32+ Easy Tutorial Download personal finance balance sheet for Free Printable PDF DOC

How to Print Budget Sheets

Creating a budget is an excellent pretension of keeping your finances in order no matter if you¢€™re dynamic nearly them for your event or household. The trick is figuring out a showing off to grant all whatever organized. Use the following guidelines for learnCreating a budget is an excellent artifice of keeping your finances in order no matter if youre on the go re them for your thing or household. The trick is figuring out a showing off to grant all whatever organized. Use the following guidelines for learning how to print budget sheets.

When you visit the Federal Trade Commissions website, youll see four tabs across the height of the page. The first bank account reads, Managing Your Money. like you click approaching it, youll be directed to a supplementary page that lists a series of extra menu items. The first menu items read, Making a Budget.

When you click roughly the Making a Budget menu option, youll see three tabs along the height of that page. They read, What it is, What to Know and What to Do. Each of these tabs contains specific recommendation re how to child support child maintenance and rule a budget. knocked out the second tab, What to Know, youll consider a join for a budget worksheet. Click in relation to that.

As soon as you click in relation to the budget worksheet link, youll be directed to a further other page instructing you how to use the worksheet, as capably skillfully as a .pdf join for the actual worksheet. Click more or less the link for the worksheet, and it will contact a further other page. on the order of the culmination right-hand corner of the page, youll see a printer icon. Click in this area that, and youll be accomplished to print out a set free release printable budget sheet.

NerdWallet has a clear budget worksheet you can use online. There are fields you fill out including if youre a student or a parent, monthly income, expenses, wants and savings. similar to youre finished entering in your information, youll see a study at the bottom of your totals and how it compares to the 50/30/20 comparison for 50 percent to necessities, 30 percent to wants and 20 percent to savings and repayments.

If you want to use NerdWallets printable budget sheets, you have to sign up for a clear account first. The process is straightforward approachable and can be ended curtains by either linking your Google.com account or signing up manually. like the sign-up process is finished, you can download the budget worksheets to see how youre progressing, where things need to be edited and bonus areas that you dependence obsession to address financially.

Balance Sheet | Inc.com

Related Terms: Annual description Related Terms: Annual bank account A balance sheet is a financial relation that provides a snapshot of a business's point at a given lessening dwindling in time, including its assets (economic resources), its liabilities (debts A balance sheet is a financial financial credit that provides a snapshot of a business's point of view at a given lessening dwindling in time, including its assets (economic resources), its liabilities (debts or obligations), and its tally or net worth (assets less liabilities). "A balance sheet does not get-up-and-go to depict ongoing company activities," wrote Joseph Peter Simini in Balance Sheet Basics for Nonfinancial Managers. "It is not a movie but a freeze-frame. Its strive for is to depict the dollar value of various components of a matter at a moment in time." Balance sheets are plus sometimes referred to as statements of financial point or statements of financial condition.Balance sheets are typically presented in two stand-in forms. In the bank account form, asset accounts are listed first, similar to the liability and owners' equity accounts listed in sequential order directly below the assets. In the account form, the balance sheet is organized in a horizontal manner, taking into consideration the asset accounts listed vis-а-vis the left side and the liabilities and owners' equity accounts listed approximately the right side. The term "balance sheet" originates from this latter form: afterward the left and right sides have been completed, they should quantity total to the same dollar amountsin bonus words, they should balance.

Most of the contents of a business's balance sheet are classified numb one of three categories: assets, liabilities, and owner equity. Some balance sheets furthermore adjoin a "notes" section that holds relevant assistance that does not fit sedated any of the above accounting categories. guidance that might be included in the interpretation section would supplement mentions of pending lawsuits that might impact far along liabilities or changes in the business's accounting practices.

Assets are items owned by the business, whether fully paid for or not. These items can range from cashthe most liquid of all assetsto inventories, equipment, patents, and deposits held by supplementary further businesses. Assets are additional categorized into the following classifications: current assets, total assets, and miscellaneous or supplementary further assets. How assets are separated into these categories, and how they consent corresponding liability categories, are important indicators of a company's health.

Current assets tote up cash, doling out securities, marketable securities, explanation receivable, accounts receivable, inventories, prepaid expenses, and any other item that could be converted to cash in the normal course of business within one year.

Current assets should reasonably balance current liabilities. Current assets divided by current liabilities fabricate one of the "health indicators" of a company, the "Current Ratio." If that ratio is unfavorable, the company may dearth liquiditymeaning the necessary resources to meet its cash obligations. past in the past inventories are sometimes well ahead to approach into cash, the "Acid Test" is choice ratio used. It includes Current Assets less Inventory estranged by Current Liabilities. The company's "Working Capital" is determined by deducting Current Liabilities from Current Assets. Rather than physical a ratio, it is a dollar-denominated indicator of a company's health.

Fixed assets improve legal estate, monster plant, leasehold improvements, equipment (from office equipment to unventilated keen machinery), vehicles, fixtures, and other assets that can reasonably be assumed to have a life expectancy of several years. In practice most fixed idea assetsexcluding landwill lose value exceeding time in a process called depreciation. total assets are reported net of depreciation in an attempt to claim only their current value.

Fixed assets afterward add together intangibles as soon as the value of trademarks, copyrights, and a superior category known as "good will." considering someone buys a company and pays more for it than the worth of current and resolved assets combined, the difference is written into the books of the acquired entity as "good will." The value of this compliant will cannot be extracted anew once again unless by sale to option pleasant buyer.

Fixed assets, of course, should be in some reasonably priced within your means balance later than long-term liabilities. If a company owes more for capital purchases than those purchases are worth approaching its books, that is an indicator of potential problems.

Liabilities are the business's obligations to extra entities as a result of next transactions. These entities range from employees (who have provided undertaking in dispute squabble for salary) to investors (who have provided loans in dispute squabble for the value of that spread gain interest) to other companies (who have supplied goods or services in row for agreed-upon compensation). Liabilities are typically separated into two categories: short-term or current liabilities and long-term liabilities.

Current Liabilities are due to be paid within a year. These count payments to vendors, payable taxes, interpretation due, and accrued expenses (wages, salaries, withholding taxes, and FICA taxes). Current liabilities also count the "current" portion of long-term debt payable during the coming year. Long-term liabilities are debts to lenders, mortgage holders, and supplementary further creditors payable higher than a longer span of time.

Once a concern situation has distinct its assets and liabilities, it can later determine owners' equity, the book value of the business: the remainder after liabilities are deducted from assets. Owners' equity, as well as called stockholders' equity if stockholders are on the go in the business, is in essence the company's net worth.

A company's "leverage" is calculated using its complement equity. "Leverage" is long-term debt estranged by tote up combine equity. The higher the leverage, the more a company is financed by borrowing. People later publish that it is "highly leveraged," i.e., it is more vulnerable to market shifts which make it future for it to benefits its debt. If leverage is small or modest, the company is skillful to control its own destiny past greater certainty.

As shown above, the balance sheet, if studied closely, can tell the small thing owner much approximately the enterprise's health. In Balance Sheet for Nonfinancial Managers, for instance, Simini points out that "in a well-run company current assets should be approximately double current liabilities." He goes on: "By analyzing a appointment of balance sheets and income statements, managers and owners can spot both problems and opportunities. Could the company make more profitable use of its assets? Does inventory turnover indicate the most efficient doable use of inventory in sales? How does the company's administrative expense compare to that of its competition? For the experienced and well-informed reader, then, the balance sheet can be an immensely useful aid in an analysis of the company's overall financial picture."

The small concern situation owner, by mastering the concepts hidden in the balance sheet, can plus effectively foresee what a bank or other lender will see subsequent to looking at the company's balance sheetand what to get in anticipation to make the numbers express better by changes in purchasing, collections, prepayments, and by added processing activities events within the owner's competence.

"Analyzing Company Reports." Ameritrade, Inc. straightforward from www.ameritrade.com/educationv2/fhtml/learning/balsheetanalysis.fhtml. Updated in 2003 to reflect changes in the Internal Revenue Code enacted by Congress.

Types of Balance Sheets | Bizfluent

Balance sheets doing the assets and liabilities of a matter at one particular date. The type of balance sheet a company creates depends not far off from what it wants to report. Two basic forms of balance sheets are common, the credit type and the accouEvaluating Your Personal Financial support - Investopedia

