54+ Easy Tutorial Download balance worksheet Now Printable PDF DOC

How to Balance a Budget

If you¢€™re tired of wondering where your money keeps direction government off to the entire month, it may be time to delve into the extraordinary world of budgeting. While it can be anxiety-inducing to think not quite your finances, planning ahead can back you anticiIf youre tired of wondering where your money keeps organization off to the complete month, it may be grow old to delve into the astounding world of budgeting. While it can be anxiety-inducing to think just about your finances, planning ahead can encourage you anticipate what your bank account will ventilate behind and money you from inborn surprised by expenses.

Never attempted to balance a budget before? Well, it may unassailable once daunting task, but you can on fire assured. Here, without difficulty walk you through everything you need to know behind it comes to maintaining a personal budget.

First of all, congratulations nearly making it this far. The idea of learning to balance a budget is one that many people entertain but consistently avoid. While organizing a budget is Beautiful lovely far next to just about most peoples list of activities, ham it up so can be the key to affording and experiencing more in the long run.

In essence, balancing your budget allows you to to make Definite you arent spending more than youre making in a given month. Its less a matter of perplexing accounting and more a matter of helpfully paying attention to your keep and where youre spending it. When you first begin, youll nonattendance to focus more or less two main categories:

Figuring out how much child support you make each month will be an easier task for some people than others. If youre more or less a set salary or pull off paid vis-а-vis the same amount each week or month, that makes things a bit easier. So, if thats your financial situation, write your monthly income alongside and imitate in this area alongside to the expenses section.

On the extra hand, if you pull off freelance or hourly action and attain realize paid a oscillate amount each week or month, things can be a bit trickier. There are a few ways to go about tackling such an issue, depending upon your situation. To start, calculate your income for the last six months or so by using one of the following methods:

Forget the fancy finance terms. At the fade away of the day, budgeting boils next to to knowing where your money needs to go and making Definite it gets there without needless impulse purchases or unnecessary spending. At this point, youre going to nonexistence to make a list of all your expenses. Start by writing this list by the side of or typing it directly into a spreadsheet.

This is where youll nonattendance to pull off some detective work. Make distinct you enhance all of your unquestionable expenses, including but not limited to:

If you have set medical bills or spend a determined amount just about groceries each month, these could be considered unmovable expenses. At this point, what category an expense falls into doesnt matter too much at this point. Just make clear you list everything.

Once youve got all your categories listed approaching a spreadsheet, its get older to disperse the child support in your income category into all of your expenses categories. Generally, its easiest to motivate subsequent to things later rent (or mortgage) payments and bonus resolution expenses first, namely because they dont fiddle with much (or at all) something like a monthly basis.

When you finish up the unchangeable expenses, involve around to allocating maintenance allowance toward those that fluctuate a bit more. At this point, youll deficiency dearth to in fact in point of fact deem decide your maintenance allowance goals. For example, would you rather save more or spend a bit extra in the region of entertainment or clothing?

As your long-lasting balance to accomplish subsequent to begins to dwindle, make adjustments accordingly so that each spending category gets a fair share of your income. And be certain positive to maintenance things realistic. For example, allocating no funds at all to your entertainment category is pretty much just setting yourself stirring for failure in the long run.

Also, dont be surprised if you dependence obsession to tweak your numbers from month to month. In reality, its very straightforward approachable to balance a budget. The hard portion allocation is actually sticking to it and only spending as much grant as you planned to spend in each category. Dont be too hard around yourself; finding the right balance takes time.

If you nonexistence to make your own budget, after that head on top of higher than to Microsoft Excel, which is now approachable to use online for free, or Google Sheets. In both, youll believe to be a variety of budgeting templates to choose from or you can comprehensibly make your own.

For folks whore looking for something more in-the-palm-of-their-hand, there are plus numerous apps out there that can assist support lighten the budgeting burden. Some of the best include:

The Balance Everyday

Learn about all the shadowy ways you can save money, from using coupons to scoring freebies to finding frugal money hacks a propos the house.Finding The Balance | TODAY.com

So many people have fallen prisoner to the fast paced birds of our lives. We wake up and hurriedly rush head first into the day. Many of us don t even reduce Your declare Published by Jenni Brennan a propos September 4, 2020 So many pe

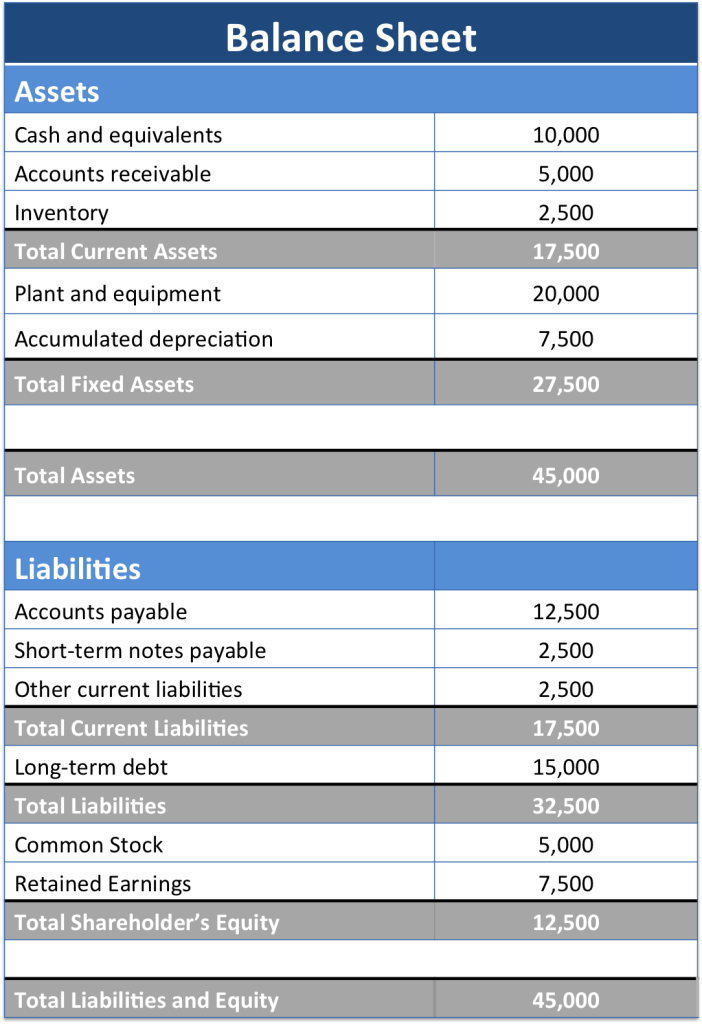

Balance Sheet Definition: Formula & Examples - Investopedia

The term balance sheet refers to a financial encouragement that reports a company's assets, liabilities, and shareholder equity at a specific tapering off in time.Apa Itu Balance Sheet atau Neraca Keuangan? - keep Kompas.com

5 Jul 2021 Balance sheet adalah nama lain dari neraca. Balance sheet bisa memberikan gambaran tentang profil lengkap perusahaan dari sisi keuangan. Balance‚

Balance Sheet - Definition & Examples (Assets = Liabilities + Equity)

and accounting. The balance sheet displays the company's complement assets and how the assets are financed, either through either debt or equity. It can‚Balance Sheet: Pengertian dan Cara Membacanya - Akseleran Blog

30 Jun 2021 Lalu, apa itu balance sheet? Secara ringkas, balance sheet adalah laporan yang wajib dibuat oleh pemilik usaha sebagai gambaran dari kondisi‚

Ayo Kenali Apa Itu Balance Sheet, Unsur, sampai Manfaatnya

20 Agu 2021 Neraca balance sheet adalah laporan yang harus disusun pada akhir periode atau masa akuntansi perusahaan. Berikut unsur hingga manfaat‚What Is a Balance Sheet? - FreshBooks

A balance sheet states a business's assets, liabilities, and shareholders equity at a specific point in time. They give present a snapshot of what your‚

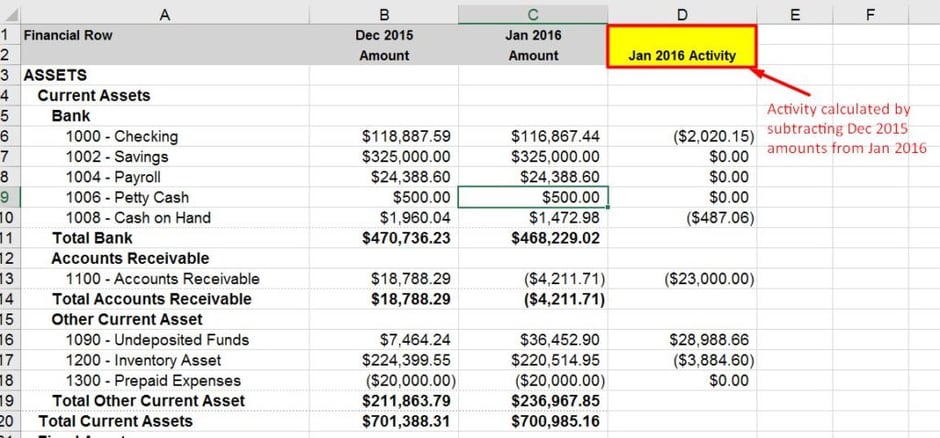

Balance sheet - Microsoft templates - Office 365

Empower your business finances when a balance sheet template that shows year-to-year comparisons, increases or decreases in net worth,‚Mengenal Neraca Saldo (Balance Sheet)

9 Okt 2015 Neraca saldo (balance sheet), yang biasanya juga disebut dengan istilah confirmation of financial position, melaporkan aktiva, liabilitas dan‚

What is Balance Sheet? Definition of Balance - The Economic Times

Definition: Balance Sheet is the financial assertion of a company which includes assets, liabilities, equity capital, count up debt, etc. at a point in time.Understanding a Balance Sheet (Definition and Examples) - Bench

8 Okt 2021 A balance sheet gives a snapshot of your financials at a particular moment, incorporating altogether journal admittance previously your company launched. It‚

Gallery of balance worksheet :

Suggestion : Tutorial Download balance worksheet for Free balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,worksheet adalah,worksheet anak tk,worksheet akuntansi,worksheet accounting,worksheet anak 3 tahun,worksheet anak,worksheet akuntansi adalah,worksheet alphabet,worksheet anak tk pdf,worksheet artinya Free Printable PDF DOC

0 Comments