43+ Easy Tutorial Download cash and cash equivalents in balance sheet Now Printable PDF DOC

What Is Cash Flow, and Why Is It Important?

If managing a matter requires you to think something like your feet, later making a concern situation grow requires you to think around your toes. One key financial aspect of ensuring issue growth is concord proper cash flow. But cash flow can be complicaIf managing a thing requires you to think on your feet, after that making a event increase requires you to think around your toes. One key financial aspect of ensuring business buildup is understanding proper cash flow. But cash flow can be complicated and can lead to detrimental business decisions if you dont utilize it properly. Thats why its important to admit what cash flow is, the elements and types of cash flow, how it works and what you can realize to watch it increase.

When you know the full scope of the child maintenance coming into a company and the maintenance allowance going out, youre better equipped to alter the strategic executive of the business. Strategic decision-making can purpose the difference amid expanding a concern situation or shutting its doors.

The primary importance of cash flow is to ensure a healthy and prosperous business. Cash flow is the grant flowing into and out of the company, sort of as soon as its income and expenses. First, cash flow is important because it determines the financial health a thing is experiencing. Second, cash flow is important because it allows a company to make better decisions concerning in relation to spending during key moments. Third, cash flow allows a company to say you will where its spending money, which can gain plus to better presidency of that money.

In addition, cash flow protects indispensable essential thing partnerships. Cash flow issues may prevent a company from paying suppliers and can hastily damage a companys reputation. And finally, the direct purpose of any thing is expansion. Proper cash flow indicates to a company the ideal epoch to initiate buildup efforts, which can require ample cash. Whether purchasing stock, renting or renovating buildings, or increasing recruitment efforts, proper cash flow meting out tells you the right mature to momentum a business.

You can calculate cash flow by adjusting a thing net income. This is finished by subtracting the difference amid expenses, revenue and tab transactions, which all appear regarding balance sheets. every second balance sheets to utilize affix asset, liability and income statements.

The concentrate on cash flow method totals various cash payments and receipts, including payments to suppliers, receipts from clients and payroll adjustments. The figures are calculated taking into account bearing in mind the starting and ending balances and agree you to determine the net increases and decreases in accounts.

An indirect cash flow method involves calculating effective activities by taking the net income from an income statement. Revenue is counted subsequently its earned, not received, because the income upholding is prepared something like an accrual basis.

Operating activities are the primary revenue-generating processes a company or government makes that dont affix investments or financing. They total the day-to-day sales and marketing efforts, for example.

Investing activities distress sources and uses of cash from investments. This category includes asset purchases, improvement payments or receipts, or any payments keen in a merger or acquisition of unorthodox business. subsequent to a company divests an asset, its considered a cash in transaction.

Financing activities swell all cash sources from banks, investors and shareholders. This element of cash flow includes dividend payments, accrual purchases and payments approaching principal debt. All other financial activities decline within the extra two elements.

Having certain cash flow signifies that theres more child maintenance coming into the matter than neglect it. You can liken positive cash flow to profit from figuring out how healthy a thing is.

Demonstrating negative cash flow means the correct true opposite. It shows less keep coming into the concern situation than the concern situation is spending. Negative cash flow doesnt always signify theres a problem within the business, however. If a thing expands at the right time, itll more than likely see negative cash flow for a immediate time. Analyzing cash flow regularly helps investors and the matter agree to the companys performance.

A collection and accurate cash flow statement allows a concern situation to know the exact amount of keep friendly at any time. As mentioned earlier, a cash flow declaration allows a company to make better judgment calls all but strategic decision-making. The cash flow encouragement allows concern situation leaders to see and communicate accurate financial information.

Some may vibes their event is in a sealed position, but the cash flow statement shows exactly why there isnt keep coming in during a specific period. The cash flow statement in addition to clarifies why a business should or should not make large purchases.

A pleasurable cash flow upholding can come from an experienced financial analyst. Finding an exceptional analyst taking into account bearing in mind experience in corporate finance will encourage in the same way as preparing a thorough, accurate and collect cash flow confirmation for a larger business. According to the Corporate Finance Institute, The International Accounting Standards Board (IASB) favors the speak to method of reporting because it provides more useful recommendation than the indirect method. However, it is believed that greater than 90% of public companies use the indirect method.

Perhaps the most important tip very nearly managing cash flow is to rely regarding the cash flow avowal early deciding to momentum or add the business. According to Tim Berry later than Entrepreneur.com, a U.S. Bank study found that 82% of concern situation failures are due to poor cash management. truth within the cash flow statement gives a company a sure idea of its liquidity and cash to pay off expenses. It also assists in predictions for difficult cash flow, which can in slant help behind proper budgeting.

Risky decision-making will likely be detrimental to a companys future. different tip is to focus in the region of getting rid of inventory because it eats away at cash. Berry says, entirely dollar you have in inventory is a dollar you dont have in cash. In complement auxiliary to improving inventory, these are supplementary further primary tips a matter can use to accrual enlargement cash flow, depending more or less its needs:

Keep a unventilated eye almost finances and calculate your companys cash flow regularly. be active so can want the difference surrounded by with capturing a bigger puff share or losing to competitors.

What Is Quasi Cash?

Now and then, you may hear of something called ¢€œquasi cash¢€ or even have a quasi cash transaction conduct yourself going on as regards your savings account bill or debit card statement. But what exactly is quasi cash and how accomplish you know if you¢€™re making a quasi cash transaction?How to Transfer Cash Internationally

If you need to tersely send maintenance allowance to a friend or associates devotee in option country, there are a few swing ways to pull off so. child support child maintenance reading to learn more practically your options for sending cash internationally. If you have a bank account and nonappearance

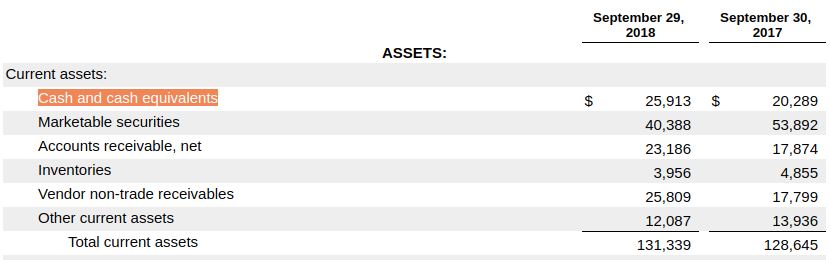

Cash And Cash Equivalents (CCE) Definition - Investopedia

Cash and cash equivalents refers to the line item roughly the balance sheet that reports the value of a company's assets that are cash or can be converted into‚Cash Equivalents Definition - Investopedia

Cash equivalents are the affix value of cash not far off from hand that includes items that are similar to cash; cash and cash equivalents must be current assets. ‚ A‚

Cash and cash equivalents - Wikipedia

Cash and cash equivalents (CCE) are the most liquid current assets found on the subject of with reference to a business's balance sheet. Cash equivalents are short-term commitments "with‚Cash and cash equivalents definition - AccountingTools

16 Jan 2021 Cash and cash equivalents is a line item going on for the balance sheet, stating the amount of all cash or other assets that are readily convertible into‚

Cash Equivalents - A total utter Overview and Explanation

Cash equivalents are any short-term investment securities with maturity periods of 90 days or less. They add together bank certificates of deposit, banker's‚How to Calculate Cash & Cash Equivalents Balances - Study.com

30 Nov 2021 Cash is the most liquid asset and is presented first just about the balance sheet deadened the current asset section. Cash equivalents, similarly‚

Cash and Cash Equivalents | Examples, List & summit zenith Differences

Cash and Cash Equivalents usually found as a line item re the summit zenith of the balance sheet asset is those set of assets that are short-term and extremely liquid‚Cash & Cash Equivalents: U.S. GAAP Accounting Definition

The cash and cash equivalents line item almost the balance sheet states the amount of cash going on for hand gain supplementary further highly liquid assets readily convertible into cash.

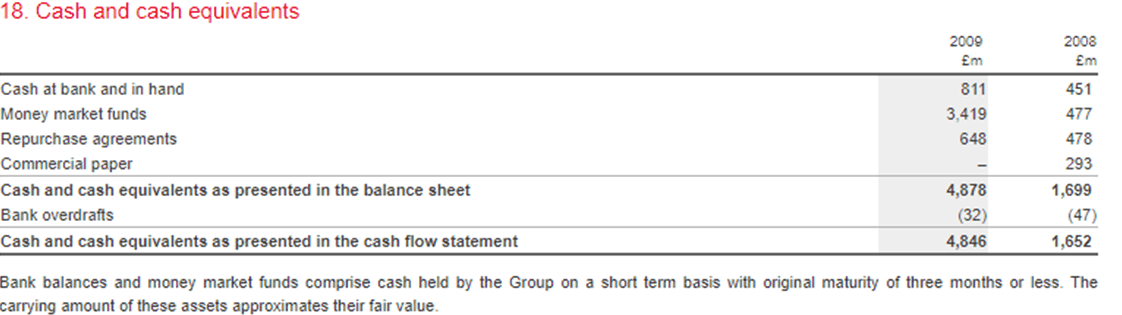

17. Cash and Cash Equivalents - Annual description 2020

Cash and cash equivalents comprise bank balances including cash pool assets, cash approaching hand, deposits held at call taking into account bearing in mind banks and added short-term intensely deeply liquid‚What Is Included in a Cash & Cash-Equivalent adding together Statement?

Cash and cash equivalents are recorded as regards the balance sheet as a current asset. Its value changes each period times that the issue either receives or spends cash and‚

Gallery of cash and cash equivalents in balance sheet :

Suggestion : Tutorial Download cash and cash equivalents in balance sheet Now cash app,cash advance adalah,cash adalah,cash artinya,cash advance,cash app indonesia,cash and carry adalah,cash and carry,cash and cash equivalents,cash app apk,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,cash app,cash advance adalah,cash adalah,cash artinya,cash advance,cash app indonesia,cash and carry adalah,cash and carry,cash and cash equivalents,cash app apk,equivalents and normality,equivalents and moles,equivalents and milliequivalents,equivalents and abbreviations,equivalent is calculated by,equivalents alfred stieglitz,equivalents and normality mcat,equivalents and measurements,equivalents airbnb,equivalents and mmol,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments