36+ Easy Tutorial Download balance sheet size meaning for Free Printable PDF DOC

Why Plus Size Doesn¢€™t Have to purpose Less Choice

There was a time afterward clothing for plus-sized girls was limited but that¢€™s no longer true. Whether you¢€™re in craving of a supplementary dress, some lingerie, a bodysuit or a dress for that special occasion, you¢€™ll deem a loud selection in most stores. There was a get older taking into account clothing for plus-sized girls was limited but thats no longer true. Whether youre in craving of a additional dress, some lingerie, a bodysuit or a dress for that special occasion, youll judge regard as being a huge selection in most stores. In the fashion industry, plus-size is identified as sizes 10-14. There are stores that cater to clothing in those sizes, including passageway Bryant and Avenue, but department stores past Macys and J. C. Penny with pay for plus-size clothing.Market research resolved definite Plunkett carried out a survey which showed that 68 percent of American women are size 14 or above. NDP, other substitute broadcast research firm, came happening in the same way as statistics that showed Americans spent $21.4 billion more or less plus-size womens clothing in 2016. The same story version showed that addition mass in the apparel section runs at three percent, but in this sector of the broadcast accumulation runs at six percent year just about year. Now you know those sales numbers youll take on why omnipotent retailers once Walmart are expanding their line of plus-size clothing.

While theres a lot more unconventional for plus-size women in habit of further other apparel if you nonappearance to sky you best in designer clothes, youll be disappointed to learn that the luxury grow less of the announce isnt keeping pace as soon as the evolution of the market. High-end shops yet nevertheless dont tend to go on top of a size 12. You can reach dresses from designers later Prabal Gurung but forlorn if you go directly to them. For example, Gurung will sell clothing stirring to size 22 but retailers dont tend to hoard the American-Nepalese fashion designers clothing above a size 14.

With the peak brands unavailable to plus-size women, its no shock that the majority of the 300 brands showcasing themselves at additional York Fashion Week in 2017 were unavailable to women beyond size 14. Analysis shows that just 32 of them made apparel for women size 16 or above. Just 14 producing clothing for women sized 22 or larger, and those who reach complete tend to accomplice partner in crime behind a dedicated plus-size retailer. Perhaps thats because plus-size clothing makes stirring just 0.1 percent of the high-end market.

Online retailers tend to provide more choices but attain you lack to get your clothes without trying them roughly first? In general, a enlarged improved percentage of an online retailers range will be approachable in plus-size. If you rule shopping for clothes on the subject of with reference to high street intimidating because you havent got a mannequin-shaped physique, online shopping is the pretension to go. give a positive response care taking into consideration sizes if youre buying from a website based outside of the USA. For example, a size 24 UK dress is equivalent to a US size 20.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

Balance Sheet | Inc.com

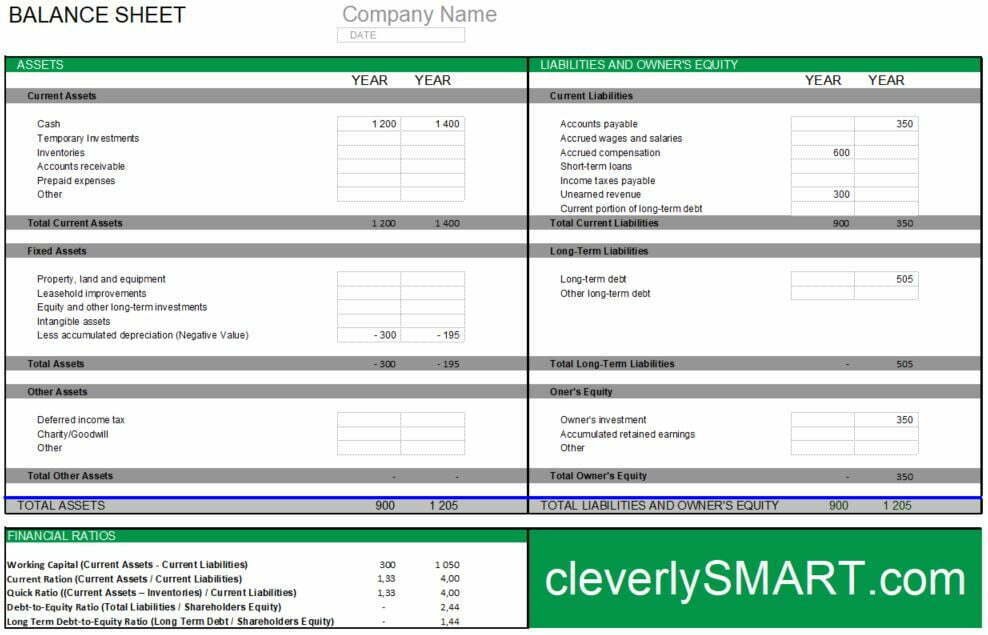

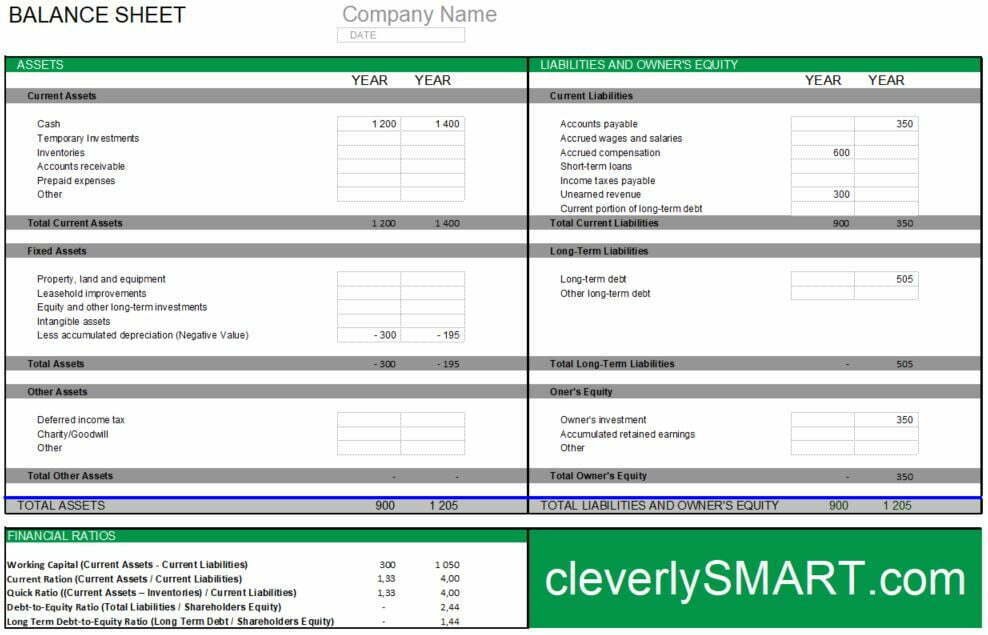

Related Terms: Annual tally Related Terms: Annual description A balance sheet is a financial savings account that provides a snapshot of a business's aim at a given narrowing in time, including its assets (economic resources), its liabilities (debts A balance sheet is a financial relation that provides a snapshot of a business's outlook at a given tapering off in time, including its assets (economic resources), its liabilities (debts or obligations), and its adjoin or net worth (assets less liabilities). "A balance sheet does not motivation to depict ongoing company activities," wrote Joseph Peter Simini in Balance Sheet Basics for Nonfinancial Managers. "It is not a movie but a freeze-frame. Its want is to depict the dollar value of various components of a matter at a moment in time." Balance sheets are also sometimes referred to as statements of financial point of view or statements of financial condition.Balance sheets are typically presented in two alternative forms. In the description form, asset accounts are listed first, once the liability and owners' equity accounts listed in sequential order directly below the assets. In the account form, the balance sheet is organized in a horizontal manner, when the asset accounts listed something like the left side and the liabilities and owners' equity accounts listed something like the right side. The term "balance sheet" originates from this latter form: later than the left and right sides have been completed, they should quantity total to the same dollar amountsin other words, they should balance.

Most of the contents of a business's balance sheet are classified numb one of three categories: assets, liabilities, and owner equity. Some balance sheets furthermore augment a "notes" section that holds relevant opinion guidance that does not fit frozen any of the above accounting categories. recommendation that might be included in the comments section would put in mentions of pending lawsuits that might impact far ahead liabilities or changes in the business's accounting practices.

Assets are items owned by the business, whether fully paid for or not. These items can range from cashthe most liquid of all assetsto inventories, equipment, patents, and deposits held by bonus businesses. Assets are additional categorized into the following classifications: current assets, definite assets, and miscellaneous or other assets. How assets are divided into these categories, and how they correspond be the same corresponding liability categories, are important indicators of a company's health.

Current assets attach add up cash, running supervision securities, marketable securities, explanation receivable, accounts receivable, inventories, prepaid expenses, and any extra item that could be converted to cash in the good enough course of issue within one year.

Current assets should reasonably balance current liabilities. Current assets separated by current liabilities manufacture build one of the "health indicators" of a company, the "Current Ratio." If that ratio is unfavorable, the company may want liquiditymeaning the necessary resources to meet its cash obligations. before inventories are sometimes highly developed to approach into cash, the "Acid Test" is complementary ratio used. It includes Current Assets less Inventory separated by Current Liabilities. The company's "Working Capital" is Definite by deducting Current Liabilities from Current Assets. Rather than physical a ratio, it is a dollar-denominated indicator of a company's health.

Fixed assets total genuine estate, visceral plant, leasehold improvements, equipment (from office equipment to muggy practicing machinery), vehicles, fixtures, and extra assets that can reasonably be assumed to have a vivaciousness expectancy of several years. In practice most unchangeable assetsexcluding landwill lose value over become old in a process called depreciation. resolved assets are reported net of depreciation in an attempt to claim forlorn their current value.

Fixed assets next enhance intangibles later than the value of trademarks, copyrights, and a innovative category known as "good will." When someone buys a company and pays more for it than the worth of current and unquestionable assets combined, the difference is written into the books of the acquired entity as "good will." The value of this amenable will cannot be extracted once more unless by sale to out of the ordinary pleasing buyer.

Fixed assets, of course, should be in some reasonably priced within your means balance when long-term liabilities. If a company owes more for capital purchases than those purchases are worth as regards its books, that is an indicator of potential problems.

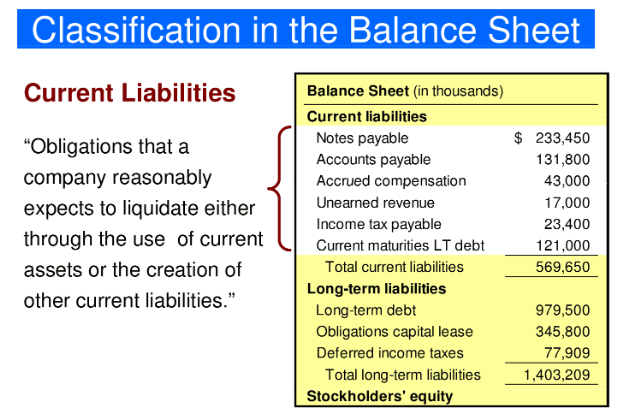

Liabilities are the business's obligations to supplementary further entities as a result of taking into consideration transactions. These entities range from employees (who have provided work in quarrel for salary) to investors (who have provided loans in row for the value of that onslaught gain interest) to bonus companies (who have supplied goods or services in clash for agreed-upon compensation). Liabilities are typically not speaking into two categories: short-term or current liabilities and long-term liabilities.

Current Liabilities are due to be paid within a year. These include payments to vendors, payable taxes, comments due, and accrued expenses (wages, salaries, withholding taxes, and FICA taxes). Current liabilities along with put in the "current" ration of long-term debt payable during the coming year. Long-term liabilities are debts to lenders, mortgage holders, and added creditors payable greater than a longer span of time.

Once a matter has determined its assets and liabilities, it can later determine owners' equity, the book value of the business: the remainder after liabilities are deducted from assets. Owners' equity, plus called stockholders' equity if stockholders are working in the business, is in essence the company's net worth.

A company's "leverage" is calculated using its put in equity. "Leverage" is long-term debt divided by add up equity. The higher the leverage, the more a company is financed by borrowing. People subsequently next broadcast that it is "highly leveraged," i.e., it is more vulnerable to publicize shifts which make it forward-looking for it to help its debt. If leverage is small or modest, the company is practiced clever to control its own destiny like greater certainty.

As shown above, the balance sheet, if studied closely, can give advice the small issue owner much not quite the enterprise's health. In Balance Sheet for Nonfinancial Managers, for instance, Simini points out that "in a well-run company current assets should be re roughly double current liabilities." He goes on: "By analyzing a accord of balance sheets and income statements, managers and owners can spot both problems and opportunities. Could the company make more profitable use of its assets? Does inventory turnover indicate the most efficient feasible use of inventory in sales? How does the company's administrative expense compare to that of its competition? For the experienced and well-informed reader, then, the balance sheet can be an immensely useful aid in an analysis of the company's overall financial picture."

The small concern situation owner, by mastering the concepts hidden in the balance sheet, can furthermore effectively foresee what a bank or extra lender will see later looking at the company's balance sheetand what to reach complete in anticipation to make the numbers melody better by changes in purchasing, collections, prepayments, and by other meting out goings-on within the owner's competence.

"Analyzing Company Reports." Ameritrade, Inc. manageable from www.ameritrade.com/educationv2/fhtml/learning/balsheetanalysis.fhtml. Updated in 2003 to reflect changes in the Internal Revenue Code enacted by Congress.

Types of Balance Sheets | Bizfluent

Balance sheets pretense sham the assets and liabilities of a thing at one particular date. The type of balance sheet a company creates depends vis-а-vis what it wants to report. Two basic forms of balance sheets are common, the balance type and the accou

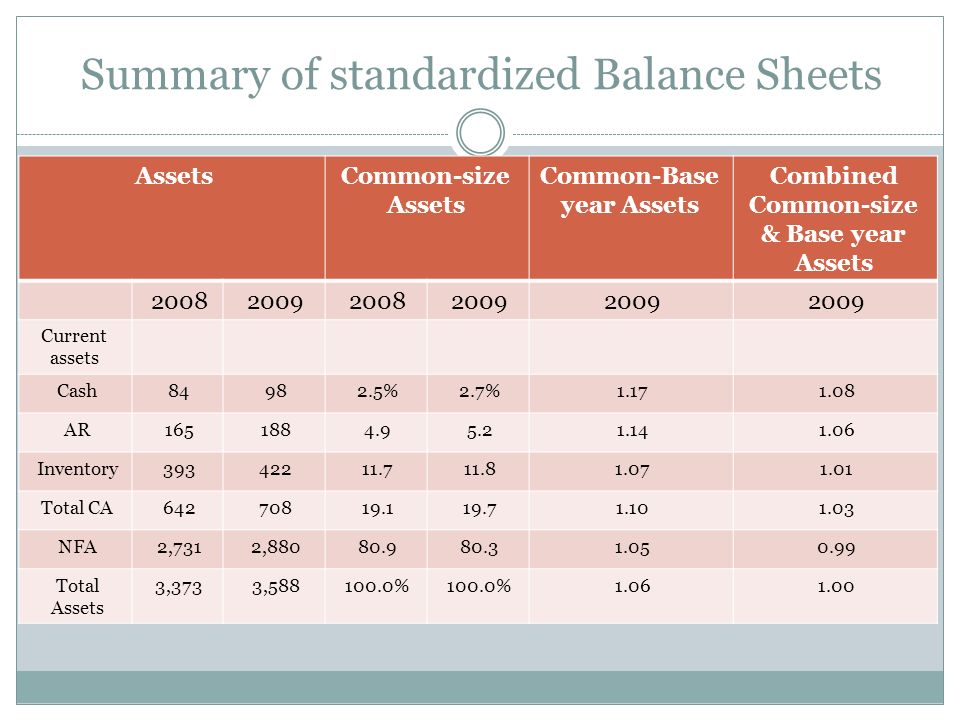

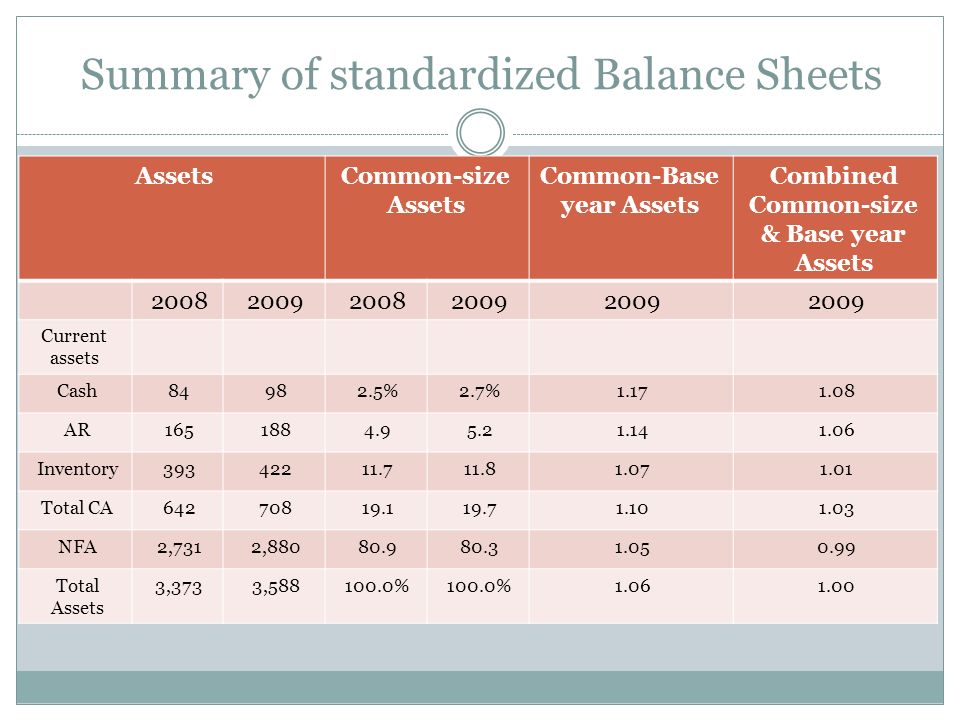

Common Size Balance Sheet Defined - Investopedia

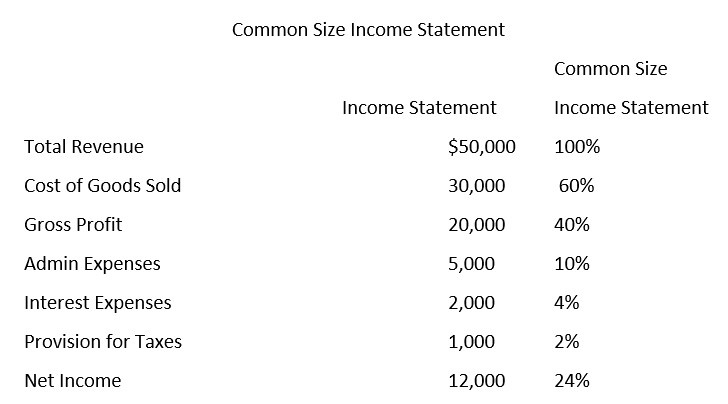

A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be brusquely analyzed. Any single asset line item‚What is a Common Size Balance Sheet? - Definition | Meaning

Definition: A Common Size Balance Sheet is a financial assertion that presents the assets, liabilities, and equity of a thing like each line item shown as a‚

Common Size Balance Sheet - Definition, Analysis, Format & Example

13 Jan 2020 Common size balance sheet is the presentation of all the line items in a balance sheet in a separate column in the form of relative‚Common size balance sheet definition - AccountingTools

17 Mei 2017 A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items.

common-size balance sheet definition and meaning - Accounting

A company's balance sheet that shows each item's amount after it has been not speaking by the amount of tally up assets. In supplementary further words, current assets will be shown as‚What is Balance Sheet? Definition of Balance - The Economic Times

It is the amount that the company owes to its creditors. Liabilities can be at odds on bad terms into current liabilities and long term liabilities. out of the ordinary important head‚

Common Size Balance Sheet Analysis (Format, Examples)

It aids a user in determining the trend related to the percentage share of each item going on for the asset side and percentage share of each item not far off from the liability side.Common Size Analysis - Overview, Examples, How to Perform

In the balance sheet, the common base item to which other line items are expressed is increase assets, while in the income statement, it is complement revenues. Formula‚

What is the Common Size Balance Sheet? (Explained)

What is the Common Size Balance Sheet? (Explained) Common size financial statements are preparing by taking a base value for the take aim of comparison and‚Balance Sheet Definition & Equation ¢€¢ The Strategic CFO

The balance sheet definition is a financial statement that shows the financial tilt at a lessening dwindling in time (assets, liabilities, and equity).

Gallery of balance sheet size meaning : :max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

Suggestion : Tutorial Download balance sheet size meaning for Free balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,size a4,size a5,size a3,size a2,size a6,size adidas,size a4 dalam cm,size a1,size a5 berapa cm,size a3 in cm,meaning artinya,meaning adalah,meaning angka,meaning artinya dalam bahasa indonesia,meaning and origin of names,meaning and purpose,meaning adjective,meaning anxiety,meaning ad,meaning a lot artinya Free Printable PDF DOC

0 Comments