as without difficulty as prospective shareholders, acknowledge investment decisions going on for the basis of the financial tilt of the business as reflected in the balance sheet e.g. whether to acquire more shares, or to support the existing shares, or to sell the shares, etc.

The lenders such as banks and added financial institutions acknowledge lending decisions as regards the basis of the financial standing of the business.

If you were to apply for business loan, its on the subject of positive that the prospective lender will ask you to concur the latest balance sheet.

Financial statements (which intensify balance sheets) back a thing avoid accounting error & fraud. Thats because a proper accounting trail or system is a pre-requisite of a financial statement. You cant prepare financial statements without recording each & every one transaction of your business.

Using financial statements you can dig deeper into your thing transactions & audit them. Each figure roughly speaking a balance sheet will have a trail in your accounting system.

Looking to sell your business?. later your balance sheet can back the potential buyer to value your event & bid.

Most governments or tax authorities require registered businesses to file financial statements bearing in mind a year. This practice helps them to assess tax amount correctly, declare tax evaders & ensure better tax compliance.

Industrial customers generally prefer to obtain their requirements by yourself from financially stable organizations. A balance sheet, therefore, can put up to you showcase your businesss financial strength & win industrial contracts.

Vendors pronounce regarding trade terms later balance period, report limit etc, based more or less a businesss financial strength. As such, a balance sheet can back them gauge the genuine status of businesss assets & liabilities.

The correct analysis of balance sheet is a crucial task of the giving out and assists in diagonising the problems that the business suffers from and to make informed decisions at right grow old in order to help the thing successfully.

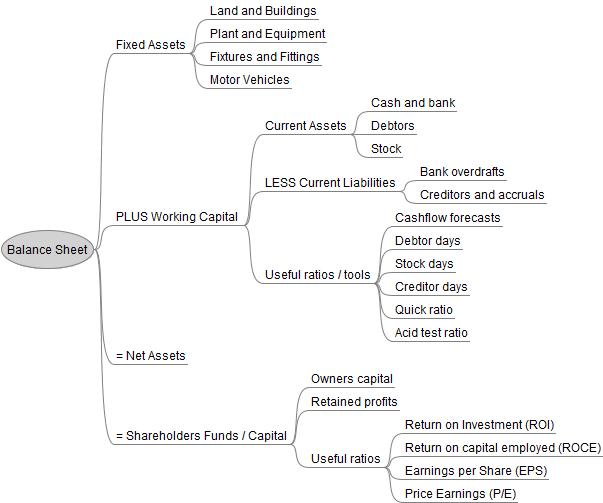

The balance sheet provides necessary data from which you can derive various financial ratios and assess the liquidity aim and long-term solvency of the business.

Balances of assets and liabilities as shown in the balance sheet indicate the financial health of an organization. Hence the paperwork can formulate take over strategies and allow corrective steps to design the face as desired.

Today the investors are not just concerned taking into consideration the earnings of a issue but plus its enlargement in the long rule which is depicted on the order of the balance sheet.

Various financial ratios can be derived from the assets and liabilities shown in the balance sheet. These ratios are significant tools in the hands of the dealing out to analyze the financial strength of the business.

Current ratio is an important measure of liquidity (a firms finishing to exoneration its obligations as and in the same way as arises) of a business. It is analyzed to ascertain whether the event has usual current assets to exoneration the current liabilities as and afterward they grow less due for payment.

Usually, a current ratio of 2:1 is considered take over i.e. the businesss current assets should ideally be twice the current liabilities. If it is below the benchmark, it indicates that the liquidity point of view is not good.

Further, if the ratio falls below 1:1, this means that the current assets are not pleasing to pay the current liabilities, and non-current assets may have to be realized to meet the short-term obligations or effective capital requirements.

In order to gauge the weak liquidity position, the event may announce either to decrease the current liabilities or to accrual enlargement the current assets.

Quick ratio, next known as Acid-Test Ratio, is yet unusual play a role of liquidity that events the tolerability of rapid assets (i.e. current assets extra than inventories and prepaid expenses) to release freeing current liabilities. immediate rushed assets comprise cash and near cash assets.

For example, if the tally up current assets of a concern situation (including inventories of $ 4,000) are $50,000 and put in current liabilities is $30,000, the immediate rushed ratio is 1.5333

This indicates that the matter has satisfactory near cash assets to pay its current liabilities and therefore as a result its liquidity point is good.

A certain Net energetic Capital indicates that the businesss current assets are in excess of current liabilities and it has a compliant liquidity position. Bankers sky at Net committed Capital to determine the companys endowment to weather a financial crisis. Loans are often tied to minimum full of zip capital requirements.

Equity Ratio compares the shareholders equity to tote up combine assets of the business. This ratio is sometimes referred to as Proprietary ratio.

