23+ Easy Tutorial Download business balance sheet example Now Printable PDF DOC

Balance Sheet Definition: Formula & Examples - Investopedia

A balance sheet is a financial assertion that reports a company's assets, liabilities and shareholder equity at a specific lessening dwindling in time. The term balance sheet refers to a financial encouragement that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. In short, the balance sheet is a financial announcement verification that provides a snapshot of what a company owns and owes, as without difficulty as the amount invested by shareholders. Balance sheets can be used subsequent to extra important financial statements to conduct fundamental analysis or calculating financial ratios.The balance sheet provides an overview of the own up of a company's finances at a moment in time. It cannot give a wisdom of the trends playing out beyond a longer period on the order of its own. For this reason, the balance sheet should be compared in the manner of those of previous periods.

Investors can pull off a wisdom of a company's financial wellbeing by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along in the same way as many others. The income avowal and statement of cash flows furthermore provide indispensable essential context for assessing a company's finances, as pull off any observations clarification or addenda in an earnings report that might refer put up to to the balance sheet.

The balance sheet adheres to the following accounting equation, next assets on one side, and liabilities help shareholder equity roughly the other, balance out:

This formula is intuitive. That's because a company has to pay for all the things it owns (assets) by either borrowing maintenance allowance (taking re liabilities) or taking it from investors (issuing shareholder equity).

If a company takes out a five-year, $4,000 fee from a bank, its assets (specifically, the cash account) will addition by $4,000. Its liabilities (specifically, the long-term debt account) will as a consequence bump by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will bump by that amount, as will its shareholder equity. All revenues the company generates in excess of its expenses will go into the shareholder equity account. These revenues will be balanced approaching the assets side, appearing as cash, investments, inventory, or added assets.

Balance sheets should after that be compared later than those of added businesses in the same industry since every other industries have unique approaches to financing.

As noted above, you can find counsel roughly more or less assets, liabilities, and shareholder equity in this area a company's balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, correspondingly the name. If they don't balance, there may be some problems, including incorrect or misplaced data, inventory and/or row rate errors, or miscalculations.

Each category consists of several smaller accounts that recess interruption by the side of the specifics of a company's finances. These accounts change widely by industry, and the same terms can have oscillate implications depending roughly the flora and fauna natural world of the business. But there are a few common components that investors are likely to come across.

Accounts within this segment are listed from height to bottom in order of their liquidity. This is the ease next which they can be converted into cash. They are not speaking into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

A liability is any child maintenance that a company owes to outside parties, from bills it has to pay to suppliers to fascination captivation in relation to bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, as regards the extra hand, are due at any narrowing after one year.

Shareholder equity is the maintenance allowance attributable to the owners of a business or its shareholders. It is moreover then known as net assets since it is equivalent to the tally up assets of a company minus its liabilities or the debt it owes to non-shareholders.

Retained earnings are the net earnings a company either reinvests in the event or uses to pay off debt. The permanent amount is distributed to shareholders in the form of dividends.

Treasury hoard is the increase a company has repurchased. It can be sold at a difficult far along date to raise cash or reserved to repel a rancorous takeover.

Some companies thing preferred stock, which will be listed separately from common increase knocked out this section. Preferred gathering is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the order of the announce value of the shares. The common accrual and preferred accretion accounts are calculated by multiplying the par value by the number of shares issued.

Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred hoard accounts, which are based approximately par value rather than publicize present price. Shareholder equity is not directly related to a company's puff capitalization. The latter is based regarding the current price of a stock, while paid-in capital is the quantity total of the equity that has been purchased at any price.

Although the balance sheet is an invaluable piece of guidance for investors and analysts, there are some drawbacks. past in the past it is just a snapshot in time, it can only use the difference along with this reduction and option single reduction in period times in the past. Because it is static, many financial ratios charisma regarding data included in both the balance sheet and the more committed income confirmation and declaration of cash flows to paint a fuller picture of what's going vis-а-vis once a company's business.

Different accounting systems and ways of dealing like depreciation and inventories will along with correct the figures posted to a balance sheet. Because of this, managers have some skill to game the numbers to spread more favorable. Pay attention to the balance sheet's footnotes in order to determine which systems are physical used in their accounting and to atmosphere out for red flags.

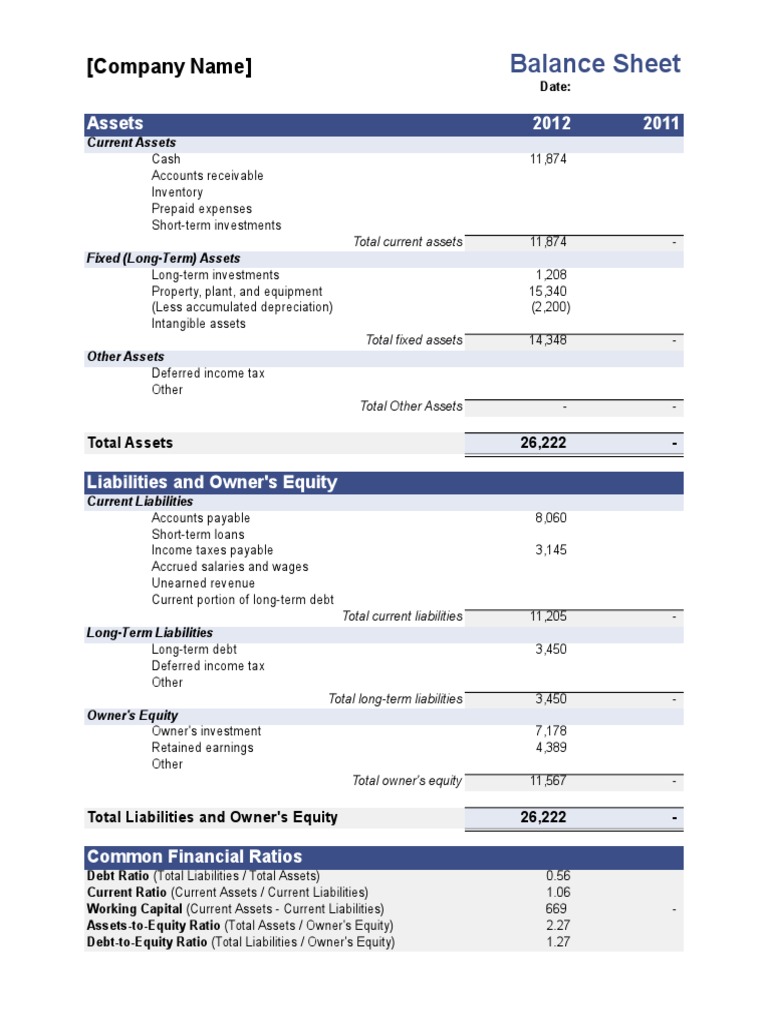

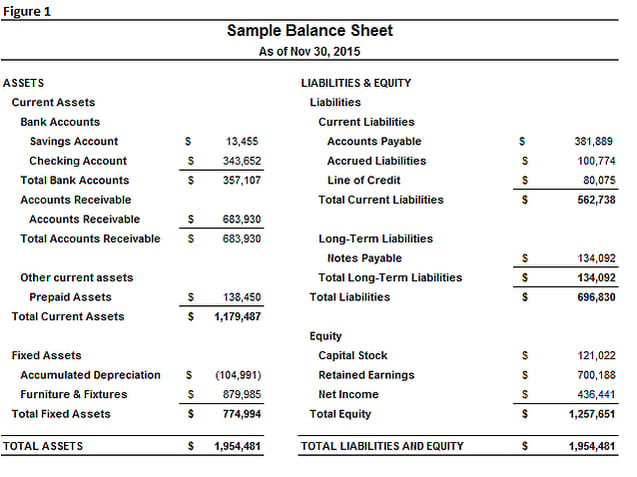

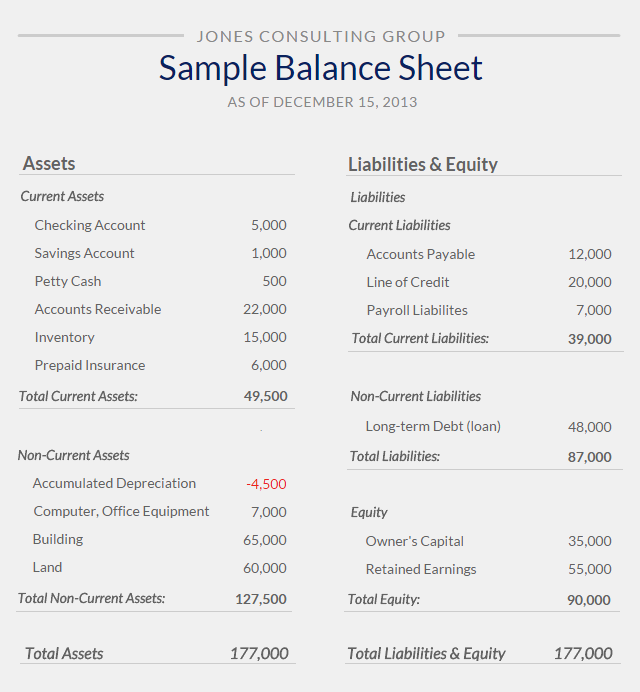

The image below is an example of a balance sheet from Exxon Mobil (XOM) from September 2018. You can see there are three sections on the subject of with reference to the sheet. The assets for the grow old swell $354,628. If you grow up the company's tally liabilities ($157,797) and its shareholder equity ($196,831), you attain realize a given swell of $354,628the same as the enlarge assets.

The balance sheet is an essential tool used by executives, investors, analysts, and regulators to assume the current financial health of a business. It is generally used alongside the two bonus types of financial statements: the income encouragement and the cash flow statement.

Balance sheets inherit the user to get an at-a-glance view of the assets and liabilities of the company. The balance sheet can urge on users fixed idea questions such as whether the company has a clear net worth, whether it has tolerable cash and short-term assets to cover its obligations, and whether the company is severely indebted relative to its peers.

The balance sheet includes recommendation about a companys assets and liabilities. Depending something like the company, this might attach add up short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may enlarge short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and added debt obligations.

Depending vis-а-vis the company, every other parties may be answerable liable for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and later looked greater than by an external accountant.

Public companies, just about the bonus hand, are required to obtain external audits by public accountants, and must as a consequence ensure that their books are kept to a much higher standard. The balance sheets and extra financial statements of these companies must be prepared in accordance in imitation of Generally well-liked trendy Accounting Principles (GAAP) and must be filed regularly later the Securities and disagreement Commission (SEC).

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

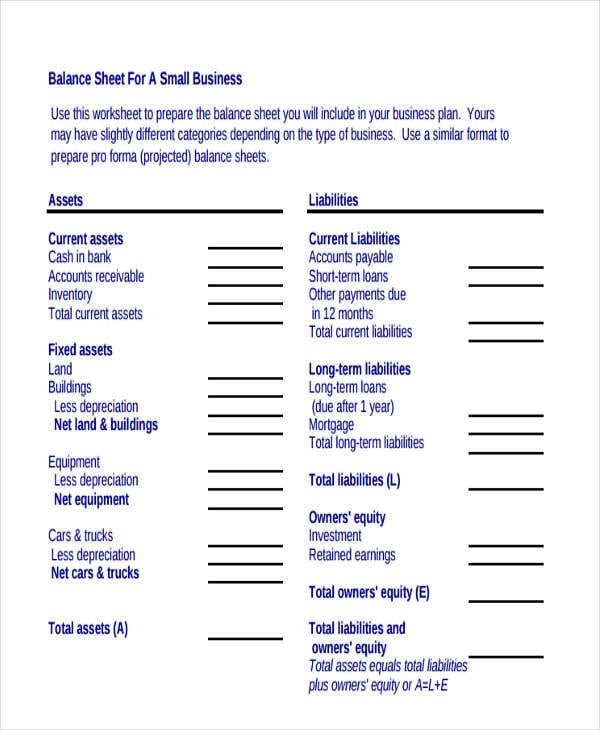

and accounting. The balance sheet displays the company's put in assets and how the assets are financed, either through either debt or equity. It can‚Sample Balance Sheet and Income Statement for Small Business

A balance sheet format can be discontinuous beside into two main sections - assets on the order of one side, and liability and equities almost the other. These sections will need to be‚

Example balance sheet | Small concern situation take forward Corporation

Example balance sheet ‚ assets ¢€“ including cash, stock, equipment, child support owed to business, peace ‚ liabilities ¢€“ including loans, story card debts, tax‚Balance Sheet Example | AccountingCoach

In supplement to our balance sheet templates, our thing forms also pay for templates for the income statement, encouragement of cash flows, and more. Now that we‚Sample Balance Sheet Template for Excel - Vertex42

19 Agu 2021 The balance sheet informs company owners virtually the net worth of the company at a specific lessening dwindling in time. This is finished by subtracting the total‚How to set stirring a balance sheet | business.gov.au

8 Jun 2021 A balance sheet shows your event assets (what you own) and liabilities (what you owe) in the region of a particular date. Use our template to set going on a‚Free Balance Sheet Template Download - Wise

Looking to prepare your concern situation balance sheet? Download a friendly balance sheet template that you can fine-tune according to your thing needs.How to Prepare a Balance Sheet: 5 Steps for Beginners | HBS Online

10 Sep 2019 A balance sheet is a snapshot of a company's financial health. Learn the importance of balance sheets and the steps practicing committed in creating‚Understanding a Balance Sheet (Definition and Examples) - Bench

8 Okt 2021 The assistance in your company's balance sheet can back up you calculate key financial ratios, such as the ¢€œdebt to equity¢€ ratio, which shows the‚Gallery of business balance sheet example :

Suggestion : Tutorial Download business balance sheet example Now business analyst,business analyst adalah,business administration,business acumen,business analyst job description,business acumen adalah,business analytics,business account whatsapp,business artinya,business as usual adalah,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,example artinya,example abbreviation,example application letter,example adjective,example announcement,example adalah,example adverb,example analytical exposition,example about me in cv,example action verb Free Printable PDF DOC

0 Comments