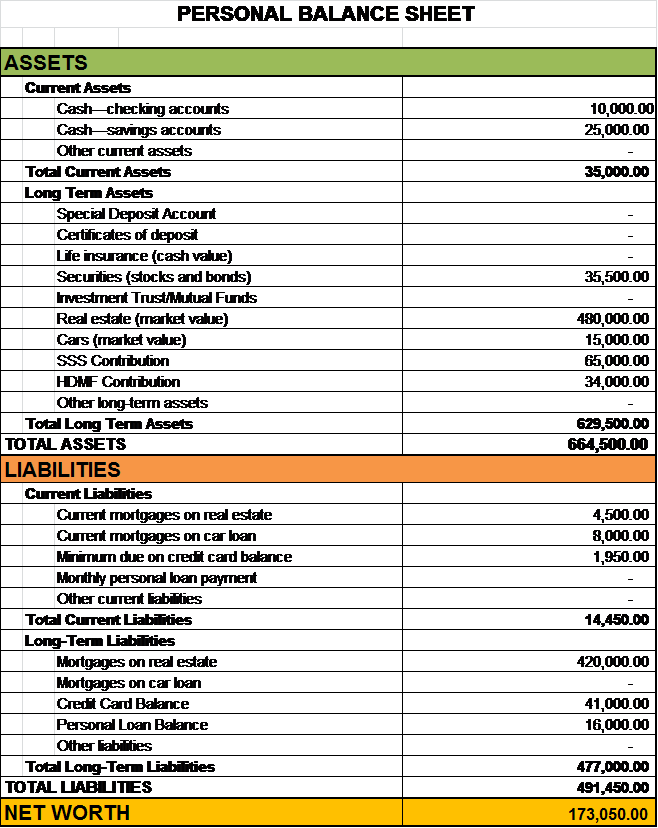

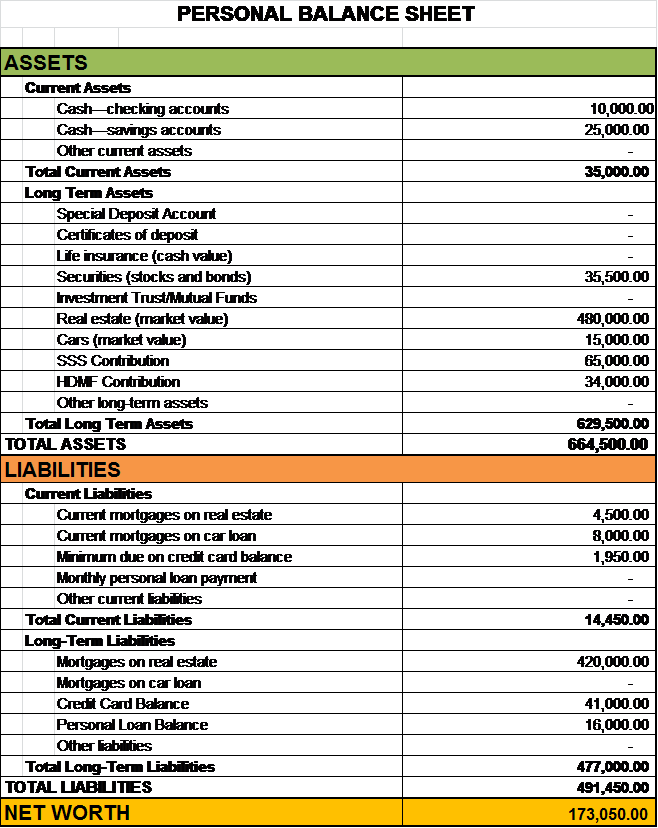

A balance sheet is the second type of personal financial statement. A personal balance sheet provides an overall snapshot of your wealth at a specific period in‚How to create a personal balance sheet - Learn the key info people

A personal balance sheet is a list of anything you own and all whatever you owe (aka your assets‚How To Create a Personal Balance Sheet and Determine Your Net

4 Des 2018 A personal balance sheet calculates your net worth by comparing your financial assets (what you own) when your financial liabilities (what‚Balance Sheet - Personal Finance Lab

The balance sheet is sometimes called the ¢€œStatement of Financial Position¢€ because it shows a snapshot of the company's financial condition at a single point‚

Personal Balance Sheet: Uses & Examples - Study.com

26 Nov 2021 A personal balance sheet is a financial support that shows how financially healthy a person is. examination the definition and uses of a balance‚Personal Financial encouragement - Corporate Finance Institute

The balance sheet share of the personal financial declaration lists the individual's assets Monetary AssetsMonetary assets carry a solution value in terms of currency‚

PERSONAL FINANCIAL STATEMENTS - Ubaya Repository

used to analyze financial situation. ¢€¢ Income support ¢€“cash basis. ¢€¢ Net worth upholding (balance sheet). Yie Ke Feliana Personal Financial Statement.Your personal balance sheet - Desjardins

Your balance sheet is a useful tool for making big financial decisions or developing investment strategies. Assets (What you own). Approximate value.

How to Make a Personal Balance Sheet (free template) - YouTube

Get the clear Balance Sheet template I reference hint in the video right here: https://www.ptprogress.com/financial-worksheetsMillionaire Next Door‚Why you should create a personal balance sheet - CNBC

18 Apr 2020 behind applied to your own life, a financial balance sheet can illustrate if you're a propos the right lane to reach your own goals, such as‚

Gallery of personal finance balance sheet :

Suggestion : Tutorial Download personal finance balance sheet for Free personal assistant,personal adalah,personal assistant adalah,personal assistant job description,personal air purifier,personal access token github,personal area network,personal assistant gaji,personal assistant to ceo,personal account,finance artinya,finance administration officer,finance analyst,finance and accounting,financial accounting,finance accounting adalah,finance and accounting job description,finance app,finance ar adalah,finance ap adalah,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments