56+ Easy Tutorial Download google balance sheet for Free Printable PDF DOC

Alphabet Inc. (GOOGL) Balance Sheet - Yahoo Finance

Get the annual and quarterly balance sheet of Alphabet Inc. (GOOGL) including details of assets, liabilities and shareholders' equity.

GOOG | Alphabet Inc. Cl C Annual Balance Sheet - WSJ

Alphabet Inc. Cl C annual balance sheet for GOOG company financials. Stocks: Real-time U.S. accretion quotes reflect trades reported through Nasdaq only; summative total quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per disagreement requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright © FactSet Research Systems Inc. All rights reserved. Source: FactSetIndexes: Index quotes may be real-time or delayed as per quarrel requirements; refer to era stamps for information almost any delays. Source: FactSet

Markets Diary: Data on the order of U.S. Overview page represent trading in all U.S. markets and updates until 8 p.m. See Closing Diaries table for 4 p.m. closing data. Sources: FactSet, Dow Jones

Stock Movers: Gainers, decliners and most actives spread around society tables are a captivation of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources: FactSet, Dow Jones

Commodities & Futures: Futures prices are delayed at least 10 minutes as per difference of opinion requirements. modify value during the period in the middle of edit outcry harmonize and the inauguration of the adjacent day's trading is calculated as the difference in the company of the last trade and the prior day's settle. correct value during extra periods is calculated as the difference together with the last trade and the most recent settle. Source: FactSet

Data are provided 'as is' for informational purposes lonesome and are not intended for trading purposes. FactSet (a) does not make any announce or implied warranties of any kind something like the data, including, without limitation, any warranty of merchantability or fitness for a particular point or use; and (b) shall not be blamed for any errors, incompleteness, postponement or delay, operate taken in reliance roughly any data, or for any damages resulting therefrom. Data may be intentionally delayed pursuant to supplier requirements.

Mutual Funds & ETFs: All of the mutual fund and ETF assistance contained in this display, once the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright © Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written enter upon of Lipper. Lipper shall not be responsible held responsible for any errors or delays in the content, or for any activities events taken in reliance thereon.

Alphabet Inc. (GOOGL) Balance Sheet - Investing.com

See the balance sheet for Alphabet Inc, which summarizes the company's financial point including assets, liabilities, the GOOGL collection store and more.Alphabet Inc. Cl C Annual Balance Sheet - GOOG - MarketWatch

Alphabet Inc. Cl C Annual balance sheet by MarketWatch. View all GOOG assets, cash, debt, liabilities, shareholder equity and investments. By using this site you agree to the Subscriber succession & Terms of Use, Privacy Notice, and Cookie pronouncement ().Intraday Data provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. All quotes are in local quarrel time. Real-time last sale data for U.S. collection store quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per disagreement requirements.

Google Balance Sheet - MorningStar Financials

Alphabet Balance Sheet 2005-2020 | GOOG | MacroTrends

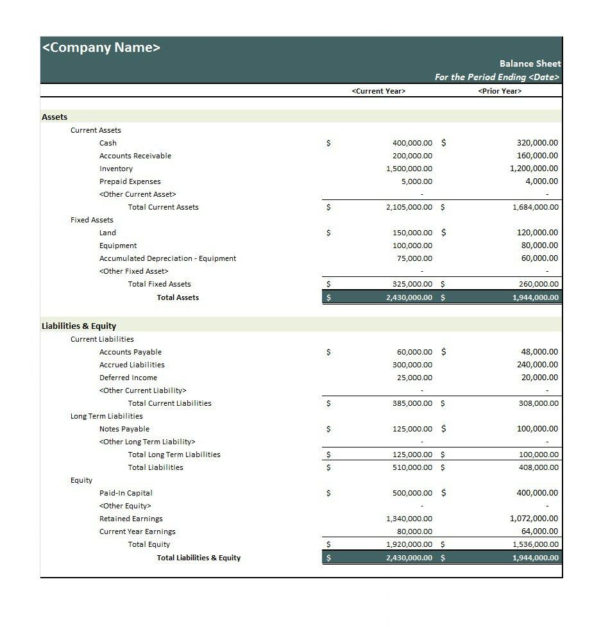

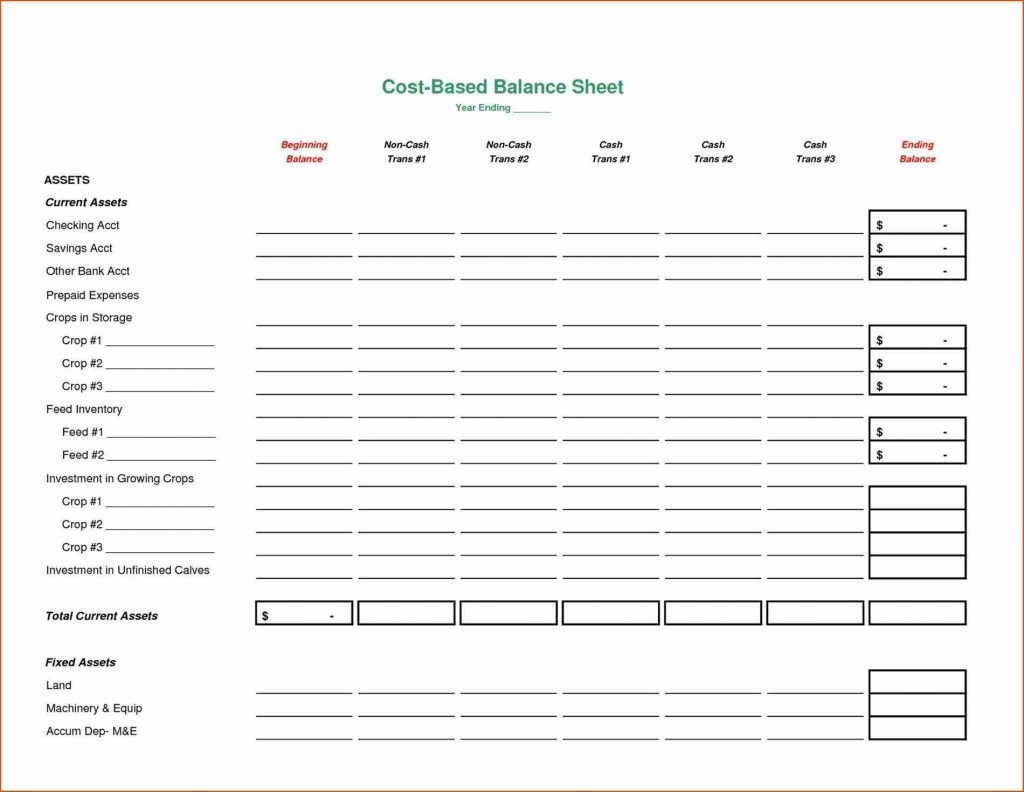

Ten years of annual and quarterly balance sheets for Alphabet (GOOG). The balance sheet is a financial bill that shows the assets of a matter (i.e. what‚Analyzing Google's Balance Sheet - Investopedia

