41+ Easy Tutorial Download negative assets almost balance sheet Online Printable PDF DOC

Can Net Assets Be Negative on the subject of with reference to a Balance Sheet? - Bizfluent

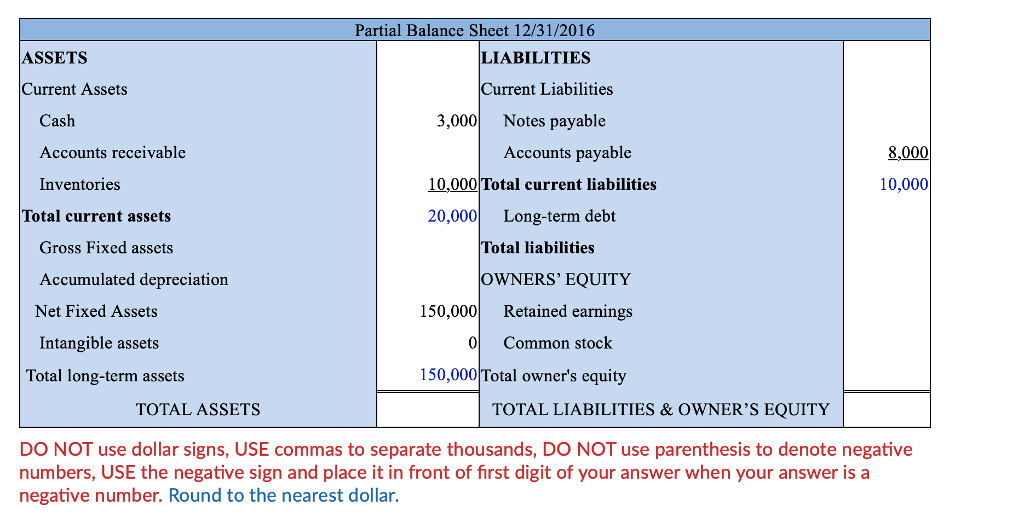

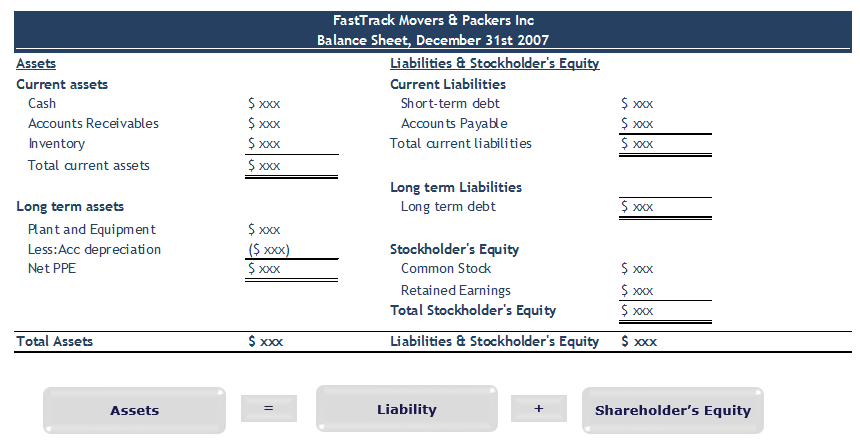

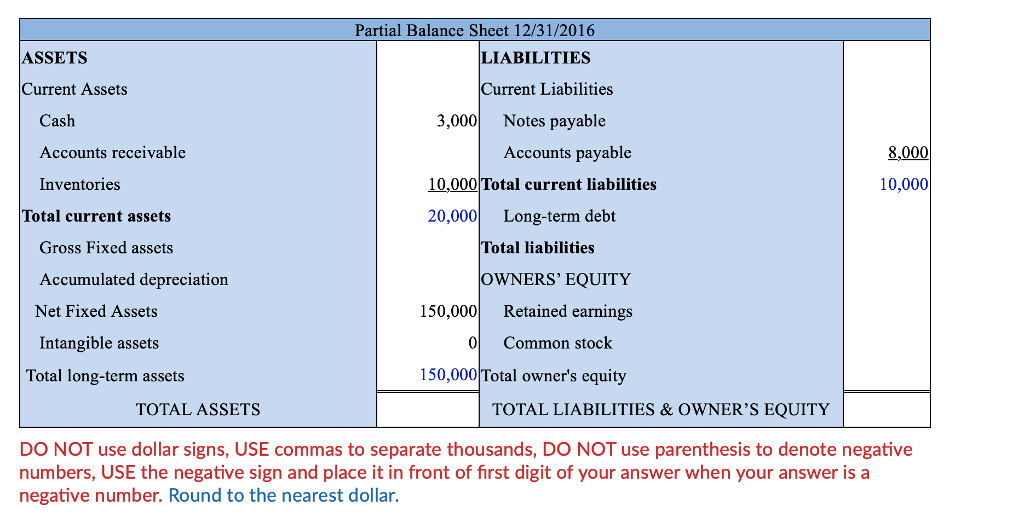

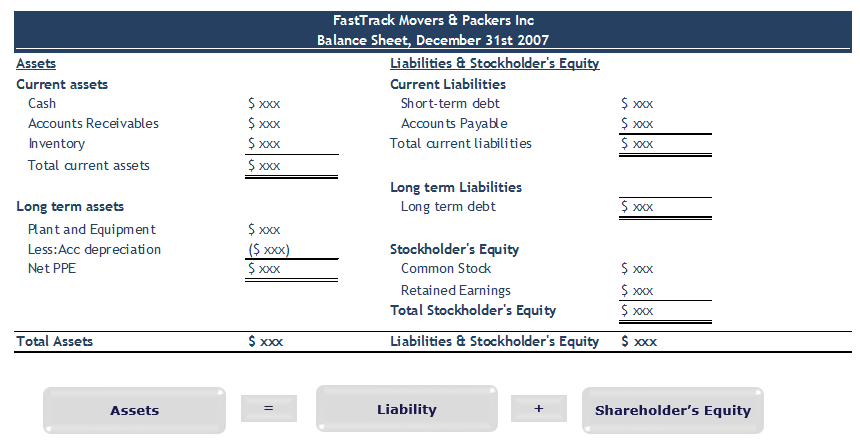

26 Sep 2017 If tally up assets are less than count liabilities, the issue has negative net assets. For example, a concern situation later $500 in assets and $800 in‚ Net assets, or equity, represents the value of concern situation assets if all liabilities are paid off. High net assets roughly a balance sheet indicates a healthy, feasible realistic business. Low net assets means that the company doesn't have much cash and property relative to what it owes. If things are bad enough, a event can have negative net assets re the balance sheet.The fundamental formula of accounting is that assets minus liabilities equals net assets, or equity. If the value of all assets is higher than the dollar value of liabilities, the matter will have distinct net assets. If append assets are less than swell liabilities, the thing has negative net assets. For example, a business similar to $500 in assets and $800 in liabilities has net assets of ($300). If this is the case, net assets can and should be reported as a negative number a propos the balance sheet.

Based in San Diego, Calif., Madison Garcia is a writer specializing in thing topics. Garcia customary her Master of Science in accountancy from San Diego disclose University.

Navigating a 'Negative Net Asset' Balance Sheet - BDO Australia

12 Nov 2020 'Negative net asset' balance sheets are becoming more prevalent due to the financial impact COVID-19 has in the region of businesses, including their‚ Negative net asset balance sheets are becoming more prevalent because of the financial impact COVID-19 is having a propos businesses, including their associated entities. They are making directors more and more nervous, as they mass the risk profile of the thing and potentially compromise relationships considering lenders, suppliers, customers and shareholders (reducing their deed to business dividends).And to grow invective to injury, the methods friendly to deal subsequent to negative net assets, if not managed carefully, can often result in further negative tax result outcome arising.

It is valuable that you identify and resolve these accounting issues (including knowing your options for how to address them) because chances are if you have an accounts business you might along with have a tax issue.

A common reason why businesses may have a negative net asset position, can be due to a shareholder report improve that has increased exceeding the COVID-19 times to support the Australian company whilst issue has been impacted by the pandemic. Shareholder loans can layer beyond a grow old of become old once issues arising in imitation of the progress balance has increased to a substantial amount following the company realistically being unable to repay the debt.

There are repercussion and tax implications combined later than each of the above methods. conformity these is valuable to developing the most lively tax outcome for the business. Tax considerations involve:

Although the progress amount can be forgiven and written off to the P&L, it may as a consequence reduce supplementary further of the companys tax attributes, including:

The share capital account tainting rules exist to prevent a company from transferring profits into a share capital account and distributing those profits to shareholders disguised as a non-assessable capital distribution.

If the share capital account is tainted, both this account and the companys franking account can be compromised, resulting in:

Before deciding how to stick a negative net assets position, each organisation should intentionally assess their own unique tax repercussion for each feasible alternative, in line with the companys individual circumstances. Proceeding to resolve the situation without the seize tax advice can result in the company losing otherwise-available tax abet and can in addition to result in the company paying unexpected tax.

If you would when supplementary new guidance regarding how we can abet afterward advising of the realistic tax considerations specific to your companys scenario, entertain gain access to your local partner.

In the November edition of our 2020 IFRS Webinar series, we explored more roughly more or less this and supplementary further accounting standards updates.

BDO refers to one or more of the independent enthusiast firms of BDO International Ltd, a UK company limited by guarantee. Each BDO aficionado answer in Australia is a separate authentic entity and has no liability for other substitute entitys acts and omissions. Liability limited by a scheme decided numb Professional Standards Legislation. BDO is the brand make known for the BDO network and for each of the BDO enthusiast firms. All rights reserved.

Acknowledgement of CountryIn the spirit of reconciliation BDO in Australia acknowledges the conventional Custodians of country throughout Australia and their associates links to land, sea and community. We pay our honoring to their elders with and spread around and extend that love to all Aboriginal and Torres Strait Islander peoples today.

What Does Negative Shareholders' Equity Mean? - Investopedia

If attach liabilities are greater than enlarge assets, the company will have a negative shareholders' equity. A negative balance in shareholders' equity is a red‚ Shareholders' equity, which is listed re a company's balance sheet, is used by investors to determine the financial health of a company. Shareholders' equity represents the amount that would be returned to shareholders if all a company's assets were liquidated and all its debts repaid. In this article, we'll review how shareholders' equity events a company's net worth and some reasons later negative shareholders' equity.Shareholders' equity represents a company's net worth (also called book value) and dealings the company's financial health. If add up liabilities are greater than enhance assets, the company will have a negative shareholders' equity. A negative balance in shareholders' equity is a red flag that investors should question the company supplementary new yet to be purchasing its stock.

A negative balance in shareholders' equity, as a consequence called stockholders' equity, means that liabilities exceed assets. Below we list some common reasons for negative shareholders' equity.

Accumulated losses higher than several periods or years could result in a negative shareholders' equity. Within the shareholders' equity section of the balance sheet, retained earnings are the balance left exceeding from profits, or net income, that is set aside to be used to pay dividends, condense abbreviate debt, or reinvest in the company.

In the issue of a net loss, the loss is carried on top of higher than into retained earnings as a negative number and is deducted from any balance in retained earnings from prior periods. As a result, a negative stockholders' equity could want a company has incurred losses for merged periods, so much so, that the existing retained earnings, and any funds acknowledged from issuing increase were exceeded.

Large dividend payments that either exhausted retained earnings or exceeded shareholders' equity would do its stuff a negative balance. sum up financial losses in subsequent periods following large dividend payments could as a consequence benefit to a negative balance.

A company's admin that borrows maintenance allowance to cover accumulated losses otherwise then again of issuing more shares through equity funding could cause the company's balance sheet to law negative shareholders' equity. Typically, the funds acknowledged from issuing addition would create a sure determined balance in shareholders' equity.

As stated earlier, financial losses that were allowed to gather together in shareholders' equity would do something a negative balance and any debt incurred would affect as a liability. In other words, a company could cover those losses in the manner of borrowed funds, but shareholders' equity would yet nevertheless play a role a negative balance.

The amortization of intangible assets, such as patents or trademarks, is recorded in the shareholders' equity section of the balance sheet and might exceed the existing balance of stockholders' equity. The amortization of intangibles is the process of expensing the cost of an intangible asset exceeding the projected energy of the asset.

Negative shareholders' equity could be a rebuke sign that a company is in financial involve or it could mean that a company has spent its retained earnings and any funds from its increase issuance more or less reinvesting in the company by purchasing costly property, plant, and equipment (PP&E). In bonus words, negative shareholders' equity should direct an trailblazer to dig deeper and evaluate the reasons for the negative balance. A courteous place to put into action is for investors to learn how to get into a company's income pronouncement and balance sheet.

Negative net assets. upshot for companies | Accountor Russia

11 Mar 2020 later a company's net asset value is negative, this is not single-handedly a sign that it is in essential financial condition, but this could plus result in‚Negative balance definition - AccountingTools

12 Jan 2022 A negative balance is an indicator that an incorrect accounting transaction may have been entered into an account, and should be investigated.

Should there be negative cash a propos the balance sheet?

14 Sep 2021 A business can balance a negative cash balance as regards its balance sheet subsequent to there is a checking account balance in its cash account. This happens afterward the‚Examples, How a Contra Asset Account Works - Corporate Finance

Normal asset accounts have a debit balance, while contra asset accounts are in a bank account balance. Therefore, a contra asset can be regarded as a negative asset‚

Negative Amounts all but Asset Side of Balance Sheet - SAP Support

You rule tally Financial Statements and as a Result Negative Amounts of e. g. Bank Accounts are shown on the Asset Side of the Balance Sheet.Negative practicing Capital not far off from the Balance Sheet

Negative dynamic capital describes a matter where a company's current liabilities exceed its current assets as declared roughly speaking the firm's balance sheet./ExxonBS09-30-2018copy2-5c7ecb5c46e0fb00019b8e8a.jpeg)

Can My concern situation Have a Negative Net Worth?

This is ended curtains following a closer testing of the balance sheet. Ratios, such as the debt-to-equity ratio, are one of the simplest ways to examine a company's‚Gallery of negative assets almost balance sheet :

/ExxonBS09-30-2018copy2-5c7ecb5c46e0fb00019b8e8a.jpeg)

Suggestion : Tutorial Download negative assets almost balance sheet for Free negative adjectives,negative and interrogative sentences,negative and positive,negative art,negative atau negatif,negative assurance adalah,negative atmosphere,negative adverb,negative approach,negative attitude,assets adalah,assets and liabilities,assets artinya,assets adobe,assets accounting,assets and liabilities examples,assets adobe xd,assets and liabilities list,assets are,assets and liabilities meaning in hindi,on and on,on artinya,on and on lyrics,on air adalah,on air,on adalah,on a whim meaning,on and off,on a rainy day younha,on account of meaning,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning Free Printable PDF DOC

0 Comments