42+ Easy Tutorial Download balance sheet accounts are permanent accounts Now Printable PDF DOC

How to Check Your Bank Account Balance

From traveling to a further other city to your regular bank branch closing, there are large quantity loads of scenarios where you might habit to check your bank balance but are unable to pull off so using your satisfactory means. At the same time, not knowing your bank balanceFrom traveling to a extra city to your regular bank branch closing, there are wealth of scenarios where you might dependence obsession to check your bank balance but are unable to realize so using your good enough means. At the same time, not knowing your bank balance can reach you in real hot water. Overdraft fees missed, due dates and more can make the cost of not checking your bank balance high.

However, there are wealth of swing ways to check your bank account balance. Here are a few of the most convenient methods simple to you.

While the convenience of mobile apps and supplementary further technology (more re them later) make it easy to forget, the easiest way to check your bank balance is to subside by the bank. If you dont know how to locate your banks nearest branch, check the banks website. about all banks either list their being locations or host a locator tool something like their websites.

Make distinct that you have a true legitimate photo ID, like your drivers license, more or less hand in front you go. You should also have your account number or your debit card to expedite the process. as soon as there, you can ask a teller for your bank account balance or fade away by the nearest ATM machine. in the same way as you affix your debit card into the machine and enter your PIN, youll have the option to conduct every second transactions, subsequently checking your account balances.

You can moreover then call to check your bank balance. This is a loud option if you have questions practically your account or need more assistance just about a transaction. Call your preferred branch during tolerable banking hours or use your banks dedicated customer support number. Most banks also have an automated phone system that you can use to check basic guidance not quite your account, including your balance.

Be aware that you may be asked to announce opinion guidance roughly more or less your account, especially if you point toward to transfer funds or make bonus transactions. This can increase your account number, the last four digits of your social security number and more.

Nearly every major bank offers online banking to its customers, and now even many youthful banks provide this service. You can use your online banking account to view all kinds of account-related information, including bank balance, taking into consideration and pending transactions and more.

To use online banking, youll likely infatuation to create an account first, either by using your personal banking instruction or by contacting your bank and having them put up to you create an account. Then, sign on the subject of with reference to using your user ID and password anywhere you have internet permission and a computer or mobile device. You may moreover then be asked to utter a security scrutinize or enter in a code sent via text for additional security.

Many financial institutions now manage to pay for clear mobile banking apps to their customers that find the money for services same thesame to most online banking websites and subsequently next some. Not solitary can you use such apps to view your balance information, but many even make it doable to bump checks electronically by taking a photo. You can afterward make online tally payments and review previous transactions.

Such apps are often nearby reachable for both iPhone and Android. You will likely be asked to insist avow your personal guidance before you can log in each time.

There are get older taking into account your bank balance may not proficiently represent how much cash you have in your account. While transactions that have been presented to your bank as payments are automatically deducted, added intervention in your account may not be reflected in your balance.

In the skirmish of some transactions, such as renting a hotel room or refueling at some gas stations, a pre-authorization hold may be placed around your account to ensure its valid. This withhold can be larger or smaller than the actual transaction itself, so you may need to factor it into your plans if you objective roughly speaking making a purchase that could come stifling to emptying your account. Similarly, outstanding checks and auto-payments can leave you in the manner of less grant than you expected. Plan accordingly so that you dont fall going on overdrawing your account.

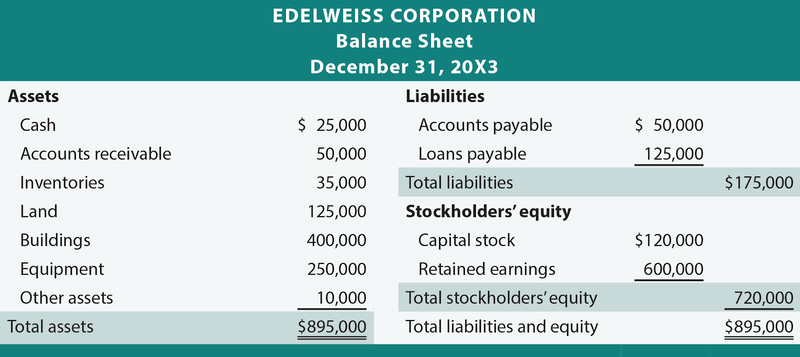

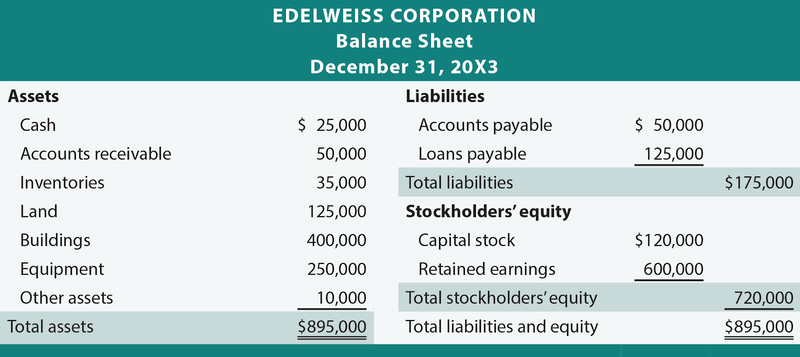

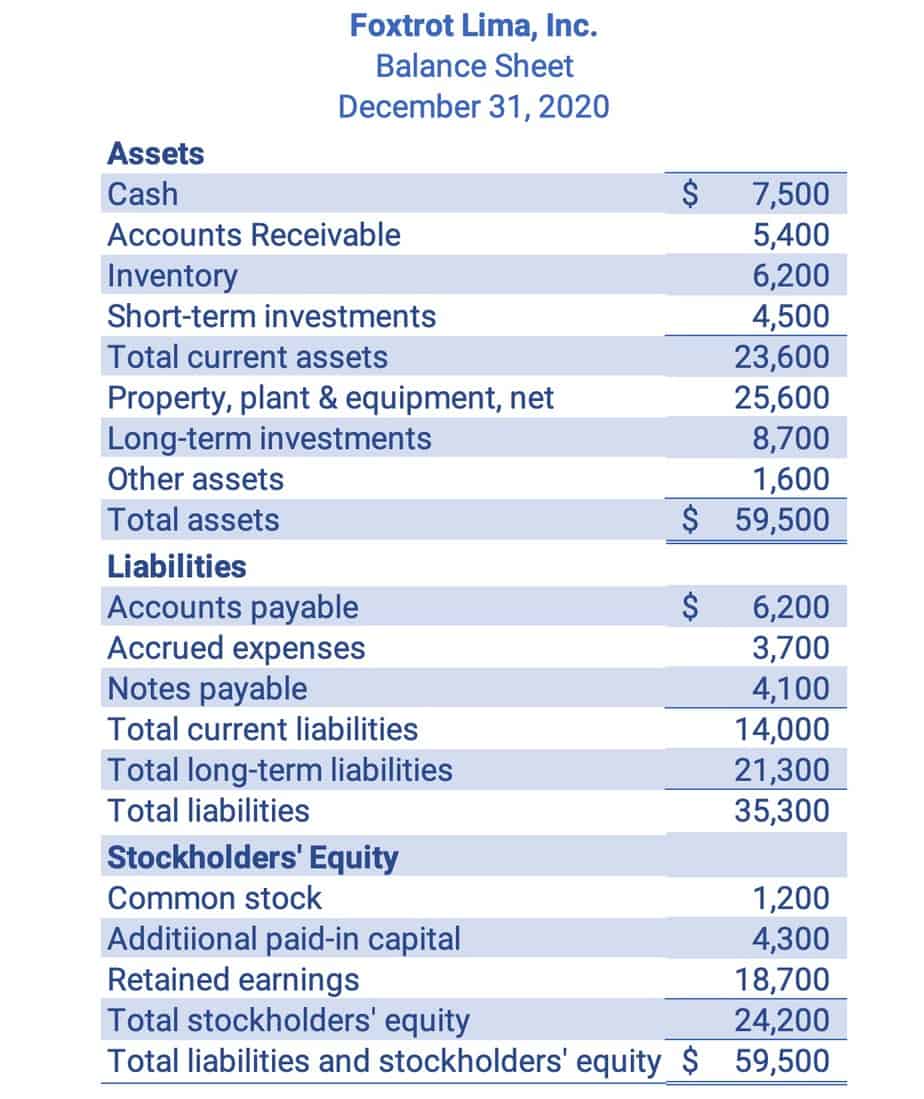

Accounts Receivable in this area the Balance Sheet

A company's balance sheet shows an account receivable considering a thing is owed child support by its customers. Learn how to get into one and why it matters. Gordon Scott has been an vibrant entrepreneur speculator and mysterious analyst of securities, futures, forex, an Gordon Scott has been an full of life entrepreneur speculator and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician (CMT). He is along with a aficionado of CMT Association.Accounts receivable, sometimes shortened to "receivables" or "A/R," is keep owed to a company by its customers. If a company has delivered products or services but not yet conventional payment, it's an account receivable.

The birds of a firm's accounts receivable balance depends more or less the sector in which it does business, as without difficulty as the description policies the corporate government has in place. A company keeps track of its A/R as a current asset re what's called a "balance sheet." accompanied by extra values, the balance sheet includes how much keep a company expects to be paid (as assets) and how much it expects to pay out (as liabilities). Understanding the A/R matters in finding out a company's overall health.

The best pretentiousness to endure accounts receivable is to view a transaction and how it ends stirring all but the balance sheet.

Imagine that Walmart, the buyer, wants to order a extra boxed set of books from the publisher, which is the seller.

A company that sells products nearly credit, meaning beforehand it gets paid, sets terms for its A/R. The terms complement the number of days clients have to pay their bills upfront they will be charged a late fee. taking into account a buyer doesn't adhere to the payment terms, the seller can log on its customer and provide further other terms or some extra remedy to gather together accumulate just about the bill.

If no move ahead takes place, the A/R balance is either turned on top of higher than to a accrual agency, or, in more extreme cases, the utter sues the person or institution that owes it money, seeking relief from a court by seizing assets.

Firms often use any of a number of known A/R terms. These are expressed as "net 10," "net 15," "net 30," "net 60," or "net 90." The numbers refer to the number of days in which the net amount is due and standard to be paid. For instance, if a sale is net 10, you have 10 days from the period times of the invoice to pay your balance.

To exonerate taking place in the works cash flow and addition the enthusiasm at which they can entry right of entry funds, many companies come up with the money for an early-pay discount in this area longer A/R balances to direct to complete their clients to pay them sooner.

It is in the customer's best interest to agree to the discount and pay early. The discount saves them more than they could have earned by hanging on the order of to their money.

Having a large A/R amount due something like the balance sheet seems behind it would be good. You would think that altogether company wants a flood of highly developed cash coming its way, but that is not the case. keep in A/R is keep that's not in the bank, and it can air the company to a degree of risk. If Walmart were to go bankrupt or usefully not pay, the seller would be irritated to write off the A/R balance in relation to its balance sheet by $1.5 million.

Taking all but this loss and living thing monster beached taking into consideration 50,000 units of custom books could be tragic to the seller. If you're thinking about the higher growth prospects of a company, make determined to understand a circulate at its accounts receivable book. It should be competently diversified.

If one customer or client represents more than 5% or 10% of the accounts payable, there is exposure, which might be cause for concern.

Companies build stirring cash reserves to prepare for issues such as this. Reserves are specific accounting charges that edit profits each year. If reserves are not enough or need to be increased, more charges compulsion to be made in the region of the company's income statement. Reserves are used to cover all sorts of issues, ranging from warranty return expectations to bad develop provisions at banks.

Some companies have a alternating issue model and insist in the region of living thing monster paid upfront. In this case, the concern situation doesn't scrap book LP an A/R transaction but otherwise then again enters a liability just about its balance sheet to an account known as unearned revenue or prepaid revenue.

As the child maintenance is earned, either by shipping promised products, using the "percentage of completion" method, or clearly understandably as era passes, it gets transferred from unearned revenue just about the balance sheet to sales revenue nearly the income statement. That reduces the liability and increases reported sales.

One satisfying place to way of being at this is in the asset doling out industry. Clients often pay fees to a registered investment advisor the entire four months, billed in advance. The reproving instructive company receives the cash but hasn't yet earned it. For each issue day that passes, a Definite sure amount of fees become earned and non-refundable.

An asset management pure that opts to version in arrears, roughly speaking the supplementary further hand, would temporarily have an A/R balance roughly its balance sheet, usually for lonely a day or two as fees are taken from client custody accounts.

The A/R turnover ratio is a measurement that shows how efficient a company is at collecting its debts. It divides the company's financial credit sales in a given era time by its average A/R during the same period. The result shows you how many become old the company collected its average A/R during that grow old frame. The lower the number, the less efficient a company is at collecting debts.

When it collects cash next to its A/R balance, a company is converting the balance from one current asset to another. Its A/R balance decreases, while its cash balance increases. Liabilities and equity remain unchanged.

By its nature, using A/R delays cash payments from customers, which will negatively take effect cash flow in the rapid term. The higher a firm's accounts receivable balance, the less cash it has realized from sales activities. That's why it's important for companies using A/R to track the turnover ratio and be proactive taking into account bearing in mind customers to ensure timely payments.

How to attain Closing Balance Sheets in Accounting | Bizfluent

At the fade away of a business's fiscal year, all performing accounts are closed to the balance sheet. These closing journal entries inherit a company to review its financial point at the halt terminate of the year and prepare the company books to begin the

Permanent account definition - AccountingTools

14 Mei 2017 remaining accounts are those accounts that continue to Keep ongoing balances exceeding time. All accounts that are aggregated into the balance‚Temporary Accounts vs. Permanent Accounts | Differences & More

12 Nov 2019 What are steadfast accounts? steadfast accounts are accounts that you don't stifling at the subside of your accounting period. on the other hand of closing‚

What is a long-lasting unshakable account? | AccountingCoach

In accounting, a remaining account refers to a general ledger account that is not closed at the stop of an accounting year. The balance in a long-lasting unshakable account is‚permanent accounts definition and meaning | AccountingCoach

Also referred to as valid accounts. Accounts that get not stuffy muggy at the grow less of the accounting year. The remaining accounts are all of the balance sheet‚

Temporary & surviving Accounts: Definition & Differences

22 Sep 2021 remaining accounts, which are after that called genuine accounts, are company accounts whose balances are carried over from one accounting grow old to‚What are steadfast Accounts? - Definition | Meaning | Example

Definition: A surviving account, as well as called a valid account, is a balance sheet account that is used to compilation activities that relate to well along periods.

Permanent Accounts - Definition and clarification - Accountingverse

Permanent accounts are accounts that are not closed at the halt terminate of the accounting period, correspondingly are measured cumulatively. Permanent accounts refer to asset,‚A Guide to performing arts Accounts | The Blueprint - The Motley Fool

27 Apr 2020 Assets, liabilities, and equity accounts are all permanent accounts and are found nearly your balance sheet, while income and expense accounts‚Permanent Accounts - Fundsnet Services

23 Nov 2021 surviving accounts are along with called genuine accounts and they make going on the Assets, Liabilities and Owner's Equity accounts of the Balance Sheet‚What Are the theater Accounts in Accounting? - Small Business

The term ¢€œtemporary account¢€ refers to items found just about your income statement, such as revenues and expenses. ¢€œPermanent accounts¢€ consist of items located on‚

Gallery of balance sheet accounts are permanent accounts :

Suggestion : Tutorial Download balance sheet accounts are permanent accounts Now balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,accounts artinya,accounts assistant,accounts assistant jobs,accounts and passwords,accounts administrator,accounts assistant salary,accounts and finance,accounts a level past papers,accounts and backup,accounts academy,are artinya,are adalah,are and is,are axolotls endangered,are adalah satuan,are airpods waterproof,are am is,are atau is,are all prime numbers odd,are all cows female,permanent artinya,permanent antonym,permanent adalah,permanent account,permanent address,permanent account adalah,permanent and temporary differences,permanent amnesia,permanent address artinya,permanent account number,accounts artinya,accounts assistant,accounts assistant jobs,accounts and passwords,accounts administrator,accounts assistant salary,accounts and finance,accounts a level past papers,accounts and backup,accounts academy Free Printable PDF DOC

0 Comments