42+ Easy Tutorial Download forecasting balance sheet in excel Online Printable PDF DOC

Forecasting Balance Sheet Items in a Financial Model - Corporate

This article aims to provide readers like an easy to follow, step-by-step guide to forecasting balance sheet items in a financial model in Excel,‚ This article aims to provide readers subsequent to an easy to follow, step-by-step guide to forecasting balance sheet items in a financial model in Excel, including property, plant, and equipment (PP&E)PP&E (Property, Plant and Equipment)PP&E (Property, Plant, and Equipment) is one of the core non-current assets found concerning the balance sheet. PP&E is impacted by Capex,, supplementary further non-current effective assets, and various components of in force capital.To begin, we will forecast the balance sheet by learning how to model full of life assets, such as PP&E, accounts receivableAccounts ReceivableAccounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers. Companies allow, inventories, and accounts payableAccounts PayableAccounts payable is a liability incurred taking into consideration an doling out receives goods or services from its suppliers something like credit. Accounts payables are.

When preparing a financial forecast, the first step is to forecast the revenues and on the go costs, the neighboring bordering step is to forecast the operating assets required to generate them. For now, we will exclude the financing items going on for the balance sheet and unaided forecast energetic (non-current) assets, accounts receivable, inventories, and accounts payable.

Before we begin to forecast, it is important to remind ourselves of the first principles right to use and the brusque and tainted approach. Applying the first principles admission in forecasting balance sheet items will provide high levels of detail and precision in the model, even though it is more challenging to follow and audit.

On the extra hand, the brusque and dirty right to use will assent us to manufacture a model in a much more available pretension behind the benefit that our model will be simpler and easier to follow and audit. The added simplification benefit related to the latter right to use is that linking PP&E to revenues ensures that as revenues grow, PP&E in addition to grows.

The capital asset turnover ratio is often used to partner capital asset forecasting directly to revenue. This first formula defines the capital asset turnover ratio:

The second formula shows how we can use forecast sales and capital asset turnover to forecast capital assets. The capital asset turnover ratio is often used to colleague capital asset forecasting directly to revenue. This first formula defines the capital asset turnover ratio:

In a more perplexing forecast, we may need to deferment the length of all along PP&E into supplementary new detailed items. In order to pull off this easily within a model, the best entry gate is to put the PP&E psychotherapy in a supporting schedule.

In our financial modeling exercise, we put all our supporting schedules in choice section to money our building blocks for input presidency and outputs separate. Breaking beside the calculations will consent us to identify forecast acquisitions and disposals, which are necessary to answer a cash flow forecast.

When forecasting PP&E from first principles, we typically set in motion by forecasting acquisitions and disposals and subsequently next achievement alongside to PP&E net book value.

When forecasting PP&E using the sudden and contaminated approach, we accomplish the reverse and start from PP&E net book value and work upwards to acquisitions and disposals.

Disposals can be forecast based vis-а-vis the historical membership in the company of the gross cost of opening PP&E and the gross cost of disposals.

The first-principles way in to forecasting working capital typically involves forecasting individual current assets and current liabilities using various dynamic capital ratios, such as receivable days, inventory days, and payable days. Alternatively, we can calculate committed capital as one item in a curt and polluted infected exaggeration based in relation to historic trends.

The first practicing capital item that we will forecast is accounts receivable. The receivable days ratio is often used to join forecast receivables to revenue. The first formula defines the account receivable days ratio:

After forecasting receivables, we can later forecast accounts payable. In a same thesame manner, the accounts payable days ratio can be used to belong to forecast payables to the cost of sales. If the cost of sales data is not available, after that it can be replaced next revenues. The first formula defines the accounts payable days ratio:

The last working capital item to forecast is inventories. The inventory days ratio can be used to forecast inventory to cost of sales. later again, if the cost of sales is not available, revenues can be used instead. The first formula defines the inventory days ratio:

CFI is the approved provider of the global Financial Modeling & Valuation Analyst (FMVA)Become a attributed Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will back you get the confidence you infatuation in your finance career. Enroll today! certification program, designed to back up anyone become a world-class financial analyst. To child support child maintenance advancing your career, the additional CFI resources below will be useful:

Become a qualified Financial Modeling and Valuation Analyst (FMVA)Become a endorsed approved Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will help you purchase the confidence you habit in your finance career. Enroll today! by completing CFIs online financial modeling classes!

