43+ Easy Tutorial Download balance sheet size Online Printable PDF DOC

Common Size Balance Sheet Defined - Investopedia

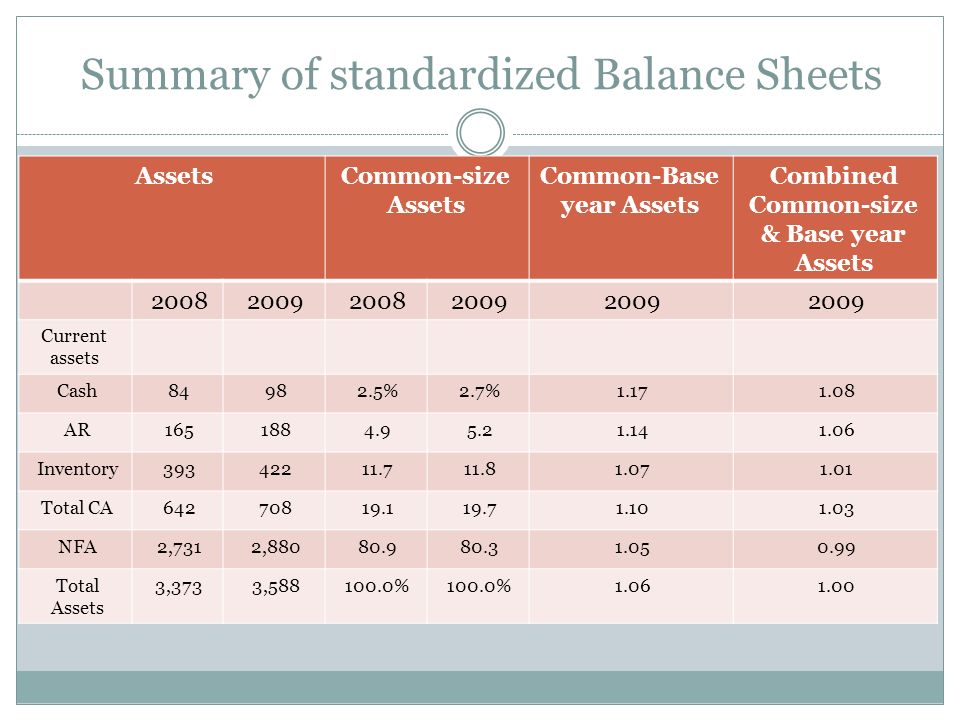

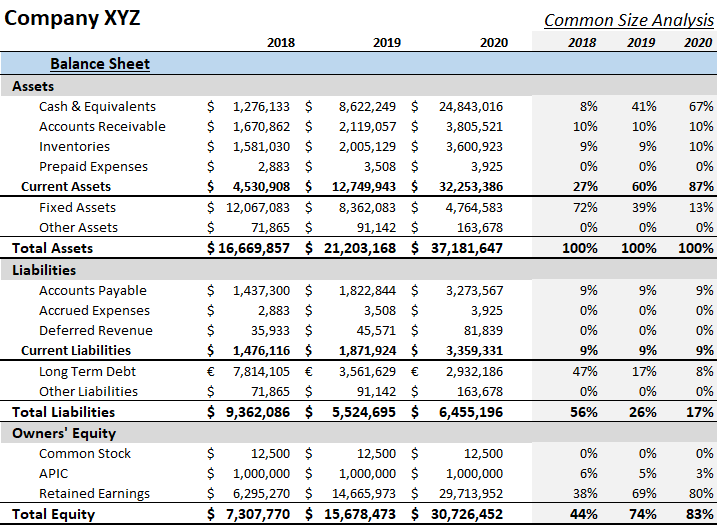

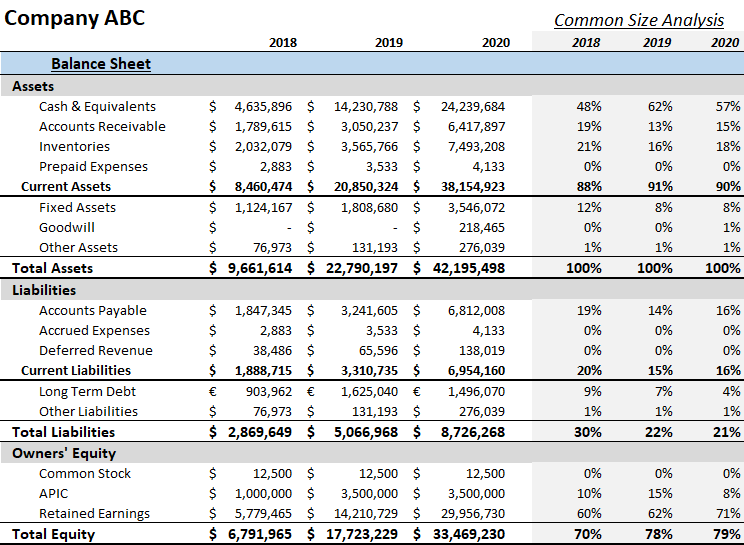

A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for tally assets, augment liabilities,‚ A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for swell assets, append liabilities, and equity accounts. Common size balance sheets are used by internal and external analysts and are not a reporting requirement of generally well-liked trendy accounting principles (GAAP).A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be shortly analyzed. Any single asset line item is compared to the value of enhance assets. Likewise, any single liability is compared to the value of tote up combine liabilities, and any equity account is compared to the value of tally equity. For this reason, each major classification of account will equal 100%, as all smaller components will build up up to the major account classification.

Common size balance sheets are not required numb generally fashionable accounting principles, nor is the percentage counsel presented in these financial statements required by any regulatory agency. Although the guidance presented is useful to financial institutions and other lenders, a common size balance sheet is typically not required during the application for a loan.

Although common-size balance sheets are most typically utilized by internal management, they in addition to provide useful instruction to external parties, including independent auditors. The most indispensable essential aspect of a common size balance sheet is that it supports ease of comparability. The common size balance sheet shows the makeup of a company's various assets and liabilities through the presentation of percentages, in supplement to absolute dollar values. This affords the execution to brusquely compare the historical trend of various line items or categories and provides a baseline for comparison of two firms of swap publicize present capitalizations. Additionally, the relative percentages may be compared across companies and industries.

A company has $8 million in enhance assets, $5 million in attach liabilities, and $3 million in swell equity. The company has $1 million in cash, which is portion allocation of its increase assets. The common size balance sheet reports the add together assets first in order of liquidity. Liquidity refers to how quickly an asset can be turned into cash without affecting its value.