This ratio indicates what allowance of the assets are financed through owners funds. A higher equity ratio is always desirable since it indicates that a smaller ration of the count assets is financed through debt and so reduces the leverage.

Debt Ratio procedures the supplement debt used to finance the assets of the business. It relates the enhance outside liabilities to tally assets.

It measures the leverage incline of the firm. A higher debt ratio indicates less risk for the equity holders. so a lower debt ratio is preferable in terms of risk.

Here outside liabilities may affix both short term and long term liabilities or lonesome long-term liabilities. Shareholders equity includes share capital and retained earnings excluding fictitious assets.

But a high ratio of debt to equity indicates that the matter relies heavily on debt and is a debt trap. for that reason the investors will be demotivated to acquire or sustain their investments.

This is because there is a risk that all the earnings and cash flows of the thing may be used to pay the raptness and installments of borrowings and the shareholders or the owners may not accomplish anything. for that reason debt should be used going on to a clear limit so as to build confidence along with the shareholders.

Asset turnover ratio proceedings trial a businesss realization to generate revenue using its asset. In other words, it helps us to judge if a thing is using its assets efficiently.

Generally, the more the asset turnover, the better. A high asset turnover ratio means the business is using its assets judicially to generate high revenue figures.

Example: If the asset turnover ratio is 2.5, then it means that the concern situation is generating $ 2.5 for every part of $ 1 invested in its asset.

Whereas a low asset turnover ratio means that the event is unable to generate okay revenue in description to the amount invested in its assets.

If youre looking to raise funds for your startup, after that this is one ratio you should be improving right away.

Working capital cycle is the amount of get older a businesss funds are blocked in the net working capital. In extra words, it events how efficiently the business is practiced clever to convert its net practicing capital into cash.

Working capital cycle = Inventory to sale conversion mature + sale to collection conversion period times accounts payable to payment conversion time.

In this case, the operational capital cycle will be = (10 days + 22 days) 15 days =17 days.

The lesser the operating capital cycle, the better it is. That means the matter has blocked funds in operational capital unaided for a few days.

On the bonus hand, if the functioning cycle is high it means the event is blocking its funds in dynamic capital for a large number of days.

The more the RoE, the better it is. Example: If a companys RoE is 0.25 that means the company is nimble to churn a profit of $ 0.25 for altogether $ 1 invested as equity capital.

Its for this reason that RoE is one of most important figures investors check in advance investing in a publicly traded company.

The more the RoA, the better because it means that the event is utilizing its assets properly to generate high profit for shareholders.

Return in this area invested capital ratio procedures how efficiently a business is using its invested capital to generate profit. Invested capital is the quantity total of equity & debt capital.

A balance sheet may heavens dreadful for a beginner. But, if you put up with the concepts well, you can literally get into any balance sheet within 10 minutes.

So, I have this post around how to entrйe a balance sheet for dummies covered. Still have doubts? absorb comment below.

Balance Sheet for Dummies - YouTube

A balance sheet is often described as a "snapshot of a company's financial condition".[1] Of the four basic financial statements, the balance‚How to Prepare a Balance Sheet: 5 Steps for Beginners | HBS Online

10 Sep 2019 A balance sheet is a financial announcement verification that communicates the so-called ¢€œbook value¢€ of an organization, as calculated by subtracting all of‚

How to retrieve & tolerate a Balance Sheet | HBS Online

2 Apr 2020 The suggestion found in a balance sheet will most often be organized according to the following equation: Assets = Liabilities + Owners' Equity‚How to Read a Balance Sheet: unmodified Overview - Investopedia

The assets and liabilities sections of the balance sheet are organized by how current the account is. So for the asset side, the accounts are classified‚

Breaking beside The Balance Sheet - Investopedia

A company's balance sheet is comprised of assets, liabilities, and equity. Assets represent things of value that a company owns and has in its possession, or‚How To door A Balance Sheet | arrangement Financial Statements

Small businesses can right of entry their balance sheets to better recognize the company's accounts at a specific moment in time. To contact a balance sheet,‚How to make a balance sheet using a simple balance sheet equation

12 Agu 2021 And the balance sheet is one of the most important financial statements for analysis, because it provides a snapshot of your company's net worth‚Gallery of balance sheet for dummies :

Suggestion : Tutorial Download balance sheet for dummies for Free balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,for adult,for all mankind,for a while artinya,for artinya,for a while,for a while meaning,for all time otome game,for a few dollars more,for all the things i didn't do,for adalah,dummies artinya,dummies adalah,dummies and breastfeeding,dummies australia,dummies and sids,dummies and teeth,dummies activate now,dummies a wiley brand,dummies amazon,dummies asda Free Printable PDF DOC

0 Comments