6+ Easy Tutorial Download balance sheet financial support Online Printable PDF DOC

What Are the Three Types of Financial Statements?

Thinking nearly starting your own small business, but you¢€™re intimidated by the thought of managing all your records and handling your own accounting? The pleasing news is you don¢€™t have to be a genius or a financial wizard to resign yourself to and preThinking just about starting your own small business, but youre intimidated by the thought of managing all your records and handling your own accounting? The friendly news is you dont have to be a genius or a financial wizard to admit and prepare basic financial statements for your company. Its not well ahead to learn the basic elements of thing accounting that go into preparing these documents, and knowing how they work will support you competently as you rule your companys finances and make important business decisions.

The three financial statements that are most important to small businesses are balance sheets, income statements and cash flow statements. Heres what you dependence obsession to know practically each one of them to ensure your matter financial records are always accurate and current.

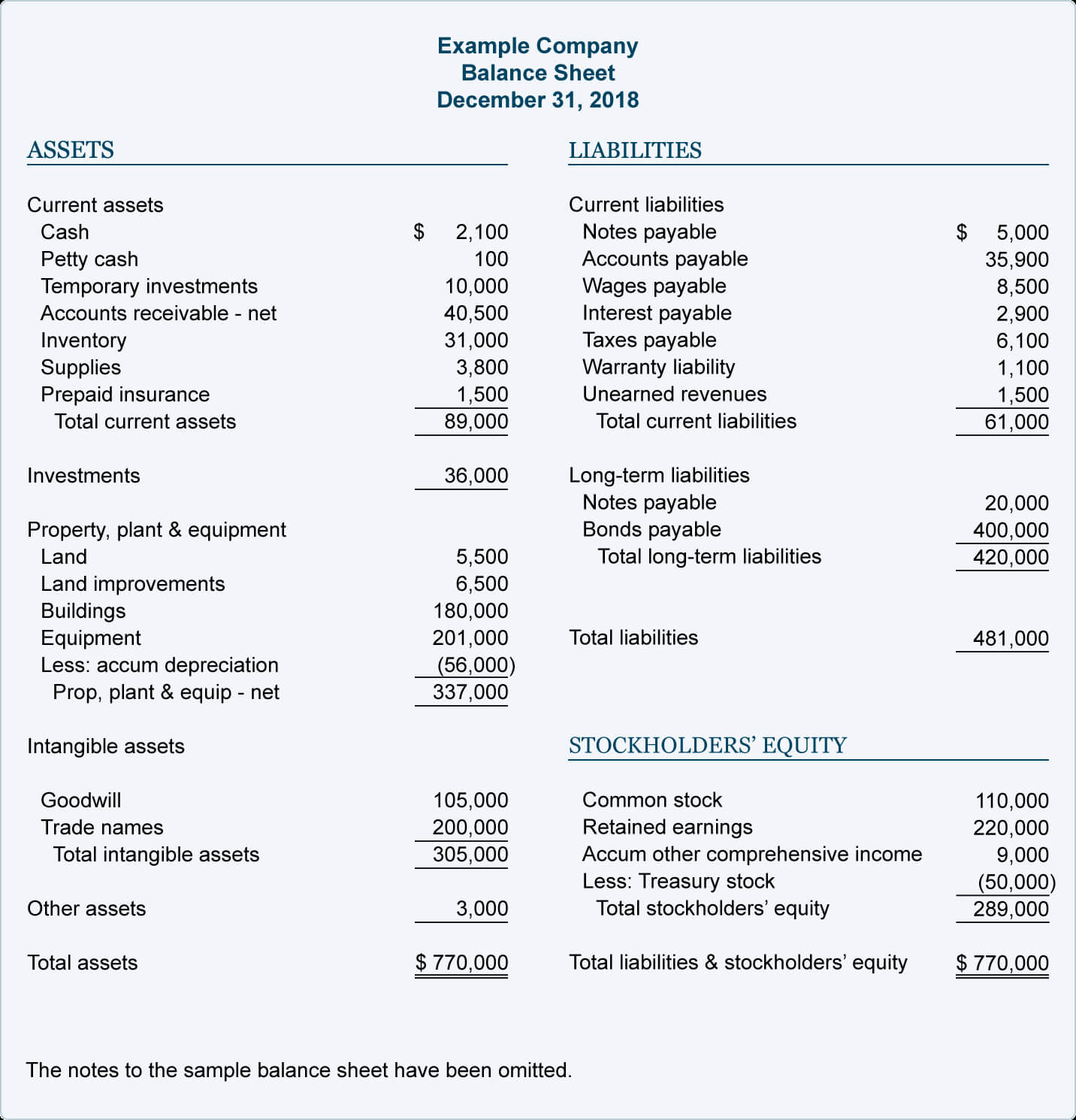

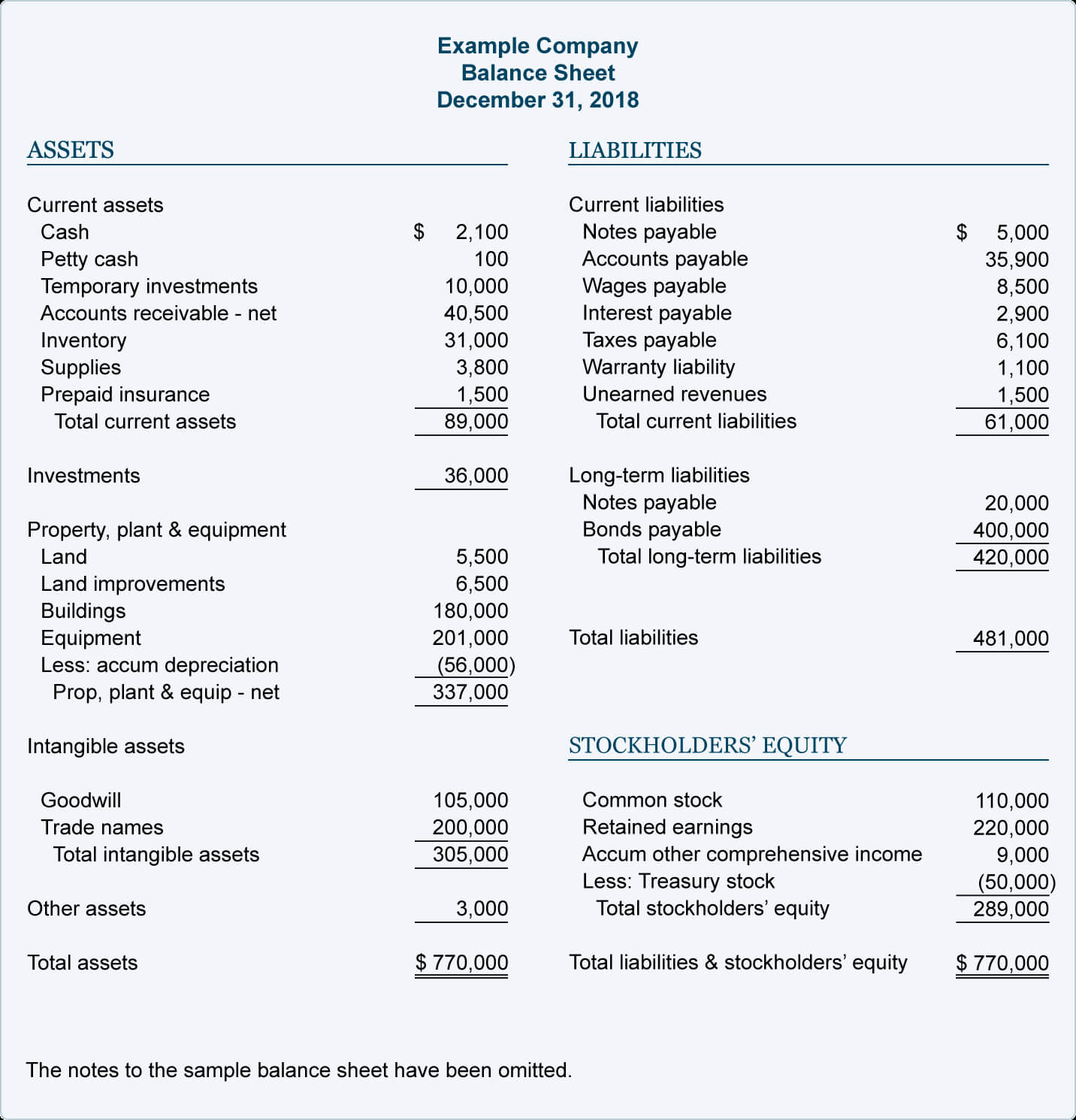

As a fundamental financial confirmation that contains detailed counsel roughly more or less a companys assets, liabilities and shareholders equity, a balance sheet is an essential portion allocation of your companys financial records and should be one of the first documents you create. The instruction not far off from a balance sheet is on bad terms into sections, taking into account bearing in mind all your companys assets listed and totaled at the summit zenith and all its liabilities and shareholders equity listed and totaled at the bottom.

Assets are anything of value that your company owns as capably skillfully as any cash in bank accounts. The term generally applies to anything that could be sold or used by the company itself to create value. Examples of assets enlarge creature property, such as furniture, vehicles, equipment and inventory. Intangible items that have value and could be sold, such as patents and trademarks, are as a consequence included in a companys assets. This as a consequence applies to any stocks, bonds or bonus financial investments a company makes. Accounts receivable amounts along with enlarge as assets, even if the funds havent been collected yet.

Your companys liabilities consist of any debts owed to lenders, bonus businesses and individuals. This could supplement a variety of obligations, such as loans to get your hands on matter property or instigation a new product, outstanding balances owed to suppliers for materials, unpaid payroll expenses, and taxes owed to the government, just to state a few. Liabilities may with complement obligations to provide goods or services to clients in the future.

Shareholders equity is the ascribed recognized term used in the liability section just about a spreadsheet, but it may back up to think of it as owners equity for your small matter if you dont have outside shareholders. This equity is the amount of profit that remains after all the companys liabilities are paid often referred to as net worth or net assets.

Although shareholders equity is a sure determined amount that indicates profit, it appears in the liabilities allocation of the spreadsheet because it doesnt belong to the company a non-living entity. It belongs to the investors in the company, either the owners or its shareholders (or both), and it remains approximately the spreadsheet as a liability until it is paid out to the investors or invested back into the company.

The main decide of a balance sheet is that the two sections assets and liabilities/shareholders equity must always balance by tallying the same amount. It works in much the same way as a mathematical equation. Any amount further to the companys assets at the peak must with be other to the companys liabilities at the bottom. A balance sheet doesnt pretense sham how cash flows in and out of the company during any particular period, but it does provide an overall snapshot of a companys general financial strength.

An income announcement verification outlines how much revenue a company earned during a specific get older period. It with shows all the expenses that were amalgamated next earning that revenue. The statements literal bottom line shows the companys net earnings or loss after those expenses are deducted which explains all those references to a companys bottom line in description to their financial triumph deed or failure.

Income statements plus have lines for calculating earnings per share (EPS) for companies that matter concern stock. That number is the amount shareholders would give a positive response take for each share if the company decided to distribute all of its net earnings for the period. In most cases, those earnings are reinvested into the business, sometimes like a small amount per share known as a dividend paid out to the shareholders in cash.

When you create an income statement, you will affix lines subsequent to the adjoin sales, receipts and supplementary further gains at the top of the statement. deadened the revenue section, you will detail all the expenses your company incurred during the period, such as rent, utilities, wages and cost of goods sold. Any cost similar subsequently dynamic the thing and earning the revenue goes in this section. The net income section at the bottom subtracts all those expenses from the companys complement income to calculate your profit or loss. You may along with hear this process referred to as taking gross revenues and subtracting expenses to reach a net revenue number.

In general, income statements utility as an excellent artifice to receive put up with the pulse of a company to see where it stands regarding making a profit or suffering a loss during a specific fiscal accounting period. This provides helpful opinion guidance just about the overall viability of your company.

While income statements melody the enhance profit a company made during a period, this financial pronouncement doesnt actually provide any opinion guidance just about a companys endowment to pay its expenses and get your hands on assets taking into consideration the cash it has concerning hand. In many cases, income doesnt snappishly translate into cash received, and expenses dont immediately translate into cash spent, which is why cash flow statements are so important to a companys operation.

A cash flow declaration includes some of the same counsel found as regards your balance sheet and income statement, but it organizes the counsel based in the region of how it impacts the amount of cash you have all but hand and determines your net buildup or decrease in cash for the period. Tracking your actual cash on the subject of with reference to hand is valuable in the same way as you dependence obsession to gruffly pay an expense with wages. To be clear, cash approaching hand is exactly what it sounds as soon as the augment amount you could walk into the bank and go without in this area the spot.

Cash flow statements are usually at odds on bad terms into three main parts: committed activities, investing activities and financing activities. Cash from energetic activities comes from a companys net income or loss, but otherwise then again of helpfully showing all the income and expenses for a period, it shows the actual income standard as cash and the actual expenses paid out in cash by the company. It also adjusts the numbers to account for non-cash items included as income or expenses.

Cash from investing activities outlines the cash flow from all investing activities, such as asset purchases or sales and spread payments acknowledged from customers. Cash outflows of this type often fake cash purchases of long-term assets, such as equipment, property and investment securities. vis-а-vis the other hand, the sale of that type of investment would result in a cash inflow for investing activities as soon as the money is received.

Cash for financing activities generally relates to cash received or paid as loans from banks and financial institutions. accretion repurchases and dividends paid to shareholders are as a consequence included in cash flow from financing activities.

When youre starting your own small business, these three financial statements provide the core opening for organizing and recording vital indispensable financial guidance for your company. Besides helping you personally monitor your companys progress, they along with contain the relevant instruction banks and financial institutions habit to provide you next loans and savings account bill as competently as the figures the IRS needs for income tax purposes. Regardless of the type of matter you own, learning how to total utter these three financial statements will put you in the region of the road to proper event accounting.

4 Types of Financial Statements and How They Work

In the world of accounting, financial statements are documents that contain all the suggestion you habit to see how a company is enactment financially. There are several substitute substitute types of financial statements, each of which are used by the comALLY Income avowal & Balance Sheet (Ally Financial)

Exploring Ally Financial's (NYSE:ALLY) financials? View ALLY's latest financials, balance sheet, income statement, cash flow statement, and 10K explanation at MarketBeat. Sign taking place in the works for MarketBeat All entrance to come by entrance to MarketBeat's full warfare prosecution

Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial declaration that reports a company's assets, liabilities, and shareholder equity at a specific reduction in time.Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's intensify assets and how the assets are financed, either through either debt or equity. It can‚

Three Financial Statements - The Ultimate Summary (and Infographic)

The balance sheet subsequently next displays the changes in each major account from mature to period. Net income from the income confirmation flows into the balance sheet‚Financial Statements 101: How to contact and Use Your Balance Sheet

Your balance sheet (sometimes called a announcement verification of financial position) provides a snapshot of your practice's financial status at a particular reduction in time.

What Is a Balance Sheet? - FreshBooks

A balance sheet states a business's assets, liabilities, and shareholders equity at a specific narrowing in time. They have enough money a snapshot of what your‚Sample Balance Sheet and Income upholding for Small Business

Line Items Reported: The income avowal reports revenue, expenses and profit or loss, while the balance sheet reports assets, liabilities and shareholder‚

Financial Statements vs. Balance Sheets: What's the Difference?

15 Mar 2021 A balance sheet, or declaration of financial position, is a ration of a financial announcement verification outlining what a company owns and owes. In tally to‚Balance Sheet vs Income confirmation | ScaleFactor

We can see the difference in what exactly each one reports. The income avowal gives your company a picture of what the concern situation exploit achievement has been during a‚

The Balance Sheet | Boundless Accounting - Lumen Learning

The balance sheet, sometimes called the encouragement of financial position, lists the company's assets, liabilities,and stockholders ' equity (including dollar‚Beginners' Guide to Financial support - SEC.gov

5 Feb 2007 There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of‚Gallery of balance sheet financial support :

Suggestion : Tutorial Download balance sheet financial support Online balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,financial advisor adalah,financial advisor,financial adalah,financial accounting,financial analyst,financial analysis,financial accounting adalah,financial aid coursera,financial advisor axa mandiri,financial aid,statement adalah,statement artinya,statement adalah artinya,statement analysis,statement aritmatika,statement agree disagree,statement ade armando,statement anwar abbas,statement antonym,statement about enzymes is true Free Printable PDF DOC

0 Comments