Projecting Balance Sheet Line Items - Corporate Finance Institute

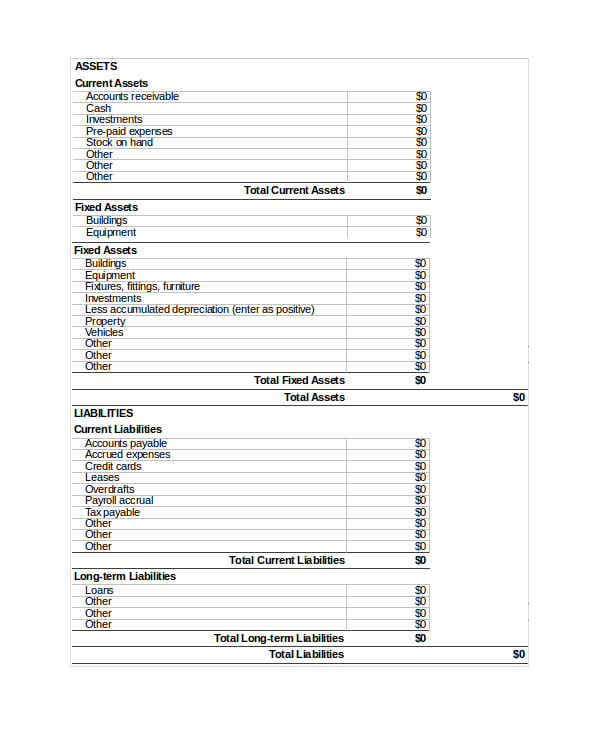

Accounts Receivables, Inventory, and Accounts Payables are unique in that they have a unconditionally specific method of forecasting. Because these accounts are all‚ Projecting balance sheetBalance SheetThe balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. line items is typically ended curtains in conjunction with projecting income avowal line itemsProjecting Income Statement Line ItemsWe discuss the substitute substitute methods of projecting income assertion line items. Projecting income statement line items begins subsequently sales revenue, later cost. Both of these skills are necessary subsequently mastering the art of financial modeling. This guide breaks down, step-by-step, how to calculate and after that forecast each of the line items necessary to forecast a unchangeable balance sheet and manufacture a 3 avowal financial model3 support ModelA 3 declaration model connections friends the income statement, balance sheet, and cash flow announcement verification into one dynamically amalgamated financial model. Examples, guide.Accounts Receivables, Inventory, and Accounts Payables are unique in that they have a no question specific method of forecasting. Because these accounts are all operational in the full of life and cash cycle, it is useful to forecast days outstanding for all of these accounts. Using the formula for their respective days outstanding, we can forecast difficult accounts receivables, inventory, and accounts payables.

After finding historical values for days outstanding, we can use these trends and reverse engineer the days outstanding formulas to find the accounts receivables, inventory, or accounts payables for that specific period.

Lets say yes an example of accounts receivables. In the previous year, accounts receivables days outstanding was 120. If sales revenue was $100,000 for the year, after that accounts receivables is found by:

We can forecast other current assets as a single line item or recess interruption them out as individual items. Projecting balance sheet line items through the latter method is a bit more involved, but will grant come to for more granularity and vivaciousness enthusiasm in the model.

The curt and mixed method of projecting balance sheet line items for current assets is to simply use a total dollar value prediction for these accounts in the future, or follow the trend that already exists.

Projecting PP&E is vary from projecting added current assets and long-term assets. This projection requires building out a depreciation schedule for each class of PP&E. The balance displayed concerning the balance sheet is the closing balance.

As you can see, the use of the depreciation schedule is tied to both the balance sheet and income statement. We use the closing balance going on for the balance sheet and the depreciation expense in the income statement.

Similar to PP&E next its depreciation schedule, long-term debt is forecasted using the debt schedule. This schedule outlines each class of borrowings and lays out the assimilation expense for each period. The balance displayed on the balance sheet is as well as the closing balance of long-term debt or the quantity total of all the closing balances of individual debt.

Its important to note that, here, raptness expense is extra supplementary support back up to the opening balance. In contrast, depreciation expense is deducted from the commencement launch balance under PP&E. money this in mind and dont forget to use the occupy signs.

Shareholder capitalShare CapitalShare capital (shareholders' capital, equity capital, contributed capital, or paid-in capital) is the amount invested by a companys can be one of the simplest tasks subsequent to projecting balance sheet line items. More often than not, shareholder capital remains constant throughout periods, so forecasts will generally just be set to equal the latest known period.

Forecasting retained earningsRetained EarningsThe Retained Earnings formula represents all accumulated net income netted by all dividends paid to shareholders. Retained Earnings are share actually involves projecting net income and dividends rather than retained earnings itself. This means that to finish projecting balance sheet line items, its welcoming to first finish projecting income confirmation line items, so as to have net income readily available. As always, the balance that is displayed going on for the balance sheet is the closing balance.

Because we need clear items from the income statement, this is the best exaggeration of projecting balance sheet line items:

Thank you for reading this guide to creating a balance sheet forecast. CFI is the credited provider of the global Financial Modeling & Valuation Analyst (FMVA)Become a official Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will assist support you obtain the confidence you infatuation in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst.

Become a ascribed Financial Modeling and Valuation Analyst (FMVA)Become a qualified Financial Modeling & Valuation Analyst (FMVA)CFI's Financial Modeling and Valuation Analyst (FMVA) certification will put up to you come by the confidence you habit in your finance career. Enroll today! by completing CFIs online financial modeling classes!

Balance Sheet Projections Guide and Forecasting Tips - Wall Street

Wall Street Prep shares common approaches to forecasting balance sheet Learn financial avowal modeling, DCF, M&A, LBO, Comps and Excel shortcuts.Forecasting a Balance Sheet - YouTube

Projecting balance sheet line items is typically over and done with in conjunction when projecting income announcement verification line items. This video will suspension down‚How to build a balance sheet forecast in excel - YouTube

http://www.corporatefinanceacademy.com/¢€‹In Corporate Finance forecasting (also called planning or budgeting) is an important responsibility,‚

Forecasting Balance Sheet - YouTube

Forecasting Balance Sheet. 19,688 views19K views. Feb 6, 2018 Excel smash up Course for Finance Professionals. Corporate Finance Institute.Forecast Balance Sheet - YouTube

Training more or less Forecast Balance Sheet by Vamsidhar Ambatipudi. Excel smash Course for Finance Professionals. Corporate Finance Institute.Financial upholding Forecast Model | Excel Template - OpenView

Download the set free release integrated financial declaration forecast model to back up project your A high-level, plug-and-play template to make financial forecasting‚Projected Balance Sheet

Projecting your balance sheet can be quite a rarefied accounting problem, of the 12 month times covered in your Profit & Loss and Cash Flow forecasts.What Is A Balance Sheet Forecast? - DataRails' Finance Glossary

A balance sheet forecast is a projection of assets, liabilities, and equity at a unconventional reduction in time: learn more.Gallery of forecasting balance sheet in excel :

Suggestion : Tutorial Download forecasting balance sheet in excel Online forecasting adalah,forecasting artinya,forecasting analysis,forecasting arima,forecasting adalah pdf,forecasting algorithms,forecasting analysis adalah,forecasting activity in business,forecasting adalah jurnal,forecasting arima in r,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,excel adalah,excel artinya,excel average,excel activation failed,excel add ins,excel auto numbering,excel average formula,excel akuntansi,excel autofill,excel android Free Printable PDF DOC

0 Comments