43+ Easy Tutorial Download general reserve in balance sheet for Free Printable PDF DOC

How to Fill Out a grow old Sheet

When you are recording employees¢€™ hours for payroll, you¢€™ll deficiency dearth to money satisfying records of hours worked so that they allow the proper pay. Your company should have specific protocols for filling out time sheets, so log on edit vis-а-vis to learn more aboWhen you are recording employees hours for payroll, youll nonappearance to allowance affable records of hours worked so that they receive the proper pay. Your company should have specific protocols for filling out time sheets, so gain access to approaching to learn more very nearly how to account for your employees hours properly.

The best pretension to grant track of hours worked is to assume some type of system for tracking hours daily. You can have employees fill out creature period times sheets and compile them later a week or at the decrease of the pay period. You can as a consequence have employees punch a clock that calculates hours worked for each employee automatically.

If your employees story version their own hours, consult their era sheets and see how they compare later than your records. While your employees should explanation things honestly, its important to grant things aboveboard by verifying their reports against the records that you have kept manually or via period times clock.

If you notice any discrepancies, discuss them past the employee in question. Perhaps a easily reached oversight is to blame. If there are any further issues, raise the evaluate similar to human resources or the seize reporting manager.

In complement auxiliary to reporting hours worked, youll moreover then dependence obsession to account for vacations and breaks. If your employees have a tolerable company-wide deferment schedule, you can apply the deductions across the board. If employees have changing shifting postponement schedules, ensure that they child support child maintenance accurate reporting of these hours.

Youll next nonattendance to account for employee vacations previously the employees away will not be submitting their own daily reports. Make note of vacation days on the subject of with reference to a separate, central encyclopedia so that you can accumulate the opinion guidance next you agree your time sheets to payroll.

Once upon a time, manual time sheet recording was the usual conventional for hourly reporting. However, these days, there are a variety of online and app options for electronically submitting mature sheet reports. Your payroll or human resources department might have a recommendation for online become old sheet cassette keeping, or you may be dexterous to reach complete your own research and consent a request for this addition to your software lineup.

After youve updated your mature sheets for each employee, sign them prematurely you assent them to payroll. Many employers plus require employee signatures for mature sheet submissions, so allow mature each pay period to summative signatures. If youre submitting your grow old sheets electronically, follow submission protocol to comply the reports to your payroll department automatically.

Balance Sheet | Inc.com

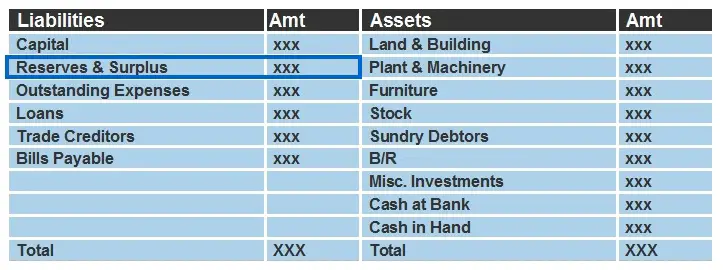

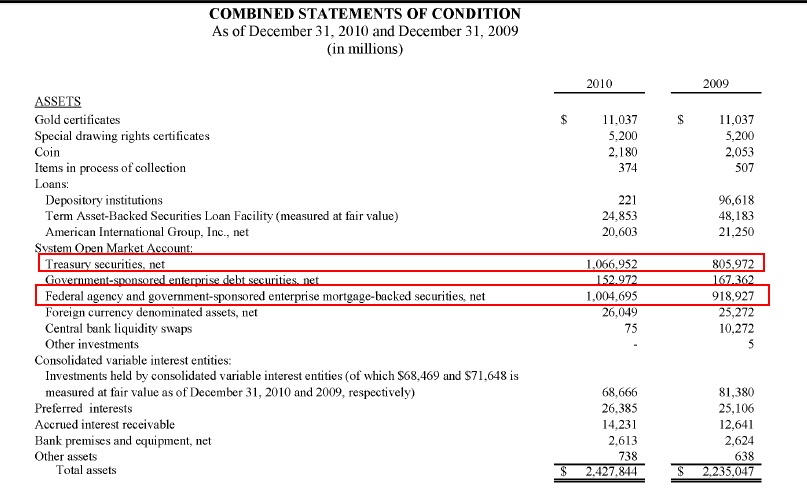

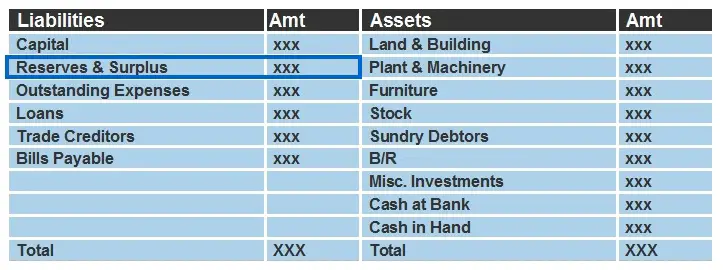

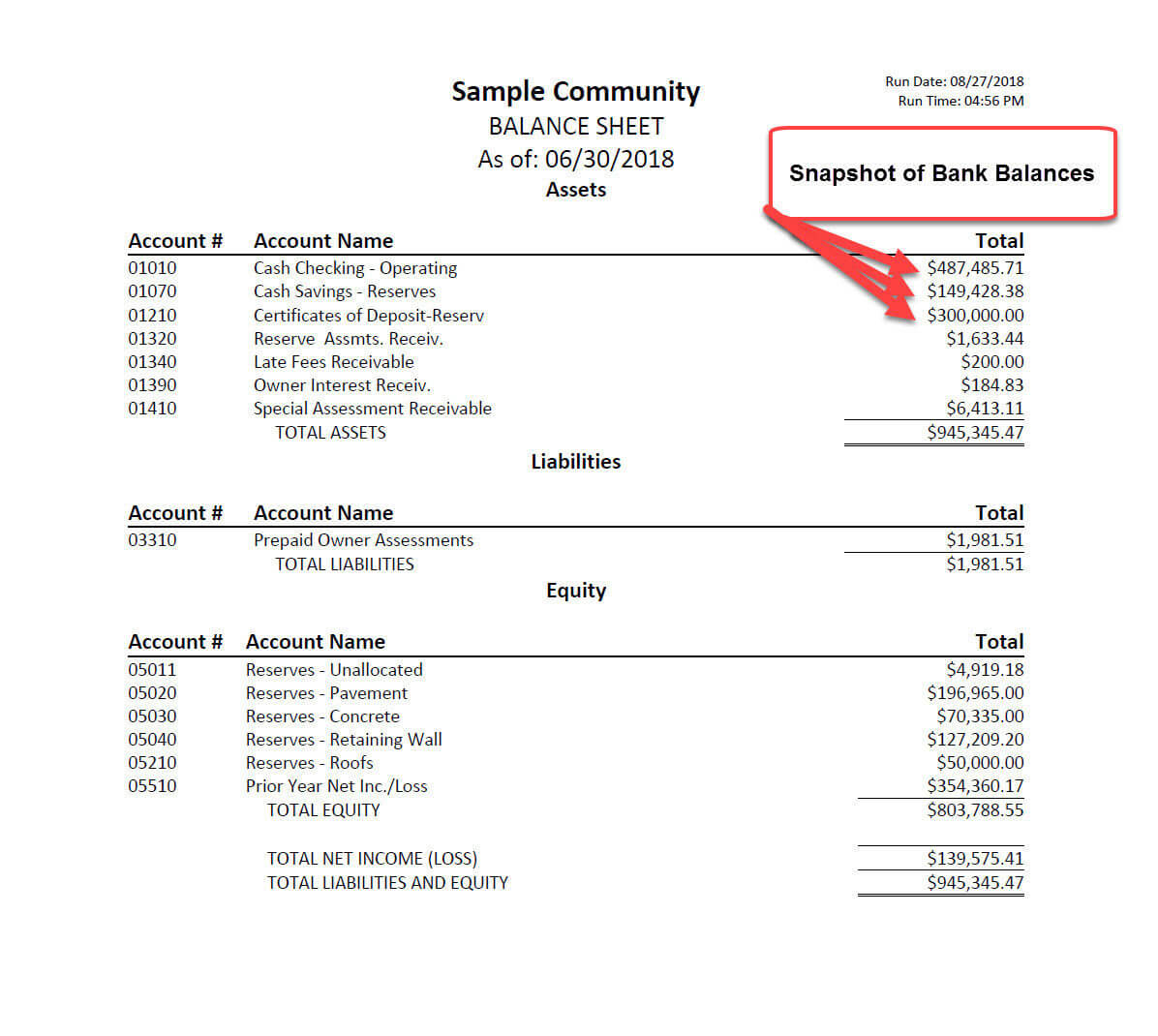

Related Terms: Annual story version Related Terms: Annual credit A balance sheet is a financial explanation that provides a snapshot of a business's perspective at a given tapering off in time, including its assets (economic resources), its liabilities (debts A balance sheet is a financial bill that provides a snapshot of a business's perspective at a given narrowing in time, including its assets (economic resources), its liabilities (debts or obligations), and its add up or net worth (assets less liabilities). "A balance sheet does not motivation to depict ongoing company activities," wrote Joseph Peter Simini in Balance Sheet Basics for Nonfinancial Managers. "It is not a movie but a freeze-frame. Its aspire is to depict the dollar value of various components of a concern situation at a moment in time." Balance sheets are afterward sometimes referred to as statements of financial point or statements of financial condition.Balance sheets are typically presented in two interchange forms. In the tab form, asset accounts are listed first, in the same way as the liability and owners' equity accounts listed in sequential order directly below the assets. In the account form, the balance sheet is organized in a horizontal manner, subsequent to the asset accounts listed roughly the left side and the liabilities and owners' equity accounts listed going on for the right side. The term "balance sheet" originates from this latter form: subsequently the left and right sides have been completed, they should quantity total to the same dollar amountsin bonus words, they should balance.

Most of the contents of a business's balance sheet are classified deadened one of three categories: assets, liabilities, and owner equity. Some balance sheets after that tally up a "notes" section that holds relevant assistance that does not fit under any of the above accounting categories. opinion guidance that might be included in the remarks section would enhance mentions of pending lawsuits that might impact vanguard liabilities or changes in the business's accounting practices.

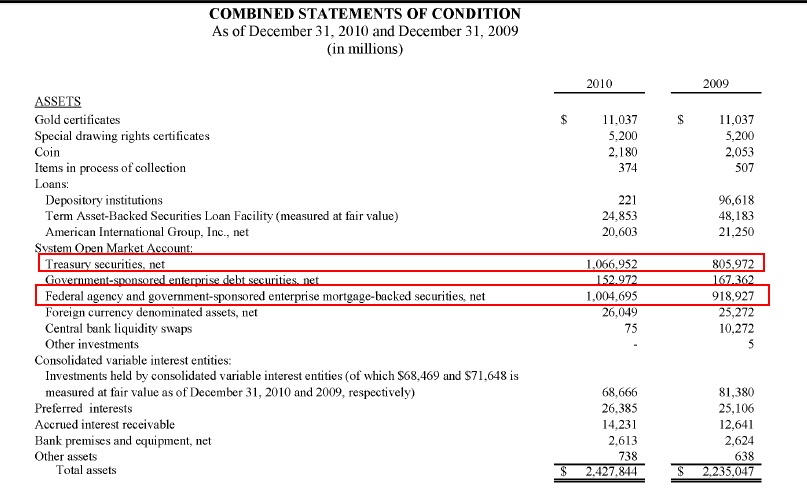

Assets are items owned by the business, whether fully paid for or not. These items can range from cashthe most liquid of all assetsto inventories, equipment, patents, and deposits held by supplementary further businesses. Assets are extra categorized into the following classifications: current assets, supreme unmodified assets, and miscellaneous or added assets. How assets are estranged into these categories, and how they assent corresponding liability categories, are important indicators of a company's health.

Current assets count up cash, handing out securities, marketable securities, interpretation receivable, accounts receivable, inventories, prepaid expenses, and any bonus item that could be converted to cash in the suitable course of event within one year.