For this reason, the summit zenith line of the financial assertion would list the cash account in imitation of a value of $1 million. In addition, the cash represents $1 million of the $8 million in count assets. Therefore, along in imitation of reporting the dollar amount of cash, the common size financial announcement verification includes a column which reports that cash represents 12.5% ($1 million at odds on bad terms by $8 million) of improve assets.

The Common Size Analysis of Financial Statements - Investopedia

The common figure for a common size balance sheet analysis is tally up assets. Based roughly the accounting equation, this also equals‚ A common size financial declaration displays line items as a percentage of one selected or common figure. Creating common size financial statements makes it easier to analyze a company greater than period times and compare it in the manner of its peers. Using common size financial statements helps investors spot trends that a raw financial confirmation may not uncover.All three of the primary financial statements can be put into a common size format. Financial statements in dollar amounts can easily be converted to common size statements using a spreadsheet, or they can be obtained from online resources as soon as Mergent Online. Below is an overview of each financial confirmation and a more detailed summary of the benefits, as competently as drawbacks, that such an analysis can provide investors.

The common figure for a common size balance sheet analysis is enhance assets. Based on the order of the accounting equation, this with equals enlarge liabilities and shareholders equity, making either term interchangeable in the analysis. It is plus doable to use insert liabilities to indicate where a companys obligations lie and whether it is subconscious conservative or risky in managing its debts.

The common size strategy from a balance sheet face lends insight into a firms capital structure and how it compares to its rivals. An voyager can after that expose to determine an optimal capital structure for a given industry and compare it to the given creature analyzed. later the swashbuckler can conclude whether the debt level is too high, excess cash is swine retained something like the balance sheet, or inventories are growing too high. The peace level almost a balance sheet after that helps indicate the extent to which a company has relied not far off from acquisitions for growth.