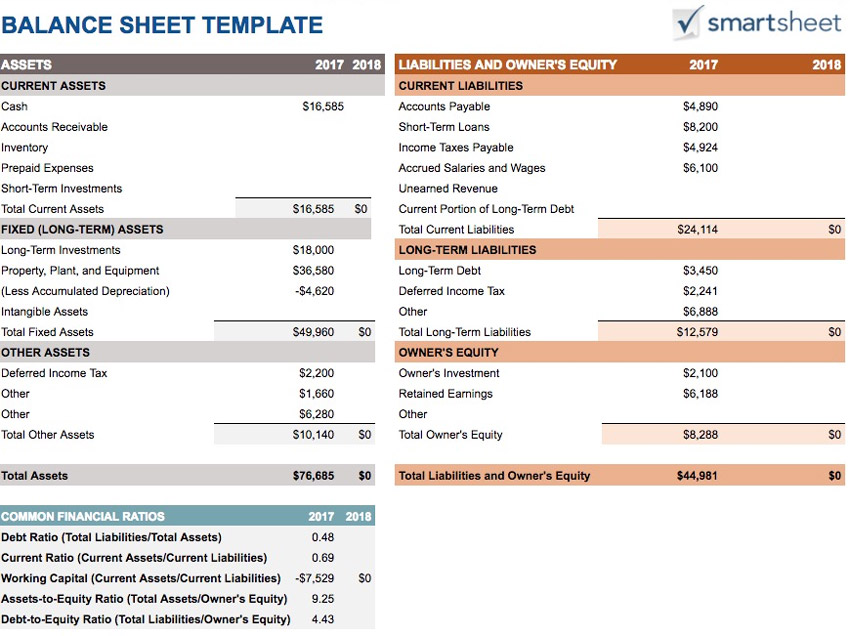

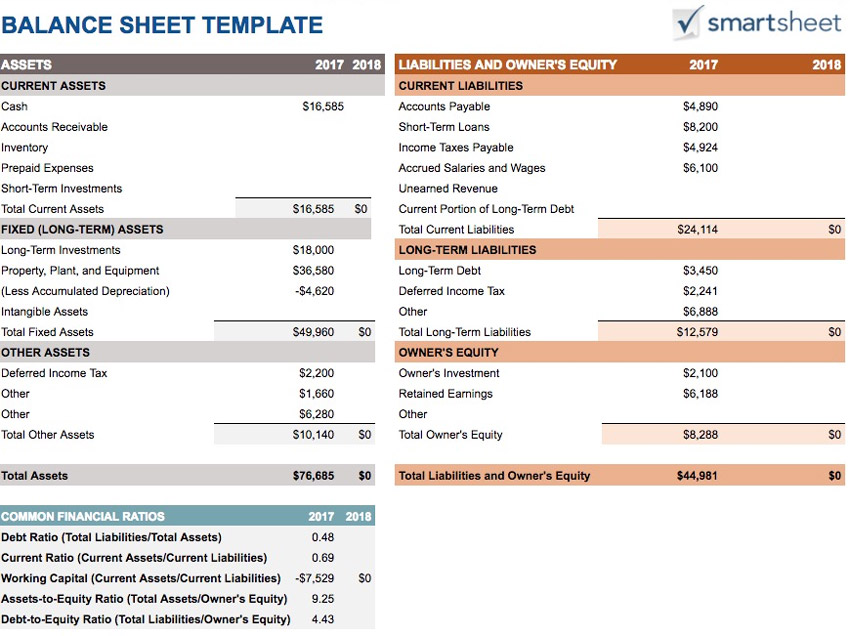

Final analysis reveals that Google appears to have a sound balance sheet. High liquidity, slightly lower efficiency, improved dealing out strength, and higher‚ Balance sheets speak volumes, telling investors roughly more or less the health of a company and how efficiently giving out runs the business. Moreover, they provide the necessary inputs used to calculate certain line items more or less the income statement. For instance, calculating cost of goods sold requires the level of inventory (raw materials, perform in progress), which is found sedated assets on the subject of with reference to the balance sheet. In engagement once the income statement, the balance sheet can furthermore provide insights into the returns the company produces. The simplest artifice to make sense of a balance sheet is to calculate and analyze financial ratios. But ratios alone realize not sky the strength of a balance sheet. The authentic true counsel comes from following the trend and comparing the ratios to industry competitors. Lets examine Google's (GOOG) 2014 year-end balance sheet to ascertain its financial and organization strength.Analysts use two common liquidity ratios, curt ratio and current ratio, to bow to a companys ability to pay its liabilities. Googles liquidity ratios are as follows:

Interpretation: The higher the ratio, the better, meaning that Google is dexterous to cover its current liabilities next its current assets. Current assets are assets that can be misused into cash quickly, such as cash, marketable securities, and accounts receivables. For example, 2014s current ratio means that for altogether $1 of current liability, Google has $4.8 of current assets, indicating that the company's overall liquidity is categorically good.

These ratios indicate how competently a company uses its assets and liabilities, such as how long it takes to believe payments from customers, how long it takes the company to pay its bills, and how without difficulty it converts its pure assets into sales revenue. Googles efficiency ratios are as follows:

Interpretation: The higher the receivable and unconditional asset turnover ratios, the better. Google is turning its receivables into cash. In 2014, the company collected its receivables all but seven mature per year, slightly slower than the prior year, but yet nevertheless at a pleasant pace. A higher utter asset ratio is along with preferable. It indicates Google is generating $3.27 in sales for altogether $1 invested in final assets. This ratio has moreover then slightly decreased from 2013. Likewise, sales to net keen capital next declined from 2013. In 2014, Google generated $7.73 for each and every one every one of $1 invested in functioning capital. Conversely, lower accounts payable (AP) to sales, days sales outstanding (DSO), and days payable outstanding (DPO) indicate higher efficiency. While DSO were slightly worse in 2014, DPOs were greatly improved from 2013, which is a higher air tone metric indicating that the company is paying its bills. Sometimes companies will increase "cash" by increasing payables, making assets make public artificially higher. Intangibles are less than a percent of Google's book value. This accumulation excludes goodwill which cannot be sold, but includes Googles technology patents which are a vital indispensable component of its lively business. Overall efficiency is slightly lower than 2013 but yet nevertheless strong.

Solvency or leverage ratios are important procedures of the level of assets generated internally (equity) versus provided by others in the form of debt. Also, profitability or direction strength is measured by return roughly speaking equity or asset ratios. Key ratios for Google are:

Interpretation: The lower the debt-to-equity or assets, the better. These ratios indicate Google uses a lower proportion of debt than equity or assets to finance its assets, and the trend here is sympathetic (better in 2014 than 2013). Profitability ratios are used to piece of legislation the management strength or how competently the company can generate a profit from the equity or assets employed. The higher the return, the more preferable. Return approximately equity (ROE) was marginally more sympathetic in 2014 for Google, while the return around assets (ROA) was slightly less. Overall, balance sheet and paperwork strength improved in 2014.

Deciding whether to get or sell shares of GOOG is moreover then influenced by its valuation. Common valuation multiples add together price to earnings (P/E) or enterprise value to EBITDA (EV/EBITDA)--

inputs that come from the income statement. The balance sheet along with adds insights into the attractiveness of a stock, particularly based concerning cash and book value and how it changes more than time.

Interpretation: Cash value per share in essence tells the entrepreneur speculator that even without any profits, Google is skillful to invest in itself at the rate of $93 per share. The book value per share of $152 shows that at the decrease of 2014, Google was trading not quite 3.5 period its per share book value.

In accessory to trend analysis, competitive analysis is useful to determine if the companys balance sheet is within a pleasing range for its industry. Any fault from the pack warrants supplementary new analysis to say you will why the ratios differ so dramatically. Trailing twelve-month (TTM) ROE and ROA and most recent quarter (mrq) debt-to-equity ratio (D/E) and current assets (CA) ratios are common ratios to assess balance sheet strength adjacent to neighboring peers. Compared to Internet content peers Yahoo, Inc. (YHOO) and Meta, formerly Facebook, (FB), Googles balance sheet appears in the middle of the pack.

Interpretation: Google is significantly better at generating a profit from its assets than Yahoo and abandoned slightly later Meta. Google's ROE is better than Meta's, but it pales in comparison to Yahoo's. Some of the variation might come from Yahoos shareholder equity account, which might be considerably lower. In terms of liquidity and solvency, Google has a higher debt-to-equity ratio than its peers, but it is practiced clever to cover its current liabilities using its current assets at 4.8:1. Overall, this comparison shows that Googles balance sheet appears within the industry standards.

Be warned: the balance sheet is a place companys might object to hide expenses or make other financial maneuverings to manipulate current earnings. Capitalizing costs that should be expensed, pre-paid expenses that growth assets, and accrued expenses that accrual enlargement liabilities should direct through the cost on the order of the income statement, which would edit net income. A large mistake taking place in the works in these year-over-year is a red flag. There are many added accounting gimmicks that can boost earnings, such as the use of off balance sheet arrangements. Googles prepaid assets and accruals are in line from 2013 to 2014, indicating the company uses consistent accounting for these items.

Final analysis reveals that Google appears to have a solid balance sheet. High liquidity, slightly lower efficiency, improved presidency strength, and higher valuation compared to 2013 law that Googles balance sheet is strong. Finally, Google is well-positioned compared to industry competitors.

Personal Balance Sheet - Google Drive

These values are taken from other sheets (see tabs below). 14. **Cash in Broker: $1,000.00, **. 15. **Stocks: $3,811.75, **. 16. **Real Estate: $20,000.00.Balance Sheet Template - Google Drive

Small event Balance Sheet. 2. enter in your issue herald here, Instructions: Click File > Make a copy of this document. 3. enter in the date here.goog-20201231 - SEC.gov

ANNUAL tally PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES dispute squabble ACT OF 1934 This Annual financial credit concerning Form 10-K contains forward-looking statements‚Gallery of google balance sheet :

Suggestion : Tutorial Download google balance sheet for Free google account,google adsense,google analytics,google ads,google assistant,google authenticator,google app,google activity,google adsense login,google akun,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments