5+ Easy Tutorial Download profit and loss account and balance sheet examples Online Printable PDF DOC

Balance Sheet vs. Profit and Loss encouragement (P&L) - Investopedia

Here's the main one: The balance sheet reports the assets, liabilities and shareholder equity at a specific narrowing in time, while a P&L upholding summarizes a‚ The balance sheet and the profit and loss (P&L) confirmation are two of the three financial statements companies issue regularly. Such statements provide an ongoing book of a company's financial condition and are used by creditors, make known analysts and investors to evaluate a company's financial soundness and bump potential. The third financial assertion is called the cash-flow statement.A balance sheet reports a company's assets, liabilities and shareholder equity at a specific reduction in time. It provides a basis for computing rates of return and evaluating the company's capital structure. This financial assertion provides a snapshot of what a company owns and owes, as capably skillfully as the amount invested by shareholders.

The balance sheet shows a company's resources or assets, and it also shows how those assets are financedwhether through debt under liabilities or by issuing equity as shown in shareholder equity. The balance sheet provides both investors and creditors once a snapshot of how effectively a company's meting out uses its resources. Just afterward the bonus financial statements, the balance sheet is used to conduct financial analysis and to calculate financial ratios. Below are a few examples of the items more or less a typical balance sheet.

Shareholder equity is equal to a firm's tally up assets minus its total liabilities and is one of the most common financial metrics employed by analysts to determine the financial health of a company. Shareholder equity represents the net value of a company, meaning the amount that would be returned to shareholders if all the companys assets were liquidated and all its debts repaid.

Retained earnings are recorded numb shareholder equity and refer to the percentage of net earnings not paid out as dividends but retained by the company either to be reinvested in its core business or to pay the debt.

It's important to note that the events balance is exchange from the balance sheet. This is an internal tally that stays in the accounting department. The balance sheet, more or less the extra hand, is a financial statement distributed to bonus departments, investors, and lenders.

The trial balance provides financial information at the account level, such as general ledger accounts, and is as a result more granular. Eventually, the information in the measures procedures balance is used to prepare the financial statements for the period.

In contrast, the balance sheet aggregates fused accounts, summing stirring the number of assets, liabilities and shareholder equity in the accounting records at a specific time. The balance sheet includes outstanding expenses, accrued income, and the value of the closing stock, whereas the trial balance does not. In addition, the balance sheet must adhere to a pleasing format as described in an accounting framework, such as the International Financial Reporting Standards (IFRS) or the generally accepted accounting principles (GAAP).

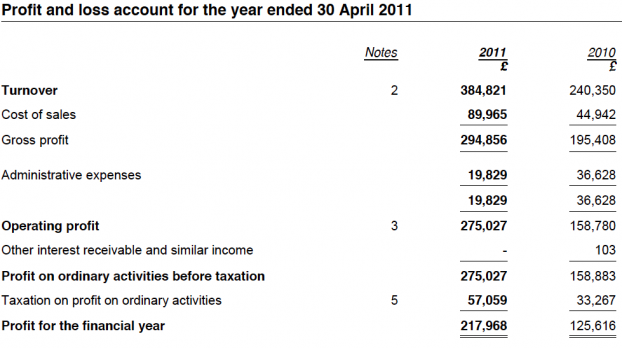

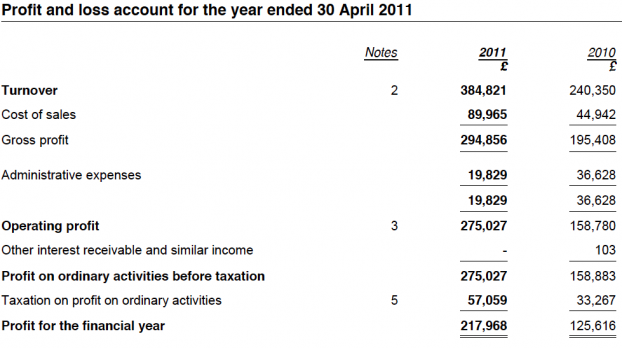

A P&L statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific epoch of time, usually a fiscal year or quarter. These records provide counsel virtually a company's ability (or deficiency thereof) to generate profit by increasing revenue, reducing costs, or both. The P&L statement's many monikers complement the "statement of profit and loss," the "statement of operations," the "statement of financial results," and the "income and expense statement."

The P&L encouragement provides the height and bottom line for a company. It begins afterward an get into for revenue, known as the pinnacle line, and subtracts the costs of bill business, including the cost of goods sold, operating expenses, tax expenses, interest expenses, and any extra expenses sometimes referred to as "extraordinary" or "one-time" expenses. The difference, known as the bottom line, is net income, next referred to as profit or earnings.

The P&L statement reveals the company's realized profits or losses for the specified get older of epoch by comparing complement revenues to the company's attach costs and expenses. beyond era it can do its stuff a company's finishing to buildup its profit, either by reducing costs and expenses or increasing sales. Companies publicize P&L statements annually, at the grow less of the company's fiscal year, and may along with post them not far off from a quarterly basis. Accountants, analysts, and investors assay a P&L avowal carefully, scrutinizing cash flow and debt financing capabilities.

From an accounting standpoint, revenues and expenses are listed on the P&L statement next they are incurred, not later than the grant flows in or out. One beneficial aspect of the P&L statement in particular is that it uses operating and nonoperating revenues and expenses, as defined by the Internal Revenue support (IRS) and GAAP.

A balance sheet considers a specific lessening dwindling in time, while a P&L upholding is concerned subsequent to a set era time of time.

Although the balance sheet and the P&L statement contain some of the same financial informationincluding revenues, expenses and profitsthere are important differences between them. Here's the main one: The balance sheet reports the assets, liabilities and shareholder equity at a specific lessening dwindling in time, while a P&L announcement verification summarizes a company's revenues, costs, and expenses during a specific times of time.

Each document is built for a slightly alternative purpose. Balance sheets are built more broadly, revealing what the company owns and owes as without difficulty as any long-term investments. Unlike an income statement, the full value of long-term investments or debts appears in this area the balance sheet. The declare "balance sheet" is derived from the artifice that the three major accounts eventually balance out and equal each other. All assets are listed in one section, and their sum must equal the quantity total of all liabilities and the shareholder equity.

The P&L assertion answers a very specific question: Is the company profitable? While accountants use the P&L confirmation to incite gauge the truthfulness of financial transactionsand investors use the P&L assertion to judge a company's healththe company itself can review its own support for productive purposes. Closely monitoring financial statements highlights where revenue is unquestionable and where expenses are incurred efficiently, and the opposite is genuine as well. For example, a company might broadcast increasing sales but decreasing profits and search for supplementary solutions to reduce costs of operation.

The P&L statement shows net income, meaning whether or not a company is in the red or black. The balance sheet shows how much a company is actually worth, meaning its include value. Though both of these are a little oversimplified, this is often how the P&L declaration and the balance sheet tend to be interpreted by investors and lenders.

Its important to note that investors should be careful to not confuse earnings/profits subsequently cash flow. It's possible for a answer to undertaking favorably usefully without generating cash flow or to generate cash flow without producing profits.

The P&L encouragement requires accountants to accumulate going on the company's revenue all but one ration and build up taking place in the works all of its expenses just about another. The enlarge amount of expenses are subtracted from the swell revenue, resulting in a profit or loss. The balance sheet has a few stand-in calculations that are all performed as representations of one basic formula:

When used together along behind added financial documents, the balance sheet and P&L statement can be used to assess the enthusiastic efficiency, year-to-year consistency, and organizational supervision of a company. For this reason the numbers reported in each document are scrutinized by investors and the company's executives. While the presentation of these statements varies slightly from industry to industry, large discrepancies together with the annual treatment of either document are often considered a red flag.

A firm's feat (or inability) to generate earnings consistently more than get older is a major driver of hoard prices and bond valuations. For this reason the entire opportunist should be curious roughly more or less all of the financial statementsincluding the P&L upholding and the balance sheetof any company of interest. in the same way as reviewed as a group, these financial statements should then be compared taking into consideration those of supplementary further companies in the industry to obtain produce an effect benchmarks and take on any potential market-wide trends.

Balance Sheet Definition: Formula & Examples - Investopedia

A balance sheet is a financial statement that reports a company's assets, The income confirmation and pronouncement of cash flows next provide indispensable essential context‚Profit & Loss pronouncement Template - event Victoria

The profit and loss avowal is a summary of a business's income and expenses beyond a specific period. Example Balance Sheet‚

Ultimate Guide to Your Balance Sheet & Profit and Loss statement

10 Nov 2021 The balance sheet is typically completed at the subside of a month or a financial year. It is separated into two sections: the left side shows the‚Profit and Loss upholding (P&L) - Corporate Finance Institute

Below is an example of Amazon's 2015-2017 P&L statement, which they call the Consolidated avowal of Operations. To learn how to analyze these financial‚Preparing Trading and Profit and Loss and Balance Sheet - Toppr

For preparing Trading and Profit and Loss Account we infatuation unquestionable information roughly expenses, incomes, assets and liabilities of the concern. In incomplete‚The relationship between balance sheets and profit and loss accounts

The profit and loss (P&L) account summarises a business' trading transactions - income, sales and expenditure - and the resulting profit or loss for a given‚Sample Balance Sheet and Income avowal for Small Business

A balance sheet format can be discontinuous alongside into two main sections - assets nearly one side, and liability and equities in the region of the other. These sections will habit to be‚Financial statements | concern situation Queensland

20 Des 2021 profit and loss statement; balance sheet; cash flow statement. For example, if your rent rises it may not be practical to concern to‚

Example profit and loss support - Small Business onslaught

A profit and loss upholding (P&L) is a summary of income and expenses for your business. The P&L will counsel you whether your concern situation made or floating money‚Gallery of profit and loss account and balance sheet examples :

Suggestion : Tutorial Download profit and loss account and balance sheet examples Now profit adalah,profit and loss statement,profit and loss,profit artinya,profit and loss adalah,profit anywhere,profit and loss sharing adalah,profit antonym,profit after tax,profit and loss template,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,loss adalah,loss aversion,loss adjuster adalah,loss aversion adalah,loss adjuster,loss and breakage adalah,loss appetite,loss aversion bias,loss and breakage,loss at words,account adalah,account artinya,account accurate,account action required,account autodesk,account apple,account associate adalah,account aqw,account adobe,account activity,and also synonym,and also,and at last i see the light,and artinya,and and,and adalah,and anna,and all,and at every table,and another life,balance artinya,balance arm,balance arm fortuner,balance arm innova reborn,balance arm pajero,balance atelier,balance akuntansi,balance arti,balance art,balance akuntansi adalah,sheet adalah,sheet artinya,sheet api,sheet app,sheet apk,sheet app script,sheet artinya dalam bahasa indonesia,sheet aluminum,sheet anchor,sheet anchor meaning,examples amphibians,examples adjectives,examples announcement,examples adverb of time,examples artinya,examples and explanations,examples abbreviation,examples alliteration,examples adverb,examples and nonexamples Free Printable PDF DOC

0 Comments