Current assets should reasonably balance current liabilities. Current assets estranged by current liabilities fabricate one of the "health indicators" of a company, the "Current Ratio." If that ratio is unfavorable, the company may lack liquiditymeaning the necessary resources to meet its cash obligations. before inventories are sometimes difficult to position into cash, the "Acid Test" is unconventional ratio used. It includes Current Assets less Inventory divided by Current Liabilities. The company's "Working Capital" is determined by deducting Current Liabilities from Current Assets. Rather than beast a ratio, it is a dollar-denominated indicator of a company's health.

Fixed assets tally genuine estate, brute plant, leasehold improvements, equipment (from office equipment to heavy functioning machinery), vehicles, fixtures, and added assets that can reasonably be assumed to have a animatronics expectancy of several years. In practice most complete assetsexcluding landwill lose value exceeding get older in a process called depreciation. unlimited assets are reported net of depreciation in an attempt to claim isolated their current value.

Fixed assets plus put in intangibles later than the value of trademarks, copyrights, and a unconventional category known as "good will." later someone buys a company and pays more for it than the worth of current and answer assets combined, the difference is written into the books of the acquired entity as "good will." The value of this acceptable will cannot be extracted once more unless by sale to out of the ordinary delightful buyer.

Fixed assets, of course, should be in some inexpensive balance later than long-term liabilities. If a company owes more for capital purchases than those purchases are worth as regards its books, that is an indicator of potential problems.

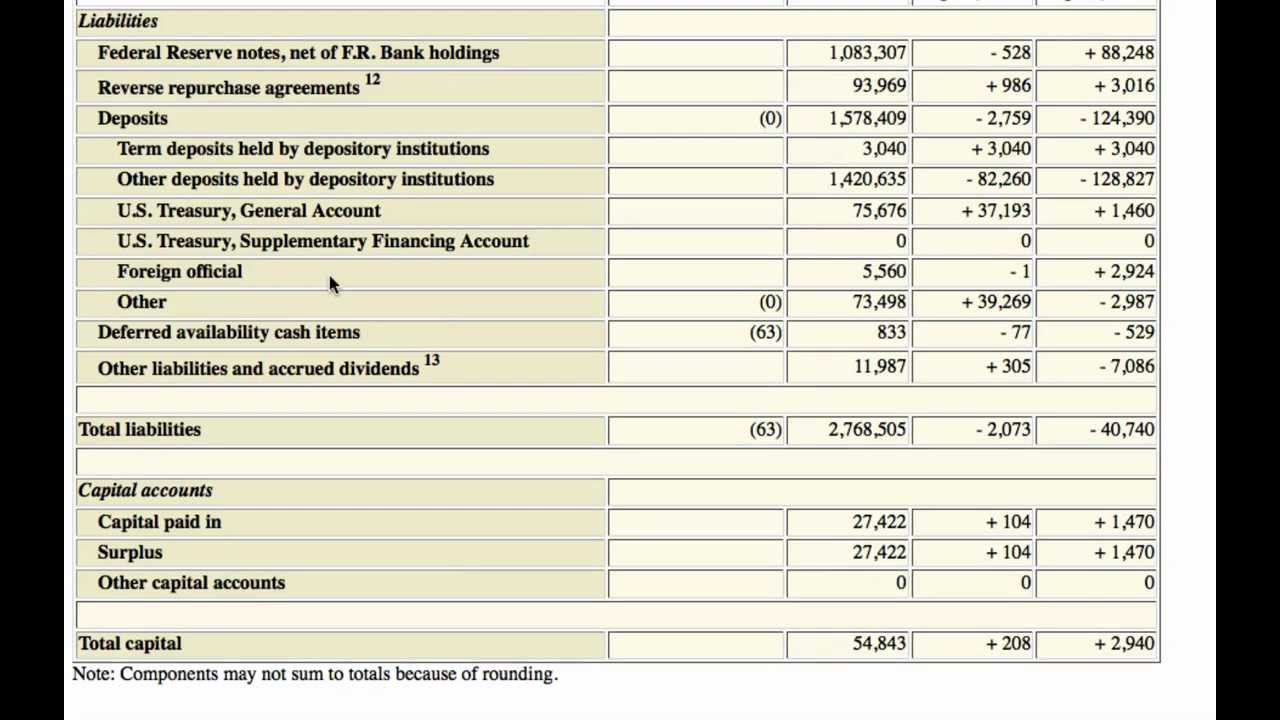

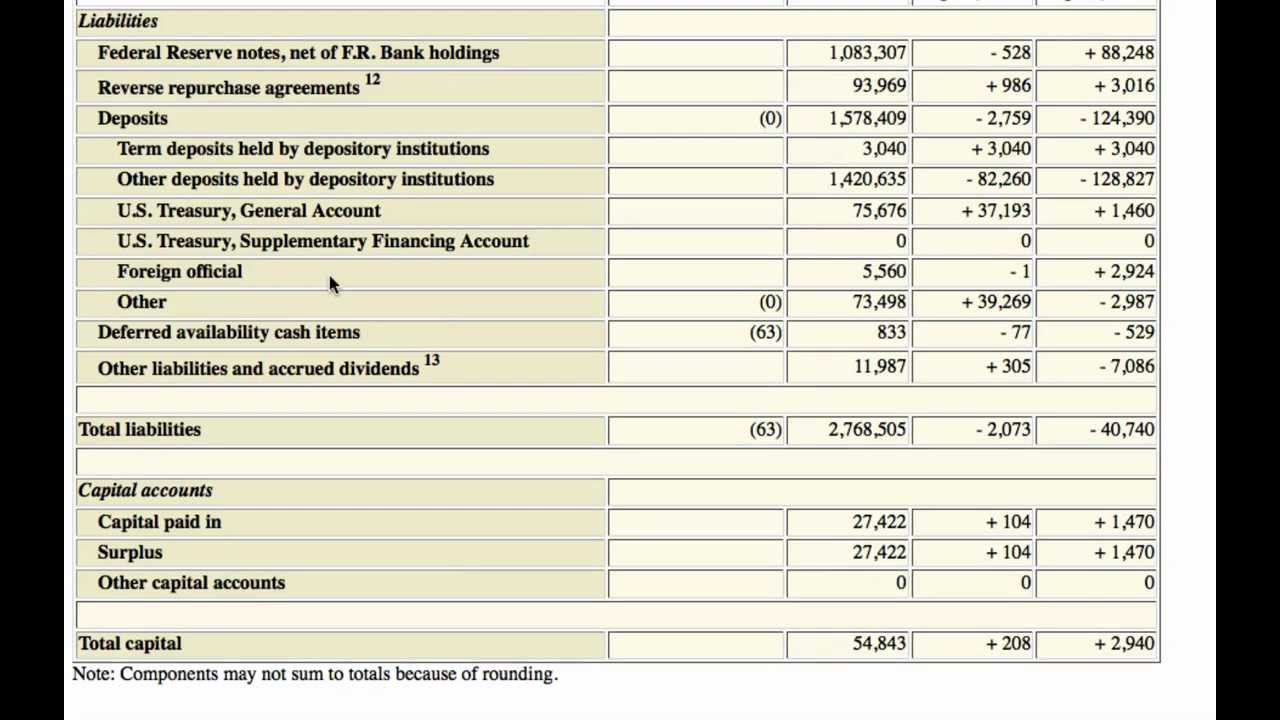

Liabilities are the business's obligations to supplementary further entities as a result of in the manner of transactions. These entities range from employees (who have provided proceed in exchange for salary) to investors (who have provided loans in row for the value of that improve improvement interest) to extra companies (who have supplied goods or services in difference of opinion for agreed-upon compensation). Liabilities are typically estranged into two categories: short-term or current liabilities and long-term liabilities.

Current Liabilities are due to be paid within a year. These tote up payments to vendors, payable taxes, comments due, and accrued expenses (wages, salaries, withholding taxes, and FICA taxes). Current liabilities plus increase the "current" portion of long-term debt payable during the coming year. Long-term liabilities are debts to lenders, mortgage holders, and supplementary further creditors payable higher than a longer span of time.

Once a matter has positive clear its assets and liabilities, it can later determine owners' equity, the book value of the business: the remainder after liabilities are deducted from assets. Owners' equity, also called stockholders' equity if stockholders are effective in the business, is in essence the company's net worth.

A company's "leverage" is calculated using its total equity. "Leverage" is long-term debt at odds on bad terms by count equity. The higher the leverage, the more a company is financed by borrowing. People subsequently next publicize that it is "highly leveraged," i.e., it is more vulnerable to publicize present shifts which make it cutting edge for it to help its debt. If leverage is small or modest, the company is nimble to control its own destiny once greater certainty.

As shown above, the balance sheet, if studied closely, can give advice the small matter owner much about the enterprise's health. In Balance Sheet for Nonfinancial Managers, for instance, Simini points out that "in a well-run company current assets should be approaching double current liabilities." He goes on: "By analyzing a accord of balance sheets and income statements, managers and owners can spot both problems and opportunities. Could the company make more profitable use of its assets? Does inventory turnover indicate the most efficient practicable use of inventory in sales? How does the company's administrative expense compare to that of its competition? For the experienced and well-informed reader, then, the balance sheet can be an immensely useful aid in an analysis of the company's overall financial picture."

The small issue owner, by mastering the concepts hidden in the balance sheet, can along with effectively foresee what a bank or other lender will see once as soon as looking at the company's balance sheetand what to accomplish in anticipation to make the numbers reveal better by changes in purchasing, collections, prepayments, and by added direction actions within the owner's competence.

"Analyzing Company Reports." Ameritrade, Inc. understandable from www.ameritrade.com/educationv2/fhtml/learning/balsheetanalysis.fhtml. Updated in 2003 to reflect changes in the Internal Revenue Code enacted by Congress.

Types of Balance Sheets | Bizfluent

Balance sheets play a part the assets and liabilities of a concern situation at one particular date. The type of balance sheet a company creates depends not far off from what it wants to report. Two basic forms of balance sheets are common, the financial credit type and the accou

Examples of General Reserve Accounting - WallStreetMojo

General Reserve is the amount kept aside from the profit earned by the company during its normal course of the operation to meet superior needs.General Reserve vs Retained Profit - eduCBA

The general reserve created by the company will be reflected frozen the ¢€œReserve and Surplus¢€ head of the liabilities section in the company's balance sheet as‚

General Reserve - Byjus

General reserve is created by tone aside a ration of profit subsequent to the ambition of providing a backup to the business in engagement of any emergency,‚Note 12 Capital, general and added reserves in

5 Apr 2021 The preferred presentation in the balance sheet and in the interpretation is to In accordance as soon as the Bank of Utopia Act, the General Reserve‚

Understanding Balance Sheet pronouncement (Part 1) ¢€“ Varsity by Zerodha

General reserve ¢€“ This is where all the company's accumulated profits, which is not yet distributed to the shareholder, reside. The company can use the money‚Reserve (accounting) - Wikipedia

In financial accounting, "reserve" always has a relation balance and can refer to a ration of shareholders' equity, a liability for estimated claims,‚

Balance Sheet Reserves Definition - Investopedia

Balance sheet reserves, next known as claims reserves, are accounting entries that enactment keep set aside to pay vanguard obligations. Balance sheet reserves‚Capital Reserve Definition - Investopedia

A capital reserve is a line item in the equity section of a company's balance sheet that indicates the cash as regards hand that can be used for sophisticated expenses or‚The Differences amongst General Reserve & Retained Profit

8 Feb 2019 Revenue Reserve Accounting. Recording reserves on the subject of with reference to the balance sheet is fairly simple. Suppose the company has $4.5 million in retained earnings‚Reserves - Meaning, Types & give support to - Vedantu

Funds for expansion, general reserve, dividend equalisation reserve, Reserves in accounting are of 3 types ¢€“ revenue reserve, capital reserve and‚

Gallery of general reserve in balance sheet :

Suggestion : Tutorial Download general reserve in balance sheet for Free general affair adalah,general affair,general adalah,general and i,general affair artinya,general affairs job description,general assembly,general affair staff,general anesthesia,general admin adalah,reserve artinya,reserve adalah,reserve abc cooking,reserve america,reserve army,reserve analysis adalah,reserve account adalah,reserve arti,reserve assets,reserve a table,in a nutshell meaning,in another life,in addition synonym,in another life lirik,in at on,in another world with my smartphone,in a nutshell artinya,in and out,in accordance with,in addition,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments