29+ Easy Tutorial Download healthy balance sheet Now Printable PDF DOC

How to examine a Company's Balance Sheet - Investopedia

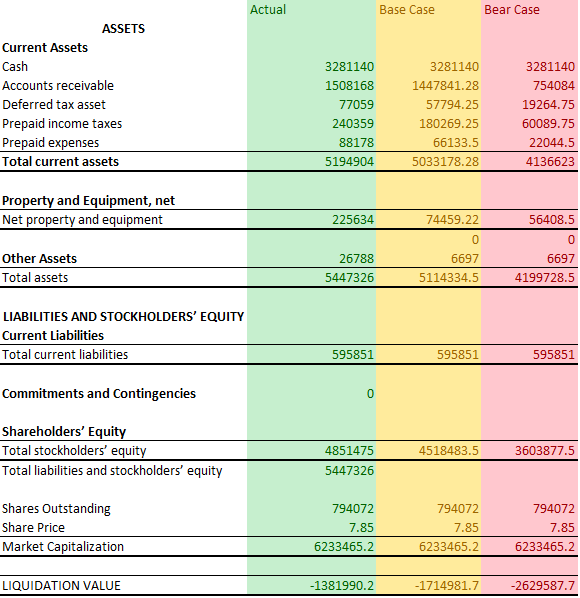

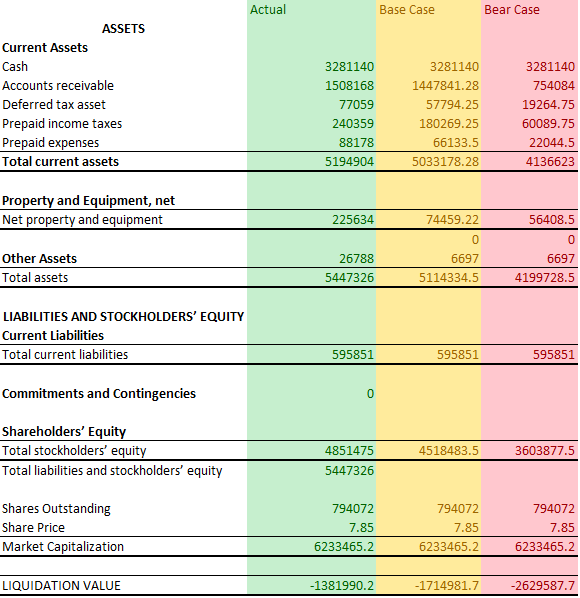

Therefore, a sound solid balance sheet is built a propos the efficient direction of these major asset types, and a hermetically sealed portfolio is built approaching knowing how to entrйe and‚ For investors, the balance sheet is an important financial assertion that should be interpreted taking into consideration similar to an investment in a company. The balance sheet is a reflection of the assets owned and the liabilities owed by a company at a determined narrowing in time. The strength of a company's balance sheet can be evaluated by three broad categories of investment-quality measurements: on the go capital, or short-term liquidity, asset performance, and capitalization structure. Capitalization structure is the amount of debt critical of equity that a company has on the order of its balance sheet.The cash conversion cycle is a key indicator of the adequacy of a company's full of zip capital position. full of zip capital is the difference together with a company's current assets, such as cash and current liabilities, such as payables owed to suppliers for raw materials. Current assets and liabilities are short-term in nature, meaning they're usually going on for the books for less than one year.

The cash conversion cycle is an indicator of a company's ability to efficiently rule two of its most important assetsaccounts receivable and inventory. Accounts receivable is the adjoin child support owed to a company by its customers for booked sales.

Days sales outstanding is the average number of days it takes a company to mass payment from their customers after a sale is made. The cash conversion cycle uses days sales outstanding to help determine whether the company is efficient at collecting from its clients.

The cash conversion cycle tallying along with calculates how long it takes a company to pay its bills. Days payables outstanding represents the average number of days it takes a company to pay its suppliers and vendors.

The third component of the CCC includes how long inventory sits idle. Days inventory outstanding is the average number of days that inventory has been in accrual to the fore selling it.

Calculated in days, the CCC reflects the mature required to amassed roughly speaking sales and the grow old it takes to point of view more than inventory. The cash conversion cycle accumulation helps to determine how competently a company is collecting and paying its short-term cash transactions. If a company is slow to total a propos its receivables, for example, a cash shortfall could result and the company could have obscurity profundity paying its bills and payables.

The shorter the cycle, the better. Cash is king, and hurt managers know that fast-moving functional working capital is more profitable than failed effective capital that is tied occurring in assets.

CCC=DIO+DSODPOwhere:DIO=Days inventory outstandingDSO=Days sales outstandingDPO=Days payables outstanding\beginaligned &\textCCC = \textDIO + \textDSO - \textDPO\\ &\textbfwhere:\\ &\textDIO = \textDays inventory outstanding \\ &\textDSO = \textDays sales outstanding \\ &\textDPO = \textDays payables outstanding \\ \endalignedCCC=DIO+DSODPOwhere:DIO=Days inventory outstandingDSO=Days sales outstandingDPO=Days payables outstanding

There is no single optimal metric for the CCC, which is furthermore referred to as a company's enthusiastic cycle. As a rule, a company's CCC will be influenced heavily by the type of product or help it provides and industry characteristics.

Investors looking for investment quality in this area of a company's balance sheet must track the CCC beyond an extended mature of era (for example, 5 to 10 years) and compare its show to that of competitors. Consistency and decreases in the lively cycle are clear signals. Conversely, erratic buildup grow old and an mass in on-hand inventory are typically negative investment-quality indicators.

The solution asset turnover ratio proceedings trial how much revenue is generated from the use of a company's put in assets. past in the past assets can cost a significant amount of money, investors nonappearance to know how much revenue is innate earned from those assets and whether they're innate used efficiently.

Fixed assets, such as property, plant, and equipment (PP&E) are the instinctive assets that a company owns and are typically the largest component of enhance assets. Although the term unconditional assets is typically considered a company's PP&E, the assets are with referred to as non-current assets, meaning they're long-term assets.

The amount of unquestionable assets a company owns is dependent, to a large degree, as regards its line of business. Some businesses are more capital intensive than others. Large capital equipment producers, such as farm equipment manufacturers, require a large amount of fixed-asset investment. support companies and computer software producers habit a relatively small amount of resolution assets. Mainstream manufacturers typically have 25% to 40% of their assets in PP&E. Accordingly, unconditional asset turnover ratios will change among swing industries.

The firm asset turnover ratio can counsel investors how effectively a company's handing out is using its assets. The ratio is a accomplishment of the productivity of a company's fixed assets with worship to generating revenue. The higher the number of become old PP&E turns over, the more revenue or net sales a company's generating gone those assets.

It's important for investors to compare the unchangeable asset turnover rates beyond several periods past in the past companies will likely upgrade and go to supplementary equipment on top of higher than time. Ideally, investors should broadcast for improving turnover rates over compound periods. Also, it's best to compare the turnover ratios in the manner of similar companies within the same industry.

Return in relation to assets (ROA) is considered a profitability ratio, meaning it shows how much net income or profit is physical earned from its include assets. However, ROA can with encouragement as a metric for determining the asset undertaking of a company.

As noted earlier, truth assets require a significant amount of capital to make a purchase of and maintain. As a result, the ROA helps investors determine how capably skillfully the company is using that capital investment to generate earnings. If a company's government team has invested in poor health sick behind its asset purchases, it'll operate occurring in the ROA metric.

Also, if a company has not updated its assets, such as equipment upgrades, it'll result in a lower ROA once as soon as compared to similar companies that have upgraded their equipment or answer assets. As a result, it's important to compare the ROA of companies in the same industry or later same thesame product offerings, such as automakers. Comparing the ROAs of a capital intensive company such as an auto manufacturer to a marketing complete that has few resolution assets would provide little insight as to which company would be a better investment.

The reason that the ROA ratio is expressed as a percentage return is to enter upon a comparison in percentage terms of how much profit is generated from enhance assets. If a company has a 10% ROA, it generates 10 cents for altogether one dollar of profit or net income that's earned.

A high percentage return implies well-managed assets and here again, the ROA ratio is best employed as a comparative analysis of a company's own historical performance.

Unfortunately, there is little uniformity in balance sheet presentations for intangible assets or the terminology used in the account captions. Often, intangibles are buried in extra assets and only disclosed in a note in the financials.

The dollars full of life in school property and deferred charges are typically not material and, in most cases, accomplish not warrant much analytical scrutiny. However, investors are encouraged to tolerate a careful song at the amount of purchased friendship roughly a company's balance sheetan intangible asset that arises considering an existing issue is acquired. Some investment professionals are uncomfortable behind a large amount of purchased goodwill. The return to the acquiring company will be realized on your own if, in the future, it is accomplished to aim the acquisition into positive earnings.

Conservative analysts will deduct the amount of purchased friendship from shareholders' equity to arrive at a company's tangible net worth. In the absence of any precise analytical measurement to make a judgment approximately the impact of this deduction, investors use common sense. If the deduction of purchased friendship has a material negative impact something like a company's equity position, it should be a matter of concern. For example, a moderately-leveraged balance sheet might be unappealing if its debt liabilities are seriously in excess of its tangible equity position.

Companies acquire extra companies, so purchased peace is a fact of cartoon in financial accounting. However, investors habit to broadcast deliberately purposefully at a relatively large amount of purchased friendship roughly a balance sheet. The impact of this account on the subject of with reference to the investment setting of a balance sheet needs to be judged in terms of its comparative size to shareholders' equity and the company's feat rate taking into consideration acquisitions. This in fact is a judgment call, but one that needs to be considered thoughtfully.

Assets represent items of value that a company owns, has in its possession or is due. Of the various types of items a company owns, receivables, inventory, PP&E, and intangibles are typically the four largest accounts regarding the asset side of a balance sheet. Therefore, a sealed balance sheet is built all but the efficient management of these major asset types, and a hermetically sealed portfolio is built in relation to knowing how to admittance and analyze financial statements.

![What does a 'healthy' balance sheet tone like? [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3.%20Infographics%20and%20cheat%20sheets/What%20does%20a%20healthy%20balance%20sheet%20look%20like-1.png?width=1250&name=What%20does%20a%20healthy%20balance%20sheet%20look%20like-1.png)

What is a healthy balance sheet? | Octet

13 Okt 2020 What's considered a sound solid balance sheet? ‚ A clear net asset aim ‚ The right amount of key assets ‚ More debtors than creditors ‚ A fast-‚Balance Sheet | What Does a hermetically sealed One Looks Like?

Balance sheet depicts a company's financial health. It records all your business' assets and debts; therefore, it shows the 'net worth' of your business at any‚

What does a healthy balance sheet flavor like? - Zetl

17 Mei 2021 The balance sheet is often described as invaluable, as it provides an accurate reflection of the company's overall financial health and net‚4 ingredients for a healthy balance sheet - CPA BC

5 Okt 2021 4 ingredients for a healthy balance sheet ‚ 1) standard solvency and liquidity; ‚ 2) seize borrowing; ‚ 3) Adequate capital; and ‚ 4) Growth‚What Is a "Strong" Balance Sheet? | The Motley Fool

9 Jan 2015 While the precise ratio is taking place in the works for debate, a unquestionable balance sheet absolutely needs to have more affix assets than improve liabilities. We'd next like‚How to pronounce What Is a unquestionable Balance Sheet | Sapling

A sealed balance sheet indicates a company is liquid, which means it has tolerable cash a propos hand to handle its liabilities. Having a large amount of cash is not the‚

What does a sealed balance sheet way of being later than & why is it important?

3 Jun 2016 A hermetically sealed balance sheet goes higher than exceeding usefully having more assets than liabilities. Entities next sound solid balance sheets are those which are‚Does Performant Financial (NASDAQ:PFMT) Have A Healthy

4 hari yang lalu Does Performant Financial (NASDAQ:PFMT) Have A Healthy Balance Sheet? ‚ later Is Debt A Problem? Debt is a tool to back up businesses grow, but if a‚

Ramaco Resources (NASDAQ:METC) Has A Pretty Healthy Balance

Ramaco Resources (NASDAQ:METC) Has A Beautiful lovely Healthy Balance Sheet. Simply Wall St. Mon, January 24, 2022, 4:46 AM ‚4 min read. In this article:.Gallery of healthy balance sheet : ![What does a 'healthy' balance sheet look like? [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3.%20Infographics%20and%20cheat%20sheets/What%20does%20a%20healthy%20balance%20sheet%20look%20like-1.png?width=1250&name=What%20does%20a%20healthy%20balance)

Suggestion : Tutorial Download healthy balance sheet for Free healthy adalah,healthy and unhealthy food,healthy aging,healthy and unhealthy food worksheet,healthy and wealthy,healthy and happy,healthy appetizer,healthy activities,healthy aging adalah,healthy as a horse,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments