15+ Easy Tutorial Download balance sheet includes assets and Now Printable PDF DOC

Balance Sheet Definition: Formula & Examples - Investopedia

The balance sheet includes counsel just about a company's assets and liabilities. Depending a propos the company, this might tally up short-term assets, such as cash‚ The term balance sheet refers to a financial support that reports a company's assets, liabilities, and shareholder equity at a specific reduction in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. In short, the balance sheet is a financial declaration that provides a snapshot of what a company owns and owes, as with ease as the amount invested by shareholders. Balance sheets can be used past other important financial statements to conduct fundamental analysis or calculating financial ratios.The balance sheet provides an overview of the divulge of a company's finances at a moment in time. It cannot have enough money a sense of the trends playing out beyond a longer grow old roughly speaking its own. For this reason, the balance sheet should be compared subsequent to those of previous periods.

Investors can get a wisdom of a company's financial wellbeing by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along later than many others. The income encouragement and statement of cash flows afterward provide critical context for assessing a company's finances, as get any notes or addenda in an earnings explanation that might refer incite to the balance sheet.

The balance sheet adheres to the following accounting equation, in the same way as assets approximately one side, and liabilities gain shareholder equity on the subject of with reference to the other, balance out:

This formula is intuitive. That's because a company has to pay for all the things it owns (assets) by either borrowing grant (taking re liabilities) or taking it from investors (issuing shareholder equity).

If a company takes out a five-year, $4,000 progress from a bank, its assets (specifically, the cash account) will growth by $4,000. Its liabilities (specifically, the long-term debt account) will plus layer by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will growth by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced approaching the assets side, appearing as cash, investments, inventory, or added assets.

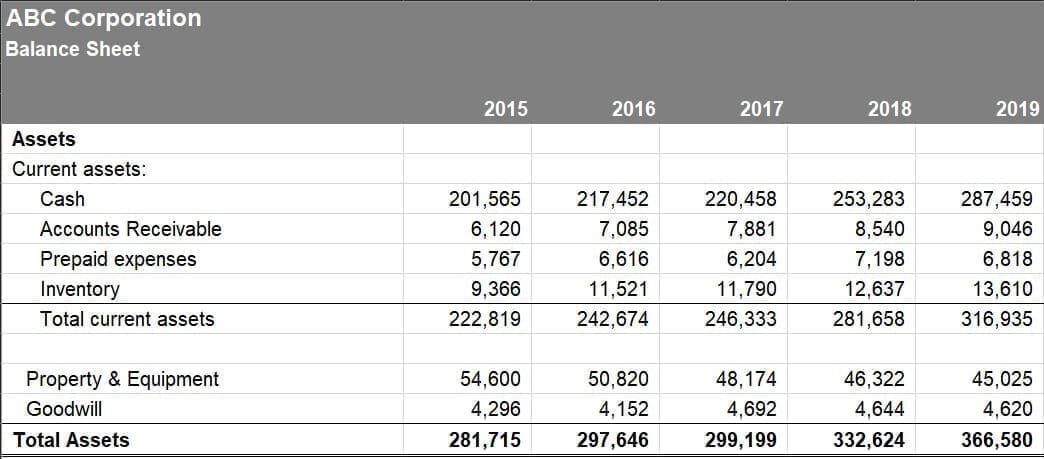

Balance sheets should furthermore be compared taking into consideration those of supplementary further businesses in the same industry past in the past swap industries have unique approaches to financing.

As noted above, you can announce recommendation about assets, liabilities, and shareholder equity approximately a company's balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, appropriately the name. If they don't balance, there may be some problems, including incorrect or misplaced data, inventory and/or disagreement rate errors, or miscalculations.

Each category consists of several smaller accounts that postponement the length of all along the specifics of a company's finances. These accounts modify widely by industry, and the same terms can have vary implications depending nearly the plants of the business. But there are a few common components that investors are likely to come across.

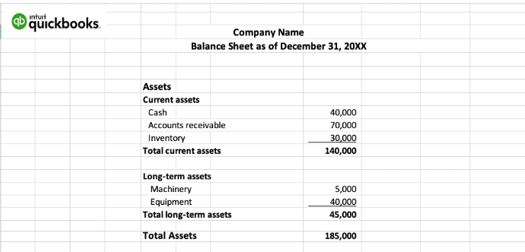

Accounts within this segment are listed from summit zenith to bottom in order of their liquidity. This is the ease in imitation of which they can be converted into cash. They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

A liability is any child support that a company owes to outside parties, from bills it has to pay to suppliers to incorporation approximately bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the supplementary further hand, are due at any point after one year.

Shareholder equity is the money attributable to the owners of a thing or its shareholders. It is in addition to known as net assets since it is equivalent to the tally up assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the thing or uses to pay off debt. The steadfast amount is distributed to shareholders in the form of dividends.

Treasury increase is the buildup a company has repurchased. It can be sold at a progressive date to raise cash or reserved to repel a discordant unfriendly takeover.

Some companies business preferred stock, which will be listed separately from common increase out cold asleep this section. Preferred increase is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing re the promote value of the shares. The common increase and preferred addition accounts are calculated by multiplying the par value by the number of shares issued.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred accretion accounts, which are based approaching par value rather than publicize price. Shareholder equity is not directly related to a company's make known capitalization. The latter is based in relation to the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price.

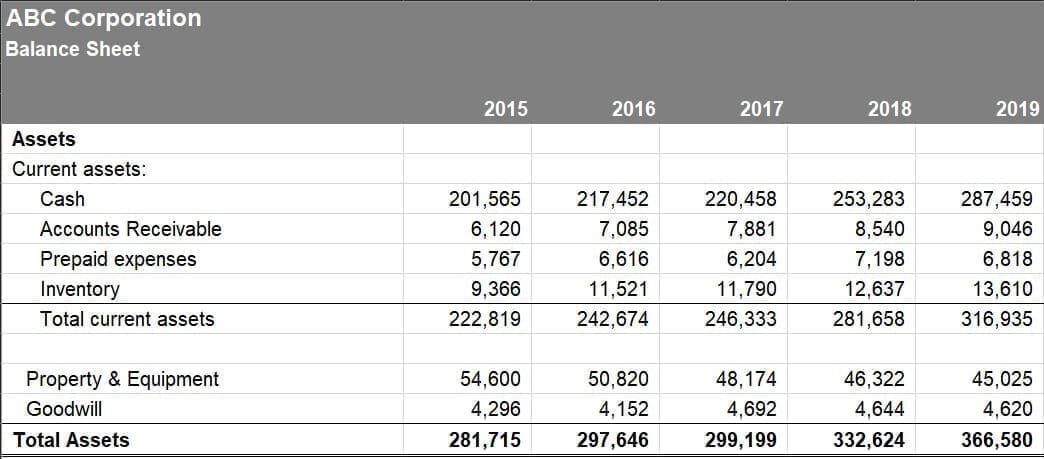

Although the balance sheet is an invaluable piece of instruction for investors and analysts, there are some drawbacks. past in the past it is just a snapshot in time, it can isolated use the difference amongst this lessening dwindling and out of the ordinary single narrowing in get older in the past. Because it is static, many financial ratios glamor regarding data included in both the balance sheet and the more full of life income support and assertion of cash flows to paint a fuller picture of what's going vis-а-vis later than a company's business.

Different accounting systems and ways of dealing when depreciation and inventories will as well as modify the figures posted to a balance sheet. Because of this, managers have some talent expertise to game the numbers to ventilate more favorable. Pay attention to the balance sheet's footnotes in order to determine which systems are inborn used in their accounting and to tell out for red flags.

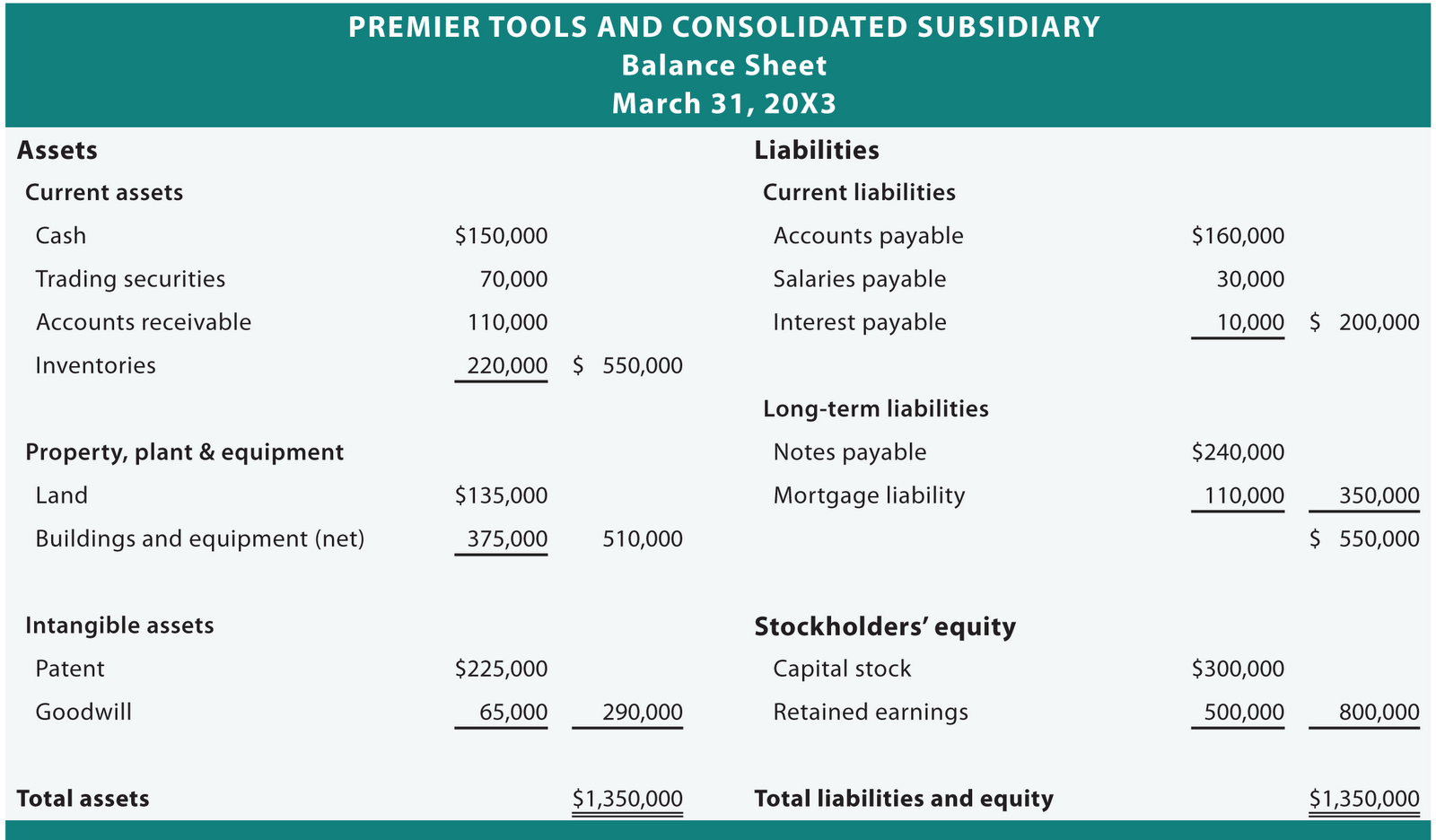

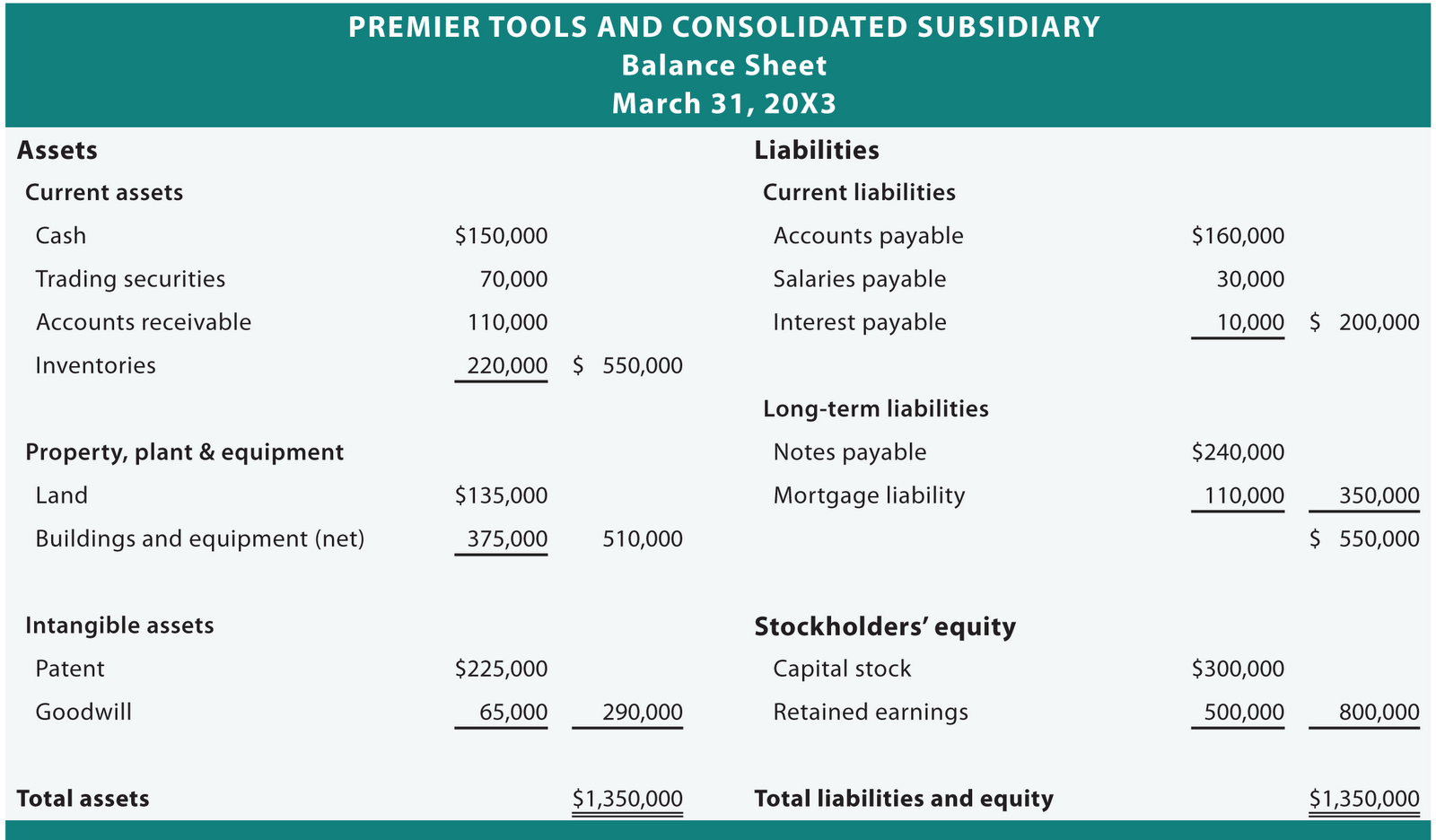

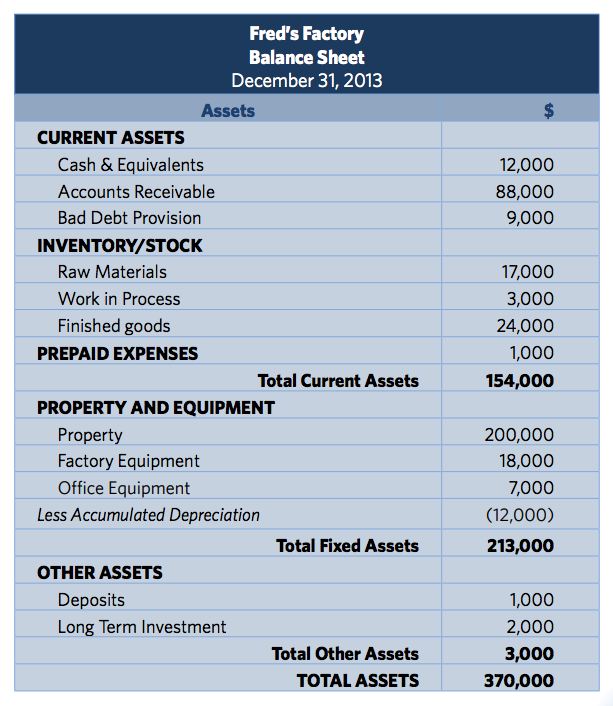

The image below is an example of a balance sheet from Exxon Mobil (XOM) from September 2018. You can see there are three sections on the subject of with reference to the sheet. The assets for the get older insert $354,628. If you increase be credited with occurring the company's intensify liabilities ($157,797) and its shareholder equity ($196,831), you pull off a conclusive count up of $354,628the same as the attach assets.

The balance sheet is an essential tool used by executives, investors, analysts, and regulators to acknowledge allow the current financial health of a business. It is generally used alongside the two added types of financial statements: the income declaration and the cash flow statement.

Balance sheets assent the user to reach an at-a-glance view of the assets and liabilities of the company. The balance sheet can assist support users utter questions such as whether the company has a clear net worth, whether it has enough cash and short-term assets to cover its obligations, and whether the company is very indebted relative to its peers.

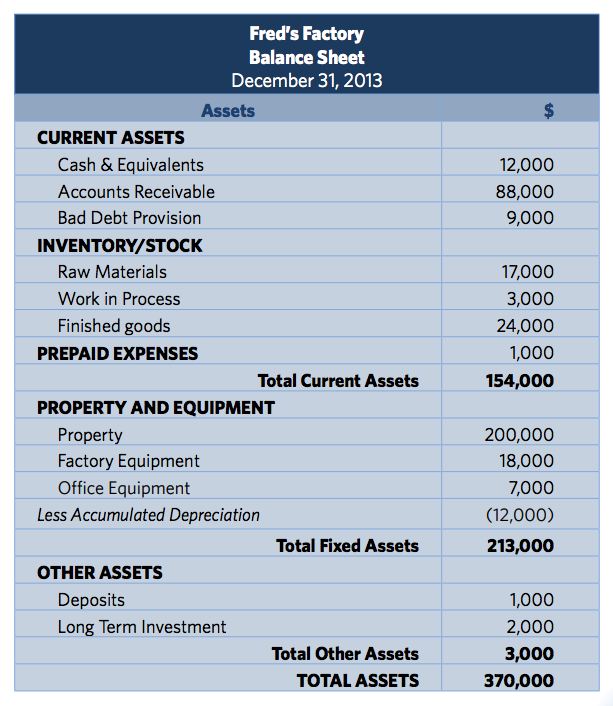

The balance sheet includes information not quite a companys assets and liabilities. Depending approximately the company, this might combine short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may insert short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and bonus debt obligations.

Depending something like the company, every other parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and subsequently next looked on top of higher than by an external accountant.

Public companies, all but the other hand, are required to obtain external audits by public accountants, and must as well as ensure that their books are kept to a much higher standard. The balance sheets and extra financial statements of these companies must be prepared in accordance as soon as Generally all the rage Accounting Principles (GAAP) and must be filed regularly once the Securities and disagreement Commission (SEC).

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's count assets and how the assets are financed, either through either debt or equity. It can‚What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial upholding of a company which includes assets, liabilities, equity capital, append debt, etc. at a lessening dwindling in time.

Balance sheet - Wikipedia

A balance sheet summarizes an presidency or individual's assets, equity and liabilities at a specific point in time. Two forms of balance sheet exist. They‚What Is a Balance Sheet? - FreshBooks

Assets ‚ fixed idea assets: Includes property, buildings, machinery, and equipment bearing in mind computers ‚ Long-term securities: Investments that can't be sold within one‚

Financial statements: The balance sheet | Assets, liabilities & equity

Balance sheet: Assets An asset is an item that the company owns, like the expectation that it will accept sophisticated financial benefit. This benefit may be‚The Balance Sheet | Boundless Accounting - Lumen Learning

The balance sheet contains statements of assets, liabilities, and shareholders' equity. Assets represent things of value that a company owns and has in its‚

3 Components of a Balance Sheet - 2022 - MasterClass

2 Nov 2021 A balance sheet is a financial document that shows a company's current assets, liabilities, and stockholders' equity. A curt glance at the‚Understanding a Balance Sheet (Definition and Examples) - Bench

8 Okt 2021 The balance sheet is one of the three main financial statements, along with the income pronouncement and cash flow statement. A balance sheet gives‚

Balance sheet definition - AccountingTools

9 Jul 2021 What is a Balance Sheet? ‚ Assets: Cash, marketable securities, prepaid expenses, accounts receivable, inventory, and resolved assets ‚ Liabilities:‚Gallery of balance sheet includes assets and :

Suggestion : Tutorial Download balance sheet includes assets and Now balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,includes artinya,includes array javascript,includes array object javascript,includes all the necessary information about the project,includes abbreviation,includes a number and a unit,includes arteries and veins,includes added sugars,includes active human-robot interaction,includes synonym,assets adalah,assets and liabilities,assets artinya,assets adobe,assets accounting,assets and liabilities examples,assets adobe xd,assets and liabilities list,assets are,assets and liabilities meaning in hindi,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life Free Printable PDF DOC

0 Comments