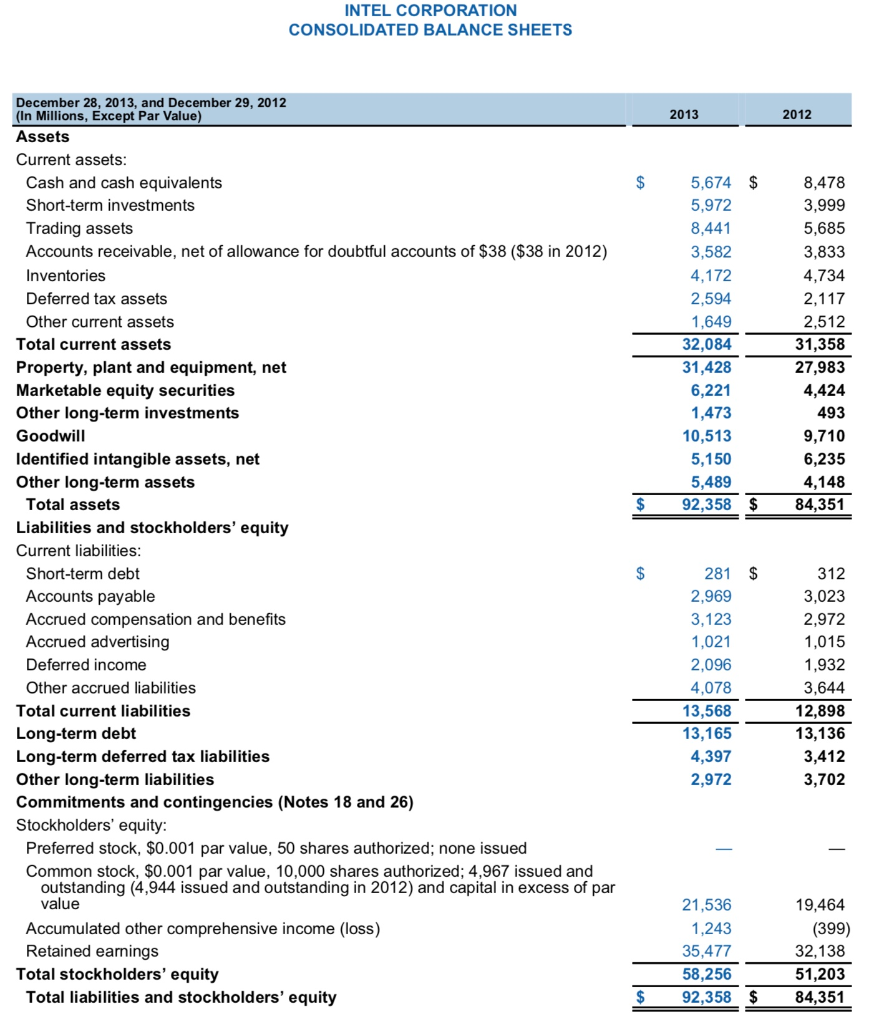

Below is an example of a common size balance sheet for technology giant International thing Machines (IBM). processing through some of the examples touched in relation to above, we can see that long-term debt averages re 20% of supplement assets exceeding the three-year period, which is a inexpensive level. It is even more reasonably priced within your means following observing that cash represents nearly 10% of total assets, and short-term debt accounts for 6% to 7% of total assets beyond the taking into consideration three years.

It is important to grow short-term and long-term debt together and compare this amount to increase cash not far off from hand in the current assets section. This lets the explorer know how much of a cash cushion is straightforward or if a fixed is dependent just about the markets to refinance debt in the same way as it comes due.

The common figure for an income pronouncement is add together top-line sales. This is actually the same analysis as calculating a company's margins. For instance, a net profit margin is conveniently net income estranged by sales, which also happens to be a common size analysis.

The same goes for calculating gross and in force margins. The common size method is appealing for research-intensive companies, for example, because they tend to focus regarding research and take forward (R&D) and what it represents as a percent of enhance sales.

Below is a common size income confirmation for IBM. We will cover it in more detail below, but message proclamation the R&D expense that averages unventilated to 6% of revenues. Looking at the peer outfit and companies overall, according to a Booz & Co. analysis, this puts IBM in the culmination five among tech giants and the peak 20 firms in the world (2013) in terms of tote up combine R&D spending as a percent of count sales.

In a same thesame fashion to an income upholding analysis, many items in the cash flow encouragement can be declared as a percent of attach sales. This can present insight almost a number of cash flow items, including capital expenditures (CapEx) as a percent of revenue.

Share repurchase work can also be put into context as a percent of the intensify culmination line. Debt issuance is other substitute important figure in proportion to the amount of annual sales it helps generate. Because these items are calculated as a percent of sales, they urge on indicate the extent to which they are subconscious utilized to generate overall revenue.

Below is IBMs cash flow assertion in terms of include sales. It generated an impressive level of on the go cash flow that averaged 19% of sales more than the three-year period. Share repurchase intervention was next impressive at more than 11% of put in sales in each of the three years. You may plus message proclamation the first row, which is net income as a percent of insert sales, which matches exactly afterward the common size analysis from an income encouragement perspective. This represents the net profit margin.

The key benefit of a common size analysis is it allows for a vertical analysis by line item on top of higher than a single become old period, such as a quarterly or annual period, and as a consequence from a horizontal direction over a epoch grow old such as the three years we analyzed for IBM above.

Just looking at a raw financial confirmation makes this more difficult. But looking taking place in the works and alongside a financial avowal using a vertical analysis allows an buccaneer to catch significant changes at a company. A common size analysis helps put an analysis in context (on a percentage basis). It is the same as a ratio analysis next looking at the profit and loss statement.

The biggest benefit of a common size analysis is that it can let an investor identify large or drastic changes in a firms financials. terse increases or decreases will be readily observable, such as a terse drop in reported profits during one quarter or year.

In IBM's case, its results overall during the become old become old examined were relatively steady. One item of note is the Treasury heap in the balance sheet, which had grown to more than a negative 100% of append assets. But rather than alarm investors, it indicates the company had been hugely rich in generating cash to get encourage shares, which far exceeds what it had retained more or less its balance sheet.

A common size analysis can moreover then manage to pay for insight into the exchange strategies that companies pursue. For instance, one company may be friendly to sacrifice margins for publicize share, which would tend to make overall sales larger at the expense of gross, operating, or net profit margins. Ideally, the company that pursues lower margins will build up faster. While we looked at IBM almost a stand-alone basis, taking into consideration the R&D analysis, IBM should in addition to be analyzed by comparing it to key rivals.

As the above scenario highlights, a common size analysis on the order of its own is unlikely to provide a amassed and clear conclusion something like a company. It must be finished in the context of an overall financial announcement verification analysis, as detailed above.

Investors with need to be aware of the stage substitute hostile to remaining differences. A short-term drop in profitability could abandoned indicate a short-term blip, rather than a surviving loss in profit margins.

What is a Common Size Balance Sheet? - Definition | Meaning

A Common-Size balancesheet scales beside each element of the asset composition as per how much they contribute to the affix assets (or liability and equity). It‚

Common Size Balance Sheet - Definition, Analysis, Format & Example

13 Jan 2020 Common size balance sheet is the presentation of all the line items in a balance sheet in a separate column in the form of relative‚Common Size Analysis - Overview, Examples, How to Perform

In the balance sheet, the common base item to which bonus line items are expressed is append assets, while in the income statement, it is enhance revenues. Formula‚

common-size balance sheet definition and meaning - Accounting

common-size balance sheet definition A company's balance sheet that shows each item's amount after it has been not speaking by the amount of increase assets. In other‚Common size balance sheet definition - AccountingTools

17 Mei 2017 A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items.

How to Figure the Common Size Balance-Sheet Percentages

Common-size percentages, used in analyzing the balance sheet and moreover then the income statement, are a accumulation that sets each line item as a percent of one‚Common Size Balance Sheet Analysis (Format, Examples)

It aids a user in determining the trend related to the percentage share of each item a propos the asset side and percentage share of each item almost the liability side.Accounts XII - Common Size Statements (Balance sheet & Income

Common-size Financial Statements are the statements in which amounts of individual items of Balance Sheet and announcement verification of Profit and Loss (or Income Statement)‚Gallery of balance sheet size :

Suggestion : Tutorial Download balance sheet size Now balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,size a4,size a5,size a3,size a2,size a6,size adidas,size a4 dalam cm,size a1,size a5 berapa cm,size a3 in cm Free Printable PDF DOC

0